Summary:

- Coca-Cola is a global enterprise with strong brand equity and growing sales volumes, despite this, the stock has underperformed the market.

- The appreciation of the US dollar has negatively impacted Coca-Cola’s reported earnings, reducing its value by 31% since 2018.

- A potential weakening of the dollar could significantly boost Coca-Cola’s reported earnings and share price, providing upside potential for investors.

Dilok Klaisataporn

Coca-Cola (NYSE:KO) is the house of brands with unrivalled global reach. The company’s flagship brand is as strong as ever before, as continuing innovation and unrelenting marketing focus keep customers thirsty for more. It is no surprise that Coke has managed to grow sales volumes, even as other consumer staples companies are facing increasing competition from private labels. KO is a great quality, very profitable and growing business.

KO stock, on the other hand, has underperformed the market by a factor of 4X since 2011. This lagging share price performance could indicate a loss of competitive position and a considerable decline in earnings growth potential. But the profit margins of the business have actually improved over the period, and sales volumes have continued increasing at a healthy pace. There does not seem to be anything fundamentally wrong with the business.

Upon further inspection of the company’s financial disclosures of the last 10+ years, we have noticed a consistent headwind that KO was sailing against during this period of underperformance. The appreciation of the US dollar has been a considerable drag on the company’s reported earnings. Had the dollar stayed at the same level as in 2011, Coke today would be considerably more valuable.

As the world is emerging from a post-pandemic slowdown and Fed is getting ready to cut rates, we believe that KO will be facing a lot more favourable operating environment soon. In the absence of currency headwinds, KO will be free to display its full earnings potential, while a reversion of the dollar value back to historic averages would provide a significant boost to the reported earnings of KO.

We are bullish on Coca-Cola.

Majority of Coke Revenues From Overseas

Coca-Cola is a truly global enterprise and one of a few major US-based businesses, generating the majority of their revenues overseas. The international markets include many of the emerging regions of the world, where incomes are gradually improving and populations are growing. Such a position enables the business to continue delivering unit volume growth even as the American thirst for Coke gets quenched.

