Summary:

- Meta Platforms has had a strong start in 2024, with stock up over 47% due to impressive quarterly results and robust revenue growth.

- Due to strong fundamentals and AI integration, Meta is expected to achieve further upside, with a target price of $655 by 2024.

- Meta targets Gen Z, enhancing video content and search functionality to boost engagement, while partnerships and AI investments drive targeted advertising revenue growth.

Robert Way

Investment Thesis

True to CEO Mark Zuckerberg’s remarks, Meta Platforms (NASDAQ:META) had an impressive start this year, continuing the momentum from last year. The social networking powerhouse, known for its comprehensive portfolio of apps, including Facebook and Instagram, has been firing at all angles to take bold steps in integrating AI across its applications to enhance engagement levels and monetize billions of its users.

Not surprisingly, the stock is already up by more than 47% for the year, towering the 16% gain for the Nasdaq 100. The gains have come from the spot delivery of impressive quarterly results on robust revenue growth. This puts the company at the sweet spot of leveraging AI to bolster its core advertising business, hence results that have gone so well with the market.

Since our latest update on Meta, the stock has surged nearly 45% in just over six months. Despite this impressive performance, we believe Meta has significant further upside potential. This optimism is grounded in Meta’s robust fundamentals, highlighted during its “year of efficiency,” and its strategic integration of AI across the Family of Apps (FoA).

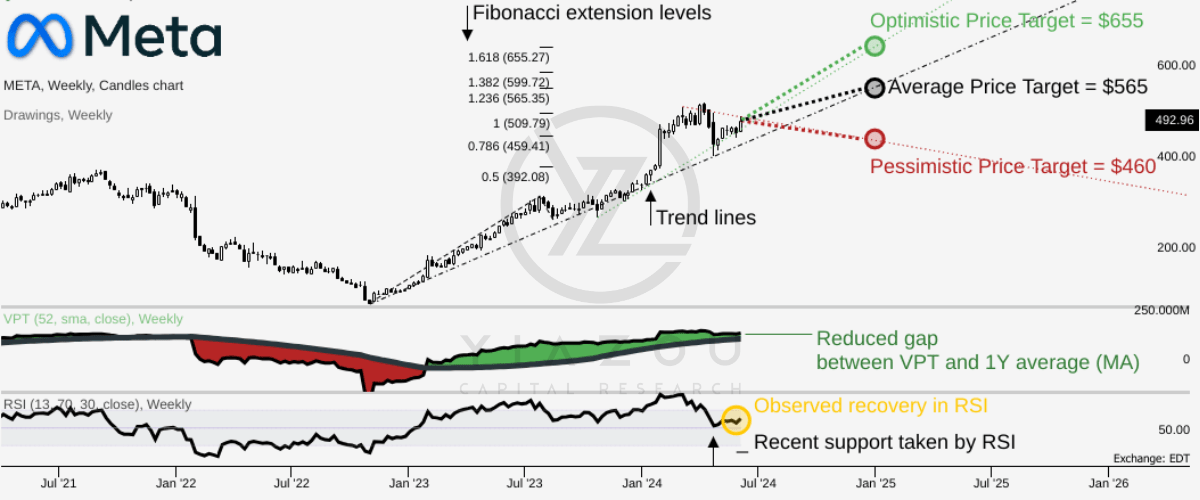

Lastly, our technical analysis supports this bullish outlook, suggesting an even more optimistic scenario for the stock’s future performance. Although Meta has grown to be the largest position in my portfolio, I will keep holding until it reaches our target price of $655 in 2024.

Stock Price Could Increase to $655 by End of 2024 Amid Stabilizing Bullish Momentum

We believe META may hit $655 optimistically by the end of 2024. Meanwhile, it may reach $565 on an average basis by 2024. On the downside, it may settle around $460 pessimistically by the end of the year. These price targets are derived from prevailing trends in the stock price over the mid-to-short term. To be conservative, higher lows are projected over Fibonacci extension levels to ascertain these targets.

