Summary:

- Aerospace suppliers are better investments than airlines due to their stability and potential in the face of operational and market challenges.

- Southwest Airlines presents a short-term trading opportunity with potential for significant gains, especially with activist investor Elliott involved.

- Despite challenges, Southwest’s strategic initiatives and potential changes driven by activists could unlock value and improve profitability.

Angel Di Bilio

Introduction

I minored in aerospace management & operations, which was a highly valuable experience, as I currently have more than 20% exposure in the aerospace & defense industry.

One of the biggest takeaways from my studies was that aerospace suppliers are better investments than airlines.

I will never forget this quote from Richard Branson:

The quickest way to become a millionaire in the airline business is to start out as a billionaire.

Essentially, there are a few reasons why airlines are “always struggling,” according to Investopedia:

- Unprofitable airlines often stay in business to protect jobs and avoid inconveniences for many travelers. This artificially alters the supply/demand curve.

- High fixed and variable costs are a real issue. Airlines need to buy/lease expensive planes, employ a lot of people, buy kerosene, and always make sure to offer attractive services to remain competitive.

- Exogenous events can hurt demand. This includes the horrible 9/11 attacks and the 2020 pandemic, to name two of the biggest events impacting airline demand in the past three decades.

- Reputation risks and pricing challenges are always an issue. It’s hard to consistently keep customers happy, given the amount of variables airlines are dealing with. They also have limited pricing power due to competition.

