Summary:

- AMD is projected to gain market share from Nvidia in 2024 and has strong growth potential in the AI chip market, at least until FY26.

- Maturity and evolution of ML models expected from this year onwards will aid in TAM penetration. Advanced Micro Devices now expects $4 billion from the sales of MI300 series AI chips alone.

- AMD’s product roadmap in Computex 2024 and the switch to annual release cycles to put AMD in a better position to compete with Nvidia.

- The company’s stock is a bargain given its project revenue ramp and its 43x forward PE.

k5hu/iStock Editorial via Getty Images

Investment Thesis

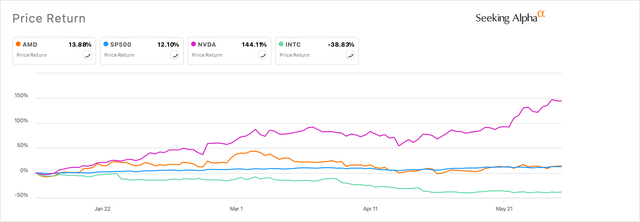

Advanced Micro Devices, Inc. (NASDAQ:AMD) has been lagging the overall semiconductor complex of stocks so far in 2024, performing in line with the broader markets and delivering a ~14%, marginally higher than the 12% YTD performance of the S&P 500 index. In contrast, the overall iShares Semiconductor ETF (SOXX) has scored a 25% return so far, while the VanEck Semiconductor ETF (SMH) has recorded gains roughly three times faster than AMD’s stock in 2024.

Exhibit A: AMD lags the semiconductor complex of stocks (Seeking Alpha)

As I have noted in my analysis below, while AMD’s data center had demonstrated some strong growth as we moved through the initial post-pandemic phase of enterprise cloud infrastructure spending, the company dropped market share in the data center chips market as OpenAI’s ChatGPT success caught the world by surprise leading to a mad dash for Nvidia’s (NVDA) GPUs in their respective data center architecture.

The recent Computex 2024 event has further consolidated my belief in the company’s growth, and I believe AMD is undervalued at current levels. I will begin my coverage on AMD by initiating a Strong Buy on the stock.

Quick Recap of AMD’s Revenue Trajectory

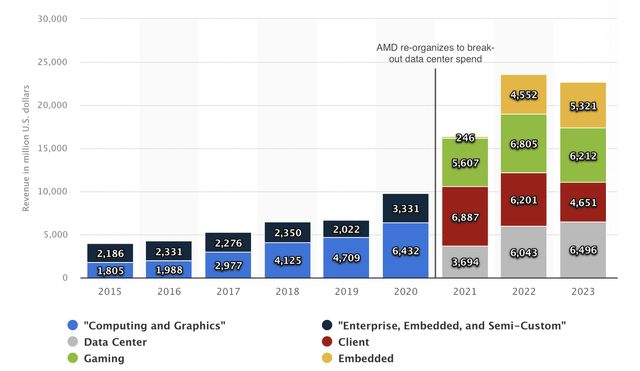

AMD has been able to successfully take market share from Intel (INTC) through the previous decade in the datacenter CPU market, which focused on the x86 CPU architecture. As we moved through the decade, AMD also reorganized its revenue segments to better break out its emerging revenue segments, such as data center revenue, as indicated in Exhibit B.

Exhibit B: AMD’s revenue segments before and after the FY21 re-organization (AMD Filings via Statista)

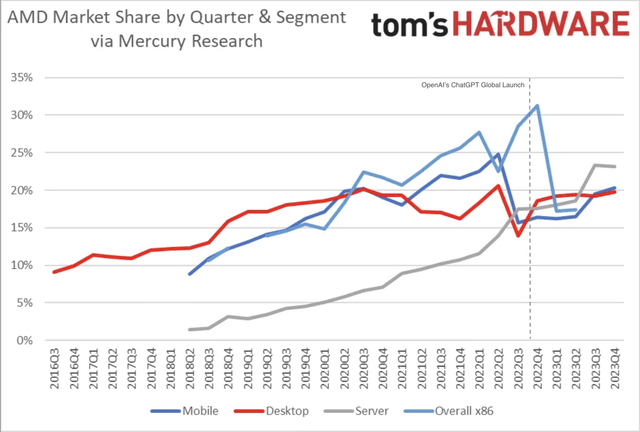

In the last decade, AMD’s chips, such as the desktop-focused Ryzen series as well as the EPYC-line of microprocessors meant for the server and embedded markets, carried the company forward as the company continued to win market share against Intel, as illustrated in the chart below in Exhibit C.

