Summary:

- McDonald’s has achieved 13 straight quarters of revenue growth, despite high inflation hurting consumer spending.

- The fast-food chain plans aggressive expansion, with a goal of reaching 50,000 global restaurant units by FY 2027.

- McDonald’s is a ‘Dividend Aristocrat’ with consistent profitability and potential for dividend growth.

- Moderating inflation could be a catalyst for a revenue re-acceleration.

- Shares trade at a bargain 19X P/E ratio and yield 2.6%.

Magdalena Wygralak

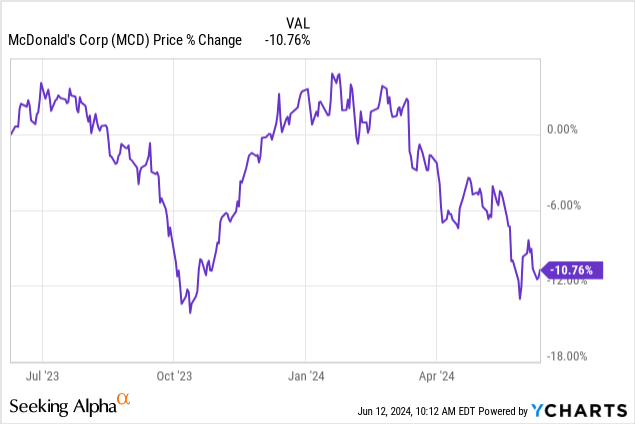

McDonald’s (NYSE:MCD) is looking back on a 13-quarter streak of uninterrupted, comparable sales growth, despite high inflation weighing on consumer spending in the last two years. The fast-food chain is, despite headwinds, generating consistent, low-single digit growth in comparable revenues and continues to focus aggressively on expansion, both in the U.S. and abroad. I believe McDonald’s is set to benefit from moderating inflation — a key catalyst for accelerating growth in system-wide sales — and the company’s aggressive unit growth plan for FY 2024 and beyond indicates significant top line expansion potential as well. Shares also trade below the 1-year average price-to-earnings ratio, which implies a favorable risk profile for long-term investors as well!

Decelerating growth

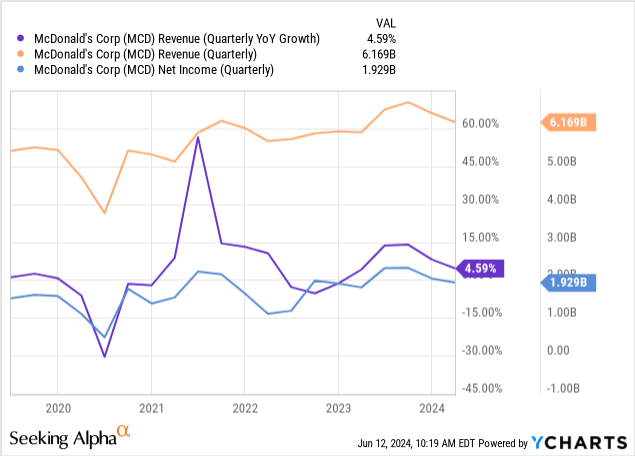

McDonald’s is one of the original American success stories that needs no introduction. The company has grown from just one hamburger place in 1940 to a multi-national fast-food behemoth with more than 40,000 restaurant locations in over 100 countries and a market cap of $185B. McDonald’s achieved $6.2B in revenues in the first fiscal quarter, showing 5% year-over-year growth.

The fast-food chain’s revenue growth has decelerated lately, in part due to inflation weighing on system-wide sales, and it negatively impacted the company’s comp figures as well. In Q1’24, McDonald’s still saw 2% comparable sales growth, however. Comp sales can grow through menu price increases, marketing of core menu items, as well as increases in customer traffic. The company’s reintroduction of the $5 meal (discussed in the next section) is meant specifically to increase foot traffic in McDonald’s U.S. restaurants.

The table below shows the trajectory of comparable sales for McDonald’s U.S. and international businesses.

| Comparable Sales Growth | Q1’23 | Q2’23 | Q3’23 | Q4’23 | Q1’24 |

| U.S. | 12.6% | 10.3% | 8.1% | 4.3% | 2.5% |

| International Operated Markets | 12.6% | 11.9% | 8.3% | 4.4% | 2.7% |

| International Dev. Licensed Markets | 12.6% | 14.0% | 10.5% | 0.7% | -0.2% |

| Total | 12.6% | 11.7% | 8.8% | 3.4% | 1.9% |

(Source: Author)

Although comp sales have seen weakness in the last year especially, the fast-food giant is still widely profitable and generated more than $1.9B in net income just in the last quarter.

