Summary:

- Lucid’s investors are poised to feel more pain as the industry cools down and competition intensifies.

- Despite a 60% share price drop, the company is still overvalued with a high price-to-sales ratio.

- The DCF simulation indicates Lucid’s fair value is $2.27 billion, far below its current market cap, supporting a “Strong Sell” rating.

jetcityimage

Investment thesis

My previous bearish thesis about Lucid (NASDAQ:LCID) aged well as the stock lost 27% of its value since February 2024, while the broader U.S. market grew by 9%. The company continues to disappoint investors by underperforming against consensus forecasts. Lucid’s Q1 performance might add optimism to some investors; however, there are a few robust indications that the industry is cooling down. Moreover, the competition continues to intensify as another prominent luxury brand is set to expand into the U.S. market. The company’s $6 billion valuation is not justified since the business’s fair value figured out by my calculations is still far below. All in all, I reiterate my “Strong Sell” rating for Lucid’s stock.

Recent developments

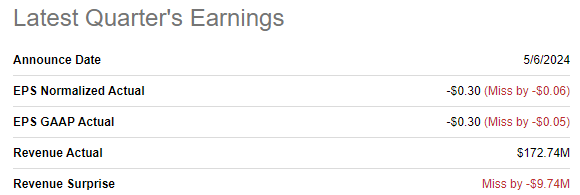

Lucid released its latest quarterly earnings on May 6 when the company missed both revenue and EPS consensus estimates. It was the company’s sixth consecutive quarter of missing revenue estimates. Revenue grew by 15.6% YoY and the adjusted EPS improved from -$0.39 to -$0.30.

Seeking Alpha

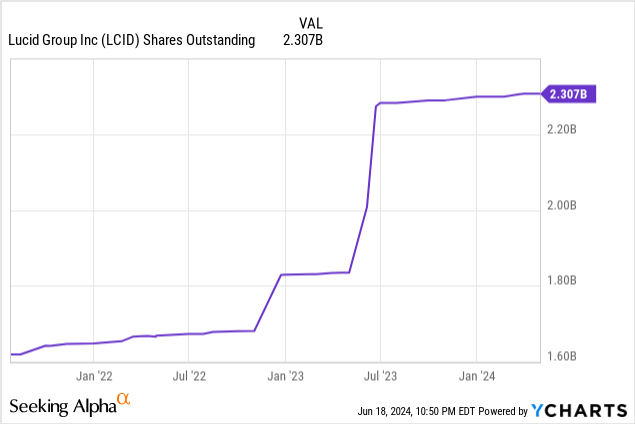

Despite the EPS improvement, profitability ratios still look extremely poor. The company’s cost of goods solid is still substantially higher than its revenue, as the gross margin was -134% in Q1. The situation is much worse with the operating margin, which is at -422%. As a result, the company burned half-a-billion in cash from operations during Q1, slightly more on a sequential basis. Lucid’s balance sheet is still healthy with a $1.6 billion net cash position as of March 31. However, with half-a-billion operating cash burn, the company is poised to run out of its solid net cash position by the fiscal year-end. Therefore, it is reasonable to expect more dilution for shareholders closer to the year-end, which stabilized in recent quarters.

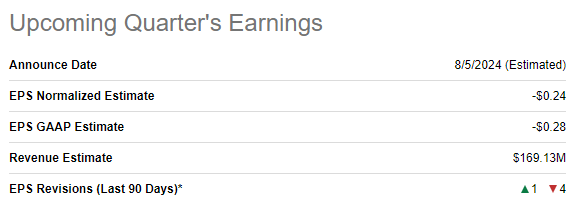

The upcoming earnings release is scheduled for August 5, revenue is expected to decrease sequentially to $169 million. This indicates approximately 12% YoY growth, but considering Lucid’s rich history of revenue underperformance, the actual revenue increase might be lower. The good information is that the adjusted EPS is expected to improve further, to -$0.24. On the other hand, there were four EPS forecast downgrades over the last 90 days, which indicates that Wall Street expectations are softening.

Seeking Alpha

Lucid does not report its deliveries every month, which makes it difficult to forecast the Q2 sales figures’ strength. Therefore, we can only look at some less direct clues. For example, we can look at the performance of the overall U.S. automotive market in April and May.

The Fed’s tight monetary policy continues weighing on automotive sales in the U.S. According to the source, total new light vehicle sales in the U.S. were 2.4% lower in April 2024 compared to the same month last year. Light vehicle sales ticked up in May, but passenger vehicles still demonstrated softness with a 1.1% YoY decline.

Within the soft passenger vehicle industry, EVs appear to be losing their appeal. According to the report from J.D. Power, the American consumers have a notably lower intent to buy electric vehicles than they had in the last three years. This is another bearish sign that might be an obstacle for Lucid to sustain its revenue growth demonstrated in Q1.

