Summary:

- PepsiCo’s latest earnings beat expectations, but faced headwinds in the U.S. due to inflation and product recalls.

- Dividend safety is a concern as cash flows declined, but future free cash flow growth projections remain positive, albeit slower.

- Valuation appears attractive with potential upside, but downside risks include inflationary pressures will likely continue to negatively impact their financial performance.

- Free cash flow was negative during Q1, but the most recent dividend increase shows management is confident in their ability to continue paying the dividend.

marchmeena29/iStock via Getty Images

Introduction

PepsiCo (NASDAQ:PEP) has long been one of my favorite dividend stocks. And for obvious reasons. The company has a very long history of paying growing dividends, more than a half of century to be exact. But as a result of higher interest rates, the snack behemoth has faced its fair share of headwinds. In this article I discuss their latest earnings, the dividend, headwinds, and why I am downgrading the stock to a hold.

Previous Buy Rating

I last covered Pepsi back in December of 2023 assigning a buy rating for the company as I considered the share price at the time attractive. Since then, the stock is up less than 2%, significantly underperforming the S&P who is up double-digits at roughly 26%.

I discussed their share price underperformance, which in my opinion was attributed to surging treasury rates at the time. With a historical low-yield, and fixed-income investments appearing more attractive, investors saw the snack giant as a high-risk, low reward investment.

Additionally, I touched on the company’s performance during and after the Great Financial Crisis, impressively growing its earnings and dividends over the same period.

Latest Earnings

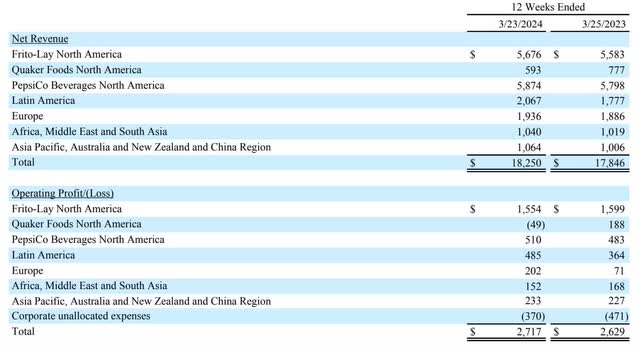

Pepsi reported their Q1 earnings back in late April, with a beat on both its top & bottom lines. Earnings per share came in at $1.61 while revenue came in at $18.25 billion, beating estimates by $0.09 and $140 million, respectively.

This was thanks to their portfolio of strong brands and pricing power, which is a double-edged sword for the company. I’ll touch more on this later. Although they managed to post a beat on both EPS and revenue during the quarter, both declined significantly from Q4. EPS was higher at $1.78 while revenue was also higher at $27.85 billion, a drop of roughly 10% and 34% respectively.

However, earnings grew more than 7% year-over-year, while revenue growth was lower at roughly 2% over the same period. Not overly impressive, but considering the challenging environment for many businesses due to tighter consumer spending, some growth is good to see.

I typically like to see the dividend growers in my portfolio show growth over time. As an investor mainly focused on income, a drop in earnings over a quarter or two is not as concerning as dropping on an annualized basis.

In the chart below, I compare Pepsi’s annual growth to their biggest peer and competitor, Coca-Cola (KO). KO over the same period grew their top & bottom lines by roughly 3% and 6% respectively on an annualized basis. Not too much of a difference between the two in terms of growth in revenue and earnings.

|

PEP |

KO |

|

| Q1’23 | ||

|

Earnings |

$1.50 |

$0.68 |

|

Revenue (In Billions) |

$17.85 |

$11 |

|

Q1’24 |

||

|

Earnings |

$1.61 |

$0.72 |

|

Revenue (In Billions) |

$18.25 |

$11.3 |

U.S. Consumer Headwinds

Pepsi has faced a slew of headwinds over the past year. From higher interest rates to consumers complaining of higher prices on their products for starters. Although earnings & revenue increased year-over-year, some of their segments in North America have not shown quite the same growth, declining over the same time frame.

Operating profits in Frito-Lay North America declined from $1.599 billion to $1.544 billion as inflationary pressures weighed on consumers, as well as product recalls. Net revenue in the segment also declined year-over-year as you can see from the chart as a result of those products recalls and soft category growth. However, net revenues in other countries, particularly in Latin America, showed solid growth year-over-year.

This was driven by tighter consumer financials here in the U.S. Inflation continues to be a huge problem; something that has been the topic of discussion for quite some time now. While interest rates were recently lowered in Europe and Canada, the FED has elected to keep interest rates steady to continue its fight.

Furthermore, Pepsi’s products were also pulled from shelves in France due to the significant price hikes on some of their products. However, recently, the French carrier has resumed carrying the snack giant’s products after months of going back and forth.

Dividend Safety Headwinds

Another headwind that has plagued the company in my opinion, although few have mentioned it, is the company’s cash flows. After their recent earnings back in April, Pepsi conducted another dividend raise, adding to its long streak of dividend increases.

They raised the dividend by a respectable amount from $1.265 to the current $1.355, more than a 7% increase. And while this dividend increase is nice, especially for shareholders, this has put more pressure on the company’s ability to sustain their dividend.

