Summary:

- I previously warned about the possibility of Tesla, Inc. stock falling to re-test the $150 support level.

- Tesla stock fell toward the $140 zone but bottomed soon after. Is the decline over?

- Shareholders reapproved CEO Elon Musk’s 2018 compensation package, but legal challenges remain.

- Investors should be cautious about Tesla’s hype surrounding Robotaxi Day, given Tesla’s growth premium.

- I argue why cracks are building up underneath the surface, suggesting Tesla investors must brace for more pain.

Apu Gomes/Getty Images News

My Tesla Stock Caution Panned Out

I cautioned Tesla, Inc. (NASDAQ:TSLA) investors about adding ahead of TSLA’s Q1 earnings release, as it seemed increasingly likely to re-test its $150 support zone. My caution on TSLA panned out, as it fell toward the $140 zone before bottoming. However, Tesla buyers appeared to have shaken off its relatively weak Q1 performance. In addition, CEO Elon Musk won a crucial confidence vote as shareholders voted overwhelmingly in favor of reapproving Musk’s 2018 compensation package. As a result, I assess that the opportunity for me to provide an update for TSLA investors is timely.

Tesla investors should note that TSLA stock is still down more than 30% over the past year, significantly underperforming the S&P 500 (SP500, SPX, SPY). Therefore, the market has continued to take out new all-time highs, while TSLA buyers haven’t returned aggressively to lift TSLA’s expensive valuation multiples.

Elon Musk’s Pay Is Approved, But Challenges Not Over

Moreover, investors must note that the recent shareholder approval hasn’t reinstated the judge’s decision to invalidate Musk’s 2018 pay package. As a result, investors must continue monitoring the legal developments as Tesla looks to potentially appeal the court’s decision. Despite that, it should assure investors that Musk’s focus should remain on Tesla. Musk emphasized that he “can’t cut and run, nor would [he] want to,” as Musk is required to “hold on to his stock options for five years.”

It’s arguable that TSLA’s long-term valuation is predicated on Elon Musk’s ability to build on Tesla’s breathtaking success. However, the EV market has become increasingly crowded as automakers vie for market share while navigating challenging macroeconomic conditions. Even Tesla wasn’t spared, as the leading EV maker reported negative free cash flow in Q1.

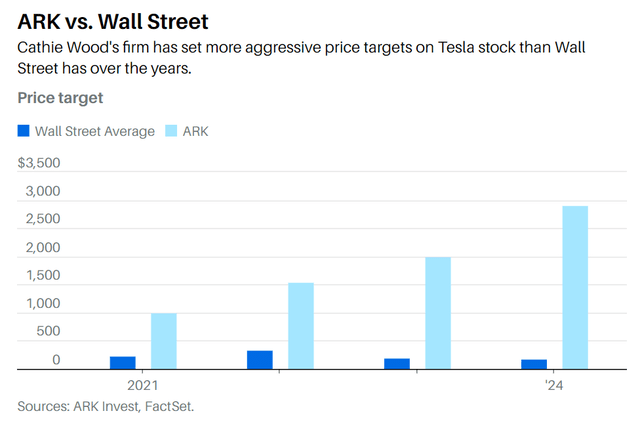

I believe Tesla investors understand that the market is placing a huge emphasis on Musk to deliver Tesla’s autonomous driving ambitions. Based on Ark Invest’s 2029 base case target price of $2,600 on Tesla, “nearly 90% of Tesla’s enterprise value and earnings by 2029 are expected to come from the robotaxi business.” Musk has also attempted to hype Tesla’s growth opportunities in Robotaxi and Optimus robots as Tesla’s EV growth slowed. As a result, investors are likely still assessing whether Musk could lift TSLA’s re-rating potential at its upcoming Robotaxi Day on August 8.

Wedbush’s Dan Ives underscores the pivotal event as a “key historical moment” for Elon Musk and his team. However, investors are urged not to throw caution to the wind, as Tesla hasn’t looked closer to solving TSLA’s vision-only FSD autonomous driving technology. As a reminder, Tesla believes that its vision-only approach is superior and provides “the lowest cost and most scalable way forward.”

Tesla Investors Are Banking On Robotaxi Hype

Notwithstanding Tesla’s optimism, a recent March ranking by The Insurance Institute for Highway Safety rates Tesla’s ADAS system poorly. Only Lexus of Toyota Motor Corporation (TM) ADAS was given an “acceptable” grade, while General Motors Company (GM) and Nissan Motor Co., Ltd. (OTCPK:NSANY) received “marginal” grades for their systems. 11 others (including Tesla) received “poor” ratings. Therefore, the study highlights the inadequacy of the current platforms in solving the complexities of real-world autonomous driving. IIHS didn’t mince its words as the independent group articulated: “These results are worrying, considering how quickly vehicles with these partial automation systems are hitting our roadways.”

