Summary:

- Algonquin is in the midst of a transformation for the better.

- It has fallen from grace and sports a 7.5% yield and discounted valuations vs peers.

- We examine its outlook to see if buying now is worthwhile.

James O’Neil

Co-authored by Treading Softly

There are points in our lives when we hit an inflection point. At that point, we need to take a moment to take stock of all that has happened before and what is going on right now so we can decide what we think is the best next step to achieve our goals.

For many companies, inflection points can occur when prior plans have failed, and shareholders or investors are losing confidence in the plan the management team has laid out. This can lead to a drop in share value. Failed strategies often lead to activist investors making moves to try to pressure the company to do what they think is best for its future. Often, the old management is fired, and the company goes in a new direction.

One great example of this would have to be Algonquin Power & Utilities Corp. (NYSE:AQN), yielding 7.3%. Their plan to take over Kentucky power from American Electric Power (AEP) failed dramatically. Not only did they take out a large amount of debt at a time when interest rates were extremely high, but they were unable to get the regulatory approvals to complete the deal, and the assets they were buying turned out to be of lower quality than expected. This led AQN to carry a large amount of debt at a poor time, resulting in a common dividend cut. Now that their convertible notes have become common shares, what are the future plans for AQN? Is there an activist investor who is taking an active role in trying to guide the future of the company?

Today, let’s look at both the activist’s plan and our outlook.

Let’s dive in!

The Activist Plan

Starboard Value LP has bought 58.4 million shares of AQN, representing just under 8.5% of the company. Starboard has a history of being a very successful activist investor.

Starboard bought a significant stake in AQN and published this letter. In it, Starboard argues:

“As we have discussed, we believe Algonquin’s Regulated Services Group is a top tier regulated utility that is currently valued at a substantial implied discount to peers pro forma for a potential sale of all or a substantial majority of the Company’s unregulated renewables assets.”

Also noting that AQN has become “uninvestable” for many traditional utility investors:

“Algonquin’s valuation has been hampered by a number of factors, most notably excessive leverage and a high dividend payout ratio. Algonquin’s high payout ratio, its recent dividend cut, its high proportion of unregulated assets, and scars from the recently-abandoned Kentucky Power deal have all combined to make Algonquin uninvestable for a large portion of traditional utility investors.”

The solution that Starboard proposes is straightforward – sell off the renewables business, including its 42% stake in the publicly traded Atlantica Sustainable Infrastructure (AY). Then, use the proceeds from those sales to reduce leverage below 5.0x debt/EBITDA and buy back equity to improve earnings per share so that AQN has a lower payout ratio, a more secure dividend, and prospects for dividend growth in the future.

In Starboard’s opinion, AQN has a “hidden gem” in its water business, which should cause AQN to trade at a premium to peers:

“While the immediate priority is untangling the Company’s unregulated renewables business in a manner that creates substantial value for shareholders, a close second is ensuring that shareholders can realize the potential of Algonquin’s extremely valuable Water Utility. Pro forma for a renewables sale, approximately 20% of Algonquin’s asset base will be from its Water Utility, making it one of the only companies in its peer group with any water reclamation and distribution exposure. Water utilities generally trade at massive premiums to Electric/Gas utilities. As such, we would expect Algonquin, with its Water Utility, to trade at a premium to other regulated utilities.”

The letter then goes on to propose that if AQN does not trade at a premium to peers, it could also consider selling the water business to improve its balance sheet and buy back even more shares.

AQN’s Current Outlook

We like AQN’s outlook for the following reasons vs peers:

- We are bullish on utilities. With the risk of recession looming and the likelihood that interest rates are more likely to come down than go up, the utility sector could become very desirable.

- AQN has the highest yield of any other regulated utility. We view the current dividend as sustainable, with good potential for future growth in 2026 and beyond. Our current utility exposure is primarily through funds because the yields in the sector aren’t high enough to meet our income goals. AQN stands alone in the sector with a yield worth entertaining.

- AQN’s plan is a good one and should simplify the investment while reducing risk. This creates potential for substantial price upside, even if AQN can only achieve an average valuation.

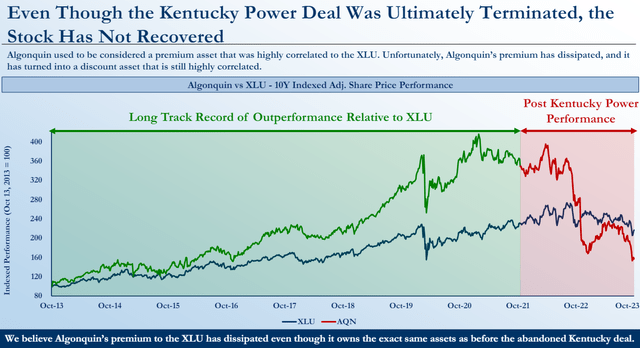

AQN has a history of trading at a significant premium to peers, but today, it is trading at a significant discount. Starboard blames the failed Kentucky Power deal, which faced significant regulatory resistance. The economics became extremely unfavorable as interest rates rose and AQN was using floating-rate debt to fund it.

The deal was terminated, but the damage to AQN’s share price has remained. Source

Starboard AQN Presentation

The main cause of the continued discount is a loss of confidence in management and the dividend cut. Investors often turn to utilities for safety and security, so a dividend cut undermines that sense of safety.

