Summary:

- Given some recent events, I see many investors get cautious about NVIDIA as some public signs of a bubble emerge.

- But looking at the growth and margin numbers and the valuation ranges that have historically coincided with unsustainable euphoric hype rallies, I believe there is upside in NVIDIA yet.

- Some analysts have compared NVIDIA to Cisco in 2000. Based on the fundamentals and valuations, I discuss why I believe NVIDIA is not the 2020’s Cisco (at least for now).

Dmitriy83/iStock via Getty Images

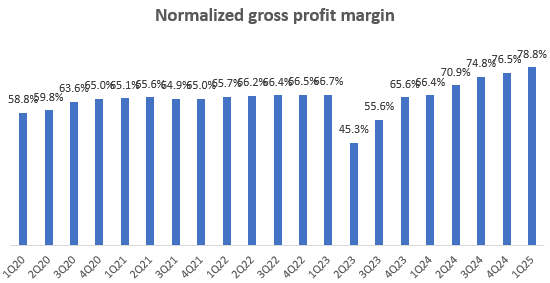

Performance Assessment

I was bullish on NVIDIA (NASDAQ:NVDA) in my last coverage of the stock but demanded too much to initiate new buys. Hence, I had rated it a ‘Neutral/Hold’, which was clearly a big mistake:

Performance since Author’s Last Coverage of NVIDIA (Author’s Last Article on NVIDIA, Seeking Alpha)

Thesis

I see many investors started to get cautious around NVIDIA recently especially after photos and videos of NVIDIA CEO Jensen Huang signing a woman’s chest went viral on social media. I understand why this may lead to fears of a ‘top’.

However, I believe a genuine hype (in this context, by hype, I mean an irrational exuberance far beyond what the fundamentals imply) cycle in NVIDIA has not yet begun. My thesis is simple:

- NVIDIA is growing in multiples, not percentages

- Margin expansion is expected to continue

- NVIDIA’s valuation multiples today are not in hype territory

I am an NVIDIA bull today, as I think there is tremendous upside optionality still to ride a massive euphoric hype in the stock.

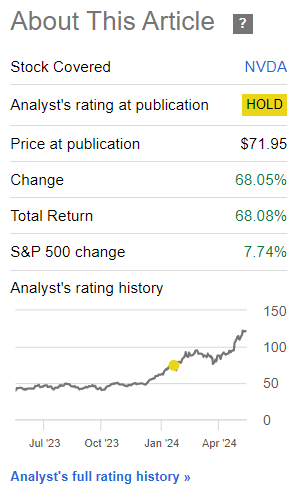

NVIDIA is growing in multiples not percentages

On a YoY growth basis, NVIDIA is more than tripling revenues:

Revenue YoY (Company Filings, Author’s Analysis)

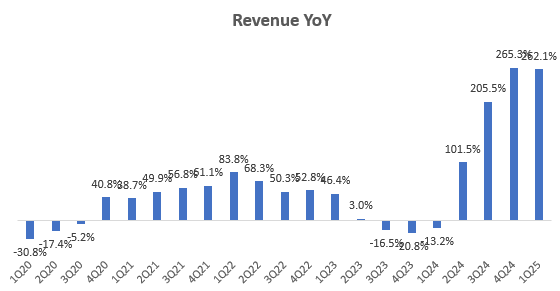

Remaining performance obligations are a leading indicator of revenues as they indicate the size of a company’s backlog. Here too, NVIDIA is seeing more than 100% YoY growth:

RPO YoY (Company Filings, Author’s Analysis)

Consensus estimates for NVIDIA’s FY25 revenues are $120 billion, representing a 97% YoY growth from FY24’s $61 billion. Even in FY26, the revenue consensus numbers imply a 31% YoY growth. Few companies in my watchlist can match this remarkable growth profile, especially at a $3 trillion scale.

