Summary:

- Pfizer is expected to experience growth in cancer treatments due to the rising global incidence of cancer, particularly aggressive forms, in young adults.

- Recent acquisitions, including Seagen and Trillium Therapeutics, have expanded Pfizer’s portfolio of cancer treatments.

- Despite weak Q1 financials, Pfizer has increased its earnings forecast, plans to invest in R&D, and has a strong cash position.

- Legal challenges and potential side effects of synthetic uridine in mRNA vaccines pose unquantifiable risks.

wildpixel

Preamble

Just over a year ago I wrote a hit piece on Pfizer Inc. (NYSE:PFE) titled; Don’t Bank On mRNA vaccines. I made the case that the company would fail to reach their revenue targets for their mRNA concoctions. In the Q4 2022 report, the company forecast around $10 billion in sales for Comirnaty (Approximately 100 million doses * Circa $100 per dose). Unfortunately for Pfizer investors, the figure given for vaccine revenue for the Q4 2023 period was around half the predicted by the management. As a result, the stock has tanked the lion’s share of 30% since publication, however, there are signs of a deceleration in the down trend.

The thesis of this piece is that the company’s oncology medications will see a ballooning demand over the years ahead due to the unfortunate rise in the incidence of cancers worldwide.

Confirmation of the upward trend in the diagnosis of this deadly disease abound. For instance, according to Yale Medicine, there has been a worrisome rise in “early-onset” cancers. These are cancers that are diagnosed between the ages of 18 and 49. Even more alarming, the article goes on to report that; “Another difference is that certain cancers, such as breast cancer, tend to be more aggressive in younger adults.”

Professor Emeritus and Senior Research Scientist in Epidemiology at Yale, Harvey Risch MD, PhD, has made a controversial claim that many cancers diagnosed these days are so aggressive that they can appropriately be described as “turbo” cancers.

As to why this is happening amongst millennials is anyone’s guess. Maybe it is the excessive consumption of highly processed foods and alcohol or perhaps the lack of exercise is to blame. Not forgetting that there are ever more novel chemicals we are exposed to in the modern world.

The upshot is that Pfizer are ideally placed to satisfy the demand for effective treatments for this expanding segment of medicine. And given Pfizer’s established reputation in the field of oncology, the way is clear for the company to increase revenues significantly in the years ahead.

The Global Oncology Market

The global oncology market is on the cusp of dramatic growth, with projections estimating a surge from $222.36 billion in 2023 to a staggering $521.6 billion by 2033. This translates to a healthy (pardon the pun) compound annual growth rate of 8.9%.

In 2023, North America held the top spot in the oncology sector with 48% market share. Whilst this unenviable position has a bad look in terms of outcomes, it can likely be attributed to factors such as advanced healthcare infrastructure, a high cost for treatments as well as a high prevalence of cancer diagnosis within the region. However, Europe is emerging as another part of the world showing a rise in cancers, so has the potential for fast market growth.

When it comes to specific cancer types, lung cancer currently holds the dubious crown in the market. This can be explained by its high prevalence, and, unfortunately, its high mortality rate. However, breast cancer is projected to be the fastest-growing segment, with diagnoses potentially surpassing those of lung cancer in the coming years.

According to the reports, the introduction of favourable reimbursement policies for various cancer treatment surgeries conducted in hospitals is expected to further influence the industry’s outlook in a positive way.

Pfizer’s Cancer Treatments

Pfizer has a growing portfolio of cancer treatments, but it’s important to note that their focus has intensified recently due to strategic acquisitions; Trillium Therapeutics in 2021 and Seagen in 2023

Established Cancer Treatments:

- Ibrance (palbociclib): This is a targeted therapy medication used for the treatment of certain types of hormone receptor-positive breast cancer.

- Xtandi (enzalutamide): This medication is used for the treatment of castration-resistant prostate cancer.

- Inlyta (axitinib): This treatment is used in combination with other drugs to treat advanced renal cell carcinoma and other types of cancer.

- Camptosar (irinotecan hydrochloride injection): This is a chemotherapy medication used to treat various types of cancer, including colorectal cancer.

- Ellence (epirubicin hydrochloride injection): This is another chemotherapy medication used for various types of cancer, including breast cancer.

Focus On Expansion:

Pfizer’s recent acquisitions highlight their strategic intent to expand their cancer treatment offerings.