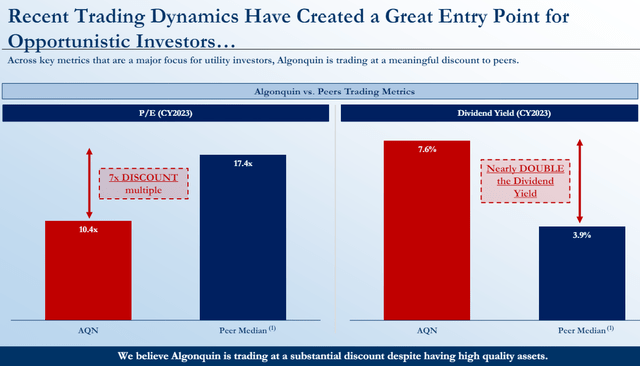

Starboard’s plan is to simplify AQN. It sees AQN as two distinct businesses – a regulated utilities business and an unregulated utilities business, which is primarily renewable energy. By stripping AQN down to its regulated business, Starboard believes it will be able to trade closer to peers and possibly even back to trading at a premium to peers.

Starboard AQN Presentation

Returning to the peer median would put the share price around $11-$12.

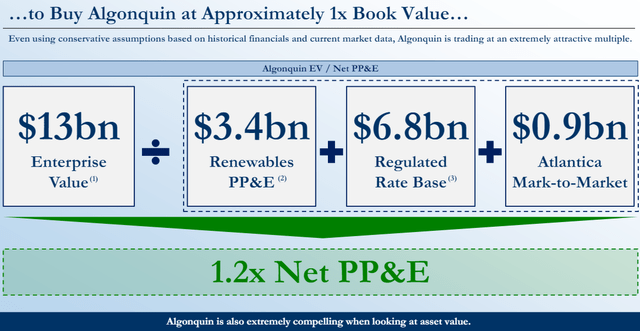

Here is how Starboard is looking at the value of the pieces of AQN:

Starboard AQN Presentation

With the news of the Atlantica sale, we now know that AQN will be receiving $1.077 billion, more than the $0.9 billion that Starboard assumed. The greatest impact from this sale is improving AQN’s leverage. However, it should be noted that AQN still has substantial renewable assets apart from its investment in AY. The market didn’t respond strongly to the news of AY, likely because the sale was widely expected and the amount of the sale was already built into AY’s share price. Speculators actually got burned as the amount of the sale is less than the share price immediately before the announcement.

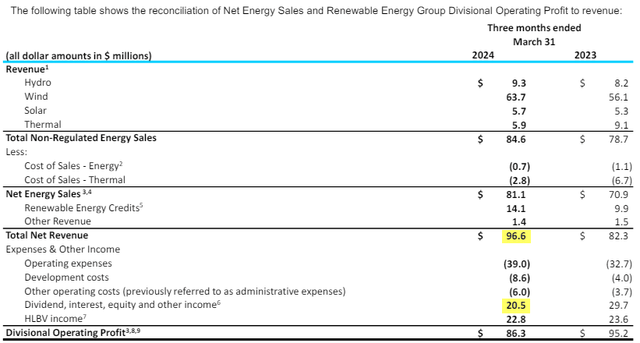

From the market’s perspective, the sale of the rest of AQN’s renewable business is less certain. Here is AQN’s reconciliation of operating profits from its renewable segment. The dividend from AY is included on the “Dividend, interest, equity, and other income” line. Source

AQN Q1 2024 Presentation

They are getting a little over $1 billion in exchange for that income. What AQN will get for the rest is still up in the air. We expect more announcements regarding these assets in the coming months.

Conclusion

With AQN, we can collect a stable 7.5% yield now, while they continue to work on their plans for the future and see success on that mission. Utilities, as a whole, is a sector that provides strong and stable income and has a good outlook as we continue to move forward. However, AQN is a rarity amongst them in that it is trading at a wider discount compared to its peers and compared to how it has historically traded when it was on a growth path. I often find that companies perform better when they focus on their core mission and don’t get distracted by secondary endeavors. So, I’m thrilled to see that AQN is refocusing on its core mission of being a regulated utility that is able to provide steady income and growth without having to pile on high levels of debt.

When it comes to retirement, a steady and stable income is always the best. However, that income should not come at the expense of a livable yield that is beating inflation and can sustain your day-to-day needs. You can receive a very stable and steady income from a Treasury note, but it will not provide you with the income that you need long-term because it’s not a livable yield. At the end of the day, the thing that most retirees enjoy the least is having to manage their checkbook or feeling like their checkbook is managing them. Use the market to unlock the income you need so you can enjoy your retirement without financial stress.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AQN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Price Increase Is Coming

Soon High Dividend Opportunities annual fee is going to rise. You can beat that increase by subscribing today. All current members will be grandfathered into our $549.99 annual membership price.

Move quickly to lock in today’s rate. Waiting would mean paying more for our valuable research when you don’t have to! Pay $549.99 this year to lock in the on-going rate forever.

Move quickly to lock in today’s rate. Waiting would mean paying more for our valuable research when you don’t have to! Pay $549.99 this year to lock in the on-going rate forever.

We’re offering a limited-time 28% discount on our annual price of $549.99 via this link only: