Summary:

- Palantir, a data analytics and software development company, went public in late 2020 and has experienced a volatile stock ride.

- The company develops software that analyzes data using AI models and proprietary algorithms to find inefficiencies and streamline operations.

- Palantir generates revenue through data subscription services, with customers signing long-term contracts, resulting in consistent and reliable revenue.

- Its failure to beat revenue expectations caused PLTR to be beaten down, but that presents a buying opportunity.

- Palantir expects to deliver even greater growth numbers through this year and is set up to regain that loss through beating future expectations.

Michael Vi

Introduction

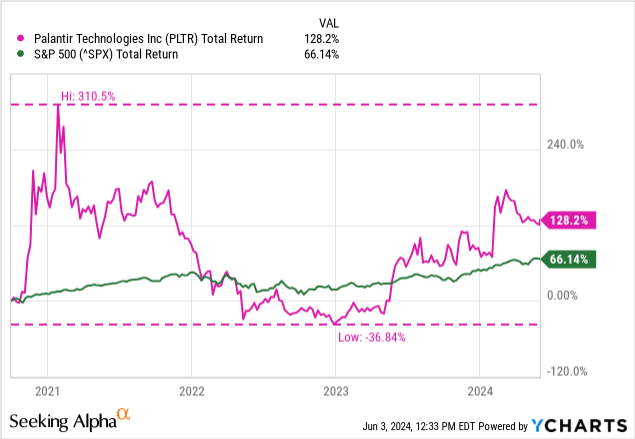

Founded by Peter Thiel (of PayPal/PYPL fame), Nathan Gettings, Joe Lonsdale, Stephen Cohen, and Alex Karp (who is still CEO) in 2003, Palantir (NYSE:PLTR) is a data analytics and software development company out of Palo Alto, CA (and also Denver, CO). It went public in late 2020 and has had a very tumultuous ride, surging up over 300% at its peak from IPO price and then falling down to 37% below its IPO price before coming back.

Note: Palantir did a “DPO” or a direct public offering instead of an IPO. For this article, the difference isn’t relevant so I am going to be using “IPO” to avoid confusion.

Today, it is still up over 100% from its debut.

Big Data

“Data analytics” is a rather vague term, and much of Palantir’s business is obfuscated through that kind of hand-waving jargon. For example, here is Palantir’s explanation of what they do, from their website,

We build software that empowers organizations to effectively integrate their data, decisions, and operations.

The best way I can put it for the majority of readers to understand: Palantir develops software that is designed to be the backbone of a corporation. All of their data is fed into this software (which I’m going to call an “operating system” or “OS” from here on out), and then the software analyzes that data using AI models and proprietary algorithms to find deficiencies, misallocated resources, and inefficient processes. The OS then enables “operators” (from businesses to governments to NGOs) to resolve these issues and streamline their operations from top to bottom.

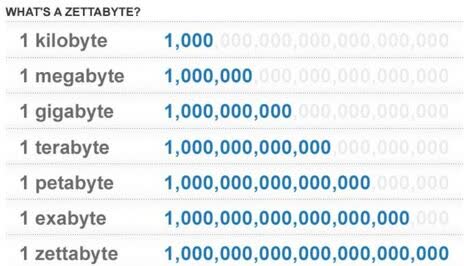

The primary “skill” being employed by the software is pattern recognition. The Palantir platforms can pour through millions of data points and “find the needle in the haystack” so to speak; that is, some pattern in the data that human operators missed or didn’t have the resources or time to manual pour over. In our world, the pool of data on individuals and in the world climbs every day. We can expect this figure to grow throughout our lives, with current figure pointing to there being almost 80 zettabytes of data currently in existence, only counting digital data.

A zettabyte is really, really big, for reference.

Figure 1 (American Energy Society)

How They Got Here

They’ve got a few big accomplishments under their belt from their 20-year tenure in the data business:

- An early investment from the CIA’s venture capital fund, In-Q-Tel

- Uncovered “GhostNet,” a Chinese-based spy ring of nearly 1,300 infected computers that had infiltrated the Dalai Lama’s office, a NATO system, and national embassies

- Deployed across the Medicare and Medicaid networks to find fraud

- Assisted in the location of Al-Qaeda leader and 9/11 orchestrator, Osama Bin Laden

- Its software was used to source records for Bernie Madoff’s conviction

- Current and former clients include the CIA, the Department of Homeland Security, the NSA, the FBI, the CDC, US Marine Corps, Air Force, and Special Operations Command; the FDA, Los Angeles PD, US ICE, the English NHS, and more

