Summary:

- ACADIA Pharmaceuticals is a biopharmaceutical company specializing in CNS disorder treatments, with two successful FDA-approved commercial products, Nuplazid and Daybue.

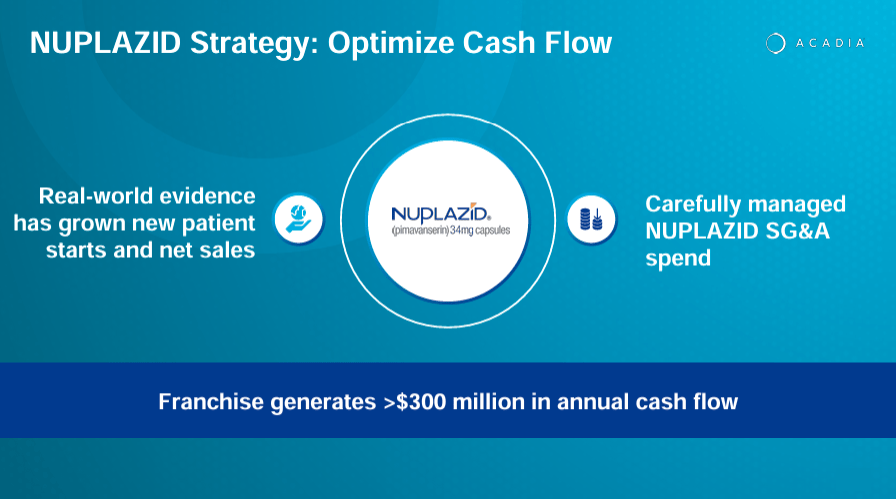

- Nuplazid, indicated for Parkinson’s disease psychosis, generates over $300 million in yearly cash flow, while Daybue, approved for Rett syndrome, had a successful launch.

- ACAD has a promising pipeline of drug candidates, including ACP-101 for Prader-Willi syndrome and ACP-204 for Alzheimer’s disease psychosis, which could create additional revenue verticals.

- The company is developing ACP-101 for Prader-Willi syndrome and ACP-204 for Alzheimer’s disease psychosis.

- ACAD’s strong pipeline and solid cash flow support its valuation, making it a compelling investment alternative in biotech.

koto_feja/E+ via Getty Images

ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) is a biopharmaceutical company specializing in developing treatments for central nervous system [CNS] conditions. The company has two successful FDA-approved commercial franchises, Nuplazid (pimavanserin), approved in 2016 for Parkinson’s disease psychosis, and Daybue (trofinetide), approved in March 2023 for Rett syndrome. Despite a setback with a failed clinical trial for a new indication for Nuplazid as a treatment for schizophrenia, the company stands strong with solid sales revenue for its commercial products and the advancement of its investigational pipeline. Hence, I rate the stock a “buy” for investors looking for steady value accumulation in biotech.

Nuplazid and Daybue: Business Overview

ACADIA Pharmaceuticals is a biopharmaceutical company specializing in developing treatments for central nervous system [CNS] disorders. Founded in 1993 and headquartered in San Diego, California, the company has two successful commercial products approved by the FDA. ACAD’s main value drivers are Nuplazid and Daybue, which I believe are enough to justify its current valuation.