- Seagen acquisition (December 2023): This acquisition brought Pfizer a significant portfolio of antibody-drug conjugates (ADCs), a promising class of targeted cancer therapies. These drugs combine an antibody that seeks out specific cancer cells with a cytotoxic agent (cell-killing toxin) to deliver a targeted attack.

- Trillium Therapeutics acquisition (August 2021): This acquisition provided Pfizer with access to Trillium’s immuno-oncology portfolio, focusing on drugs that harness the body’s immune system to fight cancer.

Overall, while Pfizer has some established cancer treatments, their recent acquisitions position them for significant growth in this area. They are actively expanding their portfolio to include innovative therapies such as ADCs and immuno-oncology drugs.

New Cancer Treatments

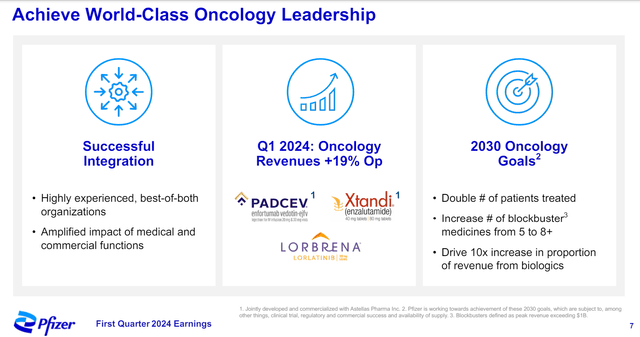

Pfizer’s latest quarterly report gave a glowing picture of the company’s more advanced treatments in the field of oncology, with revenues up 19%.

Increasing sales of cancer medicines (Pfizer quarterly report)

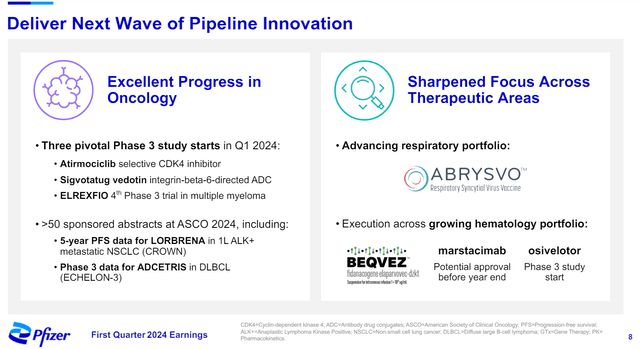

And the company has an excellent pipeline of new treatments at pivotal stages of development.

Newer cancer treatments (Pfizer quarterly report)

Financials

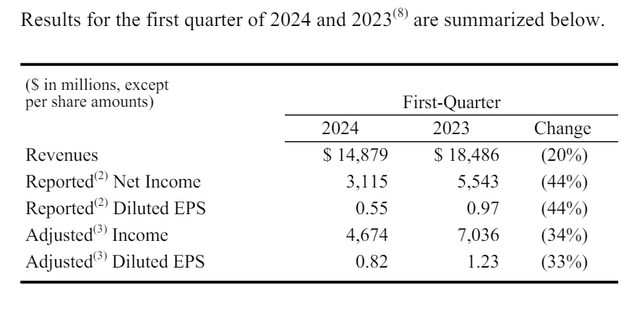

Results for the first quarter were not a pretty sight for investors, primarily as a result of poor Comirnaty sales.

Summary of revenues for quarter (Pfizer quarterly report)

However, there were a number of positives. To begin with, there was an upward revision to the forecast EPS for the year (From $2.05 to $2.25 to the new higher range of $2.15 to $2.35). Given that sales of Comirnaty have likely bottomed and that, as mentioned previously, sales of the company’s oncology medications are rising at such a rapid rate, it certainly appears that the new higher range is achievable.

From Pfizer’s huge cash pile of around $12 billion, the company announced plans to invest $2.5 billion in internal research and development projects. That is a big number in my book.

On top of this, it has to be admitted that the numbers do look favourable. For instance, the company has a PE of 12.6, which is eye catching for a number of reasons. To begin with, Pfizer’s P/E is low compared to that of the S&P as a whole, and compared to the median of the industry (19.79). On top of that, considering the thesis of the article, the company is on a clear growth path for the reasons explained herein.

Let us not forget the enticing yield of 5.7%.

Risks

Whilst things appear all quiet on the Western Front, so to speak, there are potential challenges on the horizon, which include a variety of legal problems as well as some disconcerting evidence of potential issues related to mRNA vaccines generally.