The Money Situation

So, Palantir is essentially a data subscription service. Customers buy the operating system of their choice (more on that later) based on their needs and then lock into a contract with Palantir, often for several years at a time. This means that their revenue is prone to two things:

- Sudden jumps and drops when customers sign-up or non-renew contracts

- Otherwise consistent and smooth, reliable revenue from existing customers

This is not a service that you can just drop one day and move on. Palantir’s products are all-encompassing of business operations, making the OS more like a central nervous system for many businesses. These are not easy to decouple from, so many firms end up using Palantir for a very long time. It is also difficult for governments to switch contractors, and the Army has been working extensively with PLTR since 2019 when they first reached over $50M in annual spend with Palantir.

It is notable that Palantir often lands very lucrative and large military projects. They just landed a $480M US Army project to build a prototype of the “Maven smart system” on May 29th, 2024. Back on March 6th, they landed a $178.4M contract with the US Army to build them machine learning models.

Revenue

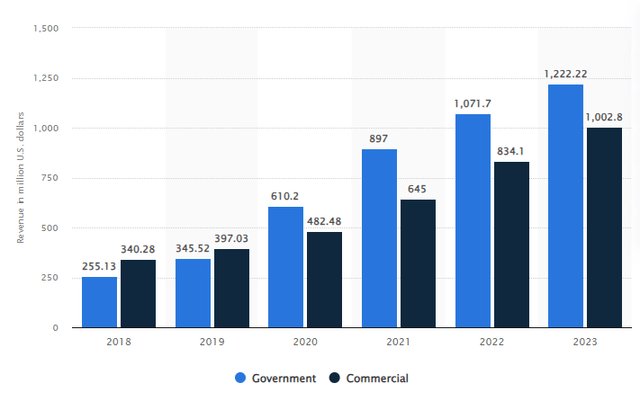

Revenue from both commercial and governmental sources have been growing, with commercial revenue starting to retake it’s pre-2020 spot as the larger revenue source.

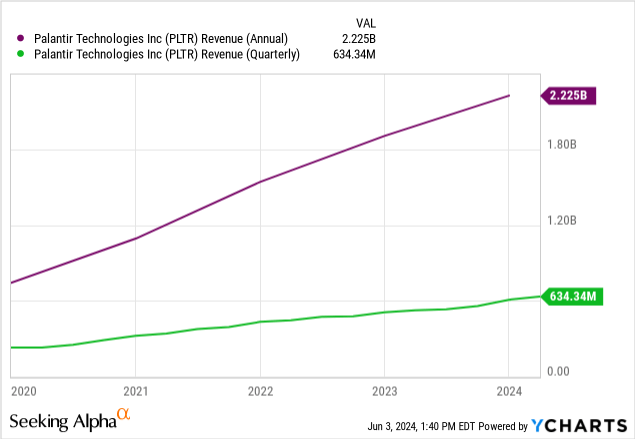

We can see these trends in their revenue figures, with the jumpy nature affecting the quarter-to-quarter results, but the annual figures having a much smoother upward trend.

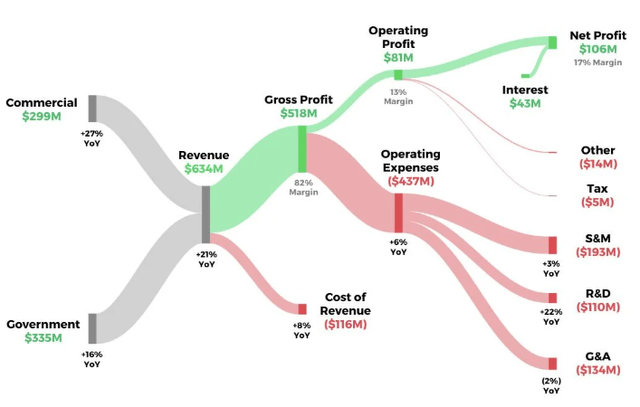

Based on Palantir’s Q1 FY2024 earnings, we can see that its customer base is almost entirely split between commercial and governmental clients, with strong growth figures for both YoY.