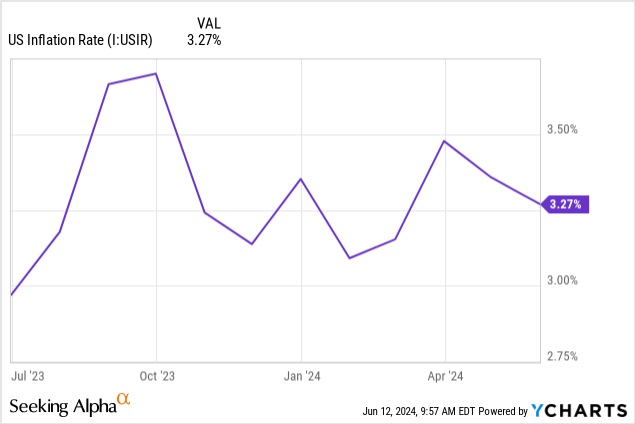

Inflation is a key risk for McDonald’s

Inflation is still a big challenge for McDonald’s customers and recent news about high-price, bare-minimum meals have forced the company to announce the return of more affordable price options, such as the $5 value meal. Inflation has broadly moderated in the last year — it has fallen from more than 9% last year to the low-3s in May — and the Federal Reserve has not yet begun to lower its federal fund rate. The company’s CEO recently also publicly voiced his concerns about run-away inflation.

As inflation moderates, however, I would expect purchasing power to be freed up, which could be a catalyst for a revenue acceleration for McDonald’s comparable sales. Since the trend in comp sales has been falling in the last year, a reversal of this trend could drastically change the appeal of an investment in McDonald’s shares, in my opinion, and be a catalyst for a share price revaluation.

According to the latest inflation update, price growth decelerated slightly in May with inflation coming in at 3.3%, showing a decline of 0.1 PP Q/Q. With McDonald’s customers obviously setting to benefit from weakening budget pressure and the return of higher-value meal options, I believe the fast-food chain could see impulses for its comparable store revenue trajectory.

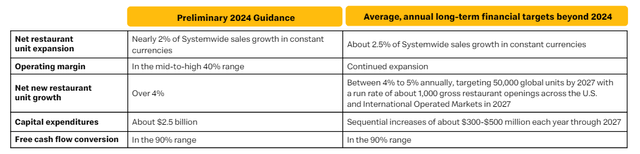

Guidance for net new restaurant growth

McDonald’s revenue growth is only in the low-to-mid single digits, but the company has another lever to grow: it can leverage its franchise footprint. McDonald’s has more than 40,000 restaurant locations and will continue to add aggressive to the existing real estate footprint in the coming years. The fast-food chain has guided for 4% annual net new restaurant unit growth in FY 2024 which McDonald’s seeks to grow to 5% by FY 2027. By this time, McDonald’s expects to have 50,000 global restaurant units, which would be a roughly 25% increase of its global restaurant footprint.

Exceptional dividend growth

McDonald’s is a consistently profitable fast-food enterprise and is a ‘Dividend Aristocrat’ meaning the company has more than 25 consecutive years of dividend growth under its belt. For dividend investors, this track is obviously hugely meaningful, as it implies that the odds are in favor of continual dividend increases in the future.

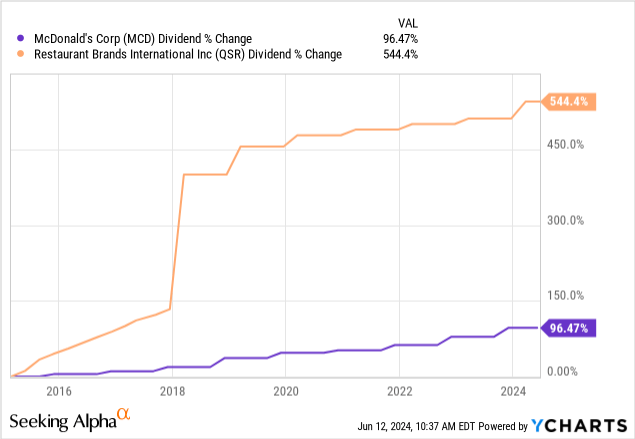

McDonald’s has widely outperformed Restaurant Brands International (QSR) in terms of dividend growth in the last ten years, a result of steady expansion of a globally successful fast-food franchise, but also due to commitment to creating shareholder value through consistently growing distributions.