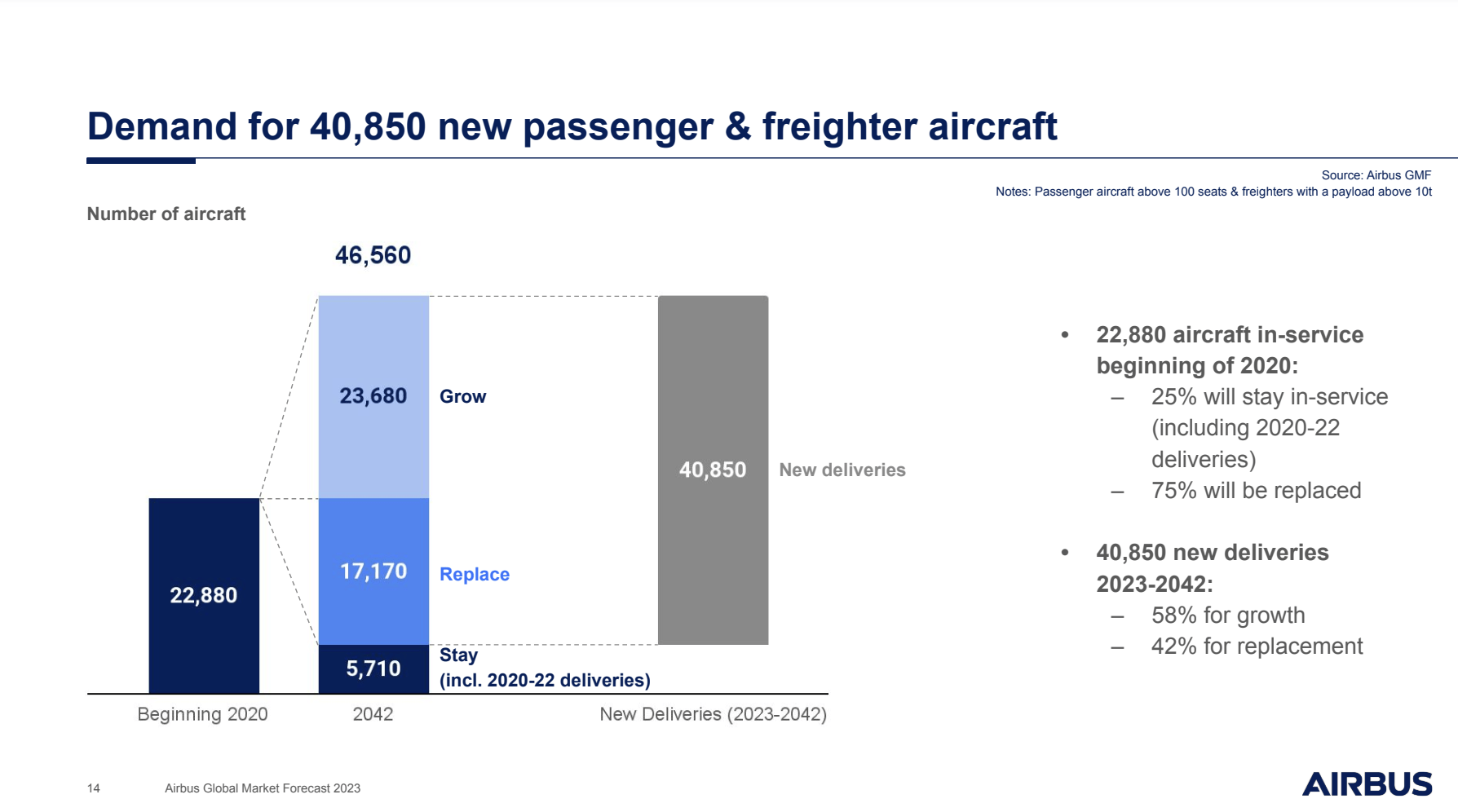

Airplane producers do not have these issues. They benefit from the ever-increasing demand for global air travel, which Airbus SE (OTCPK:EADSF) estimates to result in the demand for close to 41 thousand new planes through 2042!

Airbus

Companies like Airbus don’t care about competition between airlines. They just sell planes to satisfy growing demand.

Even better, companies that supply Airbus and its peers with critical supplies often enjoy even better pricing power, which makes them my preferred investments.

Having said all of this, airlines aren’t useless.

On the contrary!

They can make for terrific short and mid-term trades, allowing investors to find undervalued opportunities.

This brings me to Southwest Airlines Co. (NYSE:LUV), America’s largest regional airline.

My most recent article on this giant was written on September 19, 2023. Back then, I called the stock “Up To 80% Undervalued.” Unfortunately, due to a challenging market environment, I had to add “If It Weren’t For Macro Challenges.“

Since then, shares have returned 2.4%.

In this article, I’ll update my thesis with a focus on a major headline that caused the LUV ticker to soar.

So, let’s get to it!

Shareholders Are Getting An Elliott Tailwind

On June 9, at 7:29 AM, The Wall Street Journal published a headline that caused Southwest shares to rally by 9% while I am writing this.

Reportedly, Elliott Investment Management has built an investment of close to $2 billion in the airline, which would be 11% of its currently $17.7 billion market cap.

As one may expect, Elliott isn’t just a “normal” investor who looks for undervalued opportunities and hopes they rise.

No. Elliott is an activist investor.

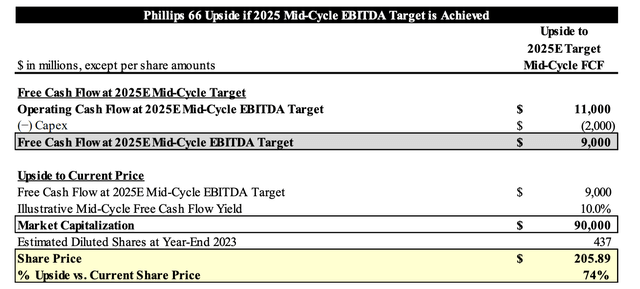

In fact, I’m a bit familiar with the methods Elliott uses to generate value. For example, on December 5, I wrote an article on Phillips 66 (PSX), calling it 60% undervalued if Elliott’s expectations were to turn into reality.

Back then, Elliott built an extensive model that showed more than 70% upside if the company were to implement changes that would allow it to become more competitive in the refinery industry.

Generally speaking, Elliott seeks to find uncorrelated investment opportunities with hidden value.

The firm takes equity-oriented positions in several of its strategies, and takes on such positions in a variety of forms. It is less common for the firm to take on long equity positions which are just driven by valuation considerations. Elliott seeks out positions in particular which are uncorrelated with other positions in the portfolio or with the risks and expected price movements of equities generally, or where value and protection against risk can be enhanced by the firm’s manual efforts. – Elliott Investment Management (emphasis added)

Often, this includes replacing a company’s CEO and/or asking for Board changes to influence decision-making.

Beyond Phillips 66, this includes Crown Castle Inc. (CCI), NRG Energy, Inc. (NRG), and The Goodyear Tire & Rubber Company (GT).

