Summary:

- Nvidia stock has been rising due to the retail investor excitement about the stock split.

- At the same time, the sales growth is expected to slow, while the valuation multiples point to the bubble.

- Further, the macro environment is deteriorating, with recession risks rising, which should negatively affect a cyclical company like Nvidia.

jetcityimage

NVDA is not a long-term buy and hold

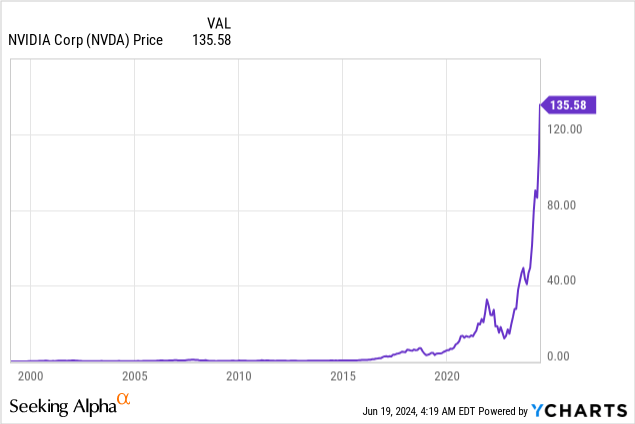

Investors who bought Nvidia (NASDAQ:NVDA) stock last year or even recently this year have significant paper gains, as NVDA is up 174% YTD, and an astonishing 3547% over the last 5 years. Nvidia is now $3.33T market cap company, the largest company by market cap in the world.

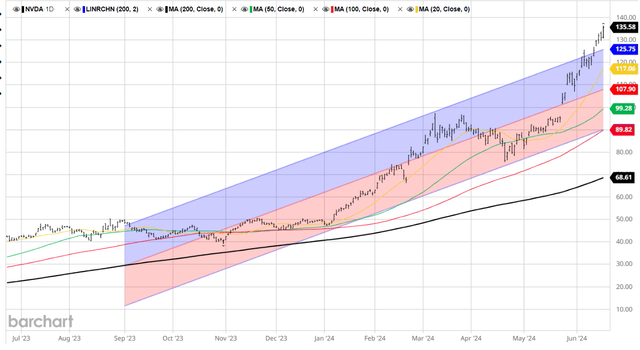

Here is the NVDA chart.

However, NVDA is not a long-term buy and hold stock at this point, as I will explain in this article, and thus the investors who currently own NVDA with hefty paper capital gains have to eventually convert these paper gains into cash – they have to sell Nvidia.

Otherwise, depending on the timing of the purchase and the average purchase price, these paper gains are likely to significantly shrink, or potentially turn into paper losses.

Specifically, as I will explain, NVDA stock is likely in a bubble based on valuations, and thus the bubble will eventually burst. It’s correct that NVDA had an amazing sales growth over the last 12 months, but NVDA sales are heavily concentrated in only two customers, the mysterious Customer A and Customer B, and this is a major risk to future sales growth if one of these customers pulls back. Most importantly, the NVDA sales growth is expected to significantly slow down, even not assuming the risk associated with the concentrated sales, and assuming that the broad economy will not enter a recession.

Thus, NVDA is currently valued as if the growth over the last 12 months will continue indefinitely, which is an irrational assumption. The economy is slowing down, slipping towards a recession, which means that the demand from Customers A and B will slow down, and the broad demand for NVDA chips will also slow down, likely producing negative YOY sales growth over the next few quarters. The semiconductor market is cyclical, and the GenAI theme will prove to be cyclical as well.

Technical considerations

First, let’s look at the technical considerations, since the bubbles are irrational by definition, dominated by the positive feedback traders or trend followers who buy strictly based on charts.

On March 8, NVDA had a sharp intraday reversal, which in-fact pointed to the potential top, and the March 8 price was the peak – until the NVDA Q1 earnings announcement and the stock split announcement, which triggered another leg higher.

The stock split does not have any fundamental significance, and yet, NVDA continued to spike higher after the stock split announcement. The retail investor was particularly excited about the stock split. In my opinion, this is the key marking of the top.

On March 11th, I wrote that NVDA was potentially topping, based on technical analysis, and assigned the HOLD rating, to evaluate the price pattern. Obviously, March 8 was not the top. The price did correct below the 50dma, but rebounded strongly after the stock split.

Technically, there is no indication that NVDA is at the top now – the price keeps climbing, as the chart below shows.

Fundamental considerations

With respect to valuation, it’s widely known that NVDA is extremely expensive.

- GAAP PE ttm is at 76

- forward GAAP PE is at 56

- PS ratio is at 40

These are very expensive valuations. Broadcom (AVGO) is the closest peer, and it similarly overvalued based on PE ratios, but significantly cheaper based on PS ratio at 19, which points that NVDA’s profit margins are unsustainably high.

In fact, NVDA has EBIT margins of around 60%, which will be difficult to maintain, as the demand for its chips slows and the competition in the sector heats up, and this points to slower earnings growth.

High valuations can be justified if sales growth is expected to continue to be very high. However, the sales growth is slowing. Here is the fact, NVDA had 18% revenue growth QoQ for FY25 Q1, where the total revenue was $26B. NVDA guides that FY25 Q2 total revenue will be $28B, which is only 7.7% QoQ growth. Thus, the revenue growth is slowing.

Thus, you have a situation where the profit margins are unsustainably high, and where the revenue growth is slowing. The combination of these two variables is negative for earnings growth.

In addition, NVDA has a very concentrated sales with only two customers representing 24% of the total revenue. Here is the warning from the recent NVDA 10Q statement:

Sales to one direct customer, Customer A, represented 13% of total revenue and sales to a second direct customer, Customer B, represented 11% of total revenue for the first quarter of fiscal year 2025, both of which were attributable to the Compute & Networking segment. There was no direct customer that represented 10% or more of total revenue for the first quarter of fiscal year 2024.

Macro considerations

None of the assumptions above assumes that the US economy could significantly slow, and potentially slip into a recession. The semiconductor industry is highly cyclical and the potential recession could have a negative effect on NVDA sales.

Based on the recent data, the US economy is slowing, and slipping towards a recession. Yet, NVDA stock keeps climbing.

Implications

Here are the facts.

- The NVDA stock is very expensive, based on the valuation multiples.

- Yet, the revenue growth rate is slowing.

- The macro environment is deteriorating, the recession risks are rising.

In this situation, where the macro risks and the firm-specific risks are rising, while the price is also rising fueled by the retail investor excitement about the stock split, it makes sense to consider converting the paper gains to cash.

Now, bear in mind that trading around the bubble is very difficult. Isaac Newton got burned trading around the South Sea Bubble. He took the profit in the South Sea stock, but the stock kept climbing, so he got back near the top. As the price kept falling, he kept buying the “dip”, yet the price kept falling. He lost most of his fortune and proclaimed:

I can calculate the motions of the heavenly bodies, but not the madness of the people.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.