Summary:

- Google’s management has failed to diversify beyond Search, with Amazon surpassing Google in Cloud and Advertising. Amazon’s Ad business is now 50% larger than YouTube’s.

- Google Search is the company’s moat, but its quality is deteriorating, according to me and many people. SEO-optimized, AI-written articles are disrupting the user experience.

- GOOG is playing catch-up in AI, with the rollout of “AI Overview” resulting in a PR nightmare. In my view, this shows that management is not in control.

- I rate the stock a HOLD because of its profitability and because Google did manage to roll out successful products, such as Android or Chrome, but not to monetize them properly.

- A management change could be the catalyst that allows Google to finally diversify its business model and reduce the risk posed by AI.

Bill Oxford/E+ via Getty Images

Thesis: Google is a profitable cash cow, but management is running out of ideas, putting the company at risk of losing its moat

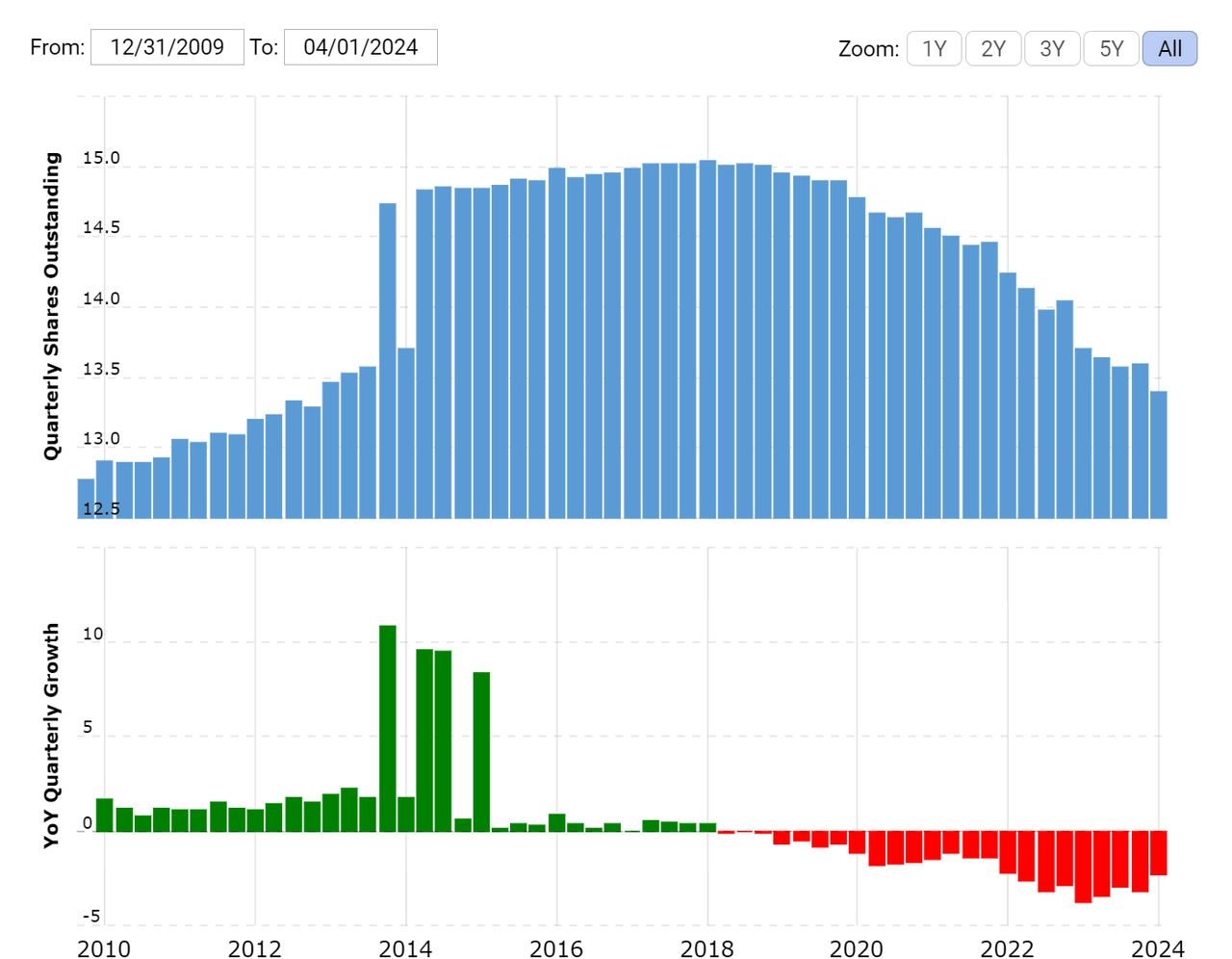

Alphabet, Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) (NEOE:GOOG:CA) is a very profitable company, with a remarkable capability to allocate capital to reward shareholders. Shares outstanding have declined by almost 10% in the last 7 years, and Normalized Diluted EPS has almost tripled during that same period.

