Summary:

- The Aerospace & defense industry offers long-term gains with anti-cyclical demand, defense innovation, and commercial aerospace tailwinds.

- The space technology market expected to double by 2033, with Rocket Lab positioned as a key player in the emerging industry.

- Rocket Lab reported record revenues, successful missions, backlog, and profitability improvements in Q1 2024 earnings. It is also in a great spot to maintain elevated growth in the years ahead.

da-kuk

Introduction

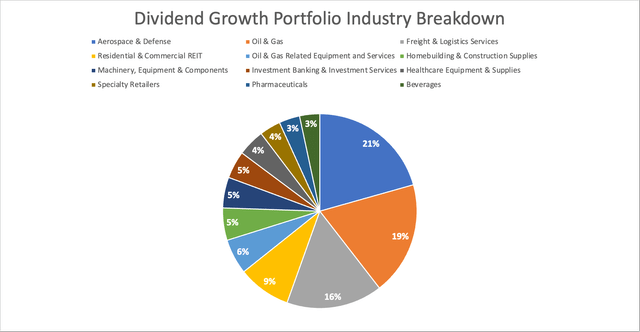

If there’s one industry we discuss a lot, it’s aerospace & defense, which has a weighting of slightly more than 20% in my dividend growth portfolio.

Since the pandemic, I have accumulated shares in four major defense contractors, as I expect the mix of anti-cyclical demand, the need for defense innovation, and commercial aerospace tailwinds to make it the perfect industry for long-term gains with a terrific risk/reward profile.

Leo Nelissen – Dividend Growth Portfolio

Right now, most of these companies enjoy tailwinds from both elevated global defense needs and the post-pandemic recovery in commercial aerospace.

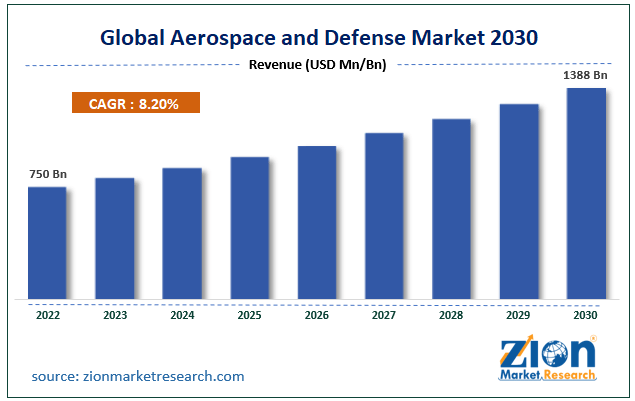

According to Zion Market Research, the global A&D market is expected to reach $1.4 trillion in 2030, which implies an 8.2% CAGR from $750 billion in 2022.

Zion Market Research

As favorable as this may be, one area stands out in particular. That area is space.

