Summary:

- Rivian has unveiled its next-gen vehicles, R2, R3, and R3X, with competitive pricing to break into the mass market.

- The company also cited $2.25 billion in savings from its decision to keep R2 production in Illinois, with tax incentives from the state.

- The company still grew revenue and vehicle deliveries in Q1, in contrast to Tesla’s high single digit revenue decline in the same quarter.

- The company’s ~$8 billion of cash is a sufficient war chest that tides Rivian over until its mass market vehicles come on the market in mid-2026.

jetcityimage/iStock Editorial via Getty Images

Even the most casual of investors will know that 2024 has been an “annus horribilis” for EV companies. Price competition has begun in earnest, especially as makers like Tesla (TSLA) slash prices in China to compete with cheaper local variants.

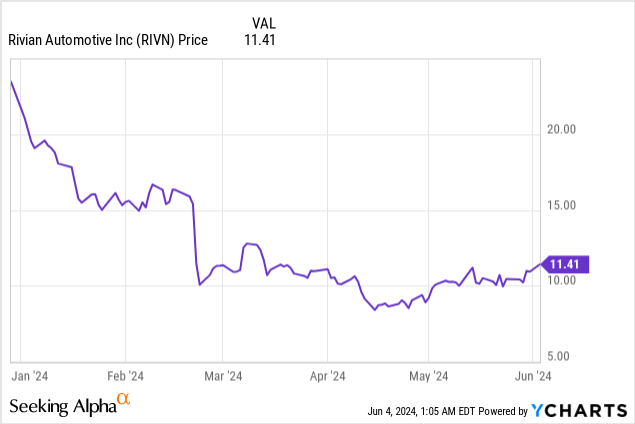

But Wall Street is famously short-term in orientation, and ignores the fact that EV companies have major product overhauls at work in the next 1-2 years. I’m not a multi-year holder of many stocks, but I am a long-term bull on Rivian (NASDAQ:RIVN), whose stock has sunk nearly ~50% year to date on a reduced production outlook.

I last wrote an article on Rivian in April, pitching the stock at a strong buy back when it was briefly trading under $9. I’m still holding onto my Rivian position, but given the sharp gains we’ve seen in the time since, I’m slightly ratcheting back my rating on Rivian to a simple buy.

That being said, I still think Rivian has plenty of upside left for the year, especially after favorable news delivered in its Q1 update.

The bottom line here: Investors will benefit from ignoring the short-term pessimism around EV stocks and getting into Rivian while it’s still trading at multi-year lows.

R2, R3, and R3X advantages; and operational upside

Before parsing into Q1 financials, we note that in Q1, Rivian unveiled its next-gen vehicles: R2, a midsize crossover SUV; R3, a smaller version of R3, and R3X, which is a performance variant of R3. Each of these vehicles will feature three motor variants (single motor, dual motor, and trimotor, and all three support fast charging, with the capability to go from 10% to 80% charge within 30 minutes.

R2 production will begin in early 2026, and first deliveries will take place in the first half of 2026 (pre-orders are open today with an upfront deposit of only $100). R3 and R3x are slated to launch directly after R2.

The key thing to note here for investors is pricing. R2 starts at $45,000, and R3 is expected to be below R2. At present, the starting price of the R1T (truck) is $70k, while the R1S (SUV) starts at $75k. It’s not difficult to see that R2 and R3 are Rivian’s equivalent of Tesla’s Model 3 and Y, and that this is Rivian’s moment to break into the mass market.

Now, beyond the top-line growth that these vehicles offer, it’s worth noting a number of operational updates that Rivian delivered alongside its Q1 earnings.