Another factor, which might weigh on Lucid’s topline, is the trend that used electric vehicle prices continue to fall faster than used gas car prices. According to the information, the average used EV price was found to down 29.5% year-over-year vs. 6.1% for the average used gas car price. This is a big gap which likely makes EVs less attractive for buyers.

Last but not least, the competition in the U.S. luxury EVs segment, where Lucid operates, is poised to intensify. The prominent German luxury brand Audi plans to build a comprehensive EV line-up with the electric version of Audi A4 debuting soon. Audi aims to launch its EV offerings across all core segments by 2027.

Valuation update

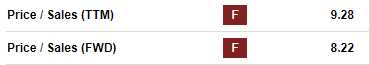

LCID’s share price plunged by almost 60% over the last twelve months, significantly underperforming compared to the broader U.S. stock market. YTD performance is also poor with a 39% share price decrease. Despite this massive share price drop, LCID’s price-to-sales ratio is still sky high at around nine. To add context, Tesla’s P/S ratio is around six at the moment.

Seeking Alpha

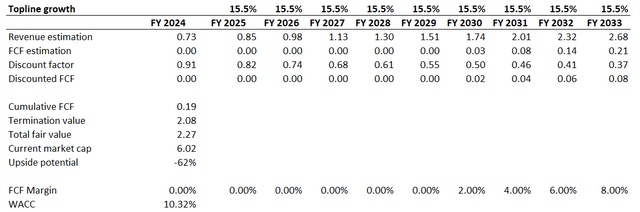

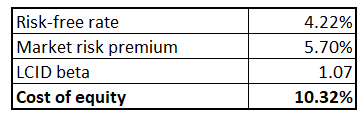

The ridiculous P/S ratio clearly signals overvaluation, but I need more evidence to make a final conclusion about the stock’s overvaluation. The discounted cash flow [DCF] approach very rarely lets me down when I value growth stocks. Lucid aggressively dilutes its shareholders with new share issuances. Therefore, I use cost of equity as a discount rate for my DCF. Below I have calculated it with the help of the CAPM approach and all assumptions are easily available on the internet.

Author’s calculations

While I usually rely on long-term consensus estimates for the topline, I will not do so in Lucid’s case. The reason is because Wall Street analysts expect revenue to increase by five times between 2024 and 2026, which looks overly optimistic considering Lucid’s rich history of failures and intensifying competition. I think that much more likely what Lucid can demonstrate is expanding its revenue in line with the U.S. EV industry, which is expected to compound with a 15.5% CAGR by 2032.

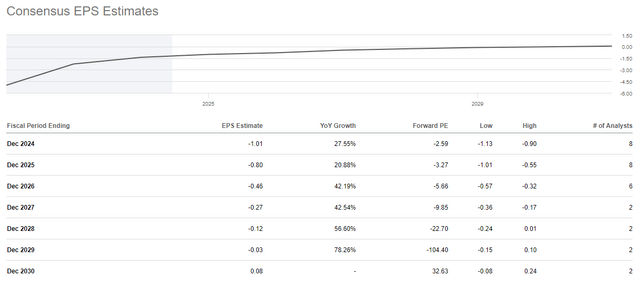

Forecasting FCF margin for a company like LCID is extremely hard, because it is still deeply unprofitable with no clear correlation between revenue growth and profitability improvements. What I want to underline is that even with an extremely aggressive revenue growth projected by consensus, Wall Street analysts expect LCID to show positive EPS only in 2030. That is, they think that LCID will not break even until it generates more than $15 billion revenue. The level of uncertainty is high, and my FCF assumption will be kind of rule of thumb, where it becomes positive in FY 2030 and will expand by two percentage points yearly.

My DCF simulation suggests that the business’s fair value is $2.27 billion. This is more than twice as low as the current market cap, meaning that LCID is still substantially overvalued.

Risks to my bearish thesis

Despite all fundamental weaknesses of Lucid, its prominent investor from Saudi Arabia still demonstrates confidence in the venture and continues injecting cash into the project. Lucid raised another billion USD from the Public Investment Fund [PIF] of Saudi Arabia in March. With billions of available cash from its oil-rich investor, Lucid might eventually roll out a sensational model which might conquer the market. However, given the company’s rich history of underperformance and intensifying competition, I consider the probability of such a scenario as extremely low.

Lucid announced a cost restructuring plan in late May, which assumes a 6% headcount cut. While the effect of this information is highly likely already priced in by the market, Lucid might go with deeper layoffs and investors might absorb this potential information with big optimism. On the other hand, cutting costs has its limits and is quite unlikely to help without sustainable revenue growth.

According to Fintel, short interest for LCID is massive at 28%. This means that there is a probability of the short squeeze and if it happens, the stock might spike. However, share price spikes powered by a short squeeze are usually not sustainable.

Bottom line

To conclude, Lucid is still a “Strong Sell”. Its financial performance improved slightly in Q1, but still was below expectations. The company’s rich history of underdelivering does not add optimism to me. Moreover, the stock is still significantly overvalued, according to my valuation analysis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.