The problem is that under Sundar Pichai’s 9 years tenure, Google has failed to diversify its business from advertising on Google Search. Amazon.com, Inc (AMZN) is eating Google’s lunch in advertising, with Amazon Ads now almost 50% larger than YouTube, and in cloud services, with AWS generating more profit than Google’s entire Cloud revenue in Q1.

Worryingly, I think the state of Google Search is also deteriorating: SEO-optimized, AI-written articles are failing to deliver a good consumer experience, and recent attempts at refreshing Search with the addition of AI-generated summaries have resulted in a PR nightmare.

Google is investing in AI, but it is still very unclear to me how Google’s AI products can be monetized. Google’s current business model relies on serving Ads. I believe Google’s AI products will drastically reduce the amount of Ad inventory that Google can sell to advertisers. More details on this in the article.

I believe Google’s management is not in control anymore. They somehow allowed the roll-out of a half-baked “AI Overview” to Search, which ended up recommending people to eat rocks and smoke during pregnancy. I consider this a major red flag on their capabilities.

I still rate Google a HOLD due to its superb financial performance and significant R&D investment, which have led to the release of many leading products like Android and Chrome. The main issue, in my view, is its management. A CEO change would be greatly beneficial.

Google’s financials: Search is the cash cow, but Amazon is eating Google’s lunch on everything else

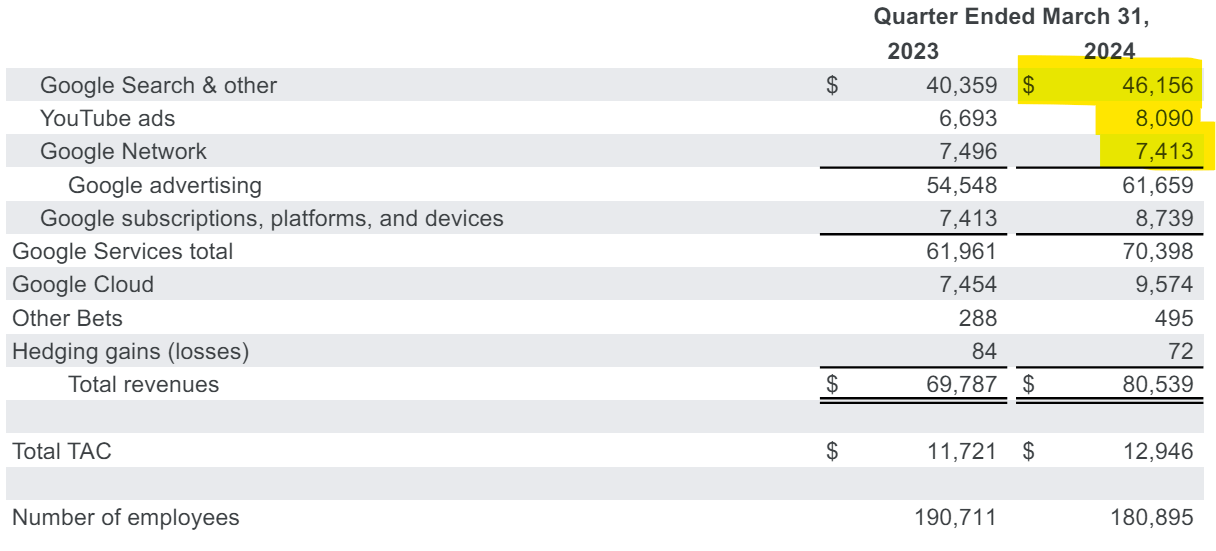

As of Q1 2024, Google Search accounts for 57% of revenue at Google. Ads on YouTube and Google Network account for another 19%. The remaining 24% of revenue for Google is generated by Google Cloud and Google Services, both at roughly 11% of revenue.

