Summary:

- Nvidia Corporation is toying around with a $3 trillion valuation, making it one of the largest companies in the world.

- The company’s largest customers are building their own GPUs and Apple’s recent announcement shows that Nvidia isn’t needed for cutting edge artificial intelligence.

- The market remains optimistic about the potential of artificial intelligence, despite limited evidence of its long-term earnings potential.

Adnan Ahmad Ali

Nvidia Corporation (NASDAQ:NVDA) is pushing around the $3 trillion valuation on the back of strong earnings and demand for its product. The company has crossed a superficial threshold, as the company is now larger than Amazon and Tesla combined.

However, as we’ll see throughout this article, despite continued enthusiasm about artificial intelligence, Nvidia is an overvalued company that cannot justify its valuation, especially with Apple’s latest announcement that its cutting edge artificial intelligence will utilize its own cutting-edge silicon.

Nvidia Financial Results

Nvidia had strong financial results, there’s no denying that, but we feel it’s key to keep in mind this is now a $3 trillion company.

The company earned $26 billion in revenue at a 78% gross margin, with $14.8 billion in net income (annualized at a P/E of ~40). Cash flow from operations went up in line with massive revenue growth, as the company’s datacenter business now makes up ~80% of its total revenue (up >5x YoY). That shows how effectively the company’s entire financial portfolio is concentrated in GPUs for artificial intelligence.

Nvidia New Chips

To be fair, Nvidia understands competition is coming, and it’s continuing to invest massively in new chips. The company has shifted its prior 2-year timeline for new chips to a 1-year timeline, and has announced the “Blackwell” line for later in 2024 along with the “Rubin” line afterward. Both are reasonable improvements over prior generations.

The turnaround in the announcements was also <3 months, highlighting Nvidia’s current goals. However, there are some other things to note. The first is that Blackwell is built on 4NP, which isn’t TSMC’s latest process and is behind the cutting-edge process currently used by Apple, who booked all of TSMC’s 3nm process.

Nvidia’s latest Blackwell GPU is essentially two linked GPUs at 2.5x the transistors and 4x the training speed of their prior H200 GPUs. Analyst estimates are ~$65K per GPU and while those are just estimates, it shows the competition as a scaled H200 system would be ~$100K based on H200 prices of ~$40K. This indicates Nvidia is continuing to push out competitive chips, but margins won’t always increase proportionally.

Nvidia Outlook

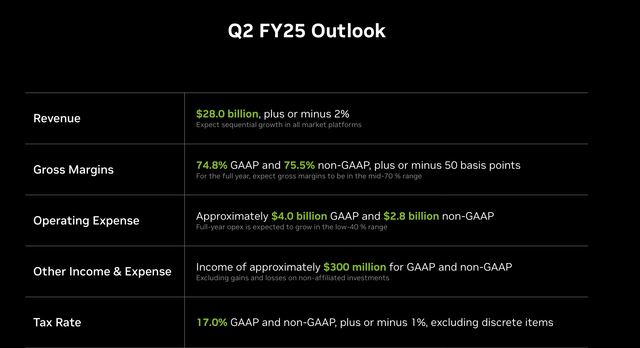

Nvidia’s outlook shows continued strength for the company, but it also highlights the risks that’re faced from moderating growth.

The company’s revenue growth rate is expected to slow down to ~$4 billion per quarter, still strong growth, but among the weakest QoQ growth since the launch of ChatGPT and start of the artificial intelligence craze. More importantly, gross margin of 74.8%, in-line with full-year estimations, are expected to go down almost 4% QoQ.

Revenue + margin growth is the secret sauce to rapid profit growth, and with opex expected to grow in the low-40% range, only revenue growth will provide future profit growth. That will slow down profit growth, which will make it harder for the company to reach profits that justify its valuation.

Artificial Intelligence Market Outlook

At the end of the day, Nvidia’s potential success depends on where the artificial intelligence market peaks. It’s tough to tell, but there are four things that concern us.

1. Most sources are reporting that lead times on Nvidia’s GPUs are dropping and have gone from 8 to 11 months to ~3 months. That indicates less of a frenzy for all that will hurt Nvidia’s profit margins even if long-term GPU demand remains strong.

2. Estimates are that Nvidia’s 4 largest customers make up ~40% of the company’s revenue, and all of them are purchasing the GPUs for potential future projects. Meta is buying the equivalent of 600K H100 GPUs as Nvidia’s second-largest customer, for a potential product it doesn’t yet know if it can create. Take a look at the amount it’s spent on VR with no return.

We question whether these companies will keep coming back year after year for 100s of thousands of new GPUs if they can’t see a quick return.

3. The end of (2) leads us into this point, which is that these GPUs aren’t the product for Nvidia’s customers, but they’re being used to train artificial intelligence models that earn the profits. OpenAI has seen its valuation grow rapidly, but despite being the largest and best recognized Gen AI company, has a valuation of only $80 billion.

If these end companies aren’t making enough profits to justify their valuations, how much longer can they keep purchasing $10s of billions in GPUs. Will those GPUs ever pay off?

4. For this one, we will give its own section (competition) below.

TSMC and Competition

Nvidia does not own its own fabs and has no announced plan to participate in that market. That’s not surprising given the decades of expertise and tens, if not hundreds, of billions of $ it would require to be competitive. However, it also presents an area of concern when TSMC (TSM) announced that it may raise prices for Nvidia.

Rumors are that Nvidia backs the price increase, understanding how reliant it is on TSMC, but there’s no denying that this will impact Nvidia margins. That’s a risk because Nvidia needs to maximize profits today, it doesn’t have an extremely long-term runway as competition scales up. For example, Apple (AAPL) announced Apple Silicon powered Apple Intelligence at its WWDC conference, with no mention of Nvidia hardware.

Granted, Apple is already a leader in desktop and mobile silicon, they do not need to catch up the same way as other major customers, but it’s a major statement in our view that one of the largest companies in the world has determined it can run its artificial intelligence on its own silicon rather than Nvidia’s.

In our view, it spells trouble down the line as massive Nvidia customers such as Google (here), Microsoft (here), and Amazon (here) all work to build their own silicon.

Microsoft, estimated to be Nvidia’s largest customer, is a particularly unique risk given Apple’s newly announced partnership with Open AI (backed heavily by Microsoft). That combines with a potential long-term future where Open AI shares Apple’s secure Private Cloud for artificial intelligence, given privacy concerns that Open AI continues to face.

Thesis Risk

The largest risk to our thesis is a market with minimal alternative locations to invest. The market is expensive, and the market is yearning for a valuable investment. Artificial intelligence has captured the market’s imagination and as the saying goes, the market can remain irrational for much longer than you can remain liquid. That combination can affect your ability to bet against the stock.

Conclusion

The net view we’re trying to espouse is that Nvidia is a great company with an incredible product and perfect timing. However, at a $3 trillion valuation, they need to grow to a $6 trillion valuation over the next decade just to match the S&P 500’s long-term returns. That means they need a path to reliable hundreds of billions of dollars in annual profit.

We simply don’t see that path. They have numerous risks, including concentrated customers, customers not earning a profit on their purchases, new and emerging competition, and declining margins. All of these add up to a lack of ability to increase current annual profits of ~$70 billion by 4-5x in the next decade, something we think the company needs to do to justify its valuation.

In fact, based on these factors, our prediction is that Nvidia’s 2030 profits are smaller than its profits today. For that reason, we recommend against investing in this overpriced company. Please let us know your thoughts in the comments below.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.