Summary:

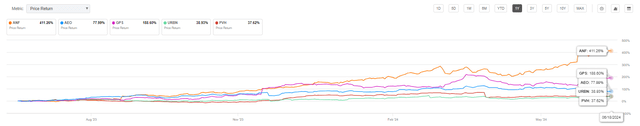

- Over the past year, Abercrombie’s stock price has quadrupled in value and outperformed the S&P 500 and many of its peers by a wide margin.

- The company has undergone a very successful digital transformation. In five years, ANF evolved from a traditional retailer to a digitally operated retail tech company.

- We believe the market has yet to fully appreciate Abercrombie’s digital capabilities. There is potential for further multiple expansion as the company continues to deliver strong financial results.

Robert Way/iStock Editorial via Getty Images

Another very strong quarter

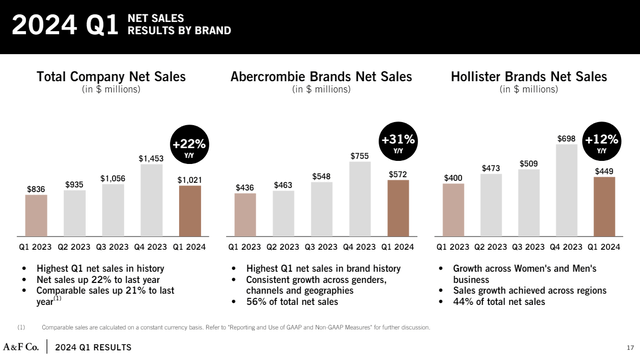

Abercrombie & Fitch Co. (NYSE:ANF) reported its Q1 financial results in May. Earnings were very strong as revenue increased 22% to $1 billion. EPS came in at $2.14 from $0.34 a year ago and the company achieved a record 13% operating margin (vs. 4.1% last year). The market responded very positively to the results, as the stock is up more than 20% since the earnings release. Over the past year, Abercrombie’s stock price has quadrupled in value and outperformed the S&P 500 and many of its peers by a wide margin (see below).

ANF price performance (Seeking Alpha)

The ANF turnaround story is really impressive. Under the leadership of CEO Fran Horowitz since 2017, the company has reinvented itself, transforming its brand, product offerings, and customer experience. We attribute the impressive price performance to several factors:

- Successful Digital Transformation: The company has undergone a very successful digital transformation. In four years, ANF evolved from a traditional retailer into a digitally operated tech company. As the market understood the company’s digital capabilities, the stock has been re-rated, which led to multiple expansion.

- Consistent Revenue Growth: For two years, ANF has delivered continuous strong revenue growth, driven by its data-driven strategies and customer-centric approach. This is unusual in retail, especially during a period of weakening consumer demand. As a result, investor confidence in ANF’s growth prospects strengthened.

- Steady Margin Expansion: ANF’s focus on operational efficiency combined with revenue growth, has translated into large margin expansions and record operating income. The market has recognized the company’s operational discipline.

Our mission is to find successful companies that can beat the market and deliver outsized returns. Such companies share certain strategic attributes that set them apart from the rest. We think ANF is one of these companies. The company has invested heavily in digital capabilities, has a high-performing operating model, is hyper-focused on its customers, and demonstrates financial discipline. We believe these attributes position the company perfectly to sustain its growth trajectory and gain further market share.

ANF Has Become a Digitally Operated Company

ANF is successfully executing its “Always Forward” plan that was initiated in 2022. A key aspect of this plan is the digital transformation that the company went through. The company first laid the foundation by migrating its infrastructure to the cloud, then modernized its ERP system and unified its data platform. This was the “core platform modernization” which then paved the way to develop more advanced retail capabilities. For instance, ANF is using data and analytics to understand its customer behavior. By combining this data with AI, the company can find emerging trends, develop new products, optimize inventory management, and create highly personalized marketing campaigns.