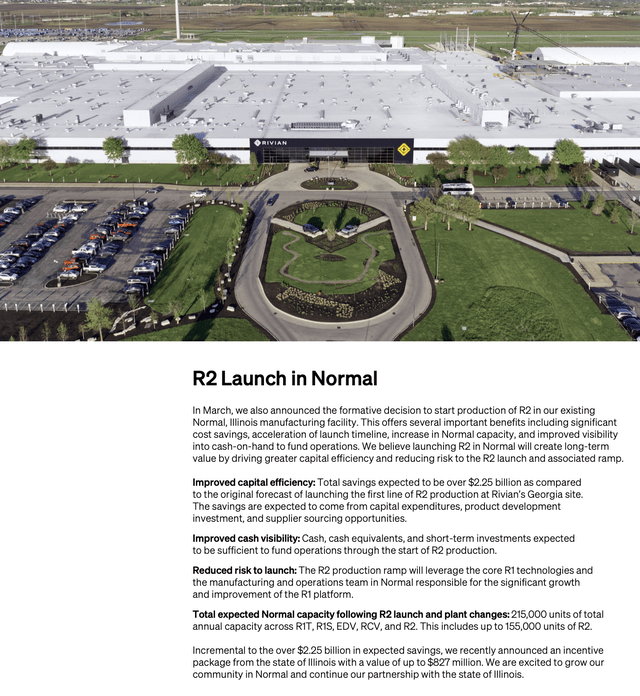

The first: R2 production is now expected to be at the company’s Normal, IL factory site, instead of shifting production to Georgia. This move is expected to deliver $2.25 billion in traditional capex savings. As a reminder, in the second half of this year, Rivian is expected to temporarily shut down this factory to incorporate additional material cost savings on the R1 line that is expected to help Rivian achieve positive gross profit in Q4 (something that has eluded Rivian thus far).

Rivian R2 production update (Rivian Q1 shareholder letter)

One key metric investors should note: after planned factory capacity changes, the Normal plant facility is expected to have capacity to produce 215k vehicles annually – nearly 4x above the current year’s 57k production target that investors so quickly lambasted.

Two additional financial savings are worth noting: first, the company received a tax incentive package from the state of Illinois worth $827 million in accordance with the company’s decision to shift R2 production away from Georgia and to Illinois.

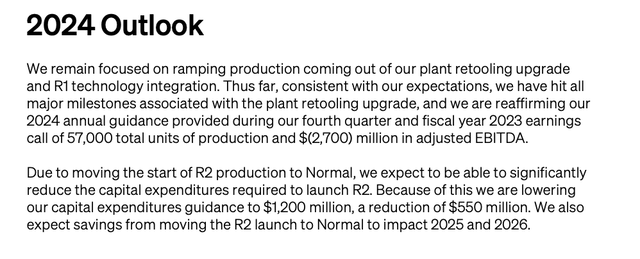

Rivian outlook: capex savings (Rivian Q1 shareholder letter)

Second, as shown in the chart above, the decision to keep R2 production in Illinois will benefit current-year capex expenses (as a portion of the total $2.25 billion in quoted savings), allowing Rivian to reduce its capex outlook from a prior $1.75 billion to just $1.20 billion (a -31% reduction!).

It’s worth noting that for a company with just $11.4 billion in market cap (or just 2% of Tesla’s value), and an even smaller $7.9 billion enterprise value (after netting off $7.9 billion in cash and $4.4 billion in debt), $2.25 billion in total savings for this production shift is a material operational improvement that investors aren’t giving Rivian enough credit for at present.

Rivian is still growing, and well funded enough to hit R2 and R3 milestones

Another note well worth mentioning: Rivian’s Q1 earnings results (which were generally favorably received) still showed the company growing.

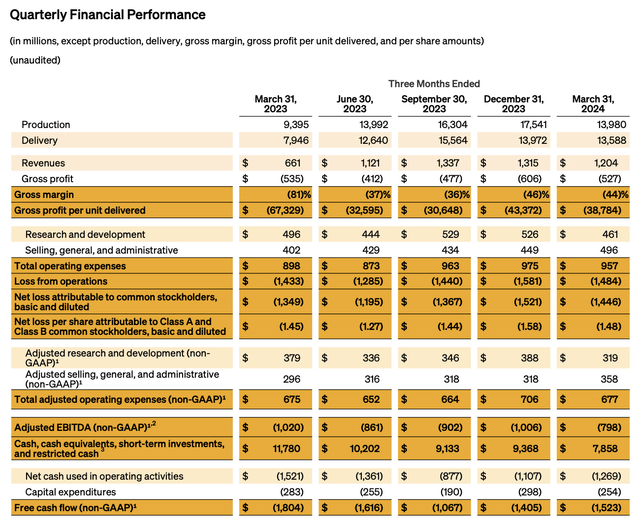

Rivian Q1 results (Rivian Q1 shareholder letter)