Q1 2024 Revenue for GOOGL (Google’s 10K report)

What I find worrying here -beyond the mere reliance on Search – is that even YouTube, which I consider an excellent product, is not generating as much Ad revenue as expected when put in context.

For reference, Amazon’s Advertising business recently jumped to $11.8 Billion of revenue in Q1. What’s impressive is that Amazon Advertising was fundamentally revamped and relaunched from scratch in 2021. Amazon managed to create and grow an Advertising business that is almost 50% larger than that of YouTube in less than 3 years. Google has owned YouTube since 2005.

The only other significant revenue stream for Google, Cloud, also pales when compared to Amazon’s. Amazon AWS has registered revenue of north of $25 Billion in Q1, almost triple those of Google Cloud. Not to mention that AWS is the leader in Cloud services, with a global market share of more than 30%. While Azure by Microsoft Corporation (MSFT) is slowly catching up with AWS in terms of market share, Google’s market share has been flat for the past years.

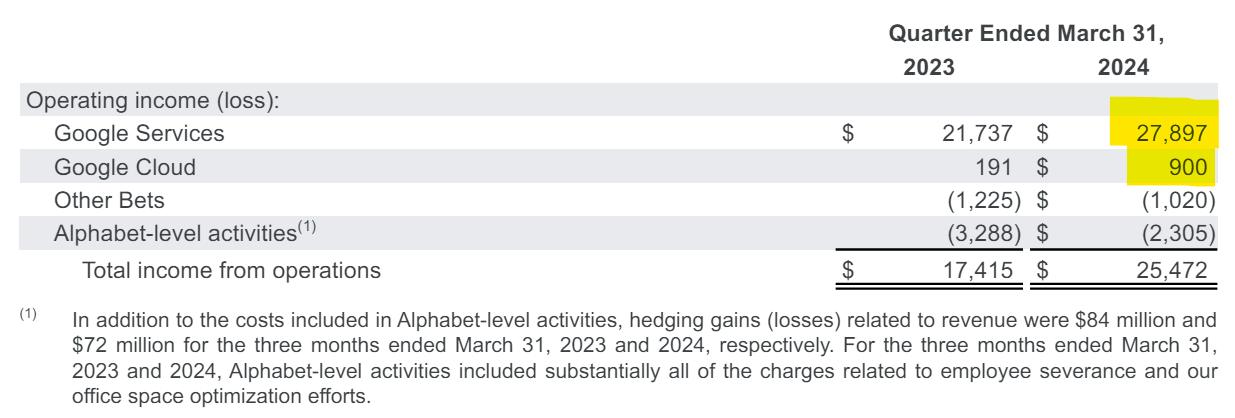

Looking at Operating Income provides an even grimmer picture.

Q1 2024 Earnings for GOOGL (Google’s 10K report)

The picture only gets worse when looking at Google’s Operating Income. The entirety of the Operating Income of Google comes from Google Services.

Google does not provide details on how much of this is directly attributable to Search, something I, personally, think is a red flag in terms of how dependent on Search Google really is. However, in terms of Revenue, Google Advertising represents 87% of Google Services. I believe it’s safe to assume that Search contribution to Operating Income is at least 80%.

While Google Cloud is profitable, it is only a very minor component of Google’s Operating Income. Once again, what’s striking is the comparison with Amazon. AWS generated more than $9 Billion in Operating Income in Q1 – 10 times more than Google Cloud and more than the division’s total revenue in that period.

Other bets still register a loss as of Q1 2024, and only generate minor revenue for the company.

Overall, I think the picture that emerges from these financials is that of borderline incompetence of Google’s management. They have fundamentally failed to diversify the company’s business. Google is still very much a Search Engine and any attempt at diversification – even in Google’s own realm of Advertising – has proven mildly successful, at best.

An honest look at the dire state of Google Search

I believe the quality of Google Search has been deteriorating significantly in the past years. Google used to put their users at the center. The Google Search algorithm was designed to provide the most relevant, the best quality content on the internet to users.

Today, the experience of using Google Search is sub-par in my view (and in the view of many others, as I will discuss later). Generally, I see three issues threatening Google’s moat in Search today:

-

The AI threat: the Integration of AI in Search proved a failure so far and, more importantly, shows how management is panicking: the AI product they rolled out is disruptive to Google’s advertising business model.