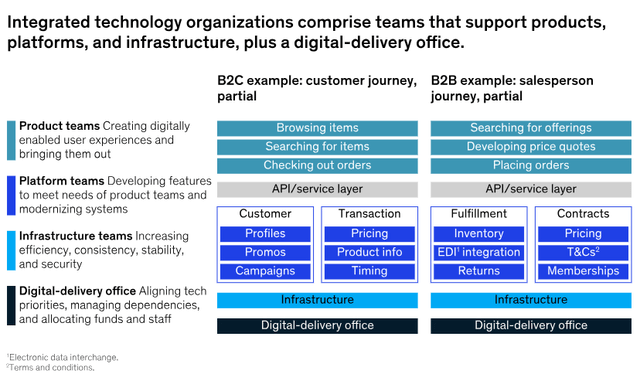

While these capabilities are not unique to the industry, ANF’s product-based operating model sets it apart we think. This model is commonly used in technology companies and organizes cross-functional teams around product lines, rather than traditional functional silos.

This is a model where small, autonomous teams with diverse skills drive new product development, by leveraging data and agile methodologies. They own their products from ideation to launch, marketing, and support, continuously gathering feedback and iterating. In this model, business and IT specialists work together on unified teams, each centered on an individual product (see below). By implementing such a model, we believe ANF has transformed into a fully functioning tech company.

Product-based operating model (McKinsey)

This model enables ANF with faster innovation and business agility. This way the company is able to respond instantly to changing customer demands and market trends which is a critical advantage in retail.

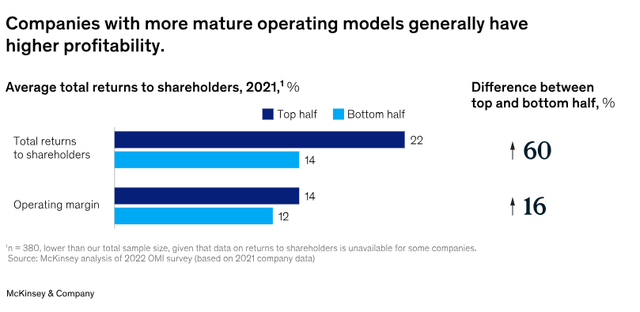

This agility also leads to more automation and operational efficiencies which ultimately have a positive impact on margins. In fact, according to McKinsey research, companies with more mature operating models achieve higher margins and profitability (see below). We believe that ANF’s margin expansion performance can be attributed to its product-based operating model.

Operating model maturity (McKinsey)

Strategic focus: Customer obsession

Successful companies differentiate themselves in the market by having a strategic focus. ANF’s strategic focus is its customer obsession. By leveraging big data and analytics, the company has mastered its customers’ behavior and has a 360 view of its customers’ preferences and shopping patterns. This is how ANF CFO Samir Desai explains the company’s data and analytics advantages in an interview:

Samir Desai (CTO):

For our business, we’ve got this, I’d say, relatively unique advantage in that, 98%, maybe 99% of our customers, we’re interacting with directly. Meaning we have first-party customer data. We’re not going through a wholesaler or franchise operator where, you know, we lose a lot of that customer data.*

So, we’re transacting directly with the customer, and we’ve got a loyalty program that has a very high penetration – 70% to 80% of our customers are members in our loyalty program, which gives us even more first-party customer data. Layer on top of all that, the fact that our business is almost 50% digital. When you have a business that’s that heavily penetrating digital, you get to learn a lot more about the customer journey that you wouldn’t learn in a brick-and-mortar experience, right?

This customer-centric approach enables the company to create highly personalized digital experiences, targeted marketing campaigns, and even in-store experiences tailored to individual customers. For example, store associates use AI-powered apps to provide personalized recommendations to customers. All these personal touchpoints drive stronger connections with its target audience and drive high loyalty and repeatable business.