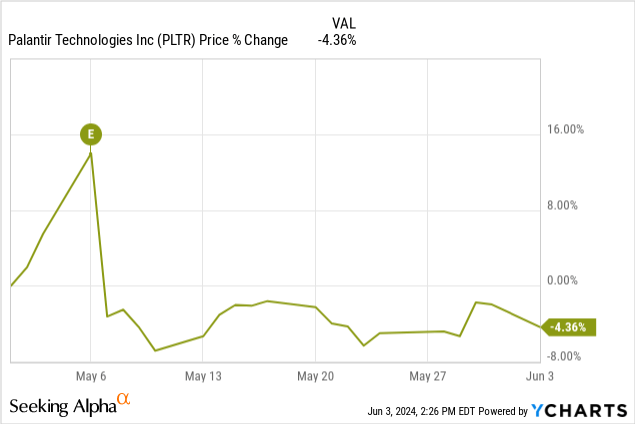

Markets were disappointed with Palantir’s revenue growth numbers since they missed previous guidance. The earnings call is noted by an “E” on the chart below and you can see what the call did to the stock price.

Guidance was for a 30%+ growth in revenue, but PLTR delivered 21%.

I believe this poses an opportunity for investors to buy in now, as Palantir has not recovered from that drop yet. Investors were not impressed with the existing growth numbers, but the future ones aim to impress them. When writing to shareholders, CEO Alex Karp wrote about this topic.

These enterprises cannot wait for custom solutions to be built. And they are unwilling to invest in software systems that might work someday down the road.

They need results now. And we believe that we have the only platform that works.

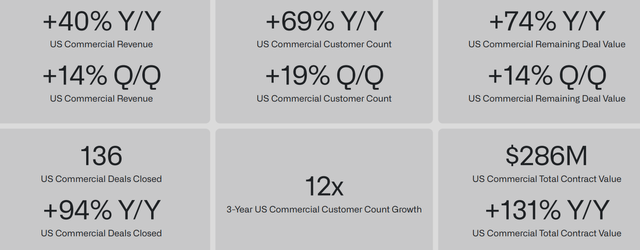

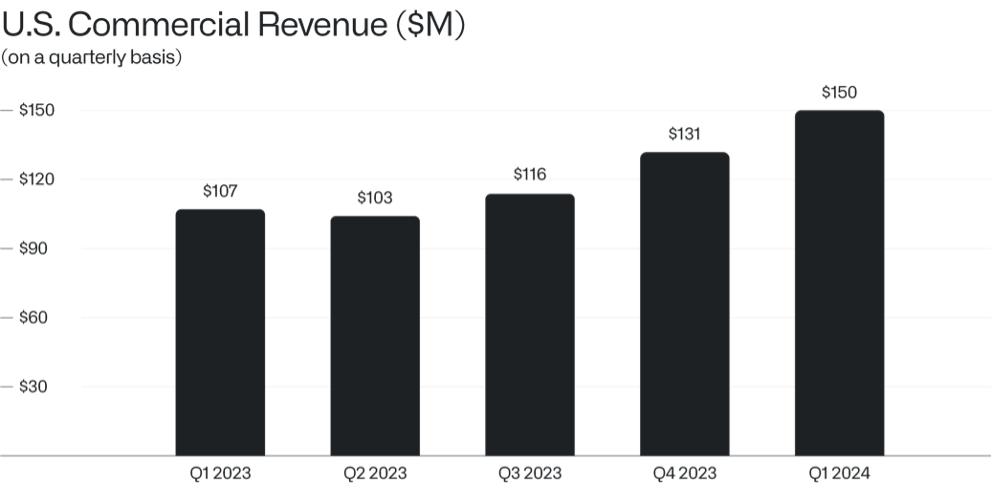

Our revenue [in Q1 2024] is a reflection of this unbridled and growing demand [for operating systems]. In the period ending March 31, 2024, we generated $150 million in revenue in the U.S. commercial market alone, representing an increase of 40% from the same period the year before. And we now expect revenue in our U.S. commercial business to grow 45% or more in 2024 compared with 2023.

That last line inspired a lot of hope that Palantir will be able to live up to these expectations in the future. A 45% growth target in the commercial segment is insane, but Karp believes it’s doable. They have been proving this so far, with rising quarterly revenues from the commercial segment since the latter half of last year and into this year so far.

