Summary:

- Intel’s stock price has dropped 30% despite strong business performance, presenting a buying opportunity.

- The launch of Intel’s new AI chip, Gaudi 3, could be a catalyst for a stock trend reversal.

- INTC’s data center positioning and potential sales growth of Gaudi 3 could lead to a re-rating of the stock.

JHVEPhoto/iStock Editorial via Getty Images

The stock price of Intel Corporation (NASDAQ:INTC) plummeted a cool 30% since I took a small position in the chip company back in January of this year. The main reason why I initiated a first position was that Mobileye, a developer of autonomous driving technologies, came off its best year in terms of sales ever and that Intel presented a robust profit outlook for 1Q24.

I think that the drop in Intel’s stock price is completely detached from the underlying reality of the chip company’s business performance and since the earnings multiple is set for decompression next year, the risk profile is poised to improve. I will describe what catalysts I see for Intel and why investors could potentially even double their money here.

Because the stock is cheap, a multiple decompression may be imminent and with a major AI chip product set to make a splash, I am modifying my stock classification to ‘Strong Buy’.

New AI Product Launch Set To Be A Catalyst For A Stock Trend Reversal

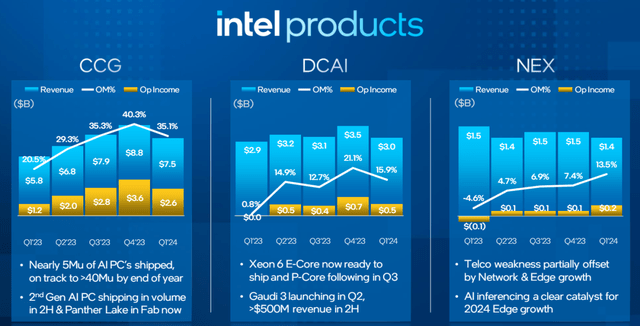

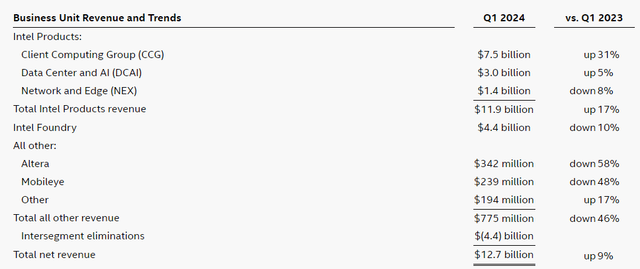

While Client Computing, Intel’s processor business, suffered mightily last year as consumer demand for computers and laptops waned, the segment is making quite a bit of a comeback as of late: In 1Q24, Client Computing was the driving force behind a 17% upswing in group sales which reflects the new way that the chip company is summarizing its financial performance.

Intel changed its reporting format recently amid of ongoing restructuring and now groups Client Computing together with Data Center and Network/Edge in one segment. In total, the new reporting unit ‘Intel Products’ had $11.9 billion in total sales in 1Q24 and growth, catalyzed by improving volume shipments in the PC business, was robust enough to even offset weakness in Intel’s Network and Edge segment.

Business Unit Revenue And Trends (Intel Corp)

The path forward for Intel, however, is what is a lot more exciting, and particularly in the context of a rather substantial crash of Intel’s stock price in recent months.

Intel is making some major moves in its Data Center segment, which is poised to include sales of Intel’s new AI accelerator Gaudi 3, which is the company’s latest AI chip meant to pose a challenge to Nvidia Corporation (NVDA).

Nvidia absolutely obliterated the competition with its H100 GPU, a graphics processing unit that is used in data centers around the world to power demanding workloads, including the training of large-language models.

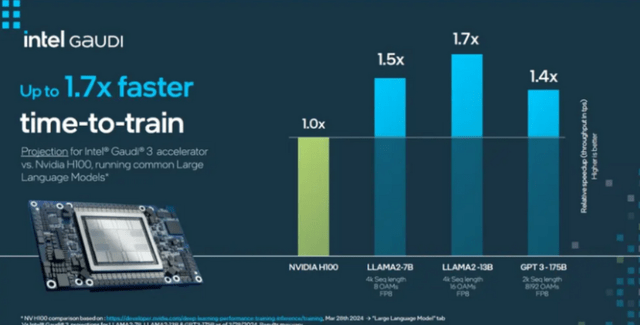

The Intel Gaudi 3 AI accelerator is poised to ship in the second quarter (that is, now) with some tests revealing an up to 40% speed advantage over Nvidia’s H100 processor.

Intel’s AI accelerator also seemingly outperforms in terms of LLM training performance, inference and efficiency, which could make Intel Gaudi 3 at least a very compelling alternative for companies that invest in LLM capabilities, which are mostly large U.S. companies.

Intel has made initial projections for Gaudi 3 AI accelerator sales, which are anticipated to clock in somewhere around the $500 million mark in the second half of the year. Intel is going to more aggressively scale deliveries after June and I think, given that large companies are lining up around the block to get their hands on AI-capable processors, Intel could absolutely crush expectations here for the Gaudi 3 AI processor, particularly if its performance claims hold up in the market. Importantly, with Nvidia charging top dollar for the H100, Intel could have a price advantage which could accelerate sales right from the release date.

