Summary:

- Salesforce, Inc. stock experienced a significant drop after its earnings report, creating a buying opportunity.

- Despite the minor revenue miss, Salesforce remains a high-quality company with growth potential and an attractive valuation.

- The market overreacted to slightly softer guidance, but Salesforce has a track record of beating estimates and has long-term growth potential.

John M. Chase

Salesforce, Inc. (NYSE:CRM) stock cratered after its “worse-than-expected earnings,” dropping by over 20% in a single session. This dynamic resulted in a one-day market cap meltdown of about $50 billion and CRM’s stock (peak to trough) loss of roughly 33%. This extreme overreaction to a 0.2% revenue miss and slightly softer guidance has created a considerable buying opportunity in CRM’s stock.

CRM remains a high-quality, market-leading company in its segment, and the period of underperformance could be transitory. Despite the minor miss, CRM has a solid track record of surpassing sales and EPS estimates, and there is a high probability that CRM’s growth and profitability will bounce back.

Moreover, CRM has become cheap. The stock trades around a 20-22 forward P/E ratio and is between 5-6 times sales relative to its next year’s estimates. Despite the near-term rockiness, CRM has substantial intermediate and long-term growth potential and considerable profitability growth prospects.

Furthermore, CRM’s optimization could benefit from AI advancements, and it could soon return to outperforming the estimates. I recently purchased CRM stock around the lows during the post-earnings selloff. I may increase my position as CRM likely has considerable upside potential ahead, especially if we look out longer-term (5-10 years).

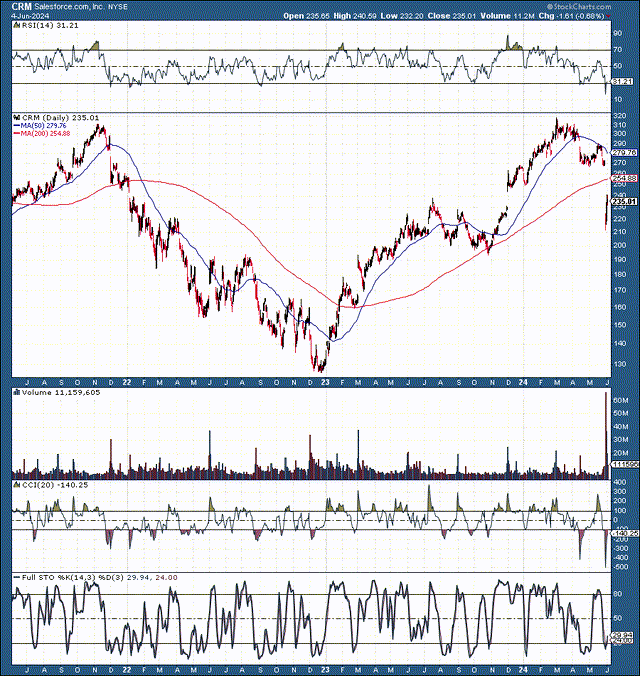

CRM: Bullish Long-Term Technical Image

Like many high-quality tech stocks, CRM experienced a major bear market. However, it advanced significantly, by about 150%, from its bottom to its recent high of around $320.

Recently, CRM became highly oversold. The stock dropped considerably on massive volume, filling the gap around $250-230, overshooting to the downside after the worse-than-expected earnings announcement.

The RSI dropped to about 20, its lowest level in at least three years, illustrating exhaustive oversold conditions for CRM stock. The CCI dropped to about -500, signaling one of the worst oversold conditions this stock has seen in its history. Also, CRM is forming a long-term inverse head and shoulders here, and the breakout above the $320 resistance is likely a matter of time.

From a fundamental standpoint, CRM has remained relatively stable. However, from a technical perspective, the stock became overextended and experienced a (needed) significant correction of about 33%. This has reset CRM’s valuation, making it a more attractive investment. As a result, the stock is expected to stabilize, consolidate, and potentially move higher in the intermediate and long term.

The Market Overreacted To Soft Guidance

CRM recently reported Q1 non-GAAP EPS of $2.44, a $0.07 beat. However, CRM’s revenue of $9.13B missed the consensus estimate by $20M (roughly 0.2%). Despite revenues being up by 10.7% YoY, this minor miss illustrates some transitory weakness for CRM. Also, expectations relevant to AI may have gotten slightly ahead of themselves, resulting in softer-than-expected revenues.