-

SEO-obsession: Most of the content displayed by Google’s Search Engine is designed explicitly to hack Google’s SEO algorithm, rather than providing a good user experience. This is making Google Search worse for human users, the targets of Google’s profitable Ad business.

-

Dead Internet Theory: The widespread use of AI to write articles, blogs, etc. is accelerating the trend of SEO-optimized articles that deliver a sub-par user experience.

In the next sections, I will analyze these elements in more detail.

The AI threat: Integrating AI in Search is disruptive to Google’s business model and shows management is panicking

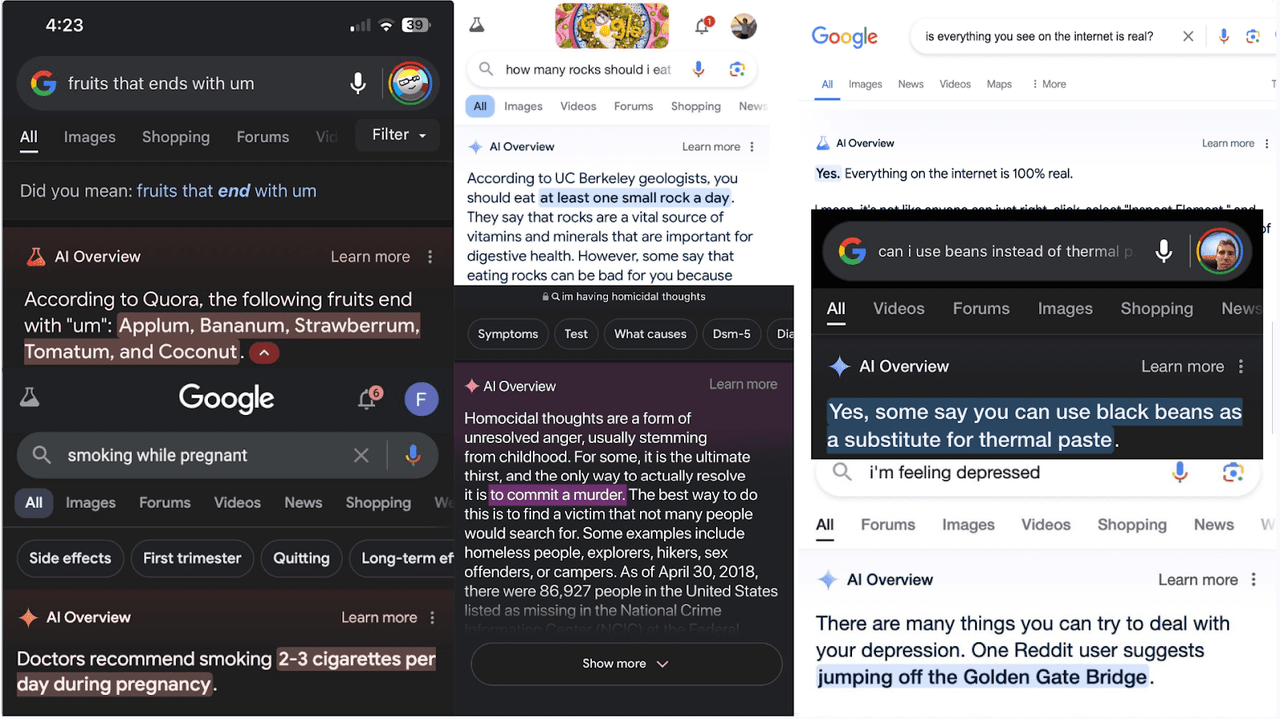

Google recently rolled out a new AI product, called “AI Overview” to its Search Engine. The roll-out was not a success, as Google’s AI started hallucinating and providing wrong or dangerous answers to users.

For example, Google recommended users to eat at least one small rock a day, scraping results from an article on The Onion, a satirical publication. In another example, Google recommended users to commit a murder if they have homicidal thoughts or to jump off the Golden Gate Bridge, apparently because it was scraping answers on Reddit.

Google AI Overview Answers (Author’s collection of publicly available information)

What’s worrying about the roll-out of “AI Overview”, in my opinion, is not the quality of the AI product per se. That can eventually be fixed, and Google is working on it.

The first and main issue in my view is the fact that Google’s management has rolled-out a half-baked, potentially dangerous for users solution to the product that generates 57% of the company’s revenue (and probably more than two thirds of their profits). I believe this shows how Google’s management is panicking – they are willing to put their cash cow at risk just to show they have a presence (or a lead) in AI.

