Summary:

- Nvidia Corporation recently surpassed all companies in market valuation, with Advanced Micro Devices, Inc.’s performance lagging, but it is likely to catch up in the second half of 2024.

- AMD’s competitive edge in PC chips, A.I. chips, and cryptocurrency mining positions it well for future growth.

- AMD’s upcoming quarterly earnings report on August 6th could serve as a catalyst for a potential spike in stock price, with it trading just above support in the mid $140s.

JHVEPhoto

I came up with the phrase “the Chippening” back in August 2020 to describe the change of the guard occurring in the semiconductor sector. At that point, two milestones occurred: (1) Nvidia Corporation (NVDA) achieved a market valuation greater than Intel Corporation (INTC), and (2) Intel was forced to restructure, largely due to its inability to produce a 7nm product and keep up with Advanced Micro Devices, Inc. (NASDAQ:AMD). As we approach the 4-year anniversary of the dawn of the Chippening, we are clearly entering a new phase, where Nvidia has now achieved the highest valuation of any publicly traded company within the domestic markets, and not merely the semiconductor industry. While AMD has substantially lagged NVDA’s performance, it appears increasingly likely that AMD will be re-evaluated significantly higher in the second half of 2024.

Though this article is primarily focused on AMD’s probable catch-up, this is in no way a claim that NVDA’s higher valuation is surprising or non-deserved. NVDA was already worth more than AMD when the Chippening began, and its well-moated position as the market leader in A.I. chips was similarly already established. Rather, my expectation is that the market will come to accept that AMD is one of few companies that possess true chip wizardry that shall make it a necessary competitor and component of the economic and technological future.

There are several reasons to expect AMD to remain competitive, including its reasonably long history of being so with traditional personal computing chips against Intel. That appears to be a race it eventually won, or at least has taken a sizable lead, despite previously often lagging. Now, in addition to PC chips, AMD is likely the second horse in the A.I. chip race (where NVDA now holds a sizable lead).

Similarly, AMD chips are highly competitive for cryptocurrency mining, with its most recent version of the Ryzen 9 often being one of the best performing choices for solving the related algorithms. The competitiveness of AMD’s CPU chips towards such specific tasks is peculiar and rather marvelous, where that business is generally handled by GPUs (i.e., graphics cards) and application-specific integrated circuits, or ASICs that are essentially specialists capable of performing a single function.

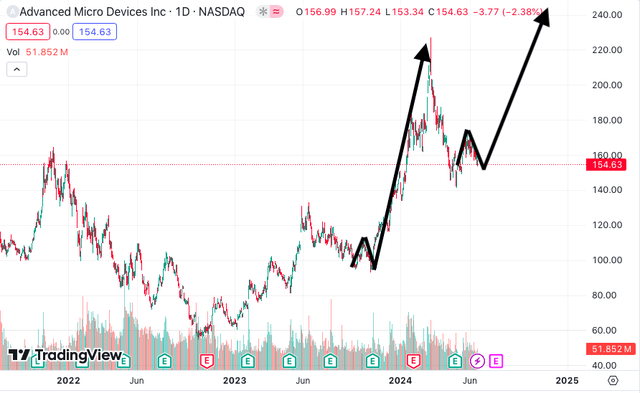

AMD’s recent underperformance also appears to be approaching a probable point of support, and simultaneously forming a similar pattern to that which preceded its spiking last year, and reaching a new high earlier this year. Before this most recent spiking, the company’s prior high was reached in 2022. That resistance level now appears to coincide with AMD’s current trading range, and it is likely that strong support shall be found just below current levels.

AMD chart (TradingView.com with black lines by Zvi Bar)

AMD is expected to report quarterly earnings on July 30th or August 6th, and it is possible that this forthcoming report could act as the catalyst for such a spike. It is also entirely possible that the move will begin in advance of reporting. Such a pre-reporting move would likely require some type of catalyst, such as a meaningful contract announcement or change in analyst projections.

The most apparent risks to this thesis would include a broad market selloff that takes most everything down, and AMD with it, as well as AMD breaching what appears to be its present support. I believe that this support is in the mid $140s. This level acted as temporary resistance during AMD’s spike in late 2023 and into early 2024, and later acted as support in April and May of this year. I expect that level to be supportive again, if tested between now and AMD’s August 6th reporting. If AMD stock were to breach the mid $140s, and especially on a weekly closing price, I would lose conviction on this potential near term spike higher.

Conclusion

I believe AMD is part of a select few equities that are likely to benefit from the current and continuing tailwinds of A.I. and cryptocurrency. Further, AMD should benefit from a potential PC refresh cycle. Despite these probable catalysts, AMD has underperformed since spiking to overbought this spring. I believe AMD now has the potential to be at support and (pardon the pun) spring from its present trading range to new highs in the second half of 2024.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.