Moreover, the slower-than-anticipated phase could last longer than expected, as CRM’s guidance also fell below the consensus range. CRM’s guidance for Q2 (fiscal 2025) was $9.2-9.25B, lower than the $9.34B consensus figure. Also, the company provided full-year (fiscal 2025) guidance of $37.7-38B, vs. the consensus estimate of $38.01B.

The Earnings Takeaway

The difference between $37.7-38B and $38.01 is minor. Moreover, CRM can increase and improve sales and may surpass the current estimate range. Therefore, the severe reaction and meltdown of $50B in the market cap may be an overreaction. Also, we should maintain a longer-term perspective when evaluating CRM because it has a long growth runway and can increase sales and improve profitability for many years. Thus, the recent selloff is likely a buying opportunity, and CRM’s stock will likely do well in the short, intermediate, and long term.

CRM’s Excellent Track Record Of Beating Estimates

One month or one quarter does not make a trend, and I maintain my viewpoint that CRM is going through a transitory underperformance stage during which its stock could remain volatile, but CRM’s stock could continue much higher long term.

CRM – Likely To Continue Beating Estimates

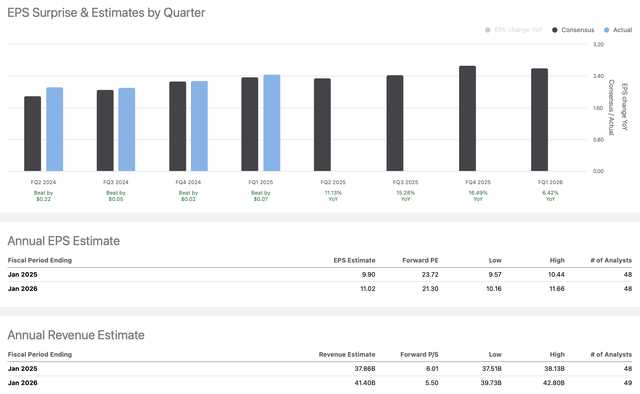

EPS vs. estimates (seekingalpha.com)

CRM consistently surpasses EPS and sales estimates. In fact, CRM has beaten EPS estimates in each of its last twenty quarters and only missed sales estimates once in this time frame. CRM delivers safe and steady results, and the recent underperformance stage is likelier a transitory slowdown than a long-term, lasting event.

Consensus estimates are for around $10 and $11 in EPS in fiscal 2025 and fiscal 2026, respectively. CRM’s TTM EPS outperformance rate has been about 3.5%. Applying a similar outperformance rate implies CRM could deliver around $10.25 this year and roughly $11.40 next year.

Applying $11.40 in EPS estimates to CRM’s current price of around $235 implies that it trades at a 20.5 forward P/E ratio. This valuation is relatively cheap for a high-quality, market-leading company in CRM’s position. Therefore, as we advance, we can see better-than-expected earnings growth, multiple expansions, and a substantially higher stock price.

Where CRM’s stock could be in the future:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $38 | $42 | $47 | $52 | $57 | $63 |

| Revenue growth | 9% | 10.5% | 12% | 11% | 10% | 9.5% |

| EPS | $10.25 | $11.40 | $13 | $15 | $17 | $19 |

| EPS growth | 25% | 11% | 14% | 15% | 14% | 12% |

| Forward P/E | 24 | 25 | 25 | 25 | 25 | 24 |

| Stock price | $275 | $325 | $375 | $425 | $475 | $525 |

Source: The Financial Prophet

CRM’s stock can move substantially higher in the coming years by incorporating modest revenue and EPS growth and operating under a slightly higher (25-26) forward P/E ratio. Moreover, CRM could experience better than anticipated growth and offer more profitability enhancements, leading to higher multiple expansion and stock appreciation in a more bullish case scenario. Nonetheless, my modest “base case scenario” 2030 price target range for CRM is $500-550.

Risks to CRM

Despite my bullish assessment, risks exist. CRM faces the risk of a more pronounced than expected slowdown, slower sales growth, and worse-than-expected profitability. Moreover, CRM may benefit less from the AI effect, affecting stock sentiment. We also have the risk of increased competition weighing on growth and profitability prospects. There are also macroeconomic and monetary policy risks. Investors should examine these and other risks before investing in CRM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!