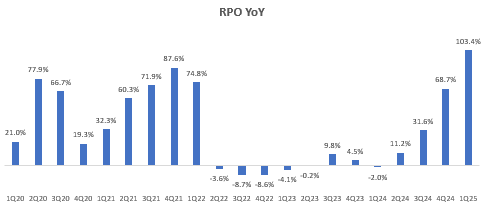

Margin expansion is expected to continue

Normalized Gross Profit Margin (Company Filings, Author’s Analysis)

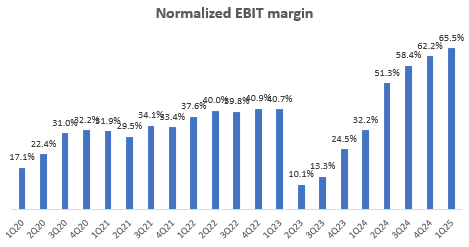

On the margins side, NVIDIA is inching toward 80% gross margins and has EBIT margins in the mid 60s:

Normalized EBIT Margin (Company Filings, Author’s Analysis)

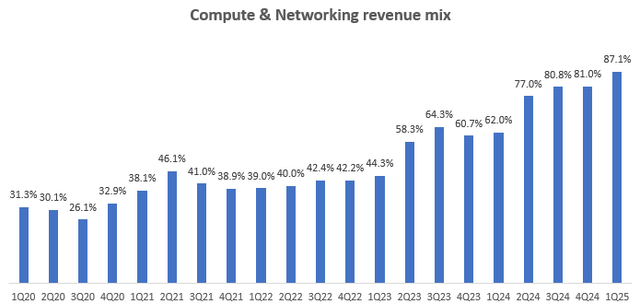

My margin expansion thesis in my last coverage of NVIDIA was that as Compute & Networking mix increases, overall EBIT margins would tick up too since this segment has 75% EBIT margins. This is playing out, and I expect this to continue as the key growth driver is still the Compute & Networking Segment:

Compute & Networking Revenue Mix (Company Filings, Author’s Analysis)

NVIDIA’s valuation multiples today are not in hype territory

I recently read Fishtown Capital’s bearish piece on the stock, which drew comparisons with the hype and crash of Cisco (CSCO) stock in 2000 around the dot-com bubble. This prompted me to dig into history a bit more to see how the situation with NVIDIA today compares with dot com bubble stocks like Cisco:

Wharton professor Dr Jeremy Siegel sounded the alarms in 2000 calling Big-Cap Tech Stocks a ‘Sucker Bet’:

History has shown that whenever companies, no matter how great, get priced above 50 to 60 times earnings, buyer beware.

– Dr Jeremy Siegel in 2000

Let’s refer to that 50x+ earnings multiple zone as hype territory.

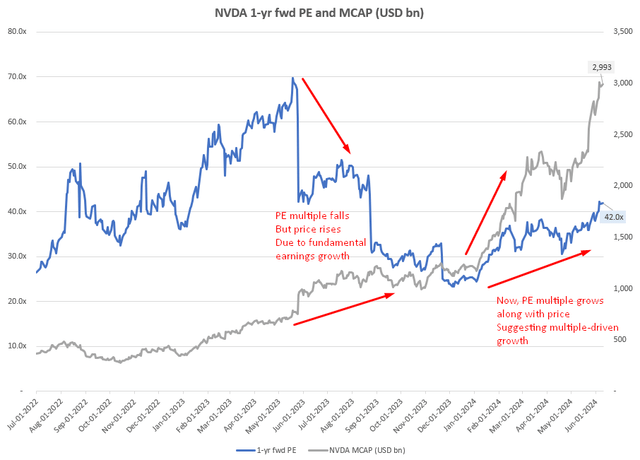

Today, when we look at NVIDIA’s 1-yr fwd PEs, we see that it is trading at 42x; below the dangerous hype territory:

NVIDIA 1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

In the chart above, notice how in May 2023, the PE multiple was in hype territory of almost 70x, but fell sharply for the rest of 2023 to a trough of 25x. Meanwhile, the price or market capitalization of NVIDIA continue to rise. This indicates that the driver of the stock’s return here was due to bullishly revised expectations of fundamental earnings, not a re-rating of the valuation multiple.

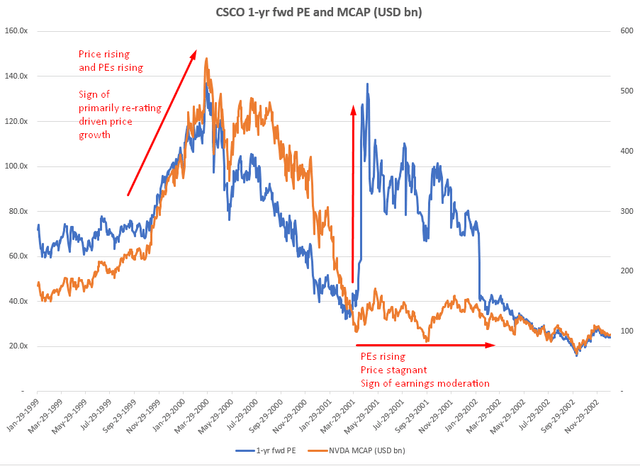

It is only more recently this year that we have seen both price and the P/E multiple rise, suggesting that there is some multiple-driven growth as well. Now, euphoria and the risks of market tops are higher when a stock’s return is driven excessively by re-ratings as opposed to fundamental earnings growth. Indeed, this is what was seen in the case of Cisco in 2000:

CSCO 1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

This is what the revenue growth, EBIT margins and valuation multiples of NVIDIA vs Cisco in 2000 look like:

| Parameter | NVIDIA Today | Cisco in 2000 |

| Revenue growth | 97% YoY 1-yr fwd, 31% YoY the following year | 28% YoY |

| EBIT Margins | Mid 60s EBIT Margin % | <30% EBIT Margins |

| PE Multiple | 42.0x 1-yr fwd PE | 150-175x 1-yr fwd PE |

Looking at these numbers, I think NVIDIA is not yet a 2000 Cisco type stock; its fundamentals are much stronger yet its valuation is nowhere near dangerous hype levels.

Nevertheless, given the recent trend of multiples rising along with the market capitalization for NVIDIA, I can understand why some investors are starting to get cautious. Still, as the stock isn’t in hype valuations territory yet, I believe low exposure to NVIDIA today may leave a lot of money on the table in the event of a genuine hype rally.

It is also worth noting that even Dr Jeremy Siegel who signaled caution in the dot-com bubble believes that NVIDIA is a “special one” that is neither overvalued or undervalued today. Looking at the numbers, I agree with this view. From the perspective of sentiment though, I believe there is a big upside risk in which NVIDIA is prone to experiencing a true euphoric hype. So I am positioning bullish to benefit from that upside optionality.

Key Risks

At a 42.0x 1-yr fwd PE, I don’t think NVIDIA is undervalued. However, my bullish stance is banking on some irrational exuberance to kick in for NVIDIA, leading to re-ratings to 50x and higher. Hence, the key risk in my thesis is if a euphoric hype run does not occur. That said, I do take some comfort in the fact that NVIDIA’s operations are going well and the company has great positioning to capture it’s $1 trillion worth of total addressable market (TAM). From that perspective, with a current EV of ~$3 trillion, the stock trades at a EV/TAM of 3x, which I think is compelling given:

- NVIDIA’s dominant market positioning with 80% market share in AI accelerators

- Recurring revenues and customer captivity enabled by NVIDIA’s accelerated computing ecosystem. We only need to look at Microsoft (MSFT) to get an idea of how valuable a dominant enterprise ecosystem of products and services is for decades of leadership in the stock markets.

Takeaway & Positioning

In summary, I think NVIDIA’s has not yet seen a hype cycle with irrational exuberance in the stock. Given its forward revenue growth, mid-60s EBIT margins trading at a 42.0x 1-yr fwd PE, I think NVIDIA is yet to experience a genuine euphoria and hype-driven rally that according to Dr Jeremy Siegel, starts from the 50-75x earnings multiple range. Hence, investors staying out of NVDA exposure may be at risk of leaving money on the table if and when a euphoric hype actually begins to take the stock to beyond fundamental reason.

From a longer term fundamentals perspective, NVIDIA is trading at ~3x EV/TAM. And given its dominant market positioning, recurring revenues and customer captivity enabled by its ecosystem, I think the company is likely to see decades of leadership in the stock market.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.