Exhibit C: AMD’s trailing market share by channel deployment (Toms Hardware)

However, as ChatGPT was launched in the fourth quarter of FY22, the overnight popularity of OpenAI’s AI chat assistant was enough to convince enterprises to upgrade their data center architectures to benefit from the oncoming demand for accelerated machine-learning workloads that most ML models would require. Hyperscalers led the way during these rapid capex expansionary phases, in the last 15-18 months.

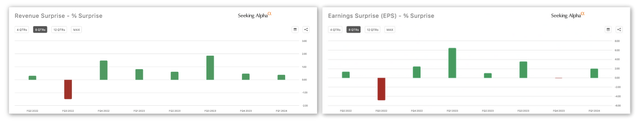

Unfortunately, companies like AMD and Intel were left behind in the demand for chips that could efficiently handle these accelerated ML-related cloud workloads. I believe this was because the existing line-up of chips both AMD and Intel had on the market at the time were based on the x86 architecture and were no match for the throughput efficiency and the large-scale data parallelization that Nvidia’s GPUs could deliver while training large models. This was also seen in a rare earnings report miss in FY22, as seen below.

Exhibit D: AMD’s quarterly earnings surprise last eight quarters (Seeking Alpha)

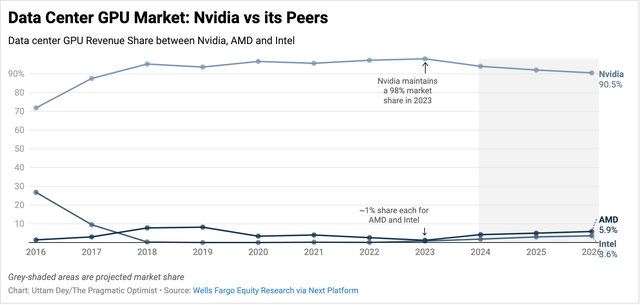

Therefore, AMD, along with Intel, was left behind in the new market for accelerated computing chips that AI had created, as demonstrated in the chart below, where I observe AMD and Intel’s market share further reduced in the low single-digits.

Exhibit E: AMD’s market share by channel deployment (Wells Fargo Equity Research via Next Platform)

AMD projected to gain market share in 2024

In Exhibit E above, I observe the penetration of Nvidia’s GPUs was at its highest in 2023, but projections also estimate that AMD and Intel are expected to win back market share from Nvidia this year onwards. While Intel’s market share win-back is expected to be ~1%, AMD is expected to win back an additional~3% of the market.

There are two reasons I believe this can play out for AMD. First, I feel encouraged by the launch of AMD’s chips in the past 6-8 months, which positions the company in a better position. Last December, AMD launched its MI300 series accelerated processing unit, aimed at competing with Nvidia’s Hopper platform GPU lineup.

In one of the previous earnings calls, AMD’s management also surprised many analysts on the call by expanding their TAM to $400 billion. Markets had been projecting TAM to be closer to the ~200 billion range. In that earnings call, AMD’s CEO added some more detail as to why they were expecting a significant ramp.