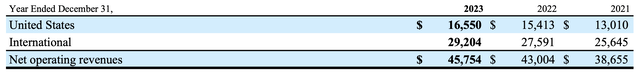

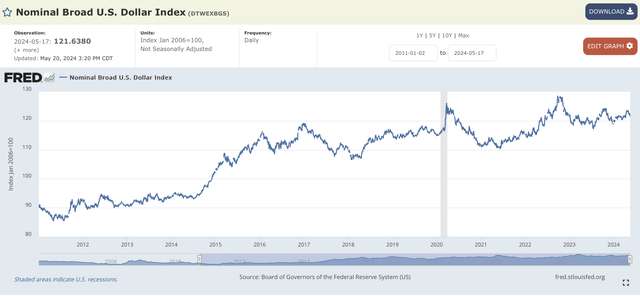

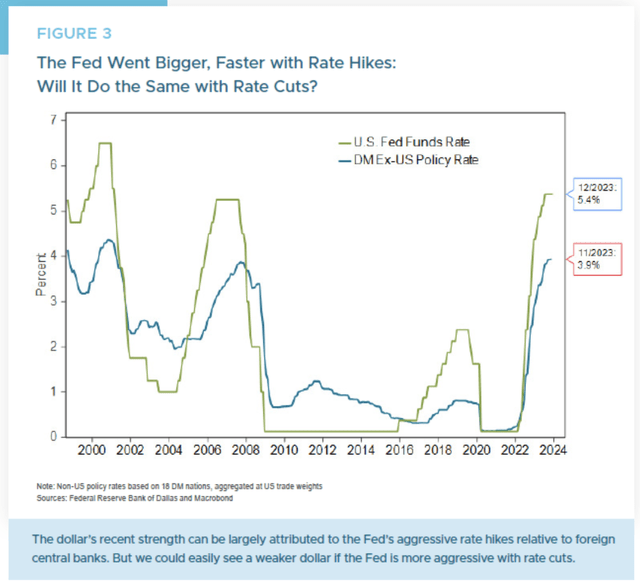

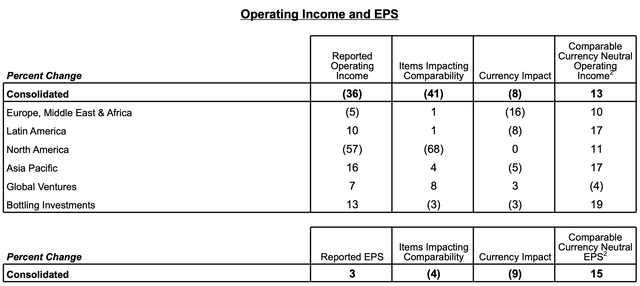

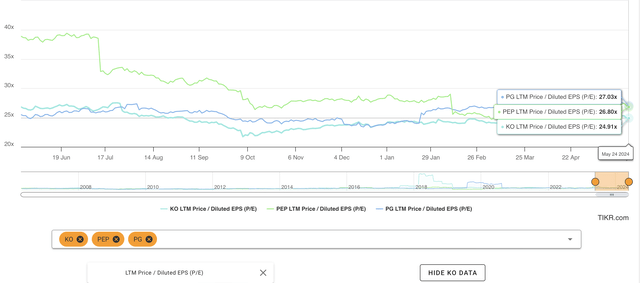

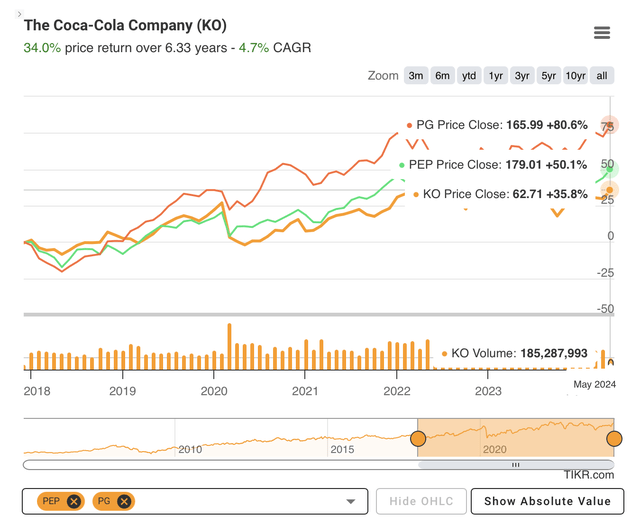

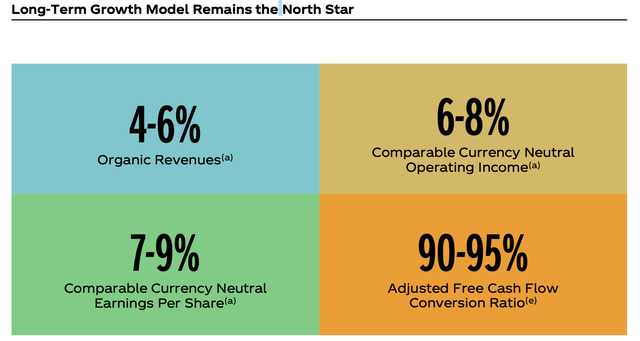

KO Annual Report This international nature of the business also means that the majority of the company’s revenues are generated outside of the US and in currencies other than the dollar, their reporting currency. The dollar is actually a very significant factor, in determining reported earnings of a business. As the dollar appreciates, international revenues generated in overseas domestic currencies get exchanged into a smaller amount of dollars. The reported financial statements of KO then show negative sales development, measured in dollars, even though the actual physical sales in international markets are improving. The impact of dollar exchange rate changes on the earnings of the business is even greater. Coca-Cola, even though it generates the majority of its revenues overseas, is based in Atlanta and has significant operations in the US. As foreign currency sales are exchanged for a lesser quantity of dollars, the cost base in the US is not affected by the FX rates. Dollar appreciation, therefore, has a negative effect on profit margins as we as the earnings of the business. The dollar’s appreciation against a basket of foreign currencies started in 2011 and has broadly continued until now, as the US has outperformed many of the world’s major economies. The dollar is currently trading at close to multiyear highs. The dollar has appreciated by 23% over the eight years until 2019 mainly driven by increasing savings globally as well as decreasing investor interest in emerging markets and Eurozone. Dollar appreciation continued during 2019 and into 2020 when the dollar was seen as safe heaven at the outset of the pandemic. After a slight dip in 2021, the dollar continued its upward trajectory, boosted by economic recovery as well as tighter monetary policy in the US. St. Louis FED Coca-Cola has been suffering because of dollar appreciation, and this has been one of the main factors contributing to the underperformance of the stock price even as the business continued growing. In its earnings announcements, KO breaks down the factors affecting reported revenue and earnings growth rates. As can be seen from the table below, the negative currency effects were the most significant negative factor. Compounded since 2018 alone, the earnings of Coca-Cola have been reduced by 31% due to the appreciation of the dollar. FY2018 FY2019 FY2020 FY2021 FY2022 FY2023 Cumulative Organic revenue change, % 5 6 (9) 16 16 12% Concentrate 3 1 (7) 9 5 2% Price/Mix 2 5 (2) 6 11 10% Transaction (16) 7 0 0 2 -1% Currency (1) (4) (2) 1 (7) -4% (16%) Revenue reported (10) 9 (11) 17 11 6% EPS change, % Reported 14 38 (13) 26 (16) 13 Currency Impact (5) (8) (6) 2 (11) (7) (31%) KO earnings reports, our estimates The company uses hedges to protect itself against currency movements, but these are mainly short-term instruments, intended to protect cash flows from significant swings in any one year. The company reports the performance of these cash flow hedges in other comprehensive income, thus these do not show up in the reported earnings but rather get taken directly to equity. The hedges are having only a very limited impact. Making calls on major currency movement trends is never easy, as many current factors, as well as future expectations, affect the relative valuations of currency pairs. Having said that, the US dollar has been appreciating since 2011 and now looks expensive compared to historic averages. We believe that significant rate cuts, whether they come in H2 2024 or 2025, are likely to lead to some mean reversion in the valuation of the dollar. Higher commodity prices could also lead to stronger EM currencies. Impact of Fed rate cuts: The US economy has been surprisingly resilient in the face of steep rate rises, even leading some to speculate that the economy faces a risk of overheating. Rate cut expectations have been largely scaled back, but continuing weak inflation is suggesting that some Fed rate cuts are on the table for 2024. Currently, the dollar is still offering substantially higher rates than currencies of other developed markets. The carry trade is likely to keep funds flowing into the US dollar and support the appreciation of the currency, while