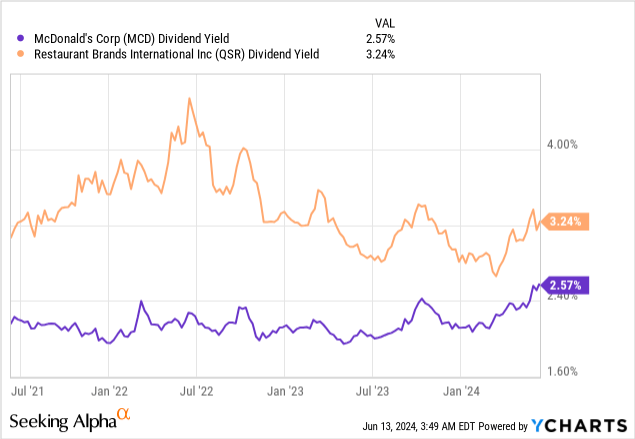

McDonald’s is currently priced at a 2.6% dividend yield, which is below the 3.2% dividend yield that shares of Restaurant Brands International pay. However, given the higher, demonstrated rate of dividend growth in the past, I believe McDonald’s remains the more attractive dividend (growth) investment going forward.

McDonald’s valuation

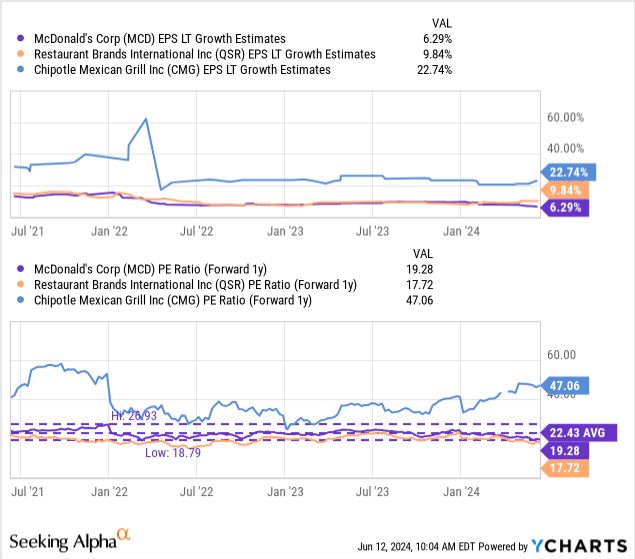

McDonald’s is profitable and therefore can easily be valued based off of a price-to-earnings ratio. Rival fast-food chains include Restaurant Brands International — which owns McDonald’s fiercest rival Burger King — as well as Chipotle Mexican Grill (CMG).

McDonald’s is looking to expand its footprint slowly and consistently over time… which is reflected in the market expecting a relatively low, long term EPS growth rate of 6% while Restaurant Brand International’s portfolio, which includes the Tim Horton’s and Popeyes brands, are expected to grow 10% in the long run, in part because they have smaller franchise networks and can grow faster.

Chipotle Mexican Grill is expected to its earnings at an annual rate of 23%, chiefly because of the company’s aggressive expansion strategy and popularity of the fast-food offering. Chipotle Mexican Grill also has much more growth potential than McDonald’s as the Mexican food chain only had about 3.4k restaurant units as of April 2024. This faster growth is reflected in a P/E ratio of 47X.

McDonald’s is currently valued at a P/E ratio of 19.3X, which is below the company’s longer-term average price-to-earnings ratio of 22.43X. Moderating inflation and reaccelerating top line growth could be catalyst for a revaluation to the upside, in my opinion. If MCD only revalues to its 3-year average P/E ratio, shares of McDonald’s could be worth as much as $300 (based off of a consensus estimate of $13.26 per-share for FY 2025). This is a dynamic number and may increase or decrease depending on McDonald’s realized earnings growth.

Risks with McDonald’s

The biggest risk, as I see it, relates to the inflation trajectory. Sticky inflation in the second half of the year will continue to pressure consumers. McDonald’s recently announced that it was bringing back, in cooperation with its franchisees, its $5 value meal in order to lure more customers to its restaurants. A resurgence of inflation in the third and fourth-quarter would likely post the biggest risk to the fast-food chain’s comparable revenue growth.

Final thoughts

McDonald’s is seeing low-single digit comparable revenue growth, but the fast-food chain is growing, nonetheless, even in a high-inflation world, and the company has an aggressive growth plan in place that will see its global restaurant footprint grow to more than 50,000 units by FY 2027. Specifically, I see a catalyst for a revenue acceleration in the next 12-18 months if inflation continues to moderate, just like it did in May. The real reason why investors may want to take a look at an investment in McDonald’s relates to the company’s excellent dividend growth. Currently, shares of MCD pay a 2.6% yield, but this yield is set to grow massively in the coming years as well, making MCD a perfect dividend growth investment!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.