Assessing the relative strength index (‘RSI’) at 60 reveals a potential upside. The RSI recovered after taking support at 50 in April this year, and the potential upside lies in the indicator’s upward movement. Moreover, the volume price trend (‘VPT’) increases above the yearly moving average. However, the gap between the indicator and its yearly moving average has been reduced recently, indicating a stabilizing bullish momentum in the stock price.

Author (trendspider.com)

Doubling Profits with AI-Driven Monetization Powering Meta’s Growth

The corporate parent of popular networking apps Facebook and Instagram delivered a 27% increase in revenue year-over-year (YoY) in the first quarter to $36.46 billion—better than analysts had predicted at $36.14 billion. That was after the company reported benefiting from a 6% increase in the average price of ads.

The growth marked the fastest rate of expansions of any quarter since 2021, as Meta Platform profits from aggressive monetization across its apps. Meta also benefits from the growing integration of AI into its flagship apps. For instance, 30% of Facebook posts use an AI-powered recommendation system.

Additionally, Meta Platforms ensures that 50% of content on its flagship photo-sharing app, Instagram, is tailored to user needs using AI. This has improved engagement levels on Instagram and Facebook, allowing Meta Platforms to attract more advertising campaigns.

Amid the robust revenue growth, net profit more than doubled to $12.37 billion or $4.71 a share compared to $5.71 billion or $2.20 a share delivered the same period a year earlier. One catalyst behind earnings more than doubling was a 16% drop in sales marketing costs in the quarter, attributed to reduced restructuring costs and lower expenditures on professional services and marketing.

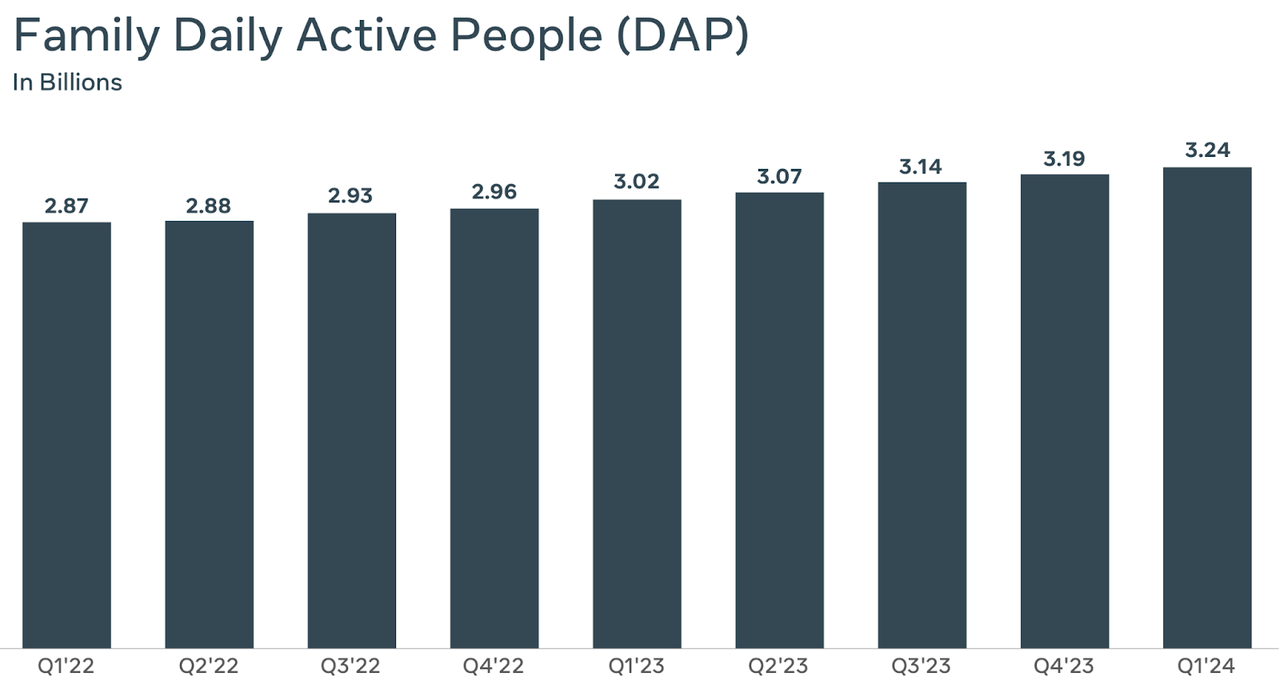

While Meta no longer reports daily active users and monthly active users for its flagship app, Facebook, it’s clear that more people are increasingly using it. Family daily active people on the app increased by 7% to 3.24 billion, maintaining its momentum and enabling the company to continue attracting advertising dollars given the massive user base marketers are always looking for.