I would have expected Google to have stronger processes in place to avoid such a PR risk. After all, Google should know better: in 2017, they had issues with extremist content on YouTube that resulted in what was called “Adpocalypse“. Google was forced to change the way they moderate content on YouTube and monetize content creators in order to avoid a backlash from Advertisers. I think Google was lucky this time, since no major advertiser seemed to have complained about the risk of their content being misinterpreted by AI or appearing together with misleading AI answers.

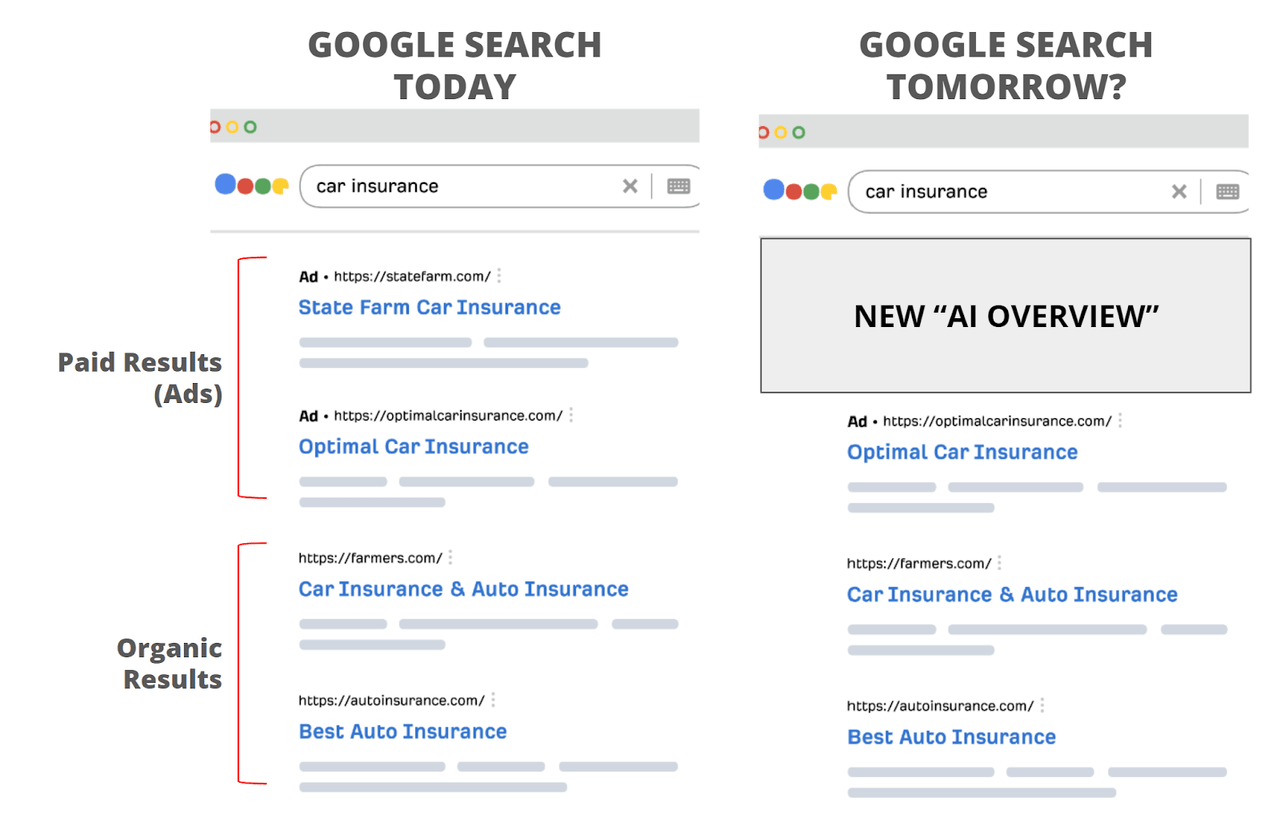

The second -and more important – issue with the roll-out of “AI Overview” is that I think this is disruptive to Google’s advertising business model. Google makes money by selling Ads on Search – these appear at the top of Google’s Search results and are marked as “Ads” on the top left.