According to The Wall Street Journal, the company is looking to “engage with the management team at Southwest.”

While we can all assume what this means, it’s the only public info at this point.

Usually, the company releases a detailed presentation and/or letter to the Board and shareholders. For now, these documents are not public, as we’re still dealing with insider information.

Finding Value At A Time Of Despair

Southwest Airlines is somewhat of a fallen star.

Historically speaking, it has been one of the best airlines in the world.

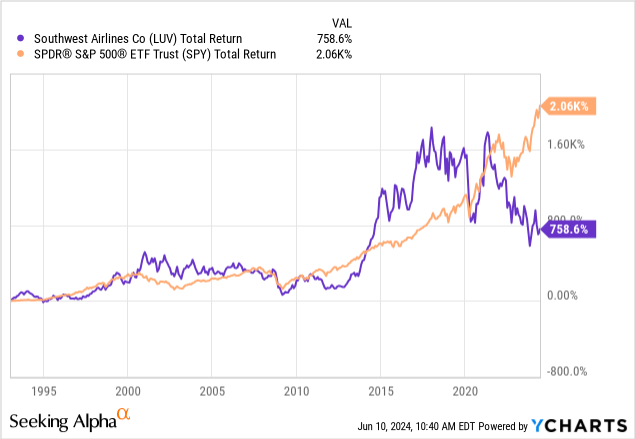

Looking at the stock price above, the company outperformed the S&P 500 until the final post-pandemic stock price surge.

While it has been a very volatile ride, the stock returned more than 1,600% between the mid-1990s and the end of the pandemic.

Now, that return is down to roughly 760%, erasing ten years’ worth of gains.

What set Southwest apart since the 1970s is its focus on low-cost routes and the fact that it only bought one aircraft model, the Boeing 737. This is a strategy also applied by the European regional player Ryanair.

This improves efficiency, as the entire company, including pilots, stewardesses/stewards, and mechanics, can fully focus on one type of plane.

Hence, the mix of low-fair tickets, a lot of destinations, and efficiency allowed LUV to consistently grow its empire.

Unfortunately, the good years are over.

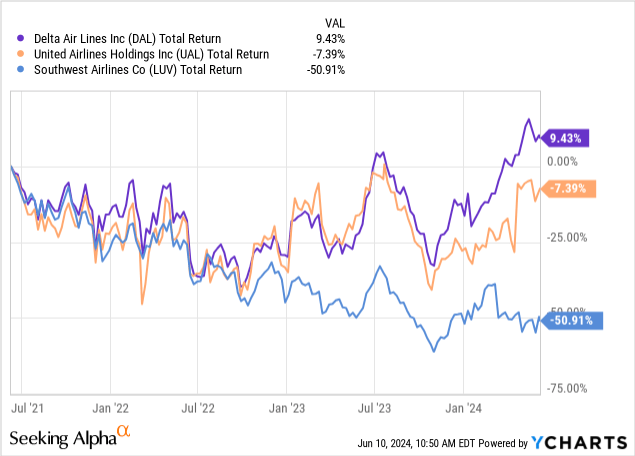

As reported by The Wall Street Journal, the stock is not keeping up with other major airlines like Delta Air Lines, Inc. (DAL) and United Airlines Holdings, Inc. (UAL).

Although both these long-haul airlines have performed somewhat poorly, it is nothing compared to the 50% decline in Southwest’s stock price over the past three years, as we can see in the chart below.

The problem is cracks in the stock’s “formula,” including the severe holiday meltdown in 2022 when outdated technology failed to handle its largest-scale operations.

This caused 15,000 flights to get canceled, the worst and most expensive outage ever suffered by an airline, according to the Wikipedia page of this infamous meltdown.

Moreover, the decision to focus solely on the 737 plane has turned it into a failed bottleneck problem, as most readers may be aware of The Boeing Company’s (BA) problem regarding the quality of its latest 737-MAX model.

In March, Southwest said it would re-evaluate its financial outlook, citing lower-than-expected deliveries of Boeing jets. Its shares fell 15%. A few weeks later, Southwest said it was ditching some airports in a rare move for the airline that backtracked on part of its network expansion plans from a few years earlier. – The Wall Street Journal (emphasis added)

This is a great example of “hidden” risks that come with a cost-efficiency focus that includes too few variables.