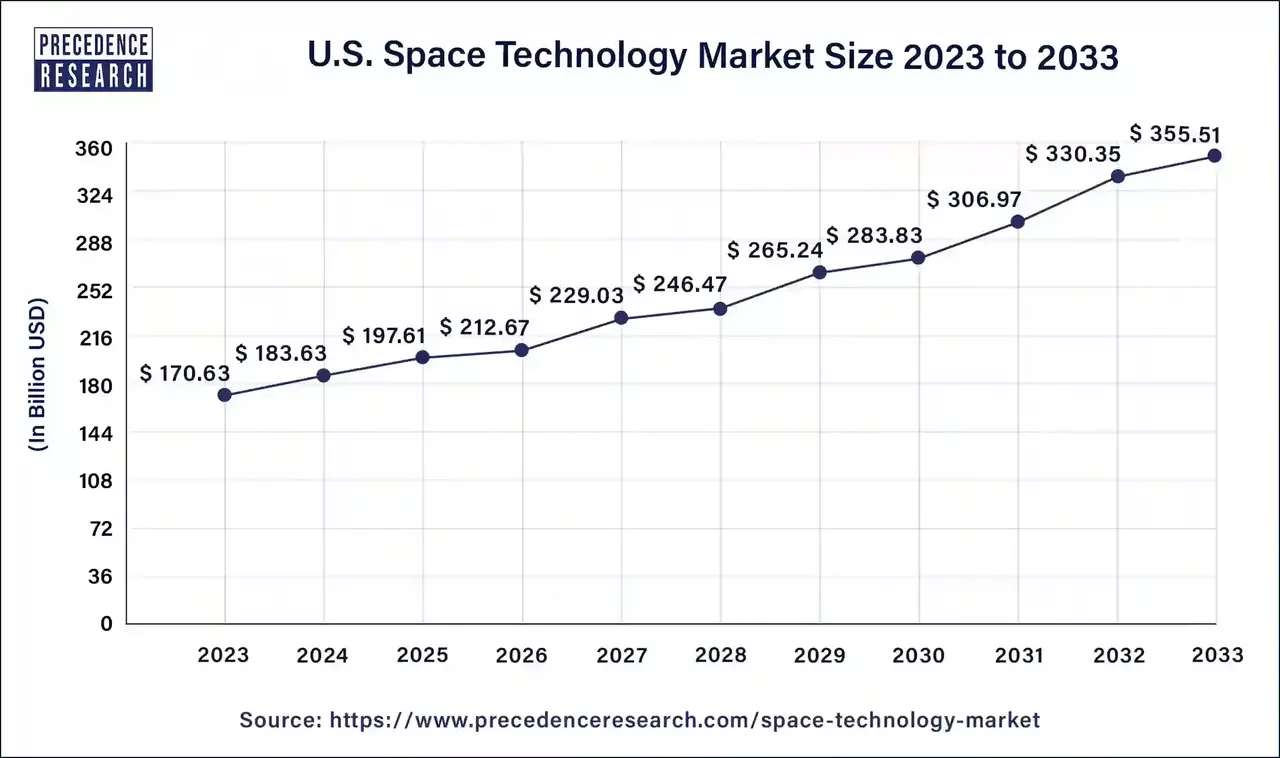

Space has become the place to be, as Precedence Research expects the space technology market to more than double through 2033.

Depending on who you ask and which variables are included, some estimates are even more bullish. I added emphasis to the quote below.

The space market, for example, has grown to approximately $447 billion—up from $280 billion in 2010—and could grow to $1 trillion by 2030. The number of active satellites—which can handle tasks ranging from tracking data on climate change to processing credit card transactions—could triple within the next decade. – McKinsey & Company

Lockheed Martin (LMT), which is my biggest defense holding, also commented on this during its Q1 2024 earnings call when it revealed a book-to-bill ratio of 1.8x in this segment, indicating that for every $1.00 in finished work, it gets $1.80 in new orders.

Notably, space booked several large national security orders in the quarter, including SDA tracking layer and other significant classified awards, contributing to a book-to-bill ratio of 1.8 and record backlog of $33 billion at space. – LMT Q1 2024 Earnings Call

This brings me to the star of this article, Rocket Lab USA (NASDAQ:RKLB), a company I have never discussed before.

The company is a pure-play space stock, which makes it interesting for investors who only seek exposure to this emerging industry.

So, without further ado, let’s get to it!

What’s Rocket Lab?

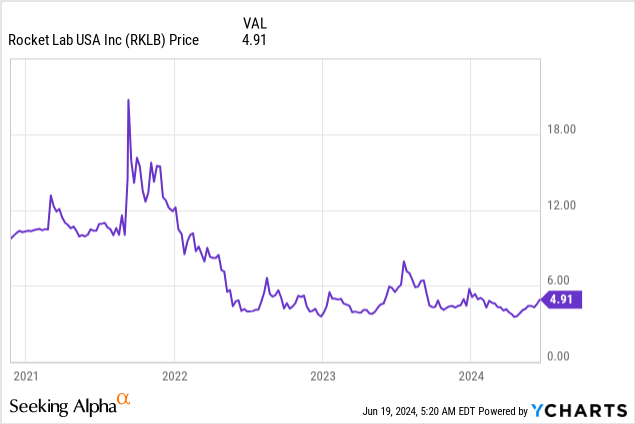

Initially, I knew about the company since 2021, when it was the result of a SPAC merger. SPAC stands for special purpose acquisition company.

Essentially, it’s a shell company that raises money to take over a private company. That way, a company can go public without an IPO.

After the pandemic, SPAC deals were very popular as money was cheap, and people’s willingness to take risks was off the charts.

Going back to Rocket Lab, the company with a current market cap of $2.4 billion was bought by Vector Acquisition Corporation, allowing the company to streamline its corporate structure and increase market access.