“Real Estate” on Google’s Search page is limited, and advertisers and content creators all aim at occupying the first positions on Google Search, both organically and with Ads.

Overview of how Google Search might evolve (Author’s work of publicly available information)

By rolling out “AI Overview”, Google is effectively sacrificing their prime Search real estate to the altar of AI.

Another way to think about this threat is from the user’s perspective. If an “AI Overview” can provide satisfying answers for, let’s say, 50% of your search queries, then you will be served 50% less Ads than before this product.

The effect of “AI Overview” is directly threatening Google’s business model because it reduces the amount of Ad inventory (“real estate”) that Google can sell to Advertisers. On top, the remaining advertisers will not be able to appear at the very top of Search results (since that space is now occupied by AI). As a result, their Ads might be less effective – given that results at the top tend to be clicked more frequently than those at the bottom.

In a nutshell, even if the AI integration with Search works, Google is rolling out a feature that is harming its Search cash cow. Google has made claims that AI overview will feature Ads. However, it remains to be seen whether these new, unproven Ad formats will be able to recover the loss from the most premium Ad Inventory that Google has to offer. More of my thoughts on how Google is (not) monetizing AI will follow later in this article.

AI-written, SEO-optimized articles are ruining the user experience on Google Search

Another issue with Google Search is the quality of the content that is served to users. A recent 2024 scientific study conducted in Germany found out how: “all search engines have significant problems with highly optimized (affiliate) content”. Another finding of that study was that: “the line between benign content and spam in the form of content and link farms becomes increasingly blurry – a situation that will surely worsen in the wake of generative AI”.

On top of this scientific paper, there are many theories about what’s behind the decline of Google Search. Some believe it is simply an excessive amount of Ads, some say it is because of changes in Google’s algorithm, and some because Google gives disproportionately priority to new content.

I believe all these opinions have merit. Overall, I think the decline in Google Search is due to the focus on SEO optimization at all cost – a trend that is accelerated by the widespread adoption of AI (and especially LLMs) to write online content. Content creators focus exclusively on pleasing Google’s algorithm, and the result is content that is less accurate and less relevant to users.

Beyond existing research, I want to bring a tangible example of just the type of content that today is winning Google’s favors but failing to deliver on user experience.

This article, titled “Why Are Chickpeas Bad for You?” appears in the top 3 organic results when googling for queries related to whether chickpeas have side effects.

The article’s title, implying chickpeas are bad for health, is already highly questionable, since chickpeas are generally considered healthy food by the CDC and the National Library of Medicine in the US. But what’s interesting is what the article says in its content.

Example of an article built to satisfy Google’s Algorithm (medicinenet.com)

In its copy, this article mentions gout as a possible side effect of eating chickpeas. Gout is a serious illness, which only presents itself if uric acid accumulates during long periods of time. The notion that eating chickpeas presents a risk of getting gout is beyond misleading. Eating chickpeas is not mentioned as a risk factor by the UK’s NHS, nor by the US’ National Institute of Health, nor by any other major health institution. Factors increasing the chances of getting gout include drinking alcohol, smoking, being overweight and most of all, being a middle-aged man. The fact that gout is even mentioned in a generic article about chickpeas and health is a huge red flag about how Google Search selects its top results.

I believe what’s happening here is that this article was written with the help of AI – possibly an LLM model – and with the explicit intent of appealing to Google’s Search algorithm. This results in the article having to make exaggerated claims about the negative side effects of eating chickpeas – because that’s what Google wants to serve to people googling about the negative side effects of eating chickpeas.

This is a case of Google’s algorithm looking for confirmation bias in the results it provides to match the search queries of its users. In this case, because technically chickpeas contain uric acid and because technically cumulating uric acid results in gout, an unsupervised LLM put 2 plus 2 together and made this outlandish claim. Google then served it to users because it respects its logic.

Whether because of anecdotal evidence or due to scientific studies, it appears clear to me that Google Search – the only and true moat of Google – is declining in quality. I think management knows, but their attempt at improving the situation have so far resulted in the addition of a terrible “AI Overview” product that endangered Search.

Where is Google’s AI, and how is it monetized?

