Summary:

- Palantir reported reasonably strong Q1 results, but growth appears to have fallen short of investor expectations.

- There is uncertainty surrounding enterprise software demand due to mixed results from other software companies. Palantir’s exposure to AI may be insulating it from this.

- Palantir’s valuation is high, and macro headwinds pose a risk despite the company’s strong fundamentals.

hapabapa

Palantir (NYSE:PLTR) reported reasonably strong results in the first quarter, although growth fell short of elevated investor expectations. Deal volumes and the increase in RPO were also potentially points for concern, which may just be the result of seasonal weakness. Overall, Palantir appears to be one of the few companies genuinely benefiting from the surge in interest in AI but its valuation more than accounts for the robust demand.

This situation is broadly in line with my previous thoughts that despite Palantir’s strong fundamentals, the stock is unattractive due to hype surrounding both AI and the company.

Market Conditions

There is elevated uncertainty regarding the strength of enterprise software demand at the moment due to mixed results from a number of software companies in recent weeks.

Weakness can likely be attributed to each of the macro conditions causing customers to renew cost-cutting efforts, or AI projects taking the share of IT budgets. This could be the case, as 96% of CIOs reportedly want to increase their AI investments, but only around 20% expect IT budgets to increase by more than 10%. Given the breadth of software vendors witnessing softness, and the fact that this has generally occurred across all customer segments, I tend to think this is more of a macro issue.

On the AI front, NVIDIA (NVDA) continues to see unprecedented demand, but AI tailwinds aren’t really showing up in many other places yet. Microsoft (MSFT) has certainly benefitted, although much of this likely comes from its relationship with OpenAI. This situation is somewhat odd, as a survey of CIOs indicated that 81% of organizations are already leveraging third-party AI Tools.

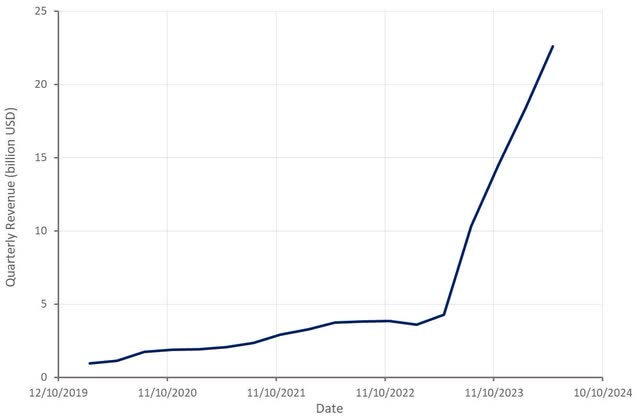

Figure 1: NVIDIA Data Center Revenue (source: Created by author using data from NVIDIA)

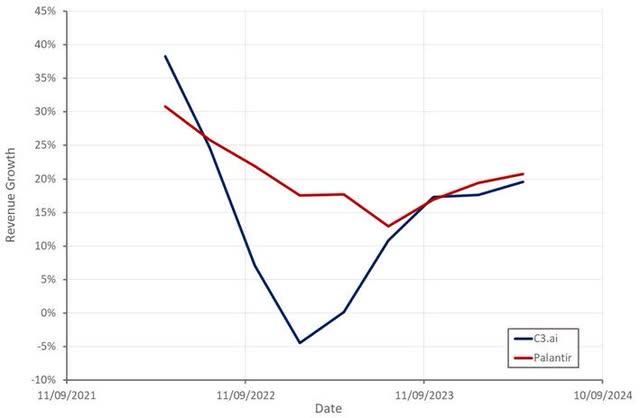

Palantir and C3.ai (AI) have both also seen growth reaccelerate meaningfully after an extended period of weakness. Given that these companies offer more holistic solutions that are generally targeted at larger organizations, this may suggest that demand for AI exists but is currently constrained by a lack of resources. This could be due to:

- A lack of knowledgeable personnel

- Uncertainty about how to implement AI

- Lack of data infrastructure

Survey data appears to support this, with 80% of CIOs believing that AI will significantly impact their business, but only 49% believing that their IT departments have the necessary skills. It is also possible that most projects are still in the experimentation phase and hence are not driving meaningful spend yet.

Figure 2: Palantir and C3.ai Revenue Growth (source: Created by author using data from company reports)

Palantir Business Updates

Palantir recently won a 480 million USD contract for a prototype of its Maven artificial intelligence system. The contract has an estimated completion date in 2029 but is still enormous on an annualized basis. Project Maven is a Department of Defense AI surveillance and targeting system, which aims to process data (imagery, video, etc.) from drones to automatically detect targets. The US Army also recently awarded Palantir a 178 million USD contract to deliver TITAN next generation deep-sensing capabilities. For this project, Palantir will provide the software to integrate sensor data and generate insights.

While Palantir’s government business has been a weak spot in recent quarters, I tend to think that this business will do well over time given Palantir’s history and ability to provide holistic and secure solutions. Palantir’s recent soft government revenue growth is notable, though, due to the fact that this has been an area of strength for C3.ai in recent quarters.

Palantir’s Artificial Intelligence Platform continues to drive the business, with the company now having completed AIP Bootcamps with over 915 organizations. Demand strength is also evidenced by deal cycle compression. For example, a leading utility company recently signed a seven-figure deal five days after completing a bootcamp. Demand also appears to be fairly broad-based, with Palantir’s US commercial business having customers from 56 of the 74 GICS industries.

Financial Analysis

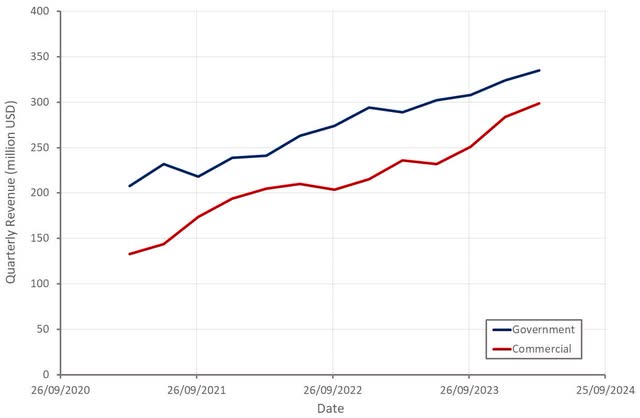

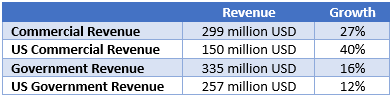

Palantir generated 634 million USD revenue in Q1, an increase of 21% YoY, driven by the US commercial business. Excluding strategic investments, Palantir’s US commercial revenue increased 68% YoY. Growth of the commercial business outside of the US is more modest, and government revenue growth remains fairly soft.

Palantir expects 649-653 million USD revenue in the second quarter of 2024, an increase of approximately 22% YoY at the midpoint. This guidance is likely conservative, and I would expect growth in excess of 25%. For the full year, Palantir expects 2,677-2,689 million USD revenue, up 21%, driven by US commercial revenue growth of at least 45%. Revenue from strategic commercial contracts will continue to be a headwind in coming quarters, causing Palantir’s underlying growth to be understated.

Figure 3: Palantir Revenue by Customer Segment (source: Created by author using data from Palantir) Table 1: Revenue Growth by Customer Segment (source: Created by author using data from Palantir)

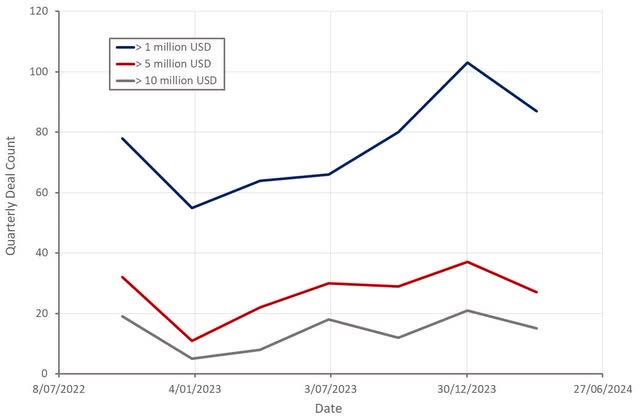

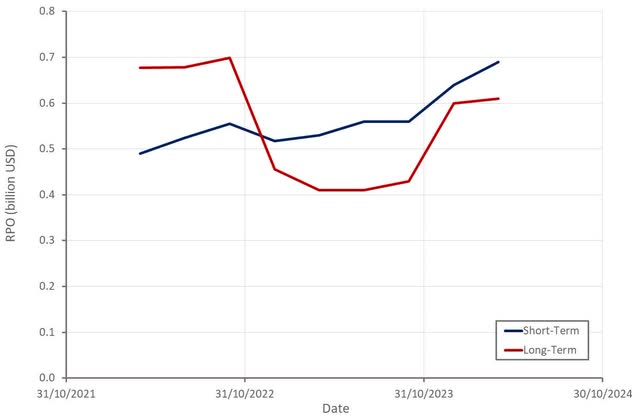

Palantir has emerged from a period of significant weakness in recent quarters, which can be clearly seen from both the company’s deal count and remaining purchase obligations. Both of these metrics suggest that growth may now be beginning to stabilize, although this could also just be due to seasonal weakness. Bookings strength is also being driven by the commercial business, with 505 million USD commercial TCV booked in Q1, an increase of 187% YoY.

