Summary:

- The Coca-Cola Company’s 61st consecutive dividend increase is expected in February.

- Coca-Cola stock outperformed the market by a wide margin in 2022.

- I expect outperformance by The Coca-Cola Company in 2023, but by a smaller margin.

AlizadaStudios/iStock Editorial via Getty Images

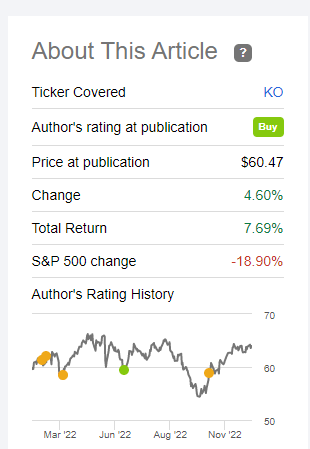

As I’ve mentioned in a few recent articles, a nice feature introduced by Seeking Alpha allows authors and readers alike to track the recommendations made by the author. It brings great satisfaction to see that your stock pick has outperformed the market by more than 25%. Obviously, I’ve had some duds as well, but why bring attention to it. Moving on.

Coke Performance (Seekingalpha.com)

Humor aside, I wrote this article around this same time last year previewing The Coca-Cola Company’s (NYSE: NYSE:KO) projected dividend increase in 2022. To keep things consistent, this article follows the same structure. Let us get into the details.

Upcoming Dividend Increase

Coca-Cola will announce its 61st consecutive dividend increase on February 16th, 2023. And no, this says nothing about me but rather speaks volumes about Coca-Cola’s stability and predictability. The company tends to announce its annual dividend increase on the third Thursday of February.

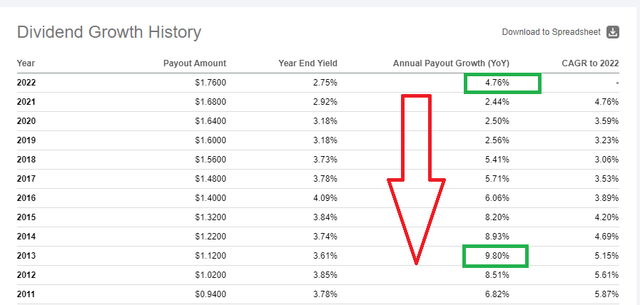

Last year’s (2022) dividend increase was about 5%. While this may have paled in comparison to inflation that ran amok, Coca-Cola finally broke a streak of 8 years where the dividend growth rate fell. We need to go back to 2013 to see the last time Coke’s dividend growth rate was better than the previous year. To be clear, I am not talking about the dividend in dollars, but just the year-on-year (“YoY”) percentage of increase.

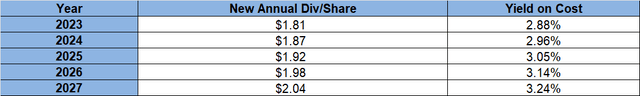

In the 2022 article, I had used a measly 2% annual dividend growth rate assumption from 2022 till 2026. Given the nice little surprise by Coke (5% increase) in 2022, the projected returns below look a little better than during last year’s review. If Coke manages a 3% increase per year, the yield on cost reaches almost 3.24% for someone buying today at $63, compared to the 3.04% 5-year yield on cost last time around. That difference may not seem like a lot until you factor in: (a) further potential upside surprises from Coke; (b) any opportunity that may come our way to buy below $63; and (c) the law of large numbers, especially when compounded. For each $1,000 invested, that’s a difference of $2 in income per year in 5 years under pessimistic assumptions.

Coke Extrapolation (seekingalpha.com)

As I’ve written in the past, Coca-Cola has rarely yielded above 4% and the “base” yield on the stock tends to be between 3.30% and 3.50% where it attracts a lot of buyers. So, the increasing dividends, even if smaller as the years go by, tend to increase the floor price of the stock. But, does Coca-Cola have the prowess to offer more than the 3% DGR assumed above, say 5% again? Let’s see.

- Current outstanding share count is at 4.325 Billion, more or less the same as last year.

- A 5% dividend increase next month will mean a quarterly dividend of 46.20 cents per share.

- That would represent a commitment of $1.99 Billion/quarter towards dividends (4.325 Billion shares times 46.20 cents).