However, as horrible as all of this sounds, I agree with Elliott. There is value in LUV.

For starters, the company is focusing on a number of strategic initiatives, including optimizing its new revenue management system, enhancing passenger volume through a new brand campaign, and exploring customer preferences to adapt services accordingly.

During its 1Q24 earnings call, the company explained the ongoing optimization of the network and capacity adjustments are expected to yield significant benefits, potentially contributing to an estimated $1.0 to $1.5 billion in incremental pre-tax profits this year.

Analysts seem to agree that the sky is blue.

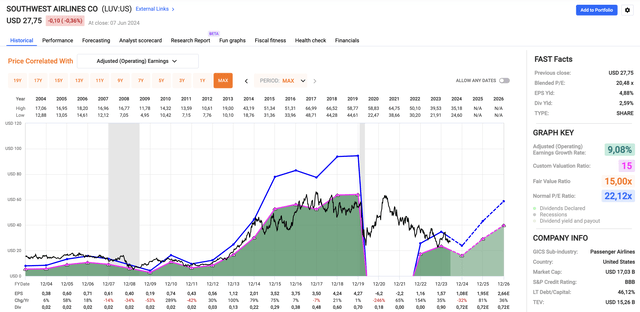

Using the FactSet data from the chart below, analysts see a path to consistent EPS growth, with 81% and 36% expected EPS growth in 2025 and 2026, respectively. This would push EPS to $2.66.

Before the pandemic, the company consistently generated north of $4.00 in EPS.

Although this is speculation, I expect Elliott to present a plan to push the company back to the $4.00-$5.00 EPS range, potentially with the help of new Board members and a best practice adoption that targets current shortfalls.

However, even using current expectations, there’s value in LUV.

If we apply a 15x multiple (below its two-decade normalized multiple of 22.1x), we get a price target of roughly $40, roughly 33% above the current post-Elliott news price of $30.

On the one hand, LUV has “messed” up. On the other hand, it’s still a fantastic airline with a business model that can generate tremendous value if bottleneck issues are solved.

If Elliott is able to “force” change, I expect the current stock price surge to be the start of a much bigger move, potentially with 80-90% potential, if the company finds a path to $4.00 in EPS.

However, please note that this is a highly speculative investment opportunity. I do not recommend Southwest Airlines to conservative dividend investors who usually buy income-generating stocks with a long-term horizon.

LUV needs to be treated as a trade with a time horizon that I estimate to be somewhere between 1-3 years.

All things considered, I continue to like the risk/reward and will stick to a Buy rating.

Takeaway

In my experience, investing in aerospace suppliers offers more stability and potential than airlines, which face constant operational and market challenges.

While they are useful for short-term trades, they often struggle due to high costs, competition, and unpredictable events.

However, airlines like Southwest can present attractive short-term trading opportunities, especially when activist investors like Elliott get involved.

While Southwest faces significant challenges, its strategic initiatives and potential activist-driven changes could unlock significant value.

Hence, I maintain a Buy rating on Southwest, as I expect potentially elevated gains if the company can navigate its current issues and improve profitability.

For long-term investors, sticking to aerospace suppliers might be wiser, but for those willing to take some risks, Southwest offers a promising opportunity.

Pros & Cons

Pros:

- Activist Investor Involvement: Elliott Investment Management’s significant stake could trigger strategic changes and unlock hidden value.

- Strategic Initiatives: Optimizing revenue management, enhancing passenger volume, and adapting services to customer preferences could lead to significant operating improvements.

- Analyst Optimism: Analysts project significant EPS growth in the coming years, indicating potential for substantial stock price appreciation.

Cons:

- Operational Challenges: Recent issues, including the severe holiday meltdown and Boeing 737-MAX delivery problems, have hurt the company’s performance.

- Market Volatility: The stock has been through significant declines, which reflects broader industry challenges and inefficiencies.

- Speculative Risks: This investment comes with high risks and is more suited for traders than conservative long-term investors.

- Uncertain Activist Impact: While Elliott’s involvement is promising, the exact changes and their outcomes remain unknown at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.