Q1 deliveries of 13.6k units grew 71% y/y, while revenue of $1.20 billion grew 82% y/y and quashed Wall Street’s expectations of $1.17 billion (+77% y/y). Of course, comps will start to get tougher for Rivian in the second half of FY24, as the company comps against strong growth in the September quarter while simultaneously expecting ~flat production and deliveries this year, amid the Normal factory shutdown. Still, it’s worth noting that in Q1, Tesla revenue declined -9% y/y. There can be no doubt that Rivian is gaining share.

We note as well that gross margins improved significantly to -44% (better than -46% in the previous quarter, and -81% in the year-ago Q1). Equally notable is a -16% y/y reduction in free cash flow burn.

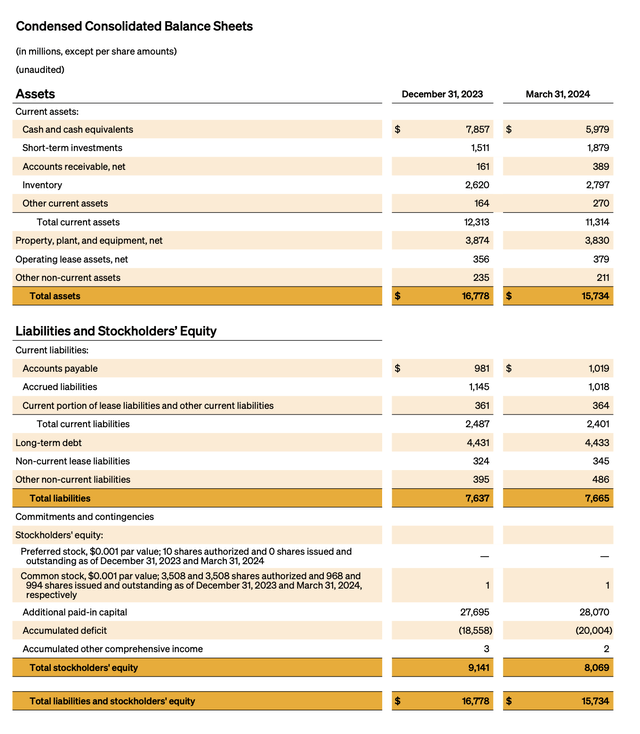

We note that Rivian still has substantial liquidity on its books. As previously mentioned, the company’s cash and short-term investments tally up to $7.9 billion – which, at its current burn rate and not considering any further improvements in profitability, is enough to last over one year.

Rivian Q1 balance sheet (Rivian Q1 shareholder letter)

Risks and key takeaways

Put in other words, Rivian has favorable trends under its belt now, even as it waits to early 2026 to kick off R2 – which will mark the brand’s first entry into the mass market and jump-start its growth the way that Model 3 caused Tesla to balloon.

Of course, there are risks at hand. The company is embarking on a major operational changeover with the release of its first new vehicles since R1S and R1T both debuted on the road in 2022. The company may fail to hit its production and savings targets. In addition, even with the R2 planned to start at $45k (which is very competitive versus Tesla’s Model Y), the roadmap for both Tesla’s next-gen mass market vehicles, as well as existing competition from lower-priced Chinese vehicles may pressure Rivian’s adoption.

Still, I consider there to be more upside than risk here, especially with Rivian’s continued enterprise partnership with Amazon (which is still in progress of delivering 100k cumulative delivery vehicles). I strongly encourage taking advantage of current-year volatility to build a position in Rivian.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.