Summary:

- I warned about the extreme optimism on CRM stock in December 2023. My caution has panned out.

- Salesforce’s AI monetization may take longer than expected, but the company remains confident in its long-term potential.

- Now, the market has become too pessimistic about CRM’s growth potential, with a forward adjusted PEG ratio of just 1.2.

- I argue why I’m a buyer at the current levels, as the AI FOMO has dissipated.

John M. Chase

My Caution On Salesforce Stock Panned Out

I cautioned Salesforce, Inc. (NYSE:CRM) investors to be wary about chasing a further rally in CRM as I assessed that the optimism was getting too frothy. In my CRM stock update in December 2023, I indicated that while CRM’s valuation was still relatively attractive, the risk/reward no longer appealed to me that much. As a result, I downgraded CRM to reflect my increased caution. CRM’s buying momentum initially baffled me by allowing the stock to surge toward its February 2024 highs. However, the moment of reckoning finally arrived after Salesforce’s first fiscal-quarter earnings release last week. Accordingly, CRM suffered a historic selloff as Salesforce reported the “slowest quarterly sales growth in its history, with revenue expected to rise by as much as 8% to $9.25B in the period ending in July.”

Notwithstanding the plunge observed in CRM stock as it fell into a bear market, I also reminded investors to capitalize on its next pullback to add exposure. Over the past week, I’ve observed relatively healthy dip-buying sentiment on CRM stock above the $212 level. Furthermore, CRM has already recovered above the $240 level as of the June 6 close. While it is still early to ascertain a decisive bullish reversal from its bear market decline, I assess an increasingly attractive opportunity for investors to turn bullish at the current levels.

Salesforce’s AI Monetization Disappointed

Before that, let’s revisit the salient points on the already well-covered earnings update and glean whether the recent pessimism was overstated. Besides reporting mixed Q1 earnings, Salesforce’s Q2 guidance was disappointing, as highlighted earlier. However, Salesforce maintained its full-year guidance range, potentially increasing execution risks in the second half. Salesforce management responded to heightened concerns about not lowering its full-year guidance in CRM’s Q1 earnings call. Salesforce enunciated that it has confidence in overcoming the “measured buying behavior” over the past two years. In addition, Salesforce indicated that its revised go-to-market changes impacted near-term performance in Q1. However, the changes should provide a firmer foundation for Salesforce to “drive productivity gains in subsequent quarters.” Consequently, Salesforce is confident it should facilitate “faster execution in Q2, Q3, and Q4.”

Notwithstanding its tepid Q1 guidance, Salesforce assured investors it should continue to gain operating leverage, maintaining its focus and discipline on driving profitable growth. As a result, CRM guided to a full-year adjusted operating margin of 32.5%, a marked improvement from FY24’s 30.5% metric.

However, I’ve always believed that the market is always right (but analysts can be wrong). The market wasn’t convinced even though Salesforce management attempted to allay investor fears with a more robust profitability outlook. The steep selloff (down almost 35% from CRM’s February 2024 highs) saw CRM stock plunging into a deep bear market before the recovery over the past week. As a result, I assess intense profit-taking likely occurred, as earlier investors took the opportunity to reallocate rapidly away from the SaaS leader. The pessimism was felt across the SaaS industry as the iShares Expanded Tech-Software Sector ETF (IGV) fell to levels last seen in November 2023, giving up its YTD gains.

What happened? Didn’t we get a robust performance from Microsoft (MSFT) earlier in April, as the Redmond-headquartered company reported solid Azure cloud growth momentum?