Figure 4 (Palantir)

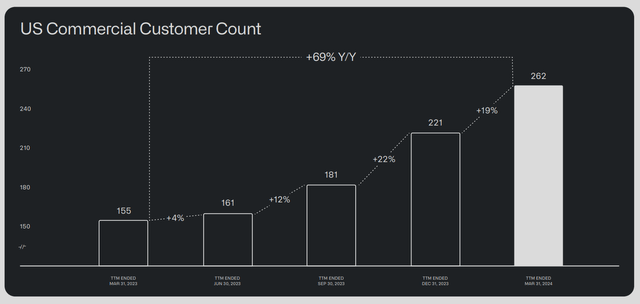

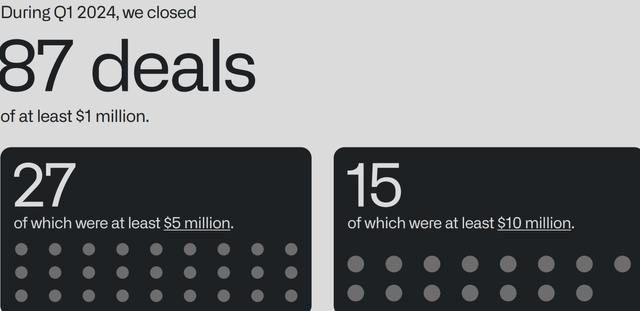

Driving this growth is an increase in the number of customers the commercial segment has. Palantir said that its commercial customer count increased YoY by 42%, which is a massive accomplishment. Over the 660 “boot camps” Palantir did in Q1, where the firm gives temporary access and training to potential customers, they were able to ink at least 87 deals worth over $1M.

Once larger institutions see those kinds of growth numbers (45%+), they will be lining up to invest in PLTR and add it into their funds, in my opinion. If Alex Karp is right (and I believe he is based on PLTR’s contract acquisition rate for this year), this means that now is a great opportunity to get into PLTR before it posts those kinds of numbers and gets more attention.

Expenditures

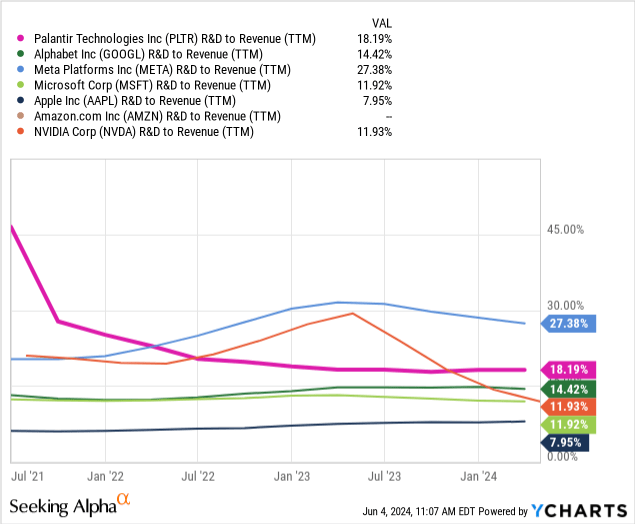

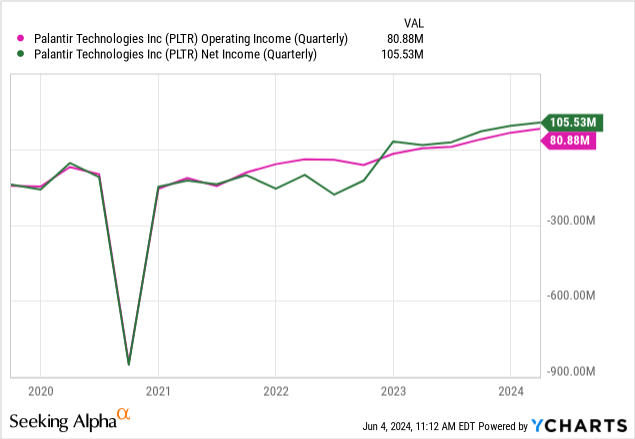

Going back to Figure 3 from the last section shows us that PLTR’s operating income is at a 13% margin. This is a current sore spot, but one that is expected with a growth company and one that is doubly expected when it comes to R&D heavy AI and software development work.

That R&D costs PLTR a fair bit of their revenue, but is a worth-while cost that will serve to further their business. Compared to mega-cap companies also spending boatloads on AI R&D, PLTR ranks fairly high in the R&D spend-to-revenue metric.

Income

PLTR has been struggling to produce consistent operating income, which is useful for them as they need to stockpile cash for future acquisitions. Palantir hasn’t acquired another firm since 2016, but general trends in tech firms have shown that acquisitions are one of the most cost-effective ways to bring in new talent and integrate tech platforms.