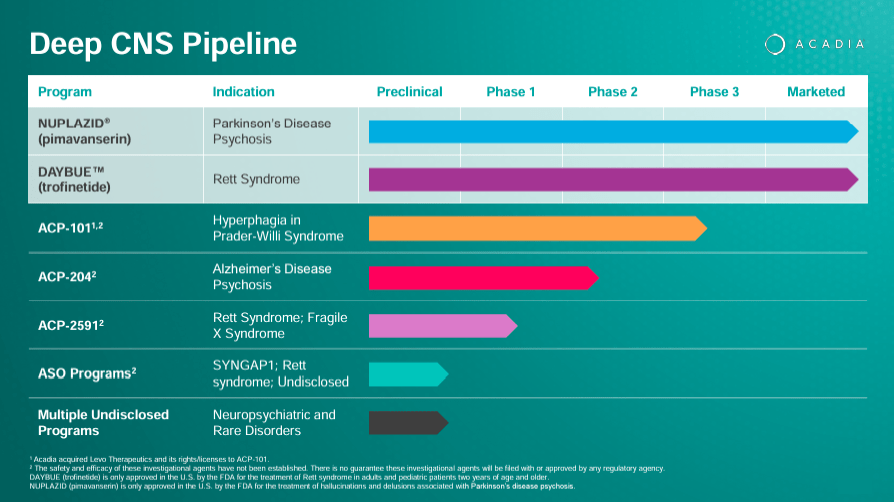

The company also researches ACP-101 for hyperphagia in Prader-Willi syndrome and ACP-204 for Alzheimer’s disease psychosis, along with preclinical antisense oligonucleotide programs for conditions such as SYNGAP1-related intellectual disability and Rett syndrome. However, ACAD is also developing a promising pipeline of drug candidates that could create additional revenue verticals. Plus, the company is working on expanding indications on its approved IP, which can also boost revenues in the future.

Source: ACADIA Corporate Presentation. 1Q24 Earnings. May 8, 2024.

Concretely, ACAD’s first commercial product is Nuplazid (pimavanserin), which was approved in 2016. It is indicated for the therapy of hallucinations and delusions related to Parkinson’s disease psychosis. Pimavanserin is a selective serotonin that binds to inhibit the activity of the 5-HT2A receptors. Such receptors are involved in the pathophysiology of neuropsychiatric diseases such as Parkinson’s psychosis. They also play a role in mood regulation and perception.

Source: ACADIA Corporate Presentation. 1Q24 Earnings. May 8, 2024.