In terms of total dollar volume, I think that Gaudi 3 AI accelerator sales could easily surpass $500 million in sales volume (which would be about equal to 7% of estimated second half sales of $6.9 billion). Next year, sales could easily go above $1.0 billion, simply because the chip will be available throughout the entire year and this estimate doesn’t even account for the effect of sales growth.

Thus, Intel has considerable re-rating potential for three specific reasons:

- Intel’s Gaudi 3 AI accelerator launch is going to make a positive sales contribution in 2H24.

- The market is going to factor in Gaudi 3 AI accelerator sales into its sales and earnings projections, meaning profit estimates could very well get revised upward.

- The introduction of Intel’s AI chip in the booming data center market at a time of escalating demand could help reestablish trust in Intel’s stock.

Chart Picture Now Looks Nasty

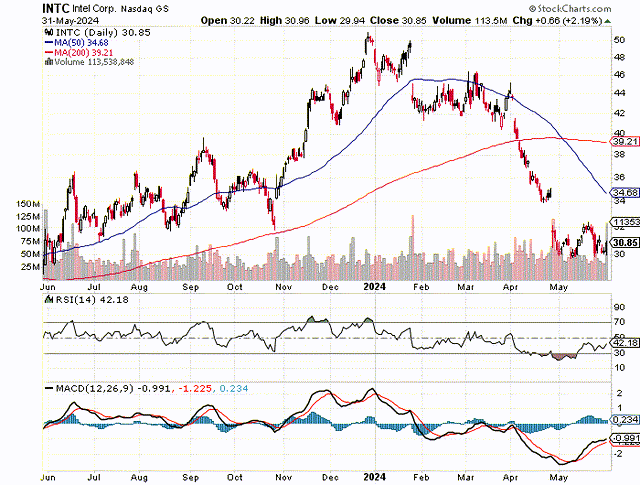

Intel’s stock picture, purely from a technical evaluation perspective, has deteriorated quite a bit since January as the stock price declined by 30%, but that doesn’t mean Intel cannot be an attractive and promising investment. Intel’s stock fell below both the 50-day and 200-day moving average lines in April, signifying a major change in investor sentiment toward the chip company, compared to the start of the year.

With the Gaudi 3 AI accelerator launch, Intel will step into one of the hottest markets in the PC/data center industry, however, which alone could help change investor interest in Intel. At around the $30 price level, Intel has found considerable support in the past, and I think that the downside here is quite limited.

Guidance And Earnings Multiple

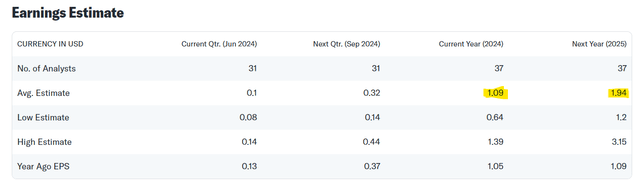

Intel is presently anticipating $0.10 per share in profits for the second quarter, which was one reason why the stock fell into a downtrend. These profits are expected to be achieved on total sales of $12.5-13.5 billion, which reflects the expectation that sales won’t grow much at all, on a YoY basis.

However, the picture is poised to change next year as Intel’s data center positioning is improving: Next year, Intel is anticipated to see an 80% jump in profits per share to $1.94, thanks to no small part to Gaudi 3. This means that Intel’s present year profit multiple of 28.3x will fall to a multiple of 15.9x based on next year’s estimated profits.

The anticipated profit recovery, in my view, is underpriced as the company is poised to enjoy a substantial multiple decompression while having substantial potential to reinvigorate interest in the come via the new GPU release in the data center market.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Disappoint

The wild card here is the acceptance and adoption of Intel’s Gaudi 3. If the release bombs, and it turns out that Intel’s AI chip is not nearly as good as it is marketed, then Nvidia will have a field day and continue to rake in the big bucks while Intel is getting just the crumbs.

With that being said, though, Intel is an experienced chip company and has subjected Gaudi 3 to rigorous testing and, to the benefit of Intel, demand for AI chips is red-hot, so if the price is low enough, I think the company won’t have any troubles selling its processors to companies in 2H24.

My Conclusion

Intel is presently out-of-favor with investors and the stock price reflects this: With a year-to-date return of -38% an investment in Intel has been a spectacularly bad one. This underperformance hurts particularly when recognizing that Nvidia, a main peer in the chip space, gained 121% during the same period.

However, the short-term underperformance may cloud investors’ perception of Intel as a promising chip buy, as the company is poised to see a robust profit recovery next year. This is set to cut the company’s present P/E ratio in half, and it could also help investors realize re-rating gains if investors are seeing improvement on the profit front.

I think that the risk/reward relationship for Intel at 52-week lows is extremely compelling and while I may have dipped in my toes a little bit early into the Intel trade last time, I am confident that Intel is poised for a sustained recovery if Gaudi 3 is a success.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.