Summary:

- The US tobacco industry evolving with vaping, e-cigarettes, reduced risk products.

- Altria struggling to adapt, stock performance lagging behind peers and S&P 500.

- Altria stock rated as sell due to continued decline in smoking rates, lack of product portfolio diversification, and overvaluation.

bmcent1

Markets evolve and companies have to adapt. While most industries are cyclical, there are also times when secular evolution occurs that forces corporations to fundamentally change their core businesses. Today, the pace of innovation and technological progress is faster than ever, and many sectors are undergoing both significant and fast-moving changes.

One industry that has changed dramatically in just the last decade is the US cigarette and tobacco sector. While this industry has traditionally been dominated by several key players and a couple of core brands such as Marlboro, Newport, and Camel, this is not the case anymore. Today, the US tobacco and cigarette industry has changed into a market with vaping, e-cigarettes, HEET sticks, other reduced-risk tobacco products, as well as different forms of chewing and oral tobacco.

The changes in the US tobacco and cigarette industry have impacted companies differently, one company that has consistently struggled to adjust to the evolving market conditions is Altria (NYSE:MO). The largest cigarette producer in the US got 87% of the company’s revenues from cigarettes and other combustibles in 2023. Altria’s partnership with JUUL was also a failure, and the company has also struggled to develop reduced-risk tobacco products since selling the distribution rights for IQOS heated tobacco products to Philip Morris International in late 2022. The cigarette industry and smoking rates in the US remain in a secular decline as well.

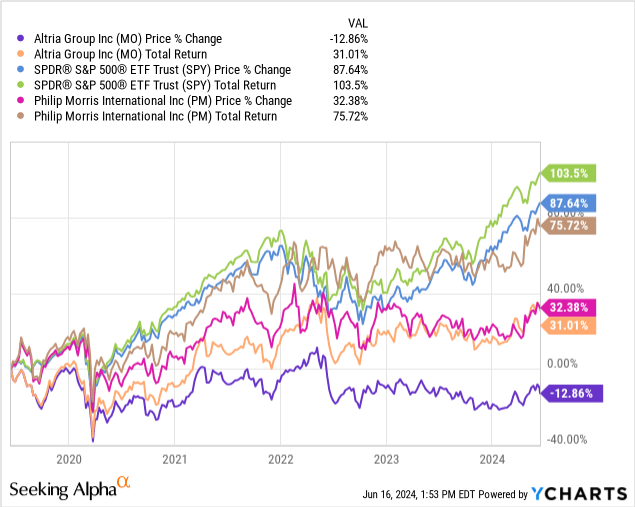

Altria has offered investors total returns of just 31% in the last 5 years, while the S&P 500 has offered investors total returns of 103.5% during this same time frame, and peers such as Philip Morris International have offered investors total returns of 75% since 2019 as well.

Today, I am rating Altria a sell. The company’s pricing power is not offsetting continued and accelerating declines in smoking rates and the leading cigarette producer remains heavily dependent on combustibles, an industry in secular decline. Altria’s management team has also consistently failed to change the company’s product portfolio or overall marketing strategy as consumers increasingly switch to e-cigarettes, vaping, and with the 2023 FDA decisions, reduced-risk products. The stock also looks overvalued using several metrics.

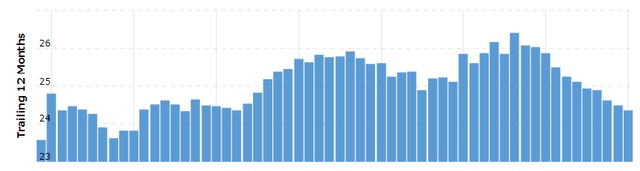

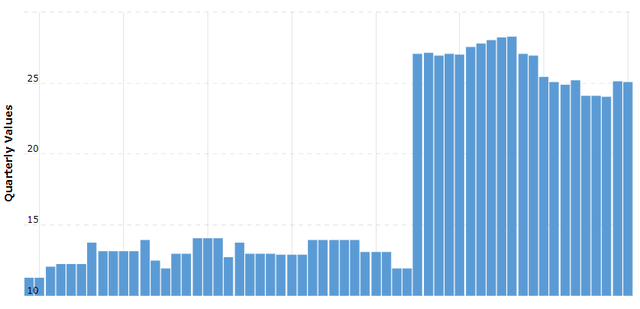

Altria’s annual revenues peaked in the middle of 2021 at nearly $26 billion, and the company’s revenues have been in decline over the last 3 years. The cigarette producer earned $24.4 billion in 2023, which was the lowest amount the company has earned since 2015.