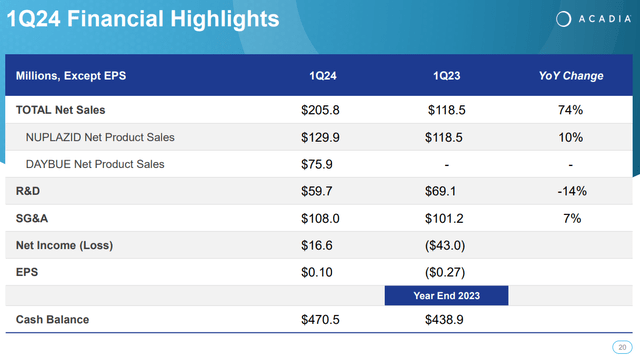

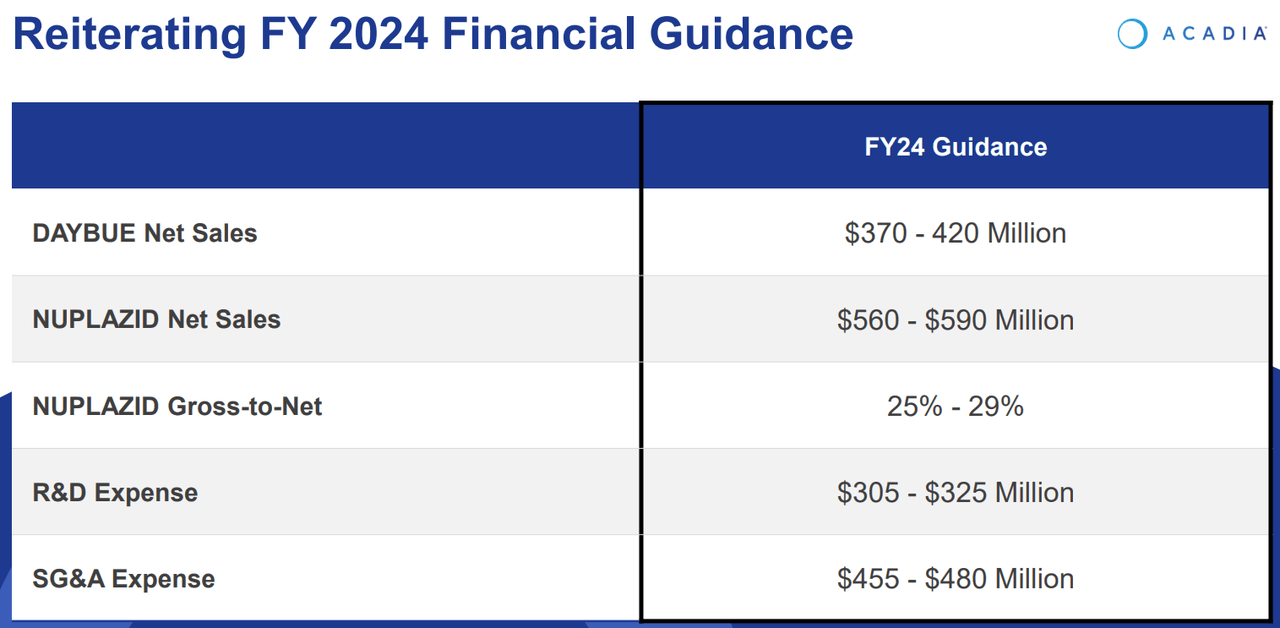

As of the latest quarter, Nuplazid’s revenues increased 9.6% YoY from $118.5 million in Q1 2023 to $129.9 million in Q1 2024. Naturally, this is not explosive growth, but it’s reasonable as this is more of a mature revenue source for the company. ACAD has tried expanding Nuplazid’s indications into Alzheimer’s Disease Psychosis [ADP] but has failed so far since the FDA rejected such indications.