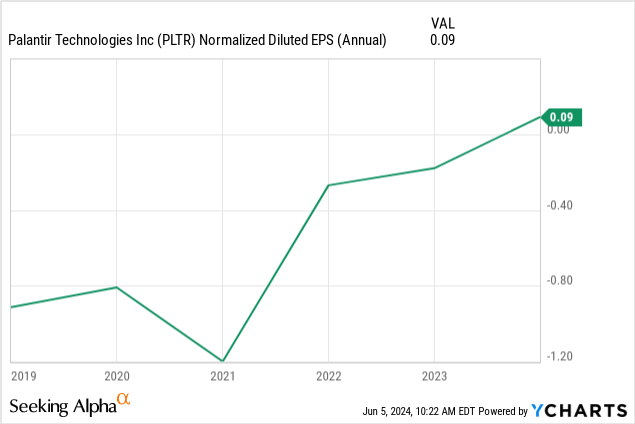

This past year was the first year since the IPO that PLTR has had a net positive margin and net income, which was a huge milestone to pass. Palantir being consistently profitable makes it one step closer to larger valuations and a potential inclusion in the S&P 500.

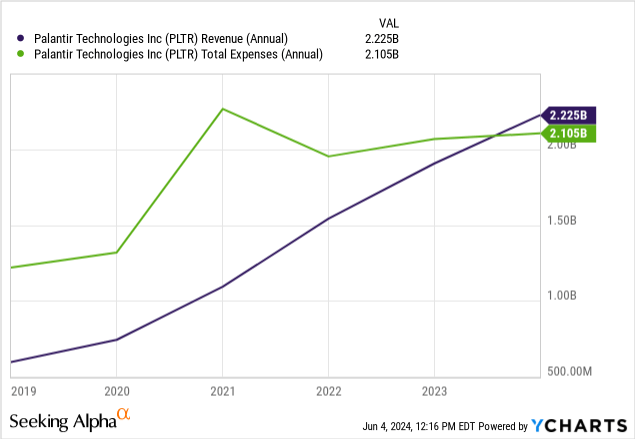

The revenue and expenses have very different slopes and are on very different trajectories, which is a good thing. We want to see the revenue line above the expenses line like we do above, and the hope is that Palantir is able to continue its revenue acquisition without linearly increasing its expenses.

So far, it has been able to maintain that trend, which is very positive for investors and will enable Palantir to accomplish a lot more in the acquisition space, increase their S&M (sales and marketing), and R&D spends, which will enable them to continue production on their unique products.

Acquiring Customers

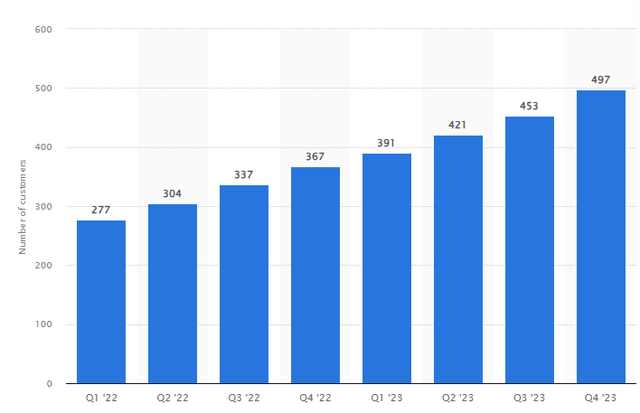

One of the core issues that Palantir has is that its customer base is very small. Because Palantir only operates commercially and governmentally, it excludes all retail customers from its pool. When I say small, I mean small. As of the end of last year, Palantir’s customer base stood at just under 500.

This is going to be Palantir’s largest struggle to grow, and one that I am going to watch closely moving forward. The largest risk to my thesis of Palantir being able to grow their revenue is that they are unable to gain new customers to generate that revenue.

The commercial segment, as mentioned before, is the largest area for growth currently. It’s important to note that Palantir either needs to do value or volume. They are currently operating on a value model, meaning that they derive most of their revenue from a small amount of contracts all offering massive payoffs, like the half-a-billion Army contract they landed this year.

Increasing their commercial customer count is one of the ways Palantir is trying to pivot to be a volume-based business, at least in the commercial segment.

CEO Alex Karp, in last quarter’s letter to shareholders, said that Palantir is moving to a more hands-off approach to corporate demos.

Other companies engage in intricate and elaborate efforts to sell and market their offerings. Their resources are focused on marketing at the expense of actually constructing the software and building the systems that they hope to sell. We have taken a different approach and are now investing even more heavily in simply letting potential partners use our software in order to decide what works and what does not for themselves.