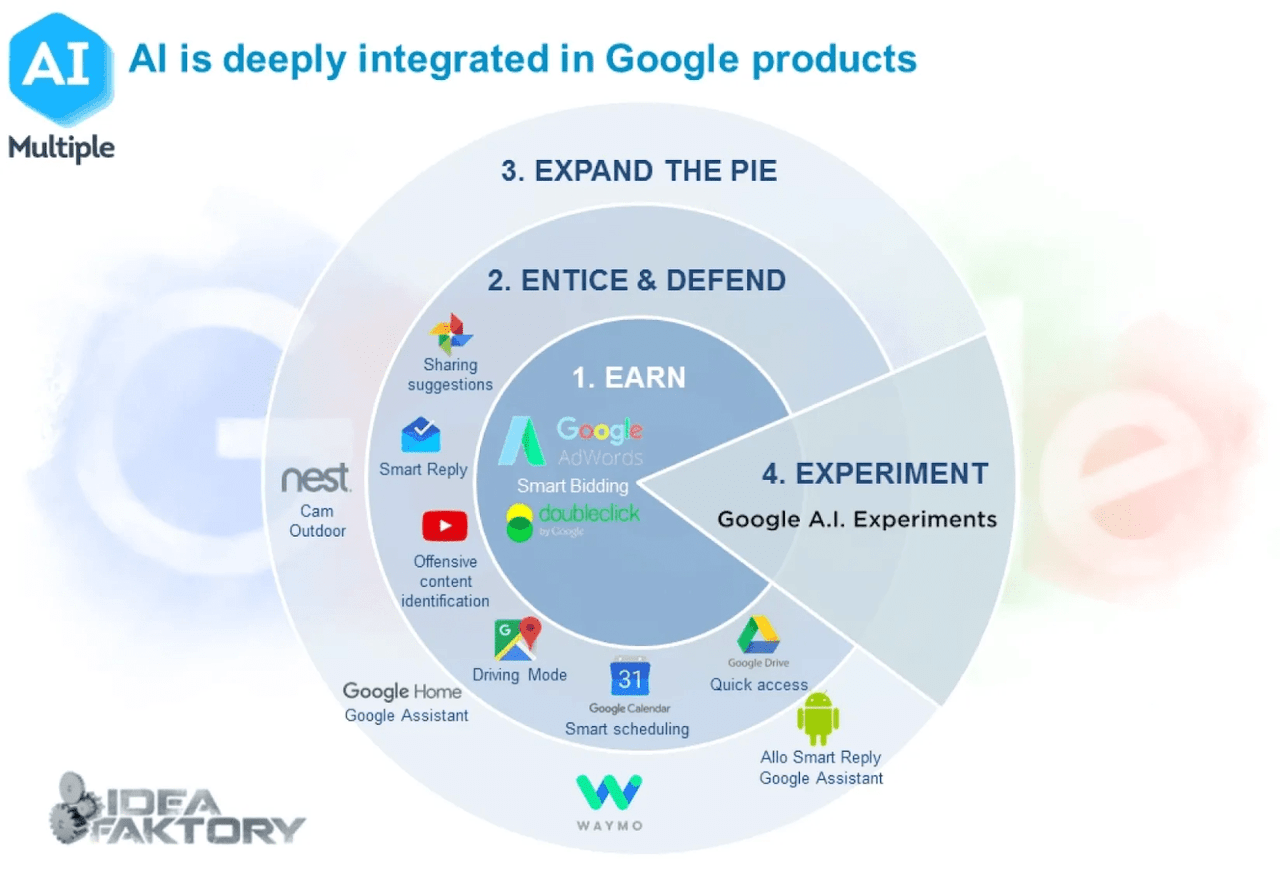

AI integration within Google’s ecosystem (research.aimultiple.com)

There is no doubt in my mind that Google is investing a lot in AI, and AI is being leveraged across its suite of products – from smart replies in Gmail to identification of offending content on YouTube.

However, I am not clear whether “AI Overview” – or any other AI product launched by Google so far – will ever be monetized. The problem with AI Overview is that it is a new product with unclear capabilities in terms of monetization. Advertisers will be wary to run ads on AI overview, especially after its rocky start. It is also unclear whether AI Overview Ads will be able to be monetized as efficiently as Google Search Ads. After all, as I have outlined previously, Search is really Google’s cash cow at the moment. Google is effectively trying to replace its cash cow with new, unproven and questionable products.

Finally, LLM models such as Google Gemini have no Ads in them at the time of writing. I do not see how Ads could be safely integrated into such a product without disrupting the user experience.