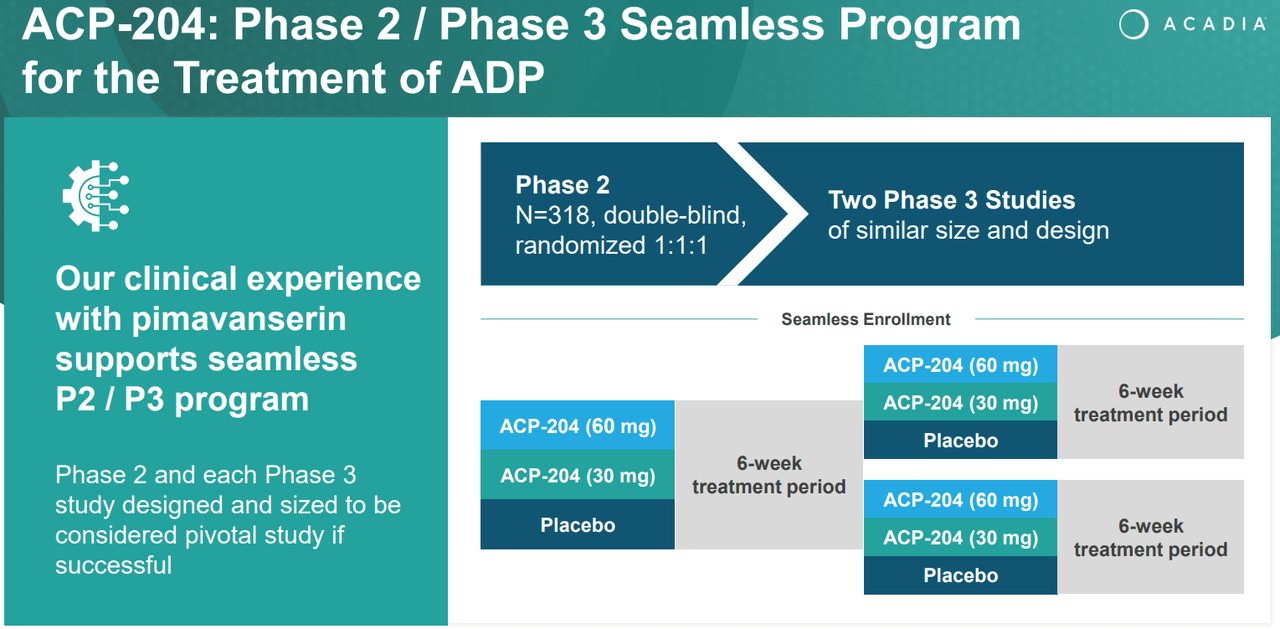

While this might seem like a substantial failure, I’d argue it’s more of a lesson because ACAD continues to develop a potential drug candidate for ADP called ACP-204. This upcoming drug candidate remains in phase ⅔, but I believe ACAD is likely getting closer to a viable drug candidate for this unaddressed need in ADP. Still, according to the company’s latest corporate presentation, Nuplazid is today a franchise that generates over $300.0 million in yearly cash flow. So, it’s a huge success, nonetheless.

Source: ACADIA Corporate Presentation. 1Q24 Earnings. May 8, 2024.

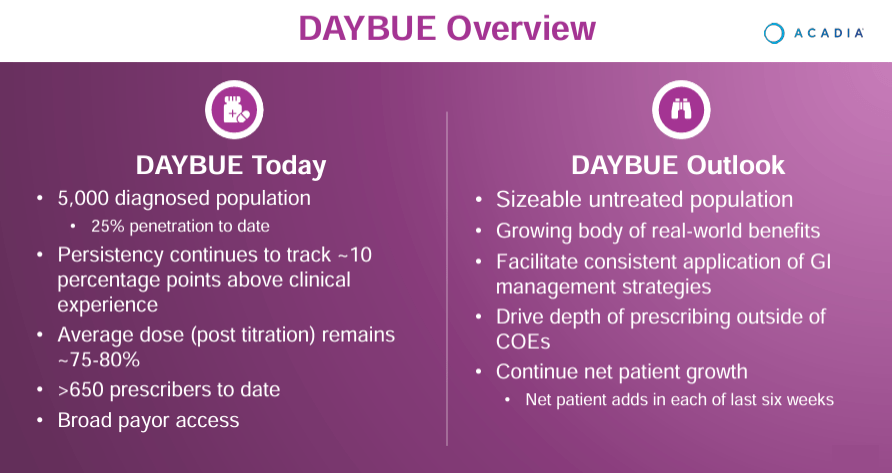

On the other hand, ACAD’s other newly approved commercial product is Daybue (trofinetide), which the FDA greenlighted in March 2023 for Rett syndrome in adults and pediatric patients older than two years. Trofinetide is a synthetic version of the tripeptide glycine-proline-glutamate [GPE], a peptide derived from insulin-like growth factor 1 [IGF-1] that plays a role in neuroprotection and neurodevelopment. Trofinetide mimics the effects of GPE, benefiting the pathways involved in neurodevelopment and synaptic function.

As a result, Debut has been shown to modulate inflammation and support neuronal signaling. Rett syndrome is a genetic disorder affecting mainly females, produced by mutations of the MECP2 gene that affects brain development with loss of coordination, movement, and communication capacities. Trofinetide targets several mechanisms of Rett syndrome, offering relief and potential improvements in the quality of life for patients.

Pipeline: Upcoming Drug Candidates

Beyond ACAD’s two approved drugs, its research pipeline includes ACP-101, a drug in phase 3 for hyperphagia in Prader-Willi syndrome [PWS]. This disease is a rare genetic condition caused by the loss of function of some genes on chromosome 15. It produces a variety of symptoms, including hyperphagia due to hypothalamic dysfunction, which leads to severe obesity and connected complications.

Source: ACADIA Corporate Presentation. 1Q24 Earnings. May 8, 2024.

Another investigational drug is ACP-204, which I previously mentioned. This one is in phase 2 and indicated for ADP. This is congruent with ACAD’s research background as it previously tried to expand its leading product, Nuplazid, into this indication. Still, I remain optimistic about this research program because the company understands how to address this indication’s FDA approval requirements after its failure with Nuplazid. In fact, the company actually acknowledged this in its corporate presentation on ACP-204.