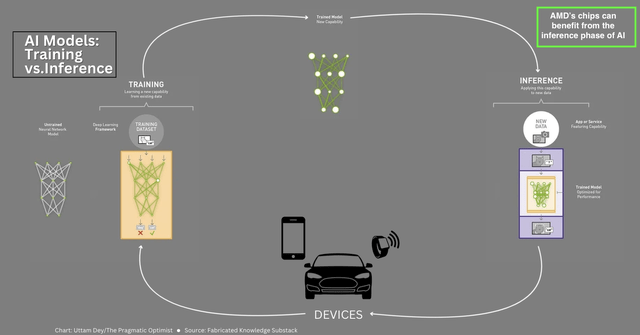

I think we expect units to grow in a sort of substantial double-digit percentage. But you should also expect that content is going to grow. So, if you think about how important memory and memory capacity is as we go forward, you can imagine that we’ll see acceleration there and just the overall content as we go to more advanced technology nodes. So, there’s some ASP uplift in there. And then, what we also do is, we are planning longer-term roadmaps with our customers in terms of how they’re thinking about sort of the size of training clusters, the number of training clusters. And then, the fact that we believe inference is actually going to exceed training as we go into the next couple of years just given as more enterprises adopt.

I believe in the next leg of AI, AMD’s chips will be better suited to tackle the enterprise ML inference needs of lower-cost, higher precision chip efficiency. Here is a chart that I adapted, which should illustrate how I see the next leg of AI evolving into, in terms of model inferencing capabilities:

Exhibit F: Model Training vs Model Inference (Author)

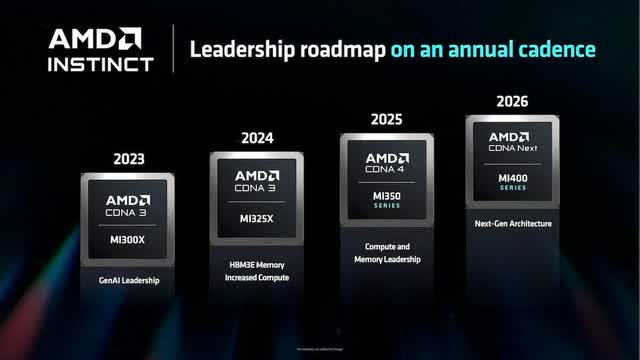

Plus, in the latest Computex 2024, I was pleased to see more clarity from AMD’s CEO on the roadmap for AMD’s accelerated chips, which is closely aligned with my vision for the next phase of AI. AMD will be moving to an annual release cycle of their accelerated GPUs this year and will eventually roll off their MI300 series to make way for the MI400 series in 2026.

I expect these strategic changes by management to supplement the market penetration that I noted earlier in Exhibit C. I have also added AMD’s roadmap for accelerator chips below in Exhibit G.

Exhibit G: AMD’s roadmap of chips over the next three years (Computex 2024, AMD Presentation)

An example of the ramp can already be seen where management mentioned the demand for their MI3000 chips launched last year. The company was able to score $1 billion in sales within 2 quarters. Based on the success, management has raised their projected guidance for the sales of the MI300 chip in 2024 to $4 billion from the previous $3.5 billion expected. Note that the MI300 chip just launched in December. Here is an excerpt from the latest BofA Securities 2024 GTC, held last week.

We literally launched MI300X last December, right? We have ramped the MI300X across $1 billion in less than two quarters. And when you think about it [Technical Difficulty] and today, we talked about in the last earnings call, we have more than 100 customers that we are engaging with either in the developing stage or in the deployment stage. So, we updated the $4 billion-plus number at the last earnings call.

AMD has upside from current levels

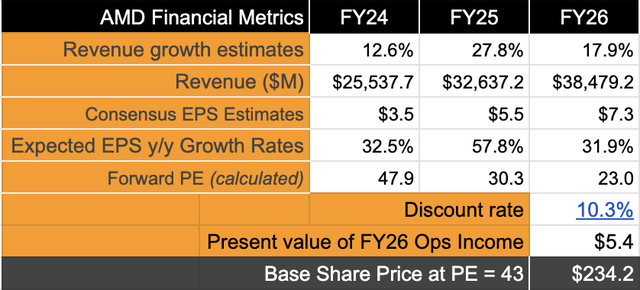

Taking the consensus expectations into consideration, I expect AMD to grow their revenues in 2024 by at least double digits as the company becomes a beneficiary of the new accelerated chips it is rolling out to its customers. Many enterprises have already stated their intentions to wean off their dependence on Nvidia’s GPUs, and this could translate to a short-term tailwind for AMD’s top-line. In addition, the need for lower-cost model inference chips would be a longer-term tailwind for AMD. Therefore, I expect AMD to be growing in line with consensus estimates, which put the chip firm at a CAGR of 19-20% over the next three years.