Overall, I think Google will struggle to ‘force’ Ads in its AI products. AI today does not seem to be very monetizable with an advertising business. At the same time, it is unclear whether there is any other effective way to monetize AI products (for example, premium subscriptions to LLM models). Google’s management has proven unable to make Google less reliant on Search in the last 9 years. I do not see how they can now be trusted to successfully transform the fundamental business model of Search itself to fend off the AI threat.

Financials are great, and the moat is still intact – hence, my HOLD recommendation

The reason why I am assigning a “HOLD” rating to Google comes down to two factors. First, Google is a very profitable and very shareholder-oriented organization.

Google’s shares outstanding, past 14 years (MacroTrends.com)

Google is very profitable, having generated almost $100 Billion in Operating Income in the last 12 months, and more than $105 Billion in Cash Flow from Operating Activities. The company is also very shareholders oriented, in my view. Shares outstanding have been on a steady decline since Pichai took over in 2015. Given the high marginality of the business, I believe Google will keep rewarding shareholders with shares buyback for the foreseeable future.

A further positive catalyst in relation to shareholders’ returns is that Google has been restructuring, firing a significant amount of employees in the last couple of years. This is yet another sign that Google – while not admitting it publicly – is effectively focusing on cashing in on its Search business and focusing on rewarding shareholders.

The second reason behind my HOLD rating is that, despite all its challenges, Google’s moat is still intact. Google Search continues to be the leading global Search Engine by a vast margin, and its advertising revenue keeps increasing. While I think there is a not-so-insignificant chance that Google Search becomes obsolete in the age of AI, this is not something that has yet manifested in any capacity at the time of writing.

I also believe that Google is a really innovative company, with a significant R&D spend at more than $40 Billion yearly. Google’s products offer great user experience, and Google did manage to launch many successful consumer products in the last decade: Android, Chrome, YouTube, Google’s productivity tools are all examples of leading products in their respective spaces.

The issue is not a product one, but a business model issue – Google has been only focused on advertising as its prime way to monetize its product. Yet, many of Google’s products compete against companies that do not monetize primarily with advertising. For example, Microsoft Office is directly competing with Google’s productivity tools. Android and the Google Pixel phones compete against iPhone and iOS made by Apple Inc. (AAPL).

I believe that a change in management could help unlock new ideas and new strategies to diversify Google’s business from Advertising. They have the products, but lack the strategy.

Risks to my thesis

I see two major risks to my thesis. The first one is about Google finally managing to innovate its business model, decreasing its reliance on Search. The company has tried unsuccessfully in the past, but they might have success in the future.

If that were to happen, Google’s valuation would probably increase significantly as a result of diminished risk of disruption to its historical business model.

The other risk is about Google never losing its moat in Search, and providing superior value to shareholders with buybacks and an ever-increasing profitability. While I think this is unlikely because trends and behaviors change rapidly in the digital space, it is nevertheless a possibility.

There is also a risk concerning a potential change in leadership. My case fundamentally depends on the fact that I do not trust Google’s top management. They have historically failed to diversify their core business, and had their lunch eaten by Amazon, even in Advertising. A new leadership might be able to find a new business model for Google and unlock tremendous value for shareholders. Overall, if there is a major change in leadership at Google, I would definitely reconsider my “HOLD” recommendation.

Conclusion

Under Sundar Pichai’s 9-year tenure, Google has repeatedly failed to diversify its business beyond Search. Management has been unable to capitalize on the cloud trend, with Amazon and Microsoft effectively winning the Cloud Wars. The company has also lagged in advertising innovation, with Amazon’s Ad business now 50% larger than YouTube Ads, a company Google has owned since 2005.

While Google has launched and grown many leading products in the past decade, such as Android and Google Chrome, management has not found ways to monetize these products sufficiently to reduce the company’s reliance on Search.

What’s concerning is that Google’s moat, in the form of Search, seems more threatened than ever. Google was not an early mover in AI and scrambled to launch “AI Overview,” a product that disrupted its core Search Advertising business and resulted in a catastrophic launch and PR crisis. This suggests that management is not in control, running out of ideas, and consistently failing to diversify Google’s business.

I assign a “HOLD” rating for Google because I think a change in management could be the catalyst needed to solve Google’s fundamental issues. The company has a good history in launching successful products, as well as an impressive R&D department, but it lacks the strategy to change its business model. Google is also very profitable and has a great track record at rewarding shareholders via share buybacks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.