Furthermore, ACAD’s pipeline includes ACP-2591 in phase 2 trials for Rett and Fragile X syndrome [FXS]. The FXS condition is a genetic disorder that causes intellectual disability with distinctive physical features. ACP-2591 addresses the symptoms of these two conditions, targeting the underlying mechanisms that produce them, aiming to enhance the patient’s well-being. The rights for this drug were acquired from Neuren Pharmaceuticals Limited (OTCPK:NURPF) in July 2023.

Source: ACADIA Corporate Presentation. 1Q24 Earnings. May 8, 2024.

Lastly, the company’s Antisense Oligonucleotide [ASO] programs are preclinical and involve researching RNA-based drugs. You can think of antisense oligonucleotides as short, synthetic strands of nucleic acids targeting specific mRNA molecules to modulate gene expression. These programs can potentially have applications in SYNGAP1, Rett Syndrome, and an Undisclosed disease. SYNGAP1 is a gene that, when mutated, causes intellectual disability, epilepsy, and autism. Additionally, ACAD is exploring other undisclosed programs for diverse neuropsychiatric symptoms, which is in line with its overall IP portfolio.

ACADIA’s Q1 2024 Updates

It’s also worth noting that Nuplazid (pimavanserin) was being studied for an additional indication regarding symptoms of schizophrenia. On March 11, 2024, the drug failed the late-stage trial for this indication, and ACAD’s stock suffered a 15% decline. The failure was related to pimavanserin not meeting the primary endpoint because there was no significant statistical improvement over placebo, so the company abandoned further clinical trials on Nuplazid. The drop in ACAD’s stock reflected the dissatisfaction of the investors with the outcome and with the company’s decision to stop further trials for schizophrenia. More importantly, it shows that ACAD’s efforts to expand Nuplazid’s indications continue to fail, and as such, it’s now giving up on this objective.

Source: TradingView.

Nevertheless, in ACAD’s latest earnings call, the company discussed Q1 2024 highlights. Nuplazid’s performance still showed a 10% YoY increase in sales, and Daybue’s launch generated $75.9 million in its first quarter. In fact, one in four diagnosed Rett patients started therapy with Daybue, which is a phenomenal achievement, in my opinion. ACAD’s executives also reported the efforts to expand Daybue’s market share, including diagnosed and undiagnosed Rett patients sharing success stories and benefits to motivate adoption. The company also reported on the advancement of the research on the drugs ACP-101 for hyperphagia in PWS and ACP-204 for Alzheimer’s disease psychosis.

So overall, despite the disappointing results with Nuplazid for new indications, ACAD’s pipeline remains promising and diverse. It has late-stage clinical trials in medicines and early-stage investigational drugs, demonstrating ACAD’s commitment to addressing critical unmet medical needs with innovative treatments. So, I think ACAD will receive more FDA approvals for new drugs over the long run, creating new revenue verticals that sustain its business and growth.

Relatively Undervalued: Valuation Analysis

From a valuation perspective, ACAD is a large biotech company trading at a $2.5 billion market cap. The company’s balance sheet holds $204.7 million in cash and equivalents, plus $265.8 million in short-term investments. This raises the company’s liquidity to about $470.5 million against no financial debt other than operating leases. I also estimate that ACAD actually generated cash flow in Q1 2024. If we add its quarterly CFOs and Net CAPEX, the company generated roughly $29.1 million in cash flow in the first quarter. Likewise, Q4 2023 also had a positive cash flow, as I estimate it generated $85.4 million. So I think the company is now self-sustaining, and coupled with its cash balances, it essentially eliminates dilution risks for investors.