Figure 4: Palantir Deal Count (source: Created by author using data from Palantir) Figure 5: Palantir RPO (source: Created by author using data from Palantir)

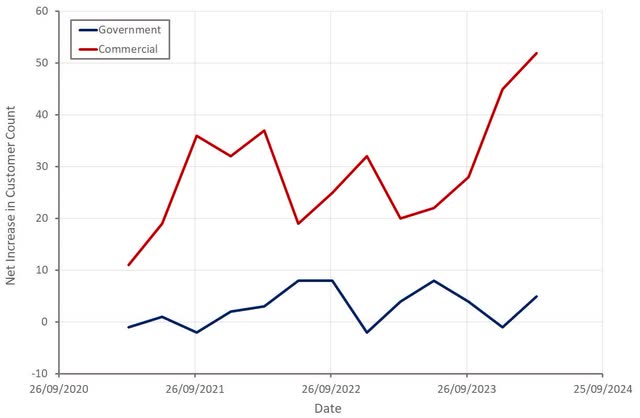

Growth is being driven by Palantir landing new customers, particularly within its commercial business. The company’s US commercial customer count grew 69% YoY in Q1, reaching 262 customers.

Palantir’s net retention rate was 111% in Q1, up slightly from the lows recorded in the prior two quarters. Palantir has suggested that this is not representative though, as it doesn’t include revenue from customers acquired in the past 12 months, and hence the acceleration in the US commercial business. While I think this is directionally correct, Palantir’s existing commercial customers are also presumably adopting AIP, which should be benefitting the company’s net retention rate.

Figure 6: Palantir Customer Growth (source: Created by author using data from Palantir)

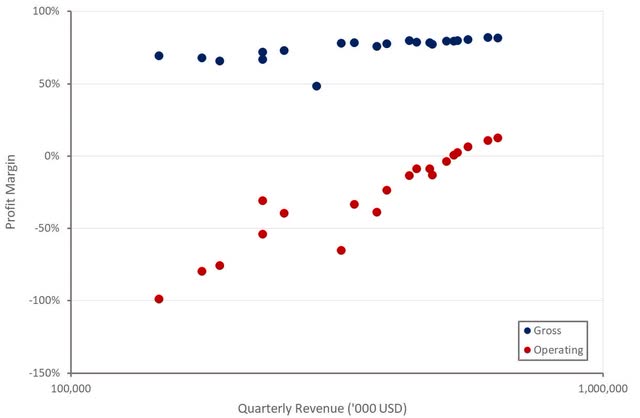

Palantir’s profit margins continue to improve with scale, although operating leverage has begun to moderate. Assuming the competitive landscape doesn’t change significantly, I expect Palantir’s operating profit margin to reach around 30% at maturity.

There is likely to downward pressure in the near term, though. Palantir has stated that it is going to increase its investments in the US to try and capitalize on both commercial and defense opportunities, leading expenses to ramp in the back half of the year.

Figure 7: Palantir Profit Margins (source: Created by author using data from Palantir)

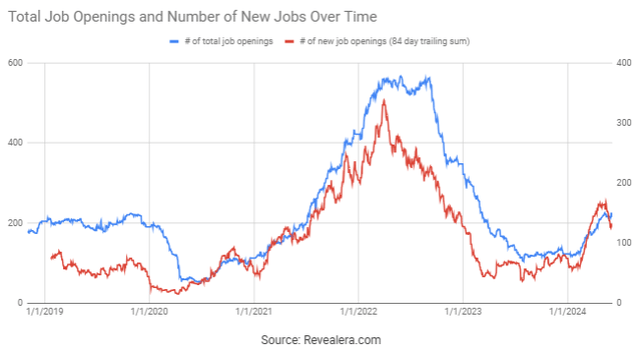

A reacceleration of hiring can already be seen in the number of Palantir job openings. This metric has stabilized in recent weeks though, which could suggest that growth isn’t accelerating to the extent that Palantir expected.

Figure 8: Palantir Job Openings (source: Revealera.com)

Conclusion

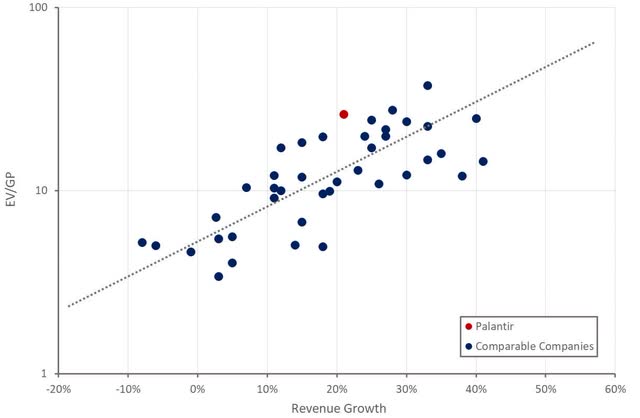

Palantir’s valuation is extremely high, particularly in light of recent haircuts for a number of high-profile SaaS peers. While expectations of lower interest rates should be supportive of valuations, mounting macro headwinds are an underappreciated risk. The company’s growth should continue to accelerate in coming quarters, but this may not be enough to drive the stock higher.

Job openings and Q1 deal volumes suggest that growth may be beginning to stabilize. This could be problematic for the stock as further growth acceleration is already priced in. This situation will likely be exacerbated by increased investments, which will put downward pressure on margins later in the year, particularly if growth disappoints.

Figure 9: Palantir EV/S Ratio (source: Created by author using data from Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.