Summary:

- Cisco Systems stock peaked at $64 in 2021, now trading around $45, potentially undervalued.

- Earnings estimates show growth potential, trading at low multiples, strong balance sheet, and dividend yield of 3.5%.

- Investments in AI, humanoid robots, and connected devices could drive future growth, similar to Microsoft’s past trajectory.

jejim

My last article on Cisco Systems (NASDAQ:CSCO) (NEOE:CSCO:CA) was bullish and published back in December 2013, when it was trading for about $20. Since then, Cisco Systems shares peaked out at around $64 in 2021. But now, the stock is back down to around $45, so I decided to take a closer look at the potential opportunities this company might have going forward, especially with AI and humanoid robots. I think the market is underestimating the potential that Cisco Systems has going forward, much like it did with Microsoft (MSFT) a few years ago. We have seen so many tech stocks fall out of favor, only to become resurgent, popular with investors, and highly valued again. I think Cisco Systems could be a prime candidate to be revalued at much higher levels in the future, so let’s take a closer look:

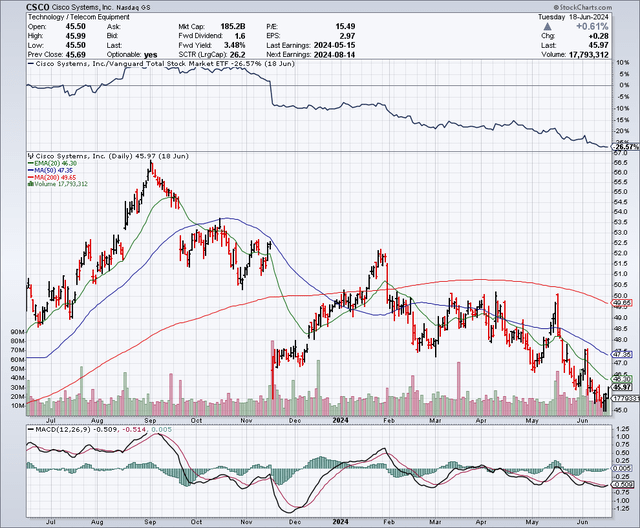

The Chart

As the chart below shows, this stock topped out at around $57 per share in September 2023, and it has since been in a general downtrend and now trades for about $45 per share. The 50-day moving average is $47.35 and the 200-day moving average is $49.65. Last November, the stock bottomed out at around $46, and it is close to this level now, so it may have bottomed out again.

StockCharts.com

Earnings Estimates And The Balance Sheet

Analysts expect Cisco Systems to earn $3.70 per share in 2024, $3.55 per share in 2025 and $3.83 per share in 2026. With earnings dipping slightly in 2025, I can see why some investors are not excited right now, especially when they see other tech companies reporting significant growth year after year. However, earnings are expected to grow by nearly 8% in 2026 and could continue to grow at that level beyond 2026, thanks to new opportunities in AI, humanoid robotics and more connected devices. Furthermore, these estimates show that this stock is trading for just around 12 times estimates for 2024 and less than 12 times estimates for 2026. That appears significantly undervalued to me, especially if Cisco Systems is able to grow earnings by about 8% annually in 2026, and beyond. The market is trading for well over 20 times earnings today, so for me, Cisco Systems appears very attractive at nearly half the multiple of the stock market.

Another reason why I feel Cisco Systems deserves a higher multiple is because it has an extremely strong balance sheet with about $33.21 billion in debt and $19.52 billion in cash. This is the balance sheet strength I like to see because it gives the company so many options to raise the R&D budget, or increase the dividend, or perhaps make a strategic acquisition. A strong balance sheet also reduces risks for investors.

The Dividend And Share Buybacks

Cisco Systems offers a quarterly dividend of $0.40 per share, which totals $1.60 per share on an annual basis. This provides a yield of about 3.5%. On May 15, 2024, the company declared that the quarterly dividend will be paid on July 24, 2024, to shareholders of record as of July 5, 2024. The dividend has more than doubled from $0.17 per share each quarter, to the current quarterly rate of $0.40 per share. The dividend has been increased every year for the past 12 years. Another positive is that the payout ratio is only 39%, which leaves plenty of room for more increases and suggests the dividend payment is very secure.

On June 12, 2024, the Federal Reserve released its latest forecasts which suggest the Fed Funds rate could drop from about 5% currently, to just around 3% in 2026. With Cisco Systems now yielding 3.5%, and money market rates yielding about 5%, it makes dividend stocks less attractive to some investors. However, money market yields are likely to follow the expected decline in the Fed Funds rate and might only yield around 3% in 2026. So, if we go forward a year or two and live in a world with 3% money market yields, it makes sense to lock in Cisco System’s 3.5% yield today, as this could set investors up with capital gains going forward from a changing interest rate environment.

