Summary:

- Accenture plc delivered strong results with a 22% increase in new bookings, surprising investors.

- Despite a high valuation at 23x next year’s EPS, Accenture’s solid balance sheet and shareholder returns make it an attractive investment.

- The company’s growth prospects, industry expertise, and commitment to innovation justify the premium valuation and support a bullish outlook.

LuckyBusiness/iStock via Getty Images

Investment Thesis

Accenture plc (NYSE:ACN) delivered exceptionally strong Q3 2024 results, with new bookings increasing by 22% y/y, marking the highest growth in new bookings over the past two fiscal years.

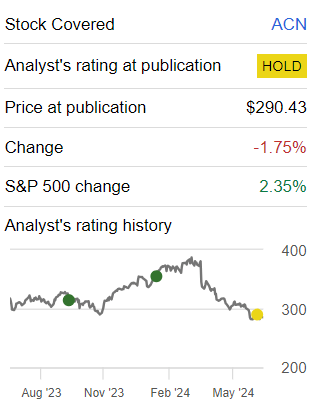

Before these results, I had given up on this stock, believing its prospects were already fully priced in.

However, I was clearly mistaken. Although the stock isn’t cheap, trading at approximately 23x next year’s EPS, its solid balance sheet, commitment to returning capital to shareholders, and a satisfactory 1.8% yield make it an attractive investment.

I must admit my error and reconsider my stance.

Rapid Recap

On the approach to this quarterly report, I was adamant that Accenture’s stock was heading lower and there was absolutely no need to buy the dip on this stock. Here’s what I said.

What investors truly find unacceptable is for management to reduce their growth prospects. And that’s what’s happened here. Accenture downwards revised its growth outlook for fiscal 2024 by a trifling amount, approximately 200 basis points.

Nonetheless, however small the downward revision, the outcome is the same, investors forcibly question whether paying a high premium for stock still makes sense?

Ultimately, I believe that the answer is no.

Author’s work on ACN

I was taken by a massive surprise as Accenture’s new booking jumped by 22% y/y to $21.1 billion. These are not small numbers we are talking about here. This will firmly put a floor on this stock and stop its slide from going lower. Here’s why.

Why Accenture? Why Now?

Accenture helps businesses navigate the digital age by providing consulting and outsourcing services to optimize operations, adopt new technologies, and drive innovation. Working across various industries, Accenture aids organizations in adapting to market trends and staying competitive. Their comprehensive approach and industry expertise make them a valuable partner for businesses aiming to navigate the complexities of digital transformation.

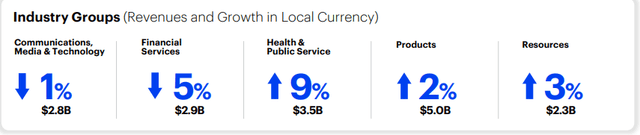

In the graphic that follows, you can see Accenture’s performance in its different industry groups.

Accenture’s near-term prospects have significantly improved, highlighted by their strong Q3 performance with its 22% y/y increase in new bookings.

According to Accenture, they have positioned themselves as the “reinvention partner of choice,” securing 23 clients with quarterly bookings exceeding $100 million.

As you’d expect, given the topic du jour, Accenture describes their leadership in Generative AI, pointing to their $500 million in revenue year-to-date from this source.

That being said, Accenture is clearly aggressive as it continues to tally up acquisitions reaching 35 acquisitions so far this fiscal year, which obviously brings with them significant risks, such as culture integration aspects, as well as perhaps future opportunities.

All that considered, let’s now discuss its fundamentals.

Accenture is Growing in the low Single Digits

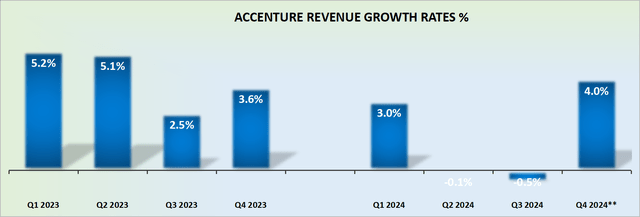

Accenture missed analysts’ revenue expectations and delivered negative 1% y/y revenue growth rates. So why are investors cheering for Accenture? Because its guidance implies that its recent dip in its revenue growth rates has now stabilized, and that Accenture is once again delivering some topline growth starting fiscal Q4 2024 (this current quarter).

Moreover, fiscal Q4 of last year provides a tougher comparable than Q3, consequently, investors are hopeful that Accenture’s strong new booking growth increase of 22% y/y could ultimately translate into a reignition of its revenue growth rates, perhaps even to mid-single digits from the low single digits 2024 is expected to deliver.

If that’s the case, this could substantially shake up this investment thesis and as such, I don’t believe it makes sense to remain neutral on this stock.

ACN Stock Valuation — 23x Next Year’s EPS

As we headed into Accenture’s fiscal Q3 results, I said,

At the high end of Accenture’s free cash flow guidance, the free cash flow is expected to increase by approximately 3% y/y, largely in line with its topline growth.

This is once again a reminder that Accenture has already maxed out all its operating efficiencies and the free cash flow can only increase, for the most part, alongside its topline.

Despite its strong new bookings, management hasn’t upwards revised its free cash flow for 2024, and continues guiding for about $9 billion of free cash flow. However, what Accenture has done, is decreased its fiscal 2024 adjusted EPS figures from $12.09 at the midpoint of its guidance to $11.93, a 1.3% decrease in its EPS figure.

This is a vindication, albeit small, of my previous contention, that Accenture has already maxed out all its operating efficiencies, and that an increase in its bottom-line profitability can only come from an increase in its future growth rates.

But since Accenture has positively surprised investors with its large increase in new booking, I believe this implies higher profits can be counted on in fiscal 2025, versus previous expectations.

As such, I now believe that Accenture’s adjusted EPS figures in fiscal 2025 can reach around $13.12 at the high of its potential. This leaves Accenture priced at 23x next year’s EPS.

On the surface, I would say that this is a punchy valuation. But then again, we must keep in mind that Accenture has more than $5 billion of cash on its balance sheet, and is clearly eager to return this cash to shareholders.

Case in point, Accenture provides a dividend that reaches a respectable 1.8%.

The Bottom Line

Paying 23x next year’s adjusted EPS for Accenture makes sense due to its strong financial performance and substantial growth in new bookings.

Additionally, Accenture’s commitment to returning capital to shareholders, evidenced by its attractive 1.8% dividend yield, further enhances its investment appeal. This combination of robust growth prospects, innovative leadership, and shareholder returns justifies the premium valuation.

In short, I was wrong to be neutral on Accenture heading into this report.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.