The family average revenue per person (ARPP) that Meta Platform generates dropped 9% quarter over quarter on revenues of $36.46 billion in the first quarter. In contrast, the company generated higher ARPP in the fourth quarter due to increased advertising, depicted as revenues of $40.11 billion. Nevertheless, Q1’s average revenue per person was still an 18% YoY increase, underlining how effective Meta has become in monetizing its massive user base and enabling it to generate more revenue per user.

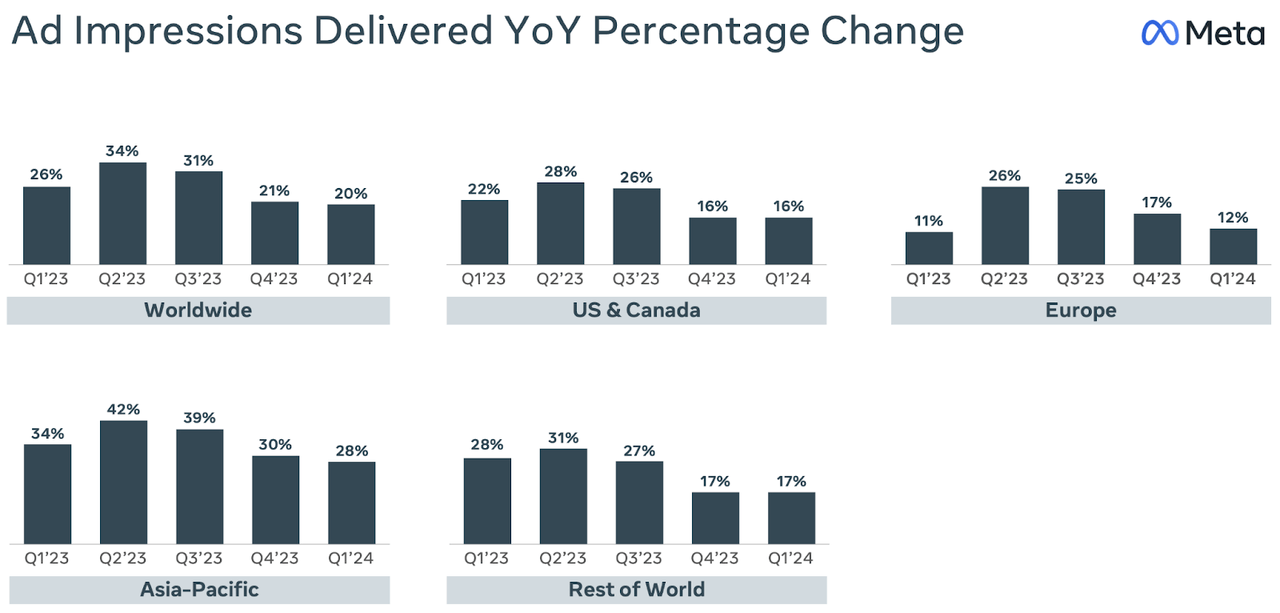

Another indicator that Meta Platforms is making impressive strides in its advertising business is that ad impressions delivered across FoA increased by 20% YoY, primarily driven by Asia-Pacific and the rest of the world. Specifically, Asia Pacific was one of the best-performing regions in Q1 as its ads impression growth rate of 28% YoY was much higher compared to 16% growth in North America and 20% for the rest of the world. However, it dropped from the 34% growth recorded in Q1 2023. Further, the company was able to generate more revenues from the increased ad impressions as the average price of the ad was up by 6% in the quarter.

Lastly, large online Chinese retailers, such as Temu and Shein, drive the growth in ad impressions in Asia Pacific. The two have been using Facebook to market their low-cost goods to target American and European customers, making up about 10% of Meta Platform’s total revenue.