A Chart of Altria’s annual revenue (Macrotrends)

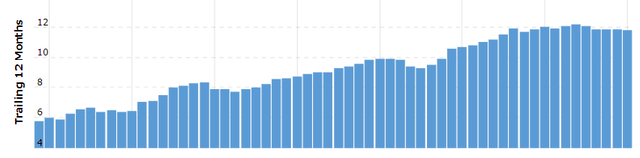

The company has only grown EBITDA from $10.55 billion to $11.74 over the last 5 years since 2019 as well.

A Chart of Altria’s EBITDA since 12/31/2009 (Macrotrends)

The leading cigarette provider’s recent earnings report also continued to show management does not have a solution for the continued deterioration of the company’s core cigarette business. For the first quarter, Altria reported both volume declines and lower pricing because of promotional activity across the combustible and smoking products the company still heavily depends on. Management also reaffirmed the disappointing guidance of 2-4.5% earnings per share growth for the full year. Altria has consistently struggled more to adapt to the changing market conditions in the US tobacco and cigarette market than Altria.

Smoking rates in the US and globally remain in a long-term decline as well. In 2000, 1 in every 3 adults consumed tobacco products, that rate is now 1 in 5. Cigarette smoking rates in the US have declined by 3.3% per year since 1980, and the NIH also projects that cigarette smoking rates in the United States could drop dramatically by 2030. While Altria has a partnership with Japan Tobacco (OTCPK:JAPAF) to develop reduced risked products called Horizon Innovations, and the company is trying to establish a stronger position in the e-cigarette market with the recent 2023 acquisition of NJOY after the tobacco producer’s failed investment in JUUL, the current management team has consistently failed to adequately adapt to the changing landscape in the US tobacco and cigarette industry.

While Japan Tobacco has some new reduced risk products such as the Ploom X that have had some success in markets outside of the US such as Japan, Philip Morris International continues to dominate the reduced risk market with the company’s IQOS technology that is well ahead of competitors. PMI is also planning on increasing marketing and production of the company’s new alternative smoking products after FDA approvals of this technology last year. British American Tobacco has also taken much of the US market in the e-cigarette industry with the company’s superior VUSE product. BTI has taken 38.5% of the e-cigarette market in the US with this brand. Altria is not likely to benefit from the FDA lifting the ban on JUUL’s products in the US since the company divested from nearly its entire position in the company and management only retain intellectual property rights to some of the JUUL’s products.

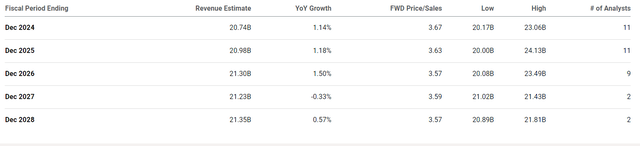

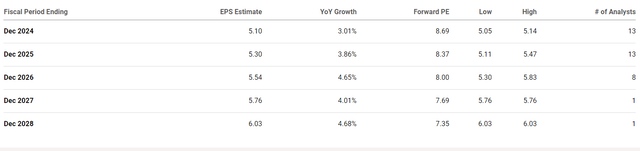

This is also why Altria looks overvalued using several metrics. While the company trades below the company’s five-year average valuation, the leading tobacco producer trades at 8.67x projected forward GAAP earnings and 3.67x expected forward sales. Analysts are projecting Altria to grow revenues at just 1-2% per year over the next 4 years, and the company is expected to grow earnings per share at just 3-4% between now and 2029.

Analysts Revenue Projections for Altria (Seeking Alpha) Analyst Earnings Per Share Estimates for Altria (Seeking Alpha)

Altria faces significant risks to the company’s core combustibles business because the FDA is increasingly approving reduced-risk products such as Philip Morris International IQOS technology at a faster pace. Higher interest rates have also made servicing the debt and borrowing to buy back shares and pay dividends more difficult, which is why the company recently announced an accelerated sale of shares from Altria’s equity stake in INBEV.

A Chart of Altria’s debt levels (Macrotrends)

Altria’s current long-term debt levels of $25.04 billion remain near a 20-year high.

While many investors have found tobacco companies such as Altria appealing for the dividend and income these companies usually offer more than long-term capital gains, and these individuals are not as focused on traditional valuation metrics, the leading tobacco company’s recent dividend growth has also been disappointing. Altria’s dividend growth over the last five years of 4.14% has been below the sector average at 4.99%. The tobacco provider’s recent dividend growth has also been well below the 7.4% average investors saw over the last 10 years as well. While Altria was one of the best-performing stocks in the market for some time, the company is likely to continue to face challenges moving forward.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.