As for share buybacks, in the second quarter of 2024, the company repurchased about 25 million shares at an average price of $49.54 per share, which totaled about $1.3 billion. There is still $8.4 billion remaining authorized under the current share buyback program.

Cisco System’s Restructuring Plan

In the past year or so, many tech companies have announced job cuts even though these companies are thriving, and in February 2024, Cisco Systems announced it would cut about 5% of its workforce, or roughly 4,250 jobs. The company estimates that these cuts will result in about $800 million in charges which will be expensed between now and through the first half of fiscal 2025. These charges are impacting profits in a negative way between now and 2025, but long term this appears to be a positive and a growth driver for earnings after 2025.

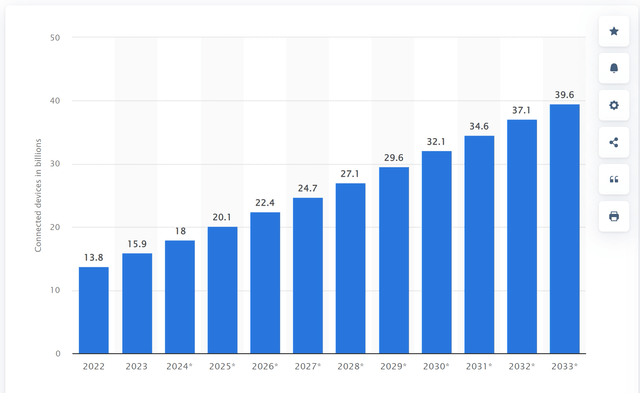

Major Growth In Connected Devices Will Benefit Cisco Systems In the Coming Years

As shown in the chart below, the number of connected devices is estimated to be around 18 billion in 2024. It also shows that between now and 2033, the number of connected devices is expected to more than double to nearly 40 billion connected devices. This growth will likely be fueled by a number of factors, including population growth, rising incomes in emerging market countries, as well as AI and humanoid robots. All of this should be beneficial for Cisco Systems going forward and act as a major tailwind for its networking equipment and cybersecurity offerings thanks to the acquisition of Splunk.

Statista

AI And Humanoid Robots Are Major Potential Growth Drivers

At the current valuation, the market seems to be underestimating the potential this company has when it comes to demand from AI networking. Many new AI data centers are expected to be built in the coming years, which should result in significant demand for networking products. In early June, Cisco Systems announced it was investing $200 million in a number of high-potential AI start-up companies. It also has announced a partnership with NVIDIA (NVDA) to build “Cisco Nexus Hyperfabric AI Clusters”.

Another leg of growth could come in the next couple of years when AI likely converges with hardware, which will result in what could be the start of mass adoption when it comes to humanoid robots. These humanoid robots could revolutionize the way we live, and they will need to be connected to the Internet in order to perform basic as well as more complicated tasks.

Comparisons To Microsoft

It was not that long ago when Microsoft was considered by many tech stock investors as being a boring “has been” company. Microsoft traded for about 12 times earnings and in the $40 range in 2016, just as Cisco Systems does now. But things have changed for Microsoft because earnings and revenue growth began to accelerate, and this created a situation whereby the valuation of the stock surged thanks to PE multiple expansion. As shown in the case with Microsoft and many other tech stocks, the combination of earnings growth, along with PE multiple expansion, can take a stock to significantly higher levels. Microsoft no longer trades for 12 times earnings because today, the current price to earnings multiple is around 38, or more than triple what it was just about 8 years ago, back in 2016.

I believe Cisco Systems could be poised to deliver the powerful combination of increased earnings growth, which would therefore drive PE multiple expansion. While I don’t expect it to deliver as large of a multiple expansion that Microsoft experienced, I do still think it will potentially provide significant upside for shareholders who buy the stock now, especially while it is still trading for nearly half the PE multiple of the stock market in general.

Potential Downside Risks

A recession would likely slow down corporate IT spending, and this could impact Cisco Systems. Even though this company is a leader when it comes to networking equipment, there are other competitors which could take market share and therefore present a downside risk. Cisco Systems shares have underperformed many other tech companies in the past few years, and this might continue to be the case, which results in an opportunity cost for investors to consider. I feel as if Nvidia is sucking all the oxygen out of the room when it comes to the tech sector, and this could also continue and lead to more money chasing high-tech momentum stocks, while leaving low PE ratio and slower growing companies to languish in terms of investment results.

In Summary

While I don’t expect Cisco Systems to follow the exact same trajectory as Microsoft in terms of PE multiple expansion and upside in the share price, I do think there are some major similarities and I also view Cisco Systems as being very underappreciated at current levels, just as Microsoft was about 8 years ago. Cisco Systems has so much to offer: a 3.5% yield that has been growing annually for many years, a rock solid balance sheet, a cost-cutting plan that can boost earnings in the coming years, plus AI and humanoid robots will be future growth drivers as the number of connected devices more than doubles in the next several years.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.