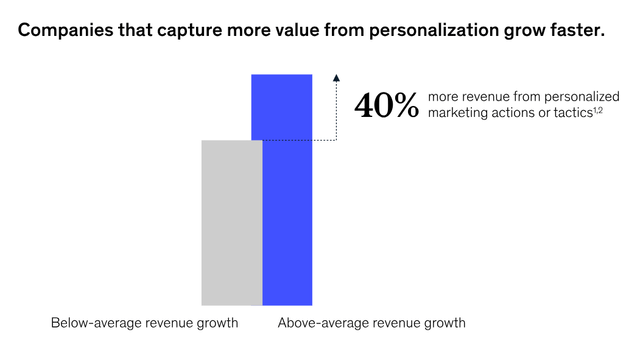

We think that the future of retail is personalization and believe that ANF’s deep understanding of its customer base creates many personalization opportunities for the company. As per McKinsey research, companies with advanced personalization capabilities grow revenue 40% faster than other companies (see below). ANF’s personalization strategy has the potential to drive significant revenue growth in the upcoming years.

Personalization drives growth (McKinsey)

Revenue Momentum Strong

ANF’s revenue momentum remains strong, as the company increased revenue by 22%. The Abercrombie brand had one of its best quarters, growing 31% YoY, while the Hollister brand delivered strong growth of 12% YoY.

At the core of ANF’s growth strategy is to achieve deeper penetration into the existing customer base through highly targeted marketing strategies. Almost 70% of its customers are loyalty members which means the company has very high customer retention.

ANF is also targeting new categories. A great sample is the newly launched Wedding Shop, where the company is entering the wedding category that will be worth $83 billion by 2030. By both growing existing brands and expanding into new categories, we believe ANF will be able to sustain its strong revenue trajectory.

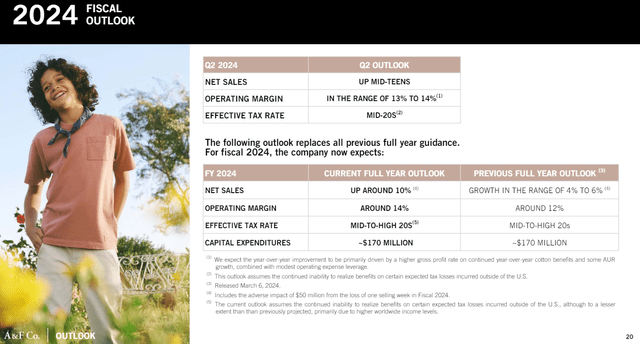

For Q2, the management team expects mid-teens revenue growth, around $1.15 billion. For the full year, the company expects around 10% revenue growth. Looking at the revenue momentum and the strong retail sales numbers for clothing, we expect a beat-and-raise quarter from the company’s Q2 earnings.

Margin Expansion Continues

ANF’s digital transformation has not only enhanced the customer experience but has also driven operational efficiencies and cost savings. The company’s focus on operational efficiency has translated into great margin performance. ANF CTO Samir Desai explains the data-driven inventory management strategy in the interview:

Samir Desai (CTO):

we’re looking not only at transactional data of the past, but also looking at other data sets like weather, like social media engagement, like clickstream data to get a better idea of how much demand there’ll be for a certain style of product in a certain zip code. It’s allowing us to be a lot more precise about how we allocate inventory, which in turn leads to less redlines and markdowns, i.e., higher margin, and also less out of stocks, right? Ultimately inventory is the kind of most expensive asset that any retailer has, and so that’s been a big focus for us.

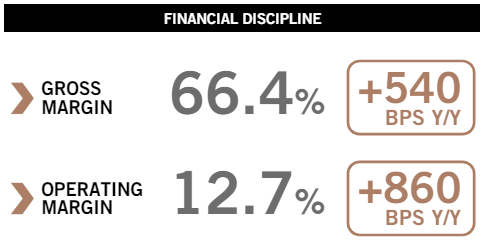

ANF reported a gross margin of 66% vs. 61% from a year ago, driven by better inventory management and fewer promotions. The company also improved its operating margin which increased to 13%, up from 4% a year ago and above guidance. This was due to higher revenue and better operating leverage.

These numbers imply great operational discipline and efficiency, as ANF