Luckily, back then, I stayed far away from the company, as it is now trading below $5, roughly half of where it traded after the SPAC deal – and a mile below its all-time high.

With that said, I believe Rocket Lab is one of the few SPAC deals that turned into a high-quality company.

While it may have been overhyped back then, I don’t think Rocket Lab is a meme stock or a get-rich-quick scheme from people who were looking to get rich in 2021.

Rocket Lab is a very serious company, as it offers a wide range of services and products, including reliable launch services, spacecraft design, manufacturing, and on-orbit management.

Essentially, the company wants to become a platform for space innovation and exploration, as it aims to provide frequent and cost-effective launch services using its Electron rocket, which is a fully carbon-composite launch vehicle powered by 3D-printed Rutherford engines.

Among its launch customers are NASA, the United States Space Force, and DARPA, three of the most desired customers in the industry, who all have a special interest when it comes to improving access to space.

The company has multiple launch complexes in Mahia, New Zealand, and the Wallops Flight Facility in Virginia, which support high-frequency launches (up to 132 missions per year).

For its missions, the company uses its Electron rocket, which is made for frequent and reliable launches.

The company is also working on Neutron, a rocket that will cater to larger payloads (up to 15 tons) with a more diverse range of potential missions, including human spaceflight.

In general, the company believes it has five strengths that set it apart in its industry and allow it to grow over time:

- First Mover Advantage: Electron’s track record of 38 successful missions (as of FY2023) is a great example of Rocket Lab’s reliability and maturity in the small launch market, which is key for winning new customers.

- Innovation: Rocket Lab’s use of carbon composites, electric turbo-pump engines, and 3D printing significantly improves its performance and reduces production timelines. It also focuses on re-using equipment to reduce costs.

- Deep Vertical Integration: Because the company has a lot of in-house capabilities, the company can control design, manufacturing, and launch processes. This makes it less prone to suppliers and external shocks (better reliability).

- Multiple Launch Complexes: Just like its in-house supply chain, its launch complexes provide reliability.

- Complete End-to-End Space Solutions: Because of its diverse capabilities, the company has become a one-stop shop for space missions.

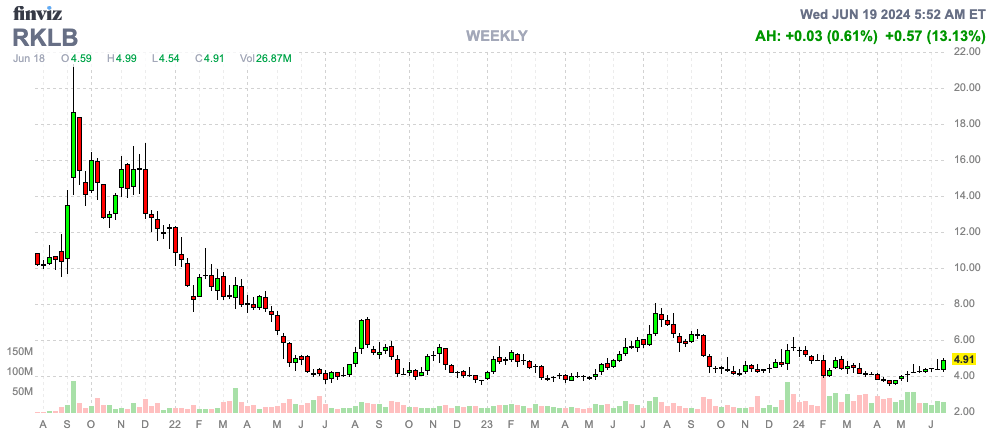

So far, this is working, as the company just got a major deal for the launch of ten Electron launches from Japanese radar imaging company Synspective.

This deal propelled the company’s stock price by 13% on June 18.

FINVIZ

This brings me to the next part of this article.

How’s Rocket Lab Doing?

Whenever we’re dealing with young companies in emerging industries, a major risk is buying a money-losing company that may never get the big breakthrough it was hoping for.

As I’m a conservative dividend growth investor, I’m extremely careful when it comes to finding emerging opportunities.

The good news is that the company is growing rapidly, suggesting its business plan is working.