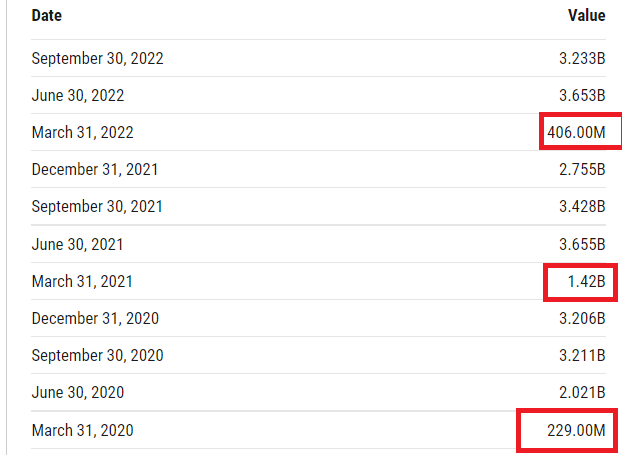

- Coca-Cola’s free cash flow[FCF] had recovered this time last year from the pandemic lows and has now flatlined. Coca-Cola’s quarterly free cash flow has generally been more than its dividend commitment as shown in the table below. The red ones were the only quarters where Coca-Cola generated less than $2 Billion.

- The current average quarterly FCF is $2.5 Billion using the most recent 4 quarters, which would represent a payout ratio of almost 80% ($1.99 B divided by $2.5 B). Both the numbers in bold have gone in the wrong direction as the quarterly FCF was $2.9 Billion and the projected payout ratio was 65% at the same time last year.

- Using forward earnings per share projections of $2.49 per share, a projected new quarterly dividend of 46.20 cents per share would represent a payout ratio of 74%, which is a hair lower than the 76% last year.

- In summary, the decrease in free cash flow shows that the post pandemic tailwind is waning, if not completely absent. I am going to be a little pessimistic about the 2023 dividend increase and say a 5% increase looks unlikely. I am expecting Coca-Cola to be a bit cautious about the economy and err on the side of caution, with a 2% to 3% dividend increase. That would place the new quarterly dividend at ~45 cents per share.

Coke FCF (YCharts.com)

More than the returns

I am sticking with the house analogy used last year as it still applies, if not more so. Coca-Cola happens to be one of the pillars in my foundation since 2011. Through stock split, dividend increases, dividend reinvestments, buybacks, averaging down on pullbacks, and sleeping well at night, Coca-Cola has performed fairly well for me.

In addition, I feel compelled to offer this analogy, too, as 2022 draws to a close. Stocks like Coca-Cola are like your insurance premiums. You feel they are not worth their time and money until you actually needed the protection. Boy, did we all need some protection in 2022. I certainly did, and I am glad that I had Coca-Cola in my portfolio. I expect 2023 to get off to a similar start where we all need some protection.

Risks

The two risk factors I had mentioned last year were inflation and COVID variants.

- Inflation remains high but is likely past its peak. Bear in mind that the official numbers like PPI and CPI are lagging indicators and the Fed’s hawkish policies will show up a few months down the road. Hence, I am taking this risk factor off the table. In addition, Coca-Cola has the required pricing power to pass on the cost to consumers without worrying about losing much share.

- While no one knows what the submicroscopic world is going to do, it appears like the COVID risk factor can also be taken off the table for now.

Instead, the two risk factors as we enter 2023 are the stock’s own valuation and the economy.

- With the 2022 flight to safety, it is hard to look past the fact that consumer staple stocks got bloated in terms of valuation. Coca-Cola is trading at a forward multiple of 25 with an expected earnings growth rate of 5%/yr. That gives the stock an eye popping price to earnings/growth (“PEG”) of 5. Peter Lynch is shaking his head somewhere, while on the other side Warren Buffett is saying “You gotta pay for quality, Peter.” Irrespective of what those reputed Goliaths say, this David thinks a PEG of 5 is too rich even for a stalwart like Coca-Cola.

- The economy may not hurt Coca-Cola’s sales as much as it may hurt the discretionary and most technology stocks. But an economic slowdown, if not a full blown recession, is definitely on the cards once the COVID-infused savings run out. Anything that hurts the consumer hurts consumer companies, staple or not.

Conclusion

I am going to offer a conclusion that may make you scratch your head a little. But let me try being as clear as possible.

- Coca-Cola’s valuation here is too rich for me personally to add more shares outright. But, I am reinvesting my dividends to avoid the headache of looking for new places to use my money. The stock deserve at least that much from me almost anytime for the relative safety it offers.

- However, if you don’t have enough (or any) exposure to Coca-Cola, I suggest waiting till the dividend increase in February to gauge where the 3% mark is to start nibbling again. If the market recovers and the risk-on trades get more attention, stocks like Coca-Cola will likely sell off (but will never crater like the fads did this year) to a more reasonable valuation. If you see a yield of 3.30% or more as a result of dividend increase and a sell-off, that’s your chance to establish a bigger position.

- If you don’t have any exposure at all to the stock, consider it like an insurance premium and initiate a small position before the dividend increase and watch the second bullet.

- If you see Coca-Cola at about 4% yield, well, let’s hope you never see it. Because the last two times it happened (COVID and 2008/09 crisis), our lives changed forever.

Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.