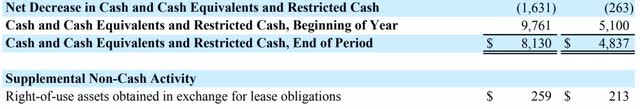

During the quarter, Pepsi’s free cash flow was negative. For context, their cash from operations was also negative during the first quarter of 2023, but the company continued to cover its dividend throughout the year, bringing in free cash flow of $8.1 billion while paying nearly $6.7 billion in dividends. For Q1’24, Pepsi paid $1.767 billion in dividends and management expects to pay $7.2 billion in dividends this year. Digging into the company’s financials, dividends were likely paid from cash on their balance sheet.

Cash & cash equivalents declined from nearly $9.8 billion to roughly $8.1 billion. It is normal for companies to cover the dividend for a temporary period from cash on their balance sheet. But as a dividend investor, this is something I prefer not to see, and would rather see it covered from free cash flow.

I also don’t give too much attention to a company’s earnings payout ratio, as dividends are mostly paid from free cash flow. Companies can experience negative cash flows for multiple reasons like large impairment charges or increased capital spending to grow the business.

But again, this is something that should only be temporary and not for a sustained period of time. I become skeptical seeing companies cover their dividends from anything other than free cash flow for more than 2 or 3 quarters.

Future FCF Growth

Despite the negative free cash flow during the first quarter, I do expect PEP to be able to cover its dividend over the full-year. Same as they did in the prior year. Although, this is something investors should keep a close eye on going forward. But, the 7.1% increase shows the company is very confident in its ability due to its strong brand and portfolio of products.

Doing some math and using data from Pepsi’s historical cash flow growth, I use this to project their future cash flows over the next few years. Below is the free cash flow the company brought in over the past 5 years. This grew from nearly $5.6 billion to $8.1 billion, a growth rate of roughly 45%. Their dividend has grown at a rate of roughly 46% from $0.9275 to $1.355 currently. So, although close, free cash flow growth has not kept up with their dividend growth.

Author creation via Pepsi 10-k

On an annual basis, this comes to about 5% growth in free cash flow and dividend growth per year. Taking into account Pepsi’s size and the macro environment, I think the company can still achieve a growth rate of at least 3% as a result of their strong branding and long operating history.

If free cash flow grows at a 3% rate for the next 5 years, this puts the free cash flow at roughly $9.4 billion in 2029. This also means that dividend growth will likely slow going forward. And looking at their dividend estimates over the next 3 years, analysts’ anticipate lower dividend growth of less than 3.5% moving forward. But Pepsi is a large brand that has the ability to make accretive acquisitions to continue growth. And I anticipate dividend growth to continue, albeit slower for the foreseeable future.

Valuation

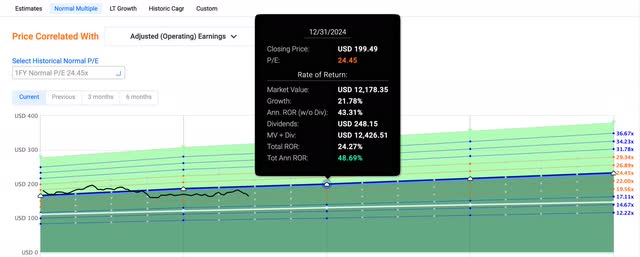

Using the earnings guidance of $8.15, this gives Pepsi a forward P/E of 20.3x. The stock is down from roughly $186 a year ago. So, it appears the valuation is attractive at the moment. Using their 1-year normal P/E of 24.45x, this gives investors some decent upside to their price target of roughly $200 a share.

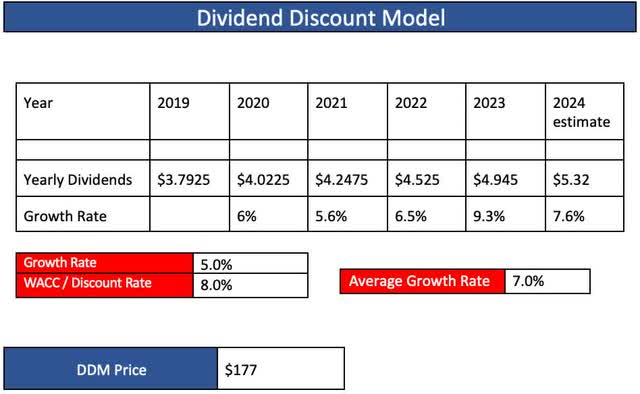

Using the Dividend Discount Model, I have a price target of $177, nearly 7% upside from the current price of $166. I decided to be a bit more conservative with a growth rate of 5% due to inflationary pressures. Additionally, I use a WACC of 8%, the lower end of the 7% – 10% the S&P has historically returned. As many know, Pepsi has trailed the index over the past decade in terms of price and total returns.

Downside Risks

Although their share price is down over the past year and trailed the S&P by a sizable margin, the snack giant faces further downside risks. With inflationary pressures continuing to affect consumers, at least for the short to medium term, their North American segment will likely continue to face headwinds. This could also impact their financials going forward, causing the stock to miss on their 2024 earnings estimates, or their upcoming quarter. If so, the stock could see a further share price decline as investors remain wary of the company’s future moving forward.

Conclusion

Pepsi is a favorite amongst dividend investors due to their strong pricing power and solid dividend growth. But as the company continues to face headwinds from inflationary pressures, the share price will likely continue to experience volatility in the coming months. Furthermore, their free cash flow is another headwind as their operating cash flow was negative during the quarter, likely another contributing factor to their underperformance.

I’m confident Pepsi can continue to cover its dividend in the foreseeable future with free cash flow, similarly to 2023. And although the stock does offer some decent upside. As a result of their dividend coverage and tighter consumer financials affecting their segments, I currently am downgrading the stock to a hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.