Salesforce Is Not Microsoft

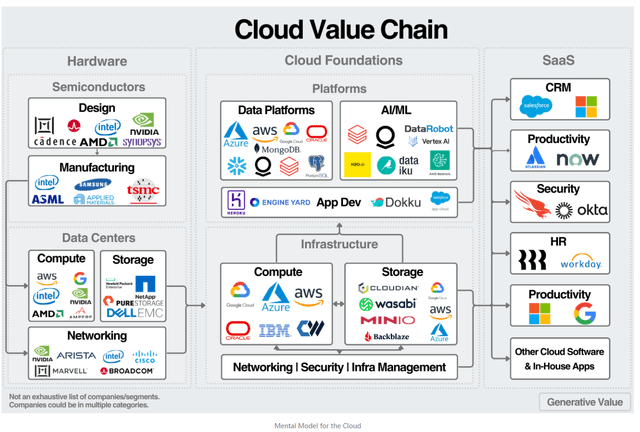

Cloud Value Chain (Public Comps)

Hold on a second. Clearly, Microsoft isn’t just a SaaS operator anymore. It’s a full-stack cloud computing leader and a Tier-1 hyperscaler. It has even ventured into the hardware space with Microsoft’s custom data center chips, looking to integrate its value chain further. As a result, Microsoft has a well-established cloud-computing ecosystem with significant capabilities in the IaaS and PaaS space, as highlighted above. In addition, it also has substantial leading SaaS modules in the systems and application SaaS areas that allow a much more synergistic and better-integrated platform compared to pure-play SaaS companies. As a result, I assess it has allowed Satya Nadella-led Microsoft to integrate its AI offerings more robustly, as Microsoft benefited from AI monetization across the stack.

While Salesforce is making solid progress in its Data Cloud and multi-cloud offerings to unify customer data, CRM doesn’t possess MSFT’s solid ecosystem advantage to monetize AI more effectively in the near term. As a result, I’m not surprised that Salesforce CEO Marc Benioff indicated that “generative AI features within Salesforce applications may not significantly impact revenue until 2025 or 2026.” Despite that, Salesforce is confident about the long-term enterprise potential of its platform, given the massive amount of data it manages. According to the company, Salesforce “manages 250 petabytes of customer data and metadata, making it one of the largest repositories globally.”

Benioff emphasized his belief that LLMs (open source or proprietary) will increasingly be commoditized. He underscored that “not all will survive.” Therefore, the key likely lies in orchestrating an effective system to deploy appropriate AI copilots on high-quality data to drive desired outcomes, providing a sustainable competitive edge. With Salesforce having access to a treasure trove of high-quality enterprise data, I believe the company is well-positioned to help its enterprise customers succeed. However, the experimentation of AI solutions in the near term suggests monetization could take longer, leading to a more progressive growth inflection for even leading players like Salesforce. That suggests investors must remain patient and avoid chasing unsustainable upward surges like the ones we observed in December 2023 and early 2024.

Is CRM Stock A Buy, Sell, Or Hold?

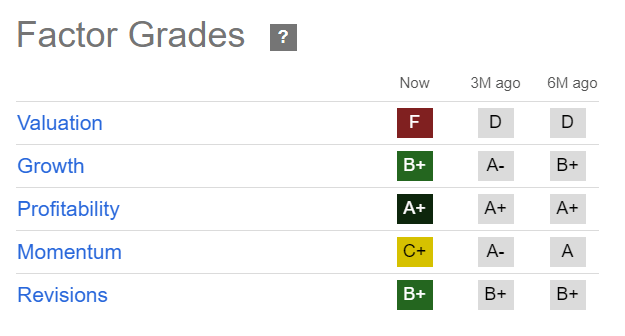

CRM Quant Grades (Seeking Alpha)

CRM isn’t valued at a discount even after its massive selloff (“F” valuation grade). Therefore, Salesforce must remain focused on outperforming its outlook for FY2025 as Wall Street grows increasingly concerned about CRM potentially missing its full-year outlook.

However, Salesforce is an enterprise SaaS behemoth with a best-in-class “A+” profitability grade, justifying its fundamentally strong business model. The selling intensity has also slowed, as I indicated earlier. CRM’s “C+” momentum grade corroborates my analysis, suggesting a possible consolidation at the current levels.

Furthermore, CRM’s forward adjusted PEG ratio has dropped to 1.23, almost 40% below its tech sector median. Hence, I assess that the market seems to have turned overly pessimistic on Salesforce’s growth thesis. Notwithstanding the market’s near-term caution, I gleaned an appealing opportunity for long-term investors to capitalize on the assessed bifurcation and buy more shares of the battered cloud SaaS leader.

Rating: Upgrade to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRM, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!