Legal Woes

Texas Attorney General Paxton has accused Pfizer of misleading the public about its COVID-19 vaccine. He alleges that Pfizer overstated the effectiveness of the vaccine. Specifically, “The pharmaceutical company’s widespread representation that its vaccine possessed 95% efficacy against infection was highly misleading.” Additionally, Paxton criticizes Pfizer for failing to disclose limitations of the data and promoting the vaccine as a way to protect others, despite lacking evidence for transmission prevention.

One can only wonder at the consequences for Pfizer and their stock holders if Ken Paxton successfully proves his case.

Although, it has to be said that Pfizer is a company with deep pockets and not without influence in high places. So, we can assume that the company will vigorously defend their product with a posse of lawyers and experts. So, it is by no means a done deal that Ken Paxton will be successful with his lawsuit.

In the unlikely event that the legal proceedings against Pfizer are successful, the costs to Pfizer’s bottom line can only be guessed at. However, the company has a significant cash balance, so any financial penalties are unlikely to sink the company.

In fact, there is a recent example of a product being withdrawn as a result of adverse effects. In 2004, Merck was forced to withdraw Vioxx, a popular painkiller, from the market after studies linked it to an increased risk of heart attacks and strokes. The controversy surrounding Vioxx led to a series of costly awards and a slump in the company’s share price, which didn’t fully recover for around 8 years.

Research

Messenger RNA is a single-stranded molecule built from nucleotides linked together. Each nucleotide contains a sugar (ribose in mRNA), a phosphate group, and a nitrogenous base. The bases are the key players in mRNA’s structure and function. There are four main types of bases in mRNA; Adenine, Guanine, Cytosine, and Uracil.

For the purposes of summarising new research, we need to understand what uridine is. It is a single nucleotide where the nitrogenous base is uracil and it pairs with a ribose ring. A key point to note is that uridine is found in natural mRNA.

However, within mRNA vaccines, a synthetic uridine is used, which is not found in nature. One of the benefits of using synthetic uridine is that it makes the mRNA of vaccines more difficult to break down and so remains active for a longer period. Unfortunately, this synthetic uridine, potentially, has a number of adverse effects, including, and not limited to, temporarily disrupting interferon signalling.

Interferon Signalling

There is a paper that was accepted for publication in May of this year that presents evidence that vaccination with mRNA vaccines induces a profound impairment in interferon signalling, which has diverse adverse and unpleasant consequences for human health. The researchers identified potential far-reaching interference with, for example, cancer surveillance resulting from issues related to the disturbed interferon signalling.

In short, Interferon is like a security system for your cells. It’s a group of proteins your body naturally makes when it detects a threat, like a virus or a cell going rogue.

The disturbances described in the research, potentially, have a causal link to a variety of conditions including, tumorigenesis. The term tumorigenesis is a fancy way of saying how a tumour first starts in the body.

Needless to say, if the body of evidence showing a link between mRNA vaccines and impairment of interferon signalling grows, it will not be a good look for Pfizer. Indeed, one could describe these circumstances as a PR disaster and who knows what the impact on Pfizer will be. Afterall, many medical professionals were obliged to receive mRNA vaccines, and I’d guess that they would be displeased to learn of these connections between impaired interferon signalling and mRNA vaccines.

Competition

Cancer treatment is quite a crowded market, and Pfizer faces stiff competition from sizeable players. For example, their newly acquired platform developed by Seagen for producing ADCs will battle companies such as AbbVie for market share. AbbVie recently acquired ADC specialist ImmunoGen, which significantly bolstered its ADC portfolio.

Daiichi Sankyo is another major force with a proprietary ADC technology platform and several approved ADCs on the market. The company is collaborating with Astra Zeneca for the development and commercialization of ADCs.

Summary

Pfizer, despite missing COVID-19 vaccine revenue forecasts, is poised for growth in cancer treatments. Cancer diagnoses are rising globally, particularly aggressive “turbo cancers” in young adults.

Pfizer has existing cancer treatments like Ibrance and Camptosar, but recent acquisitions, Seagen and Trillium Therapeutics, have significantly expanded their offerings.

While Pfizer’s Q1 financials were weak due to poor vaccine sales, there were positives. The company increased its full-year earnings forecast, plans to invest heavily in R&D, and boasts a strong cash position.

However, legal challenges regarding the efficacy of Pfizer’s COVID-19 vaccine and new research on potential side effects of synthetic uridine in mRNA vaccines pose unquantifiable risks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.