at the same time putting pressure on lowest-yielding currencies such as the Japanese yen. GW&K Invest Fed rate reductions though could diminish the attractiveness of the US dollar versus some other high-yielding DM currencies such as the Euro or the Sterling. This would unwind part of the long dollar trade, causing outflows of funds and a depreciation of the value of the greenback. Recovery of Emerging Markets: The timing of this reversal is uncertain, but we believe that the current situation of the US being the only growing major economy in the world is unsustainable. The dollar cannot appreciate in perpetuity, this would lead to decreasing competitiveness of US exports and eventually put pressure on the economy. Over a shorter timeframe, it is the relative economic recovery of the international markets that could also break the trend. China is already showing first signs of recovery, which could lead to stronger performance of its trade partners such as the EU. Having said it, the concerns about the property sector and public finances still linger in China. Most emerging countries, unfortunately, have a lot of structural issues and are not “emerging” in a consistent manner at all and staying in the low-income category for decades. Emerging countries usually export low-cost commodity-type products, whether it would be oil, agricultural commodities or minerals. A boost in the prices of commodities leads to bumper profits for most of these lower-income countries. Commodity prices have started improving in 2021, but remain below historic averages overall. Looking at individual categories, lumber and copper prices remain strong, benefiting the countries that export these. Stronger economic performance in emerging markets leads to the relative appreciation of their currencies versus the US Dollar. Trading Economics Overall, the US continues to be the fastest-growing and highest-yielding major economy, while at the same time, most of the other major economies are stagnating or dealing with significant structural issues. The US economy is likely to continue outperforming in the short term, on the other hand, the reduction in inflation will likely lead to interest rate cuts sometime in H2 2024 and 2025. While the rate cuts alone will not crush the dollar, demand for the currency will likely decline as other Developed Market currencies become more attractive for the long leg of the carry trade. As funds flow out of US treasuries, the dollar will start weakening. On top of this, improved Chinese economic performance as well as rising commodity prices could also lead to dollar depreciation. We do not expect the rest of the world to stay in stagnation forever. Coca-Cola is a major US-based exporter into developed and emerging markets globally. When the dollar weakens, their overseas-generated sales are translated into a larger number of dollars, boosting revenues as well as profit margins. A weakening dollar could also be associated with higher sales volume in emerging markets. Coca-Cola is considered a consumer staple in wealthy countries, though in many parts of the world, it is a luxury good. As incomes rise, consumers in these countries can afford to drink Coke more often, and therefore sales volumes in the emerging countries increase just as economies recover. EM economic recovery would lead to the strength of their currencies versus the dollar, leading to higher sales volumes and higher translated revenue figures. As we have shown above, Coca-Cola has experienced significant headwinds as the dollar appreciated. Not only did the currency effects reduce earnings by 31% it is likely that the relative weakness of the EM has led to weaker volume performance as well. As the dollar weakens, the reported results of Coca-Cola are likely to improve considerably, as currency effects turn positive and volume growth improves. Coca-Cola released their Q1 2024 results a month ago. Organic revenues of the business have grown an impressive 11% as compared to the Q1 of last year, the reported revenues, on the other hand, have increased by only 3% as compared to last year. The most significant negative factor affecting the reported figures was the currency headwinds, once again. The currency had a 9% negative impact on the reported EPS. KO Earnings Report In the earnings announcement, the company has also disclosed its projections for the rest of FY2024. The company expects organic revenue growth of 8%-9%. Currency headwinds are expected to