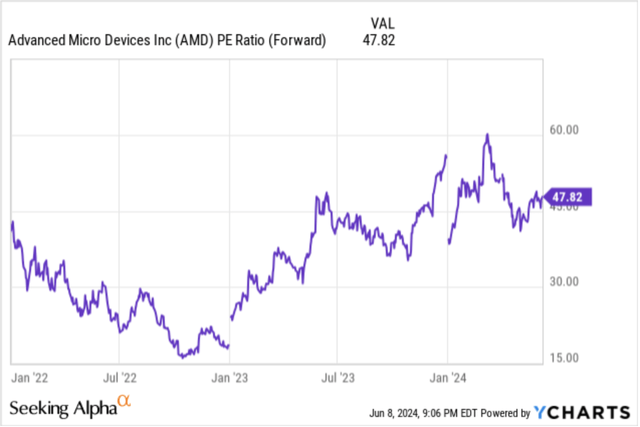

In terms of profitability, if I take the midrange of consensus EPS estimates, I observe that AMD’s EPS will eventually grow in strong double digits to FY26 EPS of $7.6. With AMD’s current market cap, this implies, markets are currently valuing AMD at 23x FY26 earnings.

Exhibit H: AMD’s current NTM forward PE (YCharts)

Comparing that to the long-term growth rates of the S&P 500, the stock should trade at least at par with its 5-year average forward PE of 43 based on its earnings growth rate, which translates to a stock price of ~$230.

Exhibit I: Valuation model for AMD (Author)

This implies there is at least 40% upside from current levels.

Risks and other factors to consider

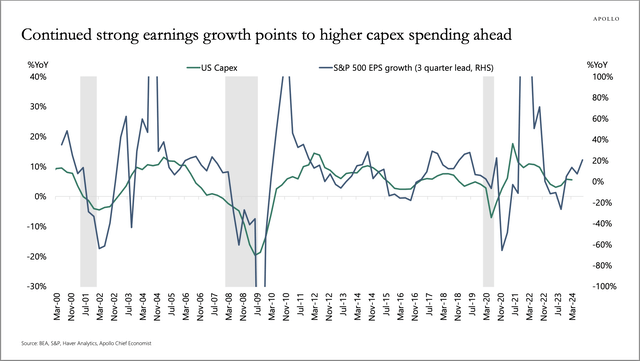

Infrastructure spending slowdowns pose the biggest risk for AMD at this point. If spending were to slow down, AMD’s growth rates would be impacted. One of the indicators that I am looking for is the anticipated capex by hyperscalers, who previously indicated that they would upgrade their datacenter architecture with the updated chips and related infrastructure. I had talked about this a couple of months ago in the macro-conditions section of my coverage of SMH.

Plus, recently, Apollo Global’s Chief Economist has illustrated how the continuation of robust earnings through the last few quarters indicates higher capex spending ahead, as illustrated in Exhibit J below. Monitoring these macrotrends will be critical to crafting the outlook for AMD as it relates to investors.

Exhibit J: Continued strength in earnings suggests that we will see a strong rebound in business fixed investment (CAPEX) over the coming quarters (Apollo Global)

Takeaway

There are enough reasons that I see to justify the value that AMD’s stock provides as per current valuation levels. I am encouraged by the additional details and clarity in AMD’s accelerator chip roadmap, which will position AMD to re-capture market share in the data center market from 2024 onwards, despite trailing behind Nvidia in #2. In addition, the shifting trends in machine learning model inference needs will put AMD in a strong position to benefit from forward trends, and I expect AMD to reap the benefits as a result.

I strongly recommend buying AMD at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMD over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.