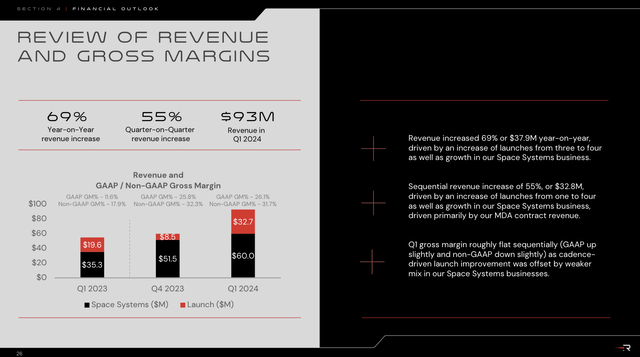

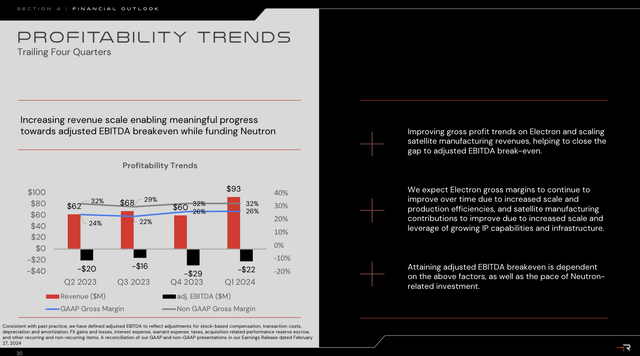

In Q1 2024, the company reported $93 million in revenues, which is a new quarterly record with a 69% year-over-year growth rate.

The Launch Services segment generated $33 million in revenue from four launches, reporting a sequential growth rate of 287%.

The average selling price per launch was $8.2 million, exceeding the target average of $7.5 million, which shows strong pricing power in an increasingly competitive industry.

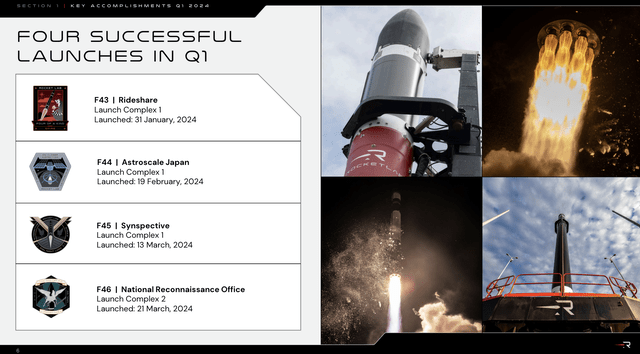

Speaking of launches, the company saw four successful missions, including three commercial launches and a national security mission for the National Reconnaissance Office (“NRO”).

During the earnings call, the company noted its innovative kick-stage technology, which allows precise and flexible satellite deployments. Or, to put it differently, it is a highly efficient way to put satellites exactly where they need to be.

For example, the company successfully executed a complex mission that involved placing two satellites into different orbits during a single launch.

This allowed it to increase efficiencies and reduce costs.

Launching a rocket isn’t the hardest part. Getting the payload exactly where it needs to be is where Rocket Lab stands out.

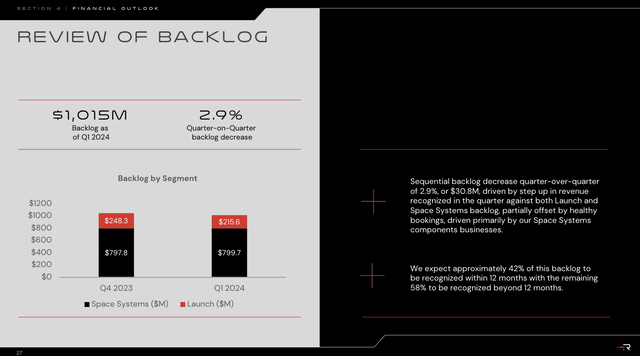

Hence, it also makes Rocket Lab an attractive partner, which is reflected in its backlog.

At the end of Q1 2024, the company had $1.02 billion in backlog. Roughly $216 million of this consists of the launch backlog, with the remaining coming from the Space Systems backlog.

42% of this backlog is expected to be turned into revenue within 12 months.

Moreover, because the company is increasingly scaling its operations, its profitability becomes stronger and more profitable.

In Q1 2024, it reported 26.1% GAAP gross margins, which is ahead of expectations and roughly 2 points higher compared to 2Q23.