This is the “drug dealer approach,” for lack of a better term, where customers are given samples of the various operating systems Palantir offers and the customer decides which one they like the most. This flies in contract to Palantir’s former strategy of working alongside customers to decide exactly what OS to deploy on their network. By shifting the onus to customers for choosing, Palantir is able to keep its current staffing and resource levels while servicing more customers at a time. I believe this is not only a prudent move, but one that will accelerate customer acquisition over the long term.

While it seems Palantir is still going to be chasing after the massive projects with the US government, the shift to acquiring commercial clients that offer much smaller deals on average is working as of now. It helps that their new product, the AI Platform (“AIP”), is a one-size-fits-all model that customers work with and customize as they work with the product. This means that deployment is quick and consistent revenue streams from these customers will be set up for years moving forward. In Q1 of this year, Palantir really aimed high and did a great volume of contracts.

Valuation

Palantir has been called out for its high valuation, and I highly encourage reading that argument from my colleague, Hunting Alpha, who wrote about PLTR from the sell side recently.

That being said, I believe PLTR can justify its valuations if it’s able to perform the kind of customer acquisitions that Karp says they are expecting to.

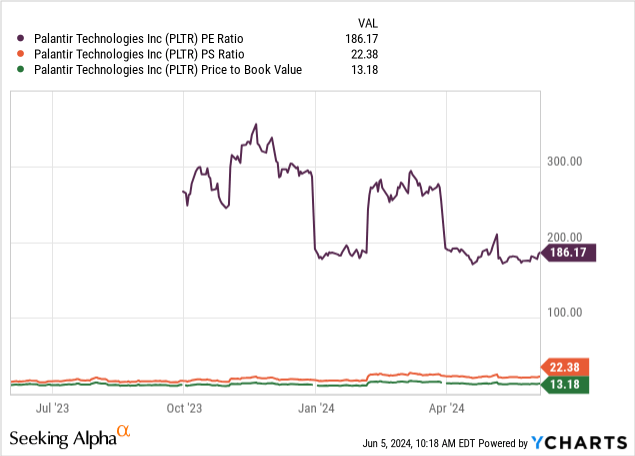

Earnings being negative until 2023 really puts the high valuation into some perspective, with a current P/E of 186x. Justifying this is difficult, because it relies on Palantir’s future, which is now unknown, but if PLTR is able to continue its trajectory of revenue and earnings growth, this ratio will come down quickly toward the end of this year. We’ve already seen good progress, with PLTR formally having been up past 300x in its P/E. Sales and book ratios remain steady and are at around industry average, albeit a little bit higher. This is a good thing for PLTR as it shows that the real issue is earnings and not its sales or book value. Earnings are being improved, and we can see over time, the trend in earnings growth is very positive.

In terms of “fair value,” I would be buying PLTR up through to $30. Over that, I want to wait for those future earnings and revenue figures to increase, and to see if they are able to secure that 40%+ increase in commercial customers that CEO Alex Karp alluded at in his letter to shareholders. If they are able to grow at that rate later this year, a $30+ stock price could be justified.

Until then, I will consider adding Palantir to my equity portfolio at its current value. If the stock drops below $10 (as it had in 2022), I will consider increasing my position from 5% to 7.5% as that, to me, would be “value territory” for PLTR.

Risks

There are several risks ahead of Palantir that investors should consider when making an investment.

- Failure to land new customers despite the uptick in S&M spending and new tactics could lead to further revenue growth underperformance

- Palantir’s R&D spend is small compared to some smaller competitors like C3.ai (AI), which could cost Palantir in the future if they were to fall behind (currently, they offer one of the most advanced platforms, for the record)

- The US government switching contracts from Palantir and moving to another contractor (like Booz Allen Hamilton (BAH)) would be devastating for Palantir’s existing revenue, which could effectively half if the US government halts its contracts

- A breakthrough in AI models that Palantir cannot catch up quickly could be a serious threat to their business and could come from a firm like Google or Microsoft

Conclusion

Palantir Technologies (PLTR) is a data-analytics company with few comparisons. Their unique offerings have set up consistent and large revenue streams that are growing at a slower-than-expected rate, but growth is looking up in the commercial segment. This uptick in commercial growth makes me hopeful that Palantir will be able to beat top and bottom line figures in the future, especially into the latter half of this year where Palantir is expecting up to 40%+ commercial customer growth.

I am giving Palantir a “buy” rating and am considering taking a position in the company. If I do, I will limit it to less than 5% of my equities portfolio. Conservative investors should consider an allocation of 2% or less.

Thanks for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PLTR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a beneficial long position in shares of GOOGL and MSFT.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.