Revamping Facebook with Video and Trends to Boost Digital Ad Revenue

While there have been growing concerns about a slowdown in Facebook growth, Meta is already looking into the future and strengthening its flagship app to safeguard its critical digital advertising revenue base. According to Piper Sandler’s study, just 32% of teens use Facebook monthly, compared to 80% on Instagram and 72% on TikTok.

Meta Platform’s latest push targets more Gen Z’s, looking to entice most of them to use the app at the expense of other emerging viral apps like TikTok. To revitalize Facebook’s prospects, Meta Platforms is pitching the network as a place for young adult users to connect with their friends shopping at the click of a button while keeping up with the latest trends.

Additionally, Meta Platforms intends to entice more Gen Z users to use Facebook by enticing more video creators to join the network. It has already started improving its video efforts on the platforms by making it possible to create and share short-form videos, which have been the catalyst behind TikTok’s popularity.

Lastly, according to head Tom Alison, the efforts are already paying off as Facebook has grown in the US, with people spending 60% of their time watching videos.

Transforming Advertising and Boosting User Engagement Across Facebook and Instagram

In contrast, even as Meta Platforms moves to reinforce its flagship Facebook app, its investments in Generative AI-based technologies—many through acquisitions—reach nearly all of the current offerings; it has built a robust roster of employees with relevant AI credentials backed by robust computing infrastructure and, therefore, a strong AI player in the marketplace. Meta was using AI tools as part of heavily realized social media applications for the mutual benefit of both Meta and the advertisers relying on AI to create, manage, and improve ad campaigns.

Meta has introduced Llama 3, a groundbreaking language model that could revolutionize the AI landscape. Recognized as one of the best AI assistants globally, this model will be the foundation for developing a wide array of new AI models. With its vast social networking data, Meta can now generate AI returns through various new models, potentially including targeted advertising, which could significantly contribute to its advertisement revenue.

Additionally, Meta’s AI capabilities extend beyond advertising. By leveraging AI, Meta can enhance the user experience on Facebook and Instagram, particularly in the Reels feature. This strategic use of technology not only makes the platforms more appealing but also has the potential to attract more users. Thus, personalized AI-driven content keeps users engaged, increasing their time on the applications.

One of the factors driving this constant gain among the various social networking applications under Meta Platform, harnessing AI, is access to 3.24 billion daily active people for the first quarter. In return, the company should attract leading advertisers who wish to tap that enormous user population and grow the revenue base.

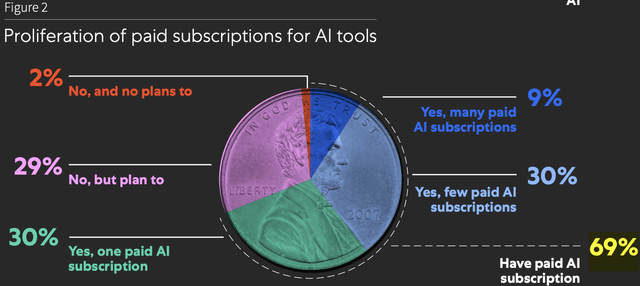

Notably, 69% of the marketing departments plan to pay for AI tools to enhance their campaigns, according to a study by Kaltura. Already, it offers various AI solutions to marketers to help them reach the right audience and get better returns on their advertisement investment.

Finally, AI tools were part of why revenue from Advantage+ Shopping and Advantage+ App Campaigns doubled in the recent quarter. In addition, Meta’s AI department is helping market advertisers automate a few processes involved in the course. Therefore, seeing a significant increase in marketers’ use of these AI-centric solutions is encouraging, which should contribute to robust growth in ad impressions and revenue.

Takeaway

Meta has had a stellar start this year, continuing its momentum from last year. The company’s strategic AI integration across its apps, including Facebook and Instagram, has driven significant user engagement and monetization. Despite a 45% rise in the past six months, we see further upside potential for Meta, supported by strong fundamentals and technical analysis. With impressive revenue growth and effective AI-driven advertising, I believe Meta’s stock could reach $655 by the end of 2024, making it a compelling investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.