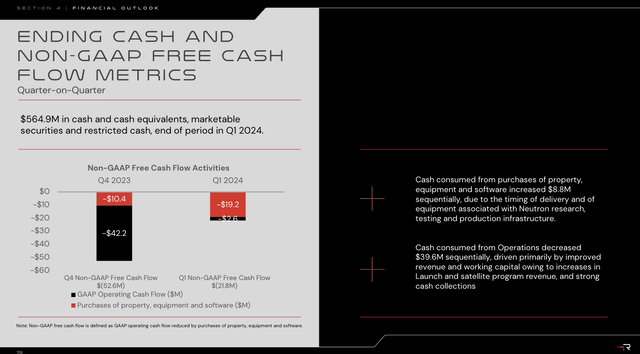

Further good news is that Rocket Lab maintains a healthy balance sheet, as it ended the first quarter with roughly $565 million in cash, which was the result of a $355 million convertible senior notes offering.

It also improved cash outflows, as Q1 2024 free cash flow was negative $2.6 million, down from negative $42.2 million in the prior quarter, which excludes investments in property, equipment, and software.

Another issue is stock-based compensation (“SBC”).

Not only is Rocket Lab not profitable and reliant on external funding to grow, but it also uses a lot of SBC to reward employees.

Last year, it had $53 million of SBC on a net loss of $183 million. Since 2021, the company has seen SBC of $142 million, which is 27% of its revenues during this period.

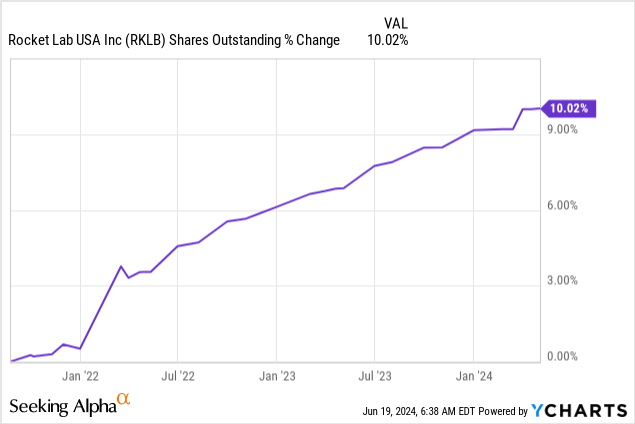

As a result, the share count has risen by 10% since the SPAC deal, which I expect to continue due to convertible notes and a steadily increasing SBC plan without buybacks.

An aggregate of 59,875,000 shares were initially reserved for the issuance of awards under the 2021 Plan. The number of shares reserved for issuance under the 2021 Plan automatically increases each January 1, beginning on January 1, 2022, by 5% of the outstanding number of shares of common stock on the immediately preceding December 31, or such lesser amount as determined by the plan administrator. The Company was authorized to issue up to 97,957,602 shares of common stock as equity awards to participants under the 2021 Plan as of December 31, 2023. There were 82,961,729 shares of common stock available for grant as of December 31, 2023. – RKLB 2023 10-K

With that said, this SBC plan is not a bad deal. Bear in mind that the company is young, revenue is rapidly rising, and its success depends on innovation.

SBCs are a great way to find and keep skilled engineers who are eager to make a lot of money with Rocket Lab.

Ideally, over time, Rocket Lab will grow into a much larger company with positive free cash flow used to buy back stock and pay a dividend.

Valuation

Putting a valuation on Rocket Lab is tricky.

- The company is not profitable.

- Its revenue growth is highly volatile and tough to predict.

- In general, the entire industry is young, which means analysts are left guessing what the industry may look like 5-10 years from now.

