Summary:

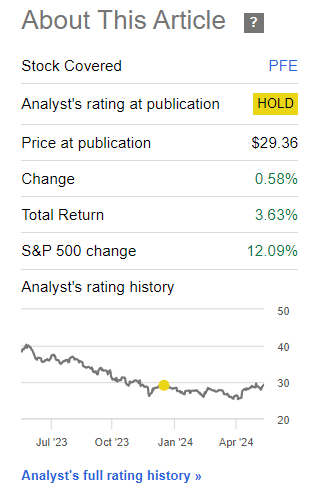

- I had a ‘Hold/Neutral’ stance on Pfizer in my last update, but the stock has performed worse than my expectations; lagging the S&P 500 by 8.46%. Yet, I maintain my stance.

- I’ve been skeptical of Pfizer’s expensive acquisition of Seagen. I believe the short-term performance incentives of the CEO are not well-aligned to value creation.

- Pfizer’s business has seen stagnant sales over the last few years besides the one-off of COVID vaccines. The oncology drugs pipeline shows us that the key catalysts are in 2025-2026.

- Hence, I believe it is too early for a turnaround case to be made, especially since there is no compelling valuation discount for buyers.

Kardd/iStock via Getty Images

Performance Assessment

In my last article on Pfizer (NYSE:PFE) (NEOE:PFE:CA), I had issued a ‘Hold/Neutral’ rating on the stock, which means I expected performance to be in-line with the S&P 500 (SPY) (SPX).

The results, however, show that PFE lagged the S&P 500 by 8.46% so a ‘Sell’ view was probably more prudent (see how to interpret my ratings at the end of this article)

Pfizer Performance since Author’s Last Update (Seeking Alpha, Author’s last article on Pfizer)

Thesis

Now, I still maintain my ‘Hold/Neutral’ view on Pfizer as I consider the following:

- Management’s short-term incentives are not aligned with prudent capital allocation

- A turnaround would not be visible until 2025-2026

- There is no sufficient discount in valuations

Management’s short-term incentives are not aligned with prudent capital allocation

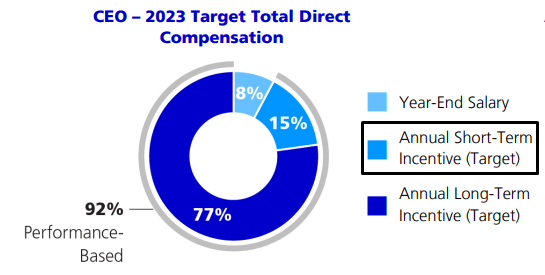

CEO Compensation Split (2024 Pfizer Proxy Statement)

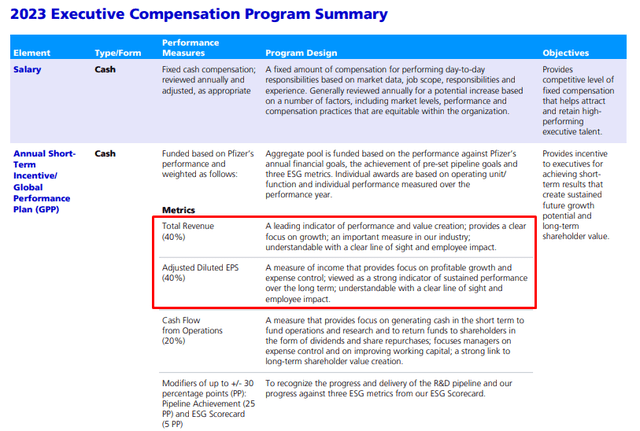

15% of Pfizer CEO Albert Bourla’s compensation is linked to annual short-term incentives. Out of this, a total of 80% is linked to overall P&L delivery (40% revenues, 40% diluted EPS):

CEO Compensation Performance Drivers (2024 Pfizer Proxy Statement)

What I don’t like about these compensation terms is that the revenue and diluted EPS metrics are not based on organic performance. This means the CEO has an incentive to get a nice boost to his compensation simply by purchasing revenues via acquisition. It does not matter if the purchase cost is exorbitant because that impact on total shareholder return plays out over a much longer period of time of 5-7 years.