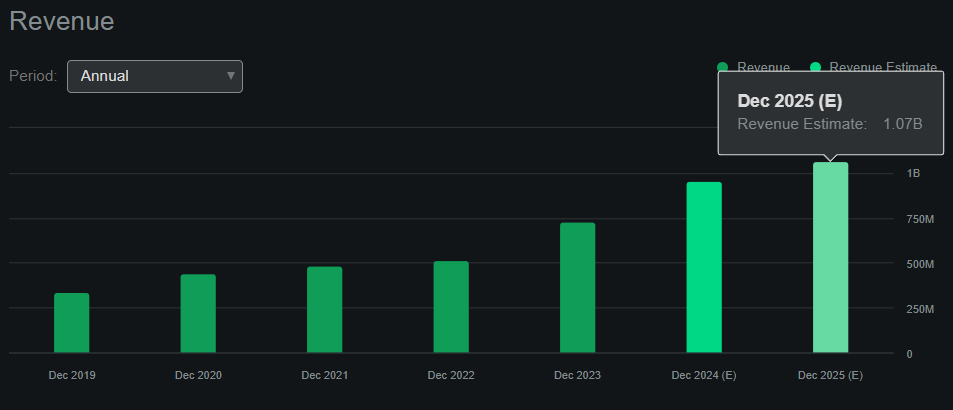

Source: Seeking Alpha.

Moreover, Seeking Alpha’s dashboard on ACAD forecasts the company will generate approximately $1.1 billion in revenues by 2025. This means the company trades at a forward P/S ratio of 2.3, which is relatively reasonable by all standards. For comparison, its sector median forward P/S ratio is 3.7, so ACAD actually appears undervalued relative to its peers. Plus, I think ACAD’s efforts with ACT-204 for ADP can pay off significantly, just as Nuplazid did on Parkinson’s. This research is in phase ⅔, but the company has been focusing on this indication for years, and I believe they have a good chance of having a breakthrough in the next few years. This would likely create a significant and unrivaled position in ADP.

Therefore, making a bearish argument about the company at these levels is difficult, so I give it a “buy” rating. The company trades at a relatively cheap valuation multiple and has steady revenue sources that financier potentially disruptive treatments in underserved indications. ACAD is not a “moonshot” type of biotech, but I think it’ll accumulate value steadily over the long run, making it a compelling investment alternative.

Investment Caveats: Risk Analysis

Naturally, ACAD is not without its risks. My thesis is that this stock will accumulate value over time through its already-approved drugs. This means that if international expansion efforts for Nuplazid and Daybue fail, this assumption will be considerably detracted from. Moreover, I also assume that ACAD will eventually be able to achieve a breakthrough in ADP, likely with ACT-204. However, the company has repeatedly failed to achieve this objective with Nuplazid. So, it’s important to consider the risk of ACT-204 disappointing as well.

Source: ACADIA Corporate Presentation. 1Q24 Earnings. May 8, 2024.

Finally, it’s important to mention that ACAD’s competition on Rett could intensify significantly if the FDA approves another drug candidate for this indication. Currently, only ACAD holds an FDA-approved first-in-class drug for this indication. However, if new gene therapy drugs were approved for Rett, it could significantly cap ACAD’s revenue prospects with Daybue. However, at this time, I judge this risk as relatively low, even though it’s a field with significant research. Obtaining FDA approval for these diseases is notably tricky, so I think ACAD’s competitive profile will remain strong for the foreseeable future. Also, the stock’s low valuation multiple and diverse product pipeline largely offset the risks I’ve mentioned. So, I consider a “buy” rating makes sense on balance.

Steady “Buy”: Conclusion

Overall, ACAD is more of a mature biotech company. It currently has two revenue sources that should continue to increase over time. Particularly, Daybue, approved in 2023, should have long-term revenue potential as it has 25% of the market today and no significant competition. Also, ACAD generates enough cash flows to be self-sustaining, eliminating dilution or financing risks for new investors. Naturally, I acknowledge regulatory risks for ACAD because the company hasn’t obtained FDA approval on ADP so far. However, I think that eventually, the company should be able to reach that breakthrough, providing it with additional revenue verticals in the long run. Moreover, the stock seems undervalued relative to its peers, so I think a “buy” rating makes sense for ACAD on balance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.