Ark Invest Vs. Wall Street price target for TSLA (Barron’s )

Consequently, I urge investors to be cautious about buying into the hype that Musk and Ark are trying to drum up as we draw closer to Tesla’s Robotaxi Day. Musk is smart enough to know that TSLA needs investors to stay on board with him as Tesla navigates immense challenges to solve and achieve Ark’s 2029 base case thesis on TSLA. However, investors should note the increasing bifurcation in TSLA price targets between Ark Invest and Wall Street. Investors must also assess Tesla’s ability to achieve growth inflection from 2025 as it’s pivotal to recover TSLA’s bullish momentum.

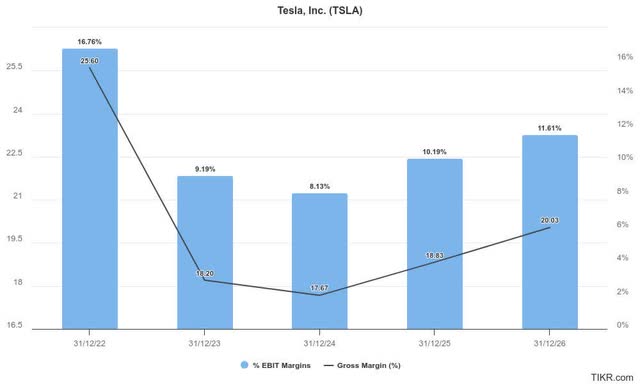

Tesla margins estimates % (TIKR)

As seen above, Tesla’s profitability margins are expected to bottom in 2024. Therefore, Wall Street has likely priced in a more robust recovery from 2025. Despite that, Tesla’s estimates have been downgraded, underscoring the challenges bedeviling Tesla and its EV peers. Given the outperformance of GM stock over TSLA in 2024, the market has likely reallocated to the legacy OEMs, given their more well-diversified lineup across ICE, hybrid, and pure-play EVs.

BloombergNEF downgraded its EV growth estimates through 2026, suggesting the challenges are expected to persist. Coupled with the uncertainties surrounding Tesla’s $25K EV program, I assess that a substantial valuation re-rating thesis in TSLA stock could be too aggressive.

TSLA is valued at a forward adjusted PEG ratio of 6.6, well above its sector median of 1.51. Therefore, Tesla investors must be willing to bet on Elon Musk’s ability to realize its autonomous driving and Robotaxi ambitions. However, even Berkshire Hathaway Inc.’s (BRK.A, BRK.B) Ajit Jain thinks Tesla investors could be too optimistic. He highlighted that “Tesla has yet to be successful with this automation effort.” However, have dip-buyers been willing to buy TSLA’s steep pullbacks, paving the way for momentum buyers to return more confidently?

Is TSLA Stock A Buy, Sell, Or Hold?

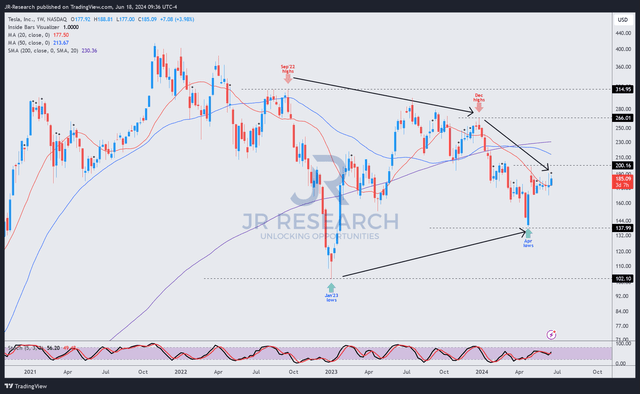

TSLA price chart (weekly, medium-term) (TradingView)

TSLA’s price chart is showing mixed signals. A closer inspection suggests a downtrend signal seems to be building up. However, TSLA dip-buyers held its recent bottom above the pivotal $150 zone, making a higher low against January 2023’s lows.

However, I must highlight that TSLA has already slid into a downtrend, indicating increasingly bearish momentum. Short sellers looking to turn bearish on TSLA are reminded to be wary, as Musk could drive more investor hype heading into its upcoming Robotaxi Day.

Bullish Tesla, Inc. investors must be cautious about expecting a significant valuation re-rating from the current levels, given the persistent headwinds faced by the EV industry. Therefore, I find it increasingly challenging to expect TSLA to outperform within the next 12 to 18 months.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!