Especially if these short-term metrics roll over every year, what is discouraging management from accumulating the easy compensation boosts from acquisitions in the short run? I don’t see much…

This may put some perspective into why Pfizer made an expensive entry into its Oncology strategy via the acquisition of Seagen at a 22.7x EV/Revenue, 15x PE multiple. I have analyzed this deal and the ask rate for making this deal value-accretive in my previous article on Pfizer.

A turnaround would not be visible until 2025-2026

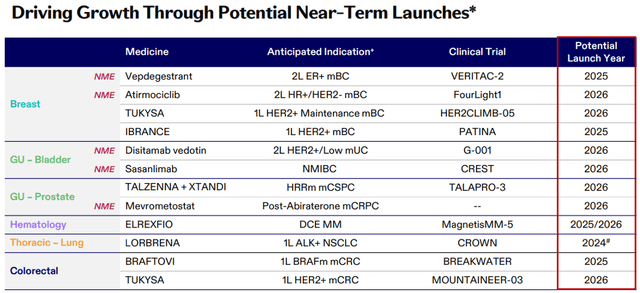

Pfizer is betting big on Oncology and has a lot of drugs undergoing clinical trials:

Pfizer Oncology Pipeline (Slide 124 of Pfizer’s Oncology Innovation Day Presentation)

Most of these launches are in 2025-2026. Hence, I believe it is too early to determine whether the fate of the company would see a meaningful turnaround that would replace lost revenues from COVID and patent expirations.

Looking at the current growth track, it is clear that Pfizer has a lot to prove, as its current track record in revenue growth is quite weak:

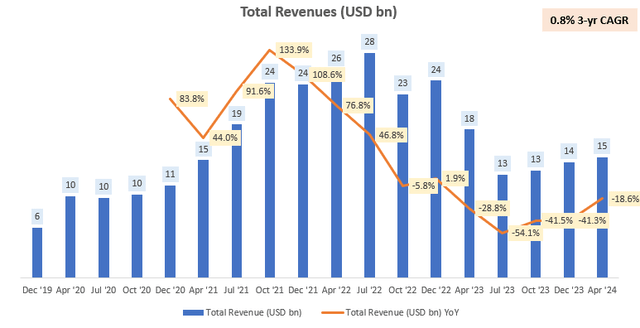

Total Revenues (Company Filings, Author’s Analysis)

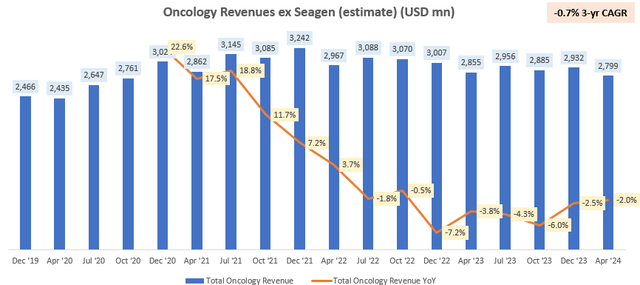

Overall revenues have been largely flat from pre-COVID levels 4 years ago. And the company’s whole focus on Oncology is almost entirely a Seagen acquisition play since organically, Pfizer’s oncology business has even had a small 0.7% compound annual degrowth rate over the last 3 years:

Pfizer Oncology revenues ex Seagen (Company Filings, Author’s Analysis)

There is no sufficient discount in valuations

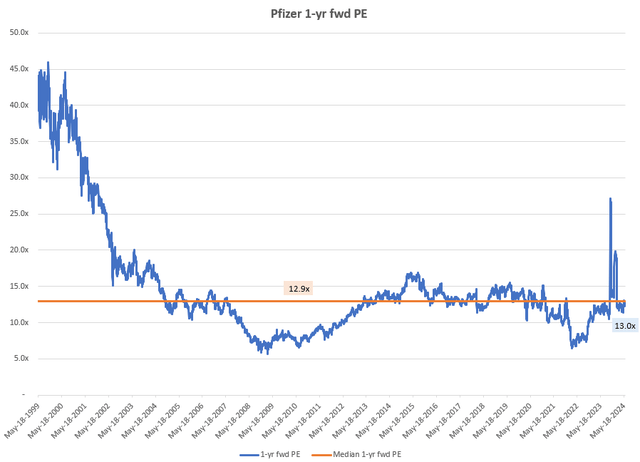

Pfizer 1-yr fwd PE (Capital IQ, Author’s Analysis)

Pfizer’s 1-yr fwd PE is currently at 13.0x, which is close to its longer term median PE of 12.9x. Thus, I deem that there is no compelling discount either to be a buyer here.

