Summary:

- OPEC’s decision to extend supply cuts until the end of 2025 is bullish for energy companies like Exxon Mobil.

- Exxon Mobil could benefit from the strength of the U.S. economy, with robust job creation and wage growth.

- The combination of OPEC’s supply cuts and a strong U.S. economy creates a positive outlook for Exxon Mobil’s earnings and free cash flow.

WendellandCarolyn/iStock Editorial via Getty Images

The Organization of Petroleum Exporting Countries could be poised to create substantial profit tailwinds for large energy companies like Exxon Mobil Corp. (NYSE:XOM).

OPEC last week decided that it would extend cuts to its crude oil supplies to the end of 2025 which is a very bullish signal for Exxon Mobil as is the recent decision of electric-vehicle manufacturers to ramp the production of EVs much more slowly.

Exxon Mobil might also profit from persistent strength in the U.S. economy, with recent labor reports revealing a robust picture in terms of job creation and wage growth.

I think that OPEC’s strategic decision to extend supply cuts creates a very bullish backdrop for energy companies that rely on high price realizations in order to drive their earnings and free cash flows.

My Rating History

My last stock classification for Exxon Mobil was a Buy, as I thought a higher-for-longer price environment was a distinct possibility for the energy sector. OPEC’s decision last week to extend supply cuts to the end of 2025 has removed all remaining uncertainty in this regard, in my view. As a consequence, I think Exxon Mobil is dealing with an improved macro picture that could yield strong earnings and free cash flow growth moving forward.

In addition, Exxon Mobil might be put into a position to increase its share repurchases, which makes me upgrade my stock classification to ‘Strong Buy.’

OPEC Supply Announcement Probably Equates To FCF Tailwinds For Exxon Mobil

When it comes to investments in the energy sector, nothing matters more than prices. Energy prices, most importantly crude oil prices, determine the underlying profitability of large energy companies such as Exxon Mobil and are also a driving force of share repurchases and dividend growth.

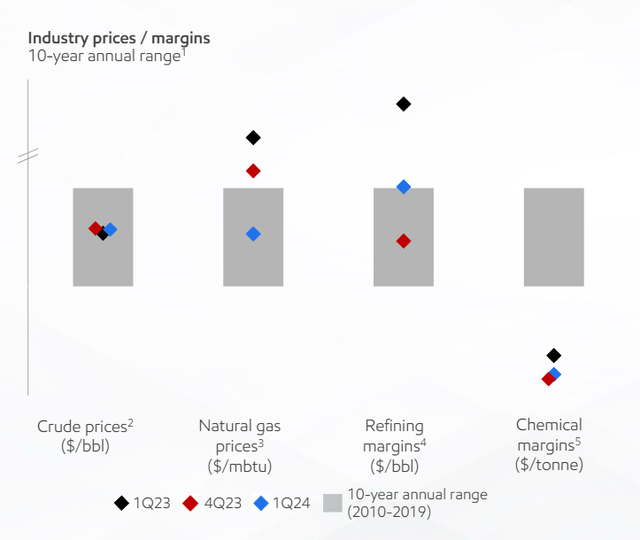

West Texas Intermediate crude oil prices, at the start of the Russia-Ukraine conflict, shot up to more than $100/barrel but have since normalized and presently sit at $75/barrel, at about the average price per barrel that they used to trade at within the last 10-year price span. The price for a barrel of West Texas Intermediate crude oil presently sits at $75. Based on Exxon Mobil’s price chart for the first quarter, depicting long-term averages, WTI sells at about the average price of the last ten years at the moment.

Industry Prices & Margins (Exxon Mobil Corp)

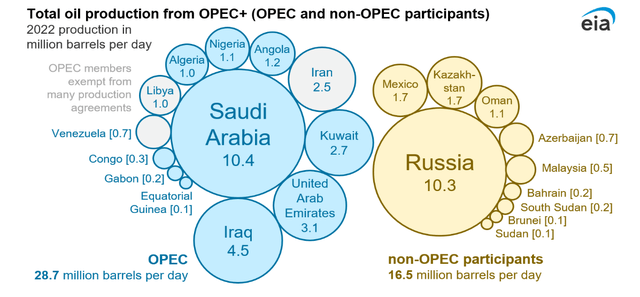

With that being said, the Organization of the Petroleum Exporting Countries and its non-OPEC participants last week decided to extend production cuts of 3.66 million bpd to the end of 2025 while at the same time also extending cuts of 2.2 million bpd to the end of September 2024.

Non-OPEC participants include Azerbaijan, Bahrain, Brunei, Brazil, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan, and Sudan with Russia being by far the most important non-OPEC influence.

Total Oil Production From OPEC (Exxon Mobil Corp)

The implications for energy markets and U.S. energy companies are obvious: Limited supply of crude oil is poised to boost long-term crude oil prices which in turn should bode well for Exxon Mobil’s free cash flows, at least until 2025.

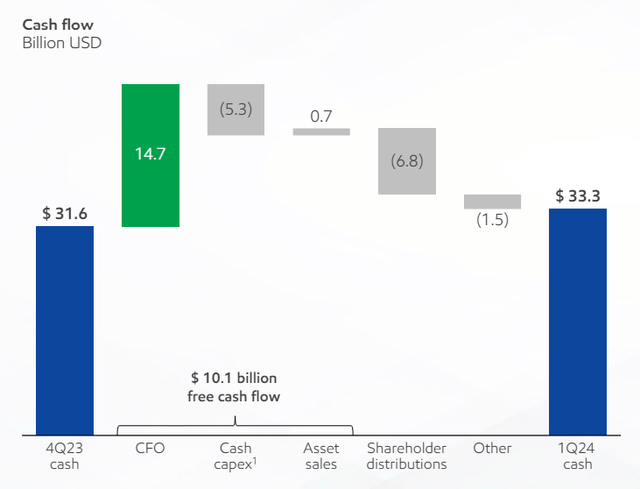

In 1Q24, Exxon Mobil’s energy assets produced a combined $14.7 billion in operating cash flow. After capital expenditures of $5.3 billion and asset sales, $10.1 billion in free cash flow remained. This cash reflects Exxon Mobil’s share and dividend growth potential, as least hypothetically.

Free cash flow is the amount of cash that can be distributed to shareholders, though companies typically choose to not return 100% of their free cash flows to investors. In 1Q24, Exxon Mobil spent $3.0 billion on share repurchases, a number that I think could climb moving forward. Presently, Exxon Mobil has a $20 billion share repurchase plan in effect.

Cash Flow (Exxon Mobil Corp)

In addition to OPEC-led tailwinds for Exxon Mobil’s free cash flow, the energy company has said that it is looking to push for structural cost savings (of $15 billion by 2027) that are poised to improve Exxon Mobil’s earnings profile at a time of increasingly favorable macro conditions.

OPEC’s price support and a strong U.S. economy are two reasons why I think investors can look optimistically into the future with regard to Exxon Mobil’s financial performance.

According to the latest jobs report, U.S. employers created 272K new (non-farm) jobs in May, beating the consensus figure of 190K by a large margin.

Hourly wages grew 4.1% YoY, while inflation ran at 3.4% in April. Strong U.S. job growth implies a robust state of the U.S. economy, which is also a prerequisite for growing demand for crude oil and related products.

Exxon Mobil Is A Steal

The setup looks great for Exxon Mobil: OPEC is doing its best to support crude oil prices, while the U.S. economy seems to be in great shape still. Inflation is still hovering around 3%, but it obviously does not hurt employment and wage growth, which indicates that U.S. GDP will continue to grow.

With a recession being unlikely in 2024, in my view, and OPEC doing what it can to help prices, I think Exxon Mobil could be poised for a substantial profit upsurge in 2024 and 2025, assuming that the U.S. economy avoids a recession.

The market presently models $9.76 per share in profits for Exxon Mobil in 2025, which reflects an estimated YoY growth rate of 7% while profits this year are anticipated to fall 4%. Be that as it may, Exxon Mobil’s stock is a bargain, as its present stock price of $112.75 reflects an 11.6x profit multiple.

Chevron Corp. (CVX) is selling for 11.0x leading (next year’s) earnings, so I would consider both Exxon Mobil and Chevron to be attractively priced investment options for investors, particularly those that want to collect recurring passive income.

Earnings Estimate (Yahoo Finance)

Why The Investment Thesis Might Not Work Out

Exxon Mobil is growing, profitable and faces an increasingly attractive macro/price picture led by OPEC’s decisions about future levels of output. Thus, a correction in crude oil prices would most obviously be the most severe risk for Exxon Mobil and its free cash flow prospects in the near-term.

Lower price realizations would have trickle-down effects on Exxon Mobil’s earnings and free cash flow and diminish the company’s share repurchase potential.

My Conclusion

OPEC last week announced supply-side measures to influence prices in its favor. With output cuts extended until the end of 2025, Exxon Mobil is dealing with a much-improved macro setup for its business. Since these support measures occur at a time of persistent strength in the U.S. economy, I think that Exxon Mobil could be a great investment for investors that look to realize upside in the company’s earnings and free cash flow prospects.

Exxon Mobil is also selling only for 11.5x leading profits, which makes the company’s stock a steal, in my view.

I am adding to my position in XOM and think that the risk/reward relationship after last week’s OPEC announcement has been further tilted in favor of Exxon Mobil. Strong Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.