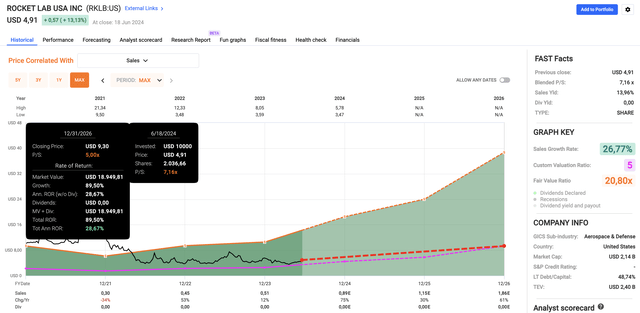

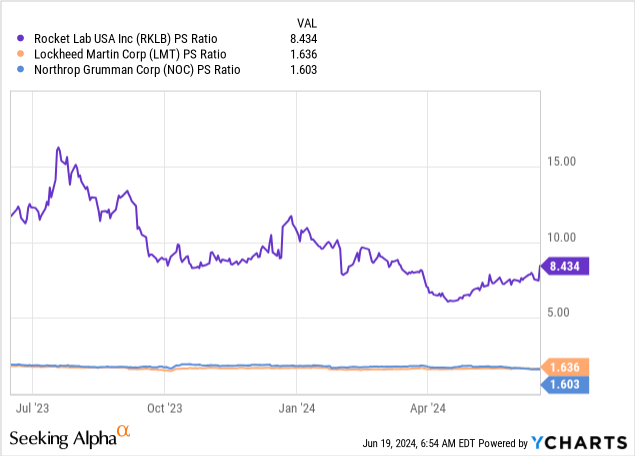

Currently, RKLB trades at 8.4x sales. Established defense giants like Lockheed and Northrop Grumman (NOC) trade at 1.6x sales.

However, both LMT and NOC are profitable and growing sales by mid-single-digits annually.

RKLB is different.

Using the FactSet data in the chart below, per-share revenues are expected to rise by 75% this year, potentially followed by 30% and 61% growth in 2025 and 2026, respectively.

The company is expected to be profitable in 2026 (with $0.14 in EPS).

Even applying a 5x P/S multiple implies a $9.30 fair stock price, 90% above the current price. Applying a 6x multiple results in an $11.20 fair stock price target.

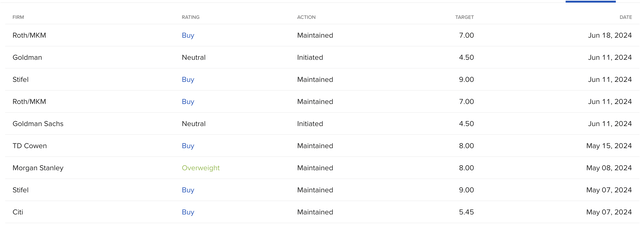

As one can imagine, analyst ratings are all over the place, as even a small difference in applied multiples and/or revenue expectations has a major impact on the company’s potential value.

Using the numbers below, we see the latest price targets range from $4.50 to $9.00, all coming from high-skilled analysts.

With all of this said, I’m bullish on RKLB and will give the stock a Strong Buy rating.

Space is a hot market, and Rocket Lab has proven it can excel, win major orders, improve operations, and innovate for new rockets and capabilities.

That said, it’s a highly volatile company that should not be compared to the dividend stocks I usually discuss. Only buy RKLB if you’re looking for a wild card.

This could be a huge success story but also a big disappointment if the company fails to remain innovative.

This is a fierce industry, and whenever we’re dealing with young companies, the risks are elevated – just like the potential rewards.

So, please keep that in mind.

Takeaway

As an investor focused on dividend growth, I see Rocket Lab not only as a speculative bet but as a serious contender in the space sector.

With an impressive portfolio of launch services and ambitious plans for future growth, including the development of the Neutron rocket, Rocket Lab is poised to capitalize on the booming demand for satellite deployment and space exploration.

However, potential investors should approach this stock with caution due to its high volatility and ongoing financial challenges.

All things considered, Rocket Lab represents an intriguing opportunity for those willing to embrace risk for potentially elevated rewards in the years ahead.

Pros & Cons

Pros:

- Innovative Leader: Rocket Lab stands out with its proven track record in the small launch market, supported by a track record of 38 successful Electron missions.

- Diverse Capabilities: From launch services to spacecraft design and on-orbit management, Rocket Lab offers comprehensive end-to-end solutions.

- Growth Plans: The development of the Neutron rocket for larger payloads and human spaceflight positions Rocket Lab for broader market reach.

- Strong Revenue Growth: The company is capable of maintaining elevated double-digit annual revenue growth on a long-term basis.

Cons:

- Financial Challenges: Rocket Lab continues to operate at a loss and relies heavily on external funding. Meanwhile, high stock-based compensation causes shareholder dilution.

- High Volatility: As a young company in an emerging industry, RKLB’s stock price is subject to significant volatility.

- Uncertain Valuation: Valuing RKLB is complex due to its non-profitability and volatile revenue growth.

- Competitive Industry: The space sector is increasingly competitive. Consistent innovation to stay ahead is key.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LMT, NOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.