Technical Analysis

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do

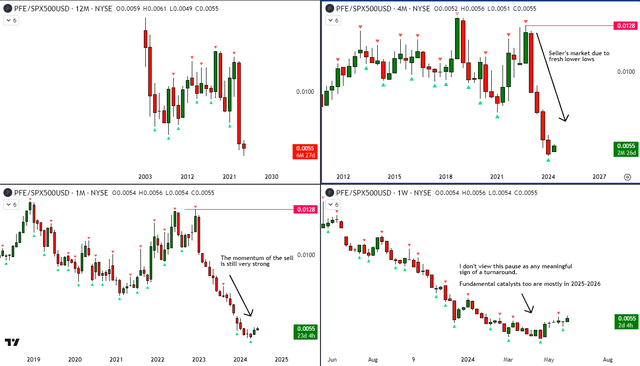

Relative Read of PFE vs SPX 500

PFE vs SPX 500 Technical Analysis (TradingView, Author’s Analysis)

Relative to the S&P 500, PFE has consistently underperformed since the start of 2023. My technical read says we are still in a sellers’ market, with strong momentum of the sellers. The temporary pause we have been seeing in the alpha erosion of Pfizer vs the S&P 500 over the last few weeks is hardly enough to make a case for a genuine turnaround of the trend. Note that as mentioned earlier, fundamentally too, the major catalysts for a turnaround aren’t due until 2025-2026.

Successful Clinical Trials are a Key Monitorable

Recently, Pfizer’s lung cancer drug Lorbrena posted a stellar success in its Phase 3 trials. 60% of lung cancer patients that used the drug saw no disease progression after 5 years. This trounced Pfizer’s older drug Xalkori which had only 8% of lung cancer patients reporting no disease progression over the same period of 5 years.

Lorbrena is a fast-growing drug in Pfizer’s portfolio; in Q1 FY24, it saw a 46% YoY growth in revenues; a stark contrast to Pfizer’s overall revenue performance. It is also expected to generate more than $1 billion in annual revenue by 2030. Currently, it’s ticking at $164 million quarterly ($656 if we do a crude annualized estimate), implying a modest 7% CAGR over the next 6 years.

If Pfizer is able to deliver this kind of positive news in the other trials in its pipeline over the next 2-3 years, the case for a genuine turnaround would become more compelling.

Takeaway & Positioning

Pfizer has done worse than my ‘Hold/Neutral’ expectations, underperforming the S&P 500 by 8.46% since my last update. I’ve been skeptical of Pfizer’s expensive (22.7x EV/Revenue, implied ~15x PE; 44% premium to sectoral 1-yr fwd PEs) Seagen acquisition. Digging into the performance incentives of CEO Albert Bourla, it becomes more apparent to me that value-creation may take a back seat in favor of easy revenue boosts via acquisition.

Furthermore, I remain unconvinced of the pharma giant’s turnaround right now. I believe it is far too early to make a case for an end to Pfizer’s revenue growth woes since its organic revenue growth is still stagnant and the key contributors from its major bet on oncology are still in the pipeline with launches in 2025-2026. I think that’s when the major turnaround catalysts would become clearer. Given a lack of a major discount in the valuations, I struggle to find the enthusiasm to be a buyer of Pfizer.

The one silver lining is that a key cancer drug in its pipeline has posted excellent results in its Phase 3 clinical trial, painting a bright future ahead for revenue growth. Recognizing that the company many have more of these successes in 2025-2026, I am adopting a ‘Hold/Neutral’ stance on the stock.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P 500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P 500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P 500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.