cut the reported figures in half, while the EPS is expected to incur a very significant 7% to 8% FX headwind. The company expects comparable EPS (non-GAAP) growth of 4% to 5%, versus $2.69 in 2023. On a reported after-currency basis, EPS contraction is expected. Coca-Cola is thus guiding a reported EPS figure of ~$2.35, as last year’s reported EPS was $2.47. Coca-Cola is currently trading at $62, or 25X last year’s EPS. This valuation multiple is in line with other high-quality consumer staples companies such as Procter & Gamble (PG) or PepsiCO (PEP). TIKR Terminal We believe the 25X PE valuation multiple is reasonable for the earnings of the business, given the strong brand equity that the company has and its continuing ability to pass on inflationary cost increases while at the same time growing sales volume. KO stock has not been a stellar performer over the last 5 years, even though operationally it has done well. KO has underperformed both Pepsi (PEP) and P&G (PG) and the currency headwinds can be largely blamed for this. If the dollar would stop appreciating, the company would be facing a lot more favourable operating environment internationally, helping to boost its reported growth figures. TIKR Terminal Assuming that no currency headwinds are incurred, Coca-Cola expects to grow earnings in the range of 7-9% in the future. Assuming also that the current 3% Dividend Yield can be maintained while the company grows, the long-term KO holders would stand to earn about 10-12% per annum average returns. This is quite a respectable return from a stable and low-risk consumer staples company with strong brands. We therefore believe the valuation of KO is already quite attractive. KO Investor Presentation But we believe there is even bigger upside potential in Coke. The earnings growth expectations are provided excluding the currency effects, assuming that the dollar will stay stable. We believe that there is potential for the dollar to start weakening in the second half of this year and into 2025 as Fed cuts rates and also as emerging markets recover. The market does not seem to be pricing in this potential as KO continues trading in line with comparable peers as seen above. As talked about earlier, on a cumulative basis, the earnings of KO have been reduced by about 31% since 2018 as the dollar has appreciated considerably. The reversal of the dollar to historic valuation averages could potentially boost the reported earnings of the business as the currency headwinds are unwound. We therefore believe that there is a considerable upside to the current share price of Coca-Cola. The timing of currency exchange rate movements is hard to predict but in this case, we do not have to be precise. As the dollar weakening is not yet priced into the stock, we do not stand to lose even if our predictions are off the mark. Heads we win, – tails we do not lose! Coca-Cola is truly a global enterprise, generating the majority of its revenues overseas. The company owns a portfolio of particularly strong brands that enable the business to pass on cost increases while growing sales volumes at the same time. KO is truly a one of a kind consumer staples company. The stock price of KO, on the other hand, has lagged behind the broader markets as well as the other high-quality consumer staples peers. The currency headwinds are the main culprit of this underperformance. The Company has lost potentially more than 30% of cumulative value since 2018 due to the appreciation of the dollar. Reversion of the valuation of the dollar would provide a significant boost to the earnings and the share price of Coca-Cola. While we see initial signs that the dollar could start weakening after Fed rate cuts are implemented, FX markets are not easy to forecast. Fortunately, the share price of KO still does not seem to be pricing in this potentially more favourable operating environment. We see this as a free bet on a great quality company. If our dollar depreciation expectations are met, we will likely benefit considerably. If these do not materialise, we do not stand to lose anything, as the price of KO today looks rather attractive already. We are bullish on Coca-Cola.The Dollar Has Been a Headwind Since 2011

A 31% Earnings Loss Due to Dollar Appreciation

Would The Dollar Weaken?

Effect of Weaker Dollar on Coca-Cola

The Recent Performance of KO

Thoughts On Valuation And Upside

The Free Bet On Coke

Bottom line

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.