Summary:

- Caesars Entertainment, Inc. is a famous and enduring brand in the gaming industry, with a strong reputation and a large customer database.

- Carl Icahn has acquired a significant holding in Caesars Palace stock, citing undervaluation and potential for growth.

- Caesars Palace’s digital sports betting platform has underperformed compared to competitors, and there is room for improvement in innovation and imagination.

Domingo Saez Romero/iStock Editorial via Getty Images

Above: Until this day, it stands at the apogee of brand value, despite the massive expansion of so many other gaming brands. Mr. Market tends to sniff at that distinction because it was once built into the valuation of the stock.

One of the most enduring lessons I learned about casino stocks came through the lens of my tenure as a senior executive at Caesars Entertainment, Inc. (NASDAQ:CZR) through most of the 1980s. Despite decades of mammoth expansion of casino properties and brands, the same lessons, as such, pretty much apply today. My mentor at the time was then newly appointed CEO Henry Gluck. Just after my hire, he said, “You’re getting one of the most famous brands in the world to market.”

It was undoubtedly true. I thought of a quotation I had read not long before. A big time journalist was once asked, “How do you judge if someone or something really deserves the tag ‘famous.'”

His answer: If you don’t need to ask what the person or place is or does after you mention the name, that person is famous. The brand that prevails over time needs no introduction to succeeding generations, and is therefore the cheapest form of marketing that a new executive can depend on as an opening gift.

I put this precept to the test.

My job included one of the top two posts in Caesars, overseeing US and international marketing. That meant I ran customer development, direct advertising and promotion, data development, entertainment and special events, and CZR branch sales offices in the US, Asia and agents in South America.

It was a wide geography to test the idea about the difference between celebrity, which was fickle, to true fame. Famous translated into durable brands that rang the cash registers decade after decade.

So, in every city I visited, in many US states, in metro areas big or small, in world cities or remote enclaves, I found time, veered off alone, visited areas and asked every day people this question: What is Caesars? The answers I got were astonishing in a way because few of my eventual responders were expected to be gamblers.

Out of 350 responders over seven years (admittedly a casual sample), 189 instantly replied, “That’s a casino in Las Vegas. They have big fights there.” Question two: Do you know of any other casinos in Las Vegas? 7 replied, “The Sands” (perhaps the fame of Sinatra’s rat pack throwing a halo effect wide enough to rise to the appellation famous).

This reply particularly validated my quest. In a quiet fishing village not far from Caracas, we stopped for lunch. The owner, a man in his sixties, responded thus in Spanish: “That is Caesars Palace. I show you.” He led us to the small bar and pointed at a wall covered with tattered photos.

“Someday I go there” he said, pointing to a ragged poster of the Palace with the head of Muhammad Ali interposed. Next to the Caesars poster, no surprise, a photo of John F. Kennedy at the inauguration podium. Famous is never a surprise.

So, unquestionably, Caesars Palace’s first building rose in 1966 and since has been massively expanded into a city within a city. And the reason it has always enjoyed the brand status of true fame is because it endures. And that endurance is a powerhouse asset that has never really shone upon the balance sheet recently.

CZR’s shares since those days have had more than their share of a roller coaster ride through terrible managements, its disastrous sale to private equity, and its rescue from that damage by the deus ex machina of Carl Icahn. It was he that was the engine that drove Eldorado’s Tom Reeg (now CEO) in 2020 to plunk down $17.5b on the barrel for CZR that ignited its recovery.

Yet, it is an asset Carl Icahn has plucked a position on once again based on his contention that it is now vastly undervalued. He needs a win after a recent tussle with the shorts that has cost him big time in bucks and credibility, and he’s on the march to another haul in the same stock.

What Icahn sees—again

Beginning right after the CZR bankruptcy, Carl Icahn began building a stake in the company that eventually amounted to 14.1%. He continued adding shares that ultimately made him the largest single outside holder that eventually ran his stake to 15.84%.

His pursuit to get Eldorado to buy CZR ended when in the much smaller based company bit and, in a mouse eats elephant deal, acquired CZR for $12.75 a share ($17.5b) in cash and stock in 22022. Icahn also got his three BOD nominees elected and eventually walked away with billions.

Google

Above: The case for a recovery is strong, as the stock has fallen 60%+ since its high in 2021.

He now announces he once more has acquired a significant holding in the stock—but not as another activist (yet to be seen). But once again he cited an undervaluation opportunity,

The trading history of CZR isn’t pretty at first glance after the Eldorado deal built on a ton of debt:

May 2020: $10.09

Oct 2021: $118.

July ’23 $57

April ’23: $41.57

Price at writing: $35.

The precipitous fall of the stock since the autumn of 2021 has rationales to Mr. Market, mostly because the company has gone through some negative earnings quarters and undoubtedly some profit taking during its apogee in 2021.

Our talks with long-time associates in the gaming industry who have had dealings with Icahn over decades believe his continuing interest in the company stems from these convictions:

As noted in our introductory anecdote, his strong belief in the CZR brand above many large peers is a huge asset. As proof, he cites its 65m database of customers—the largest by far in the industry. The CZR halo has attached itself to all of his regional properties. Its database is the feeder for its Vegas properties from its regional properties in a reward system that keeps the customers inside the system.

Despite its huge sell-off of its realty to its VICI Properties (VICI) landlord, CZR still owns significant land outright whose value may not be fully recognized on its balance sheet. Its brand value in sports betting and iGaming is underperforming. More on this later. It’s the only fully “national” footprint of properties in every part of the US. The market seems to be looking at the CZR debt load as $25.9b. Of that, $11b is bank debt and $14b are rent payments to its REIT landlord (and original creature) VICI Properties. The distinction does throw somewhat of a more positive light on the CZR debt profile.

The company has done well since the buyout, but it has not performed up to potential as Mr. Market likes. As such, he sees once again enough run room to make his current entry point.

We have been fans of the company and its management since the Eldorado deal. And we have shared to an extent the Icahn view that the stock has far more upside than its sluggish trading range. So we once more did a deep dive into the company as its ongoing priorities to see what if any changes have occurred that may suggest that Icahn is once more on the right track by opening a large position again.

As evidence that CZR is back on the road to strong performance, we note that earnings from continuing operations went from Dec ’21 ($898m) to Dec: ’23: $822m should not be lost on investors.

These have to figure in an Icahn calculus too:

Market cap: $7.68b

Enterprise Value: $33.05b (It should be obvious here there is hidden value).

Gross profit margin: (TTM) $52.64 Sector av: $36.75

1Q24 revenues essentially flat, net loss ($158m vs. ‘22 ($136m) EBITDA $837m vs ’22: $97m

Digital underperforming brand power

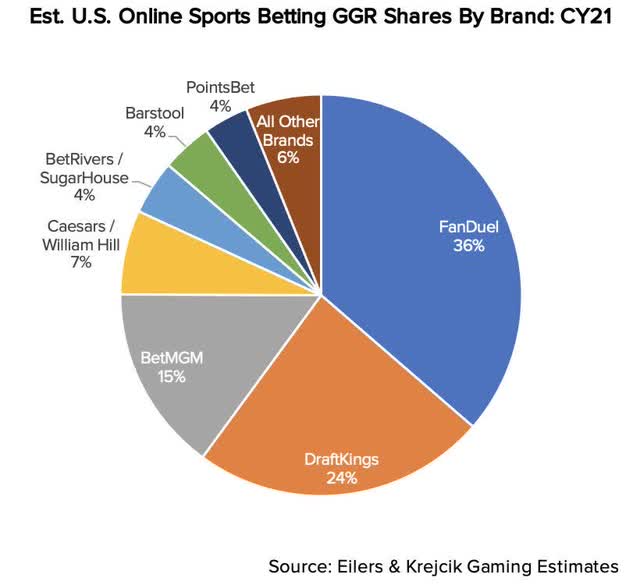

Above CZR’s sport book has still lingered below a double-digit SOM.

Our industry associates believe that the CZR digital share of the sportsbook business at ~6% to 7% since the May 2018 SCOTUS decision is an under performance. As noted above, it is clear that the magic of the CZR brand proven over 50 years and sustained by global visibility by its large international sales organization has not transferred to online sports betting.

With DraftKings (DKNG) and FanDuel (FLUT) taking first mover advantage with their fantasy databases, moving to where together their share owns 70% of the US market, that left essential pickings to the rest of the entrants. BETMGM sits in third position behind the leaders with well over 10% share and growing. CZR’s main move was to acquire the US assets of UK giant William Hill in 2020 for $2.9b.

The move made great sense. CZR saw the near insane cash burn of the share leaders. It recognized the immense capital outlay it would take to build a site from square one vs. buying an established contender already planted in casinos around the country. The brand conversion to Caesars Sportsbook should have been a boost, but it wasn’t the quantum leap it could have been.

As the state contingent expanded, we found that the CZR platform fell into the same general also ran brands that arrived. Several colleagues have told us that there have been significant changes of management at the mid-level fairly recently that reflect concern about the unit growth.

Also, the pace of brick and mortar capex spend continued in 1Q24 with over $250m. Of course, a 65-property chain, by definition, has a much larger job in continuing to upgrade and maintain first class status among peers equal to its longstanding brand status. But it also faces another reality.

In its most recent appraisal of the gaming industry growth, The American Gaming Association it indicated that brick and mortar forward growth was 3.3% in 1Q24 while online grew 27% reflecting a long-term trend. This tells us that work needs to be done in accelerating innovation and imagination for CZR digital product ahead. And needs a closer look at the capex spend and return given property improvements.

Conclusion

It would appear that a similar set of circumstances presents itself now to the prospects of CZR shares ahead that was compelling when Icahn sized up the opportunity to engineer the last CZR’s transformation. You have a legendary long-time performer, a truly well-known brand lingering after a bankruptcy brought on by bad decisions but still holding core value. I believe Icahn sees the value and what factors have been missed by Mr. Market.

And to him again, it’s a dinner table of goodies to be consumed. Last time, Uncle Carl came forward with a great meal for believers. We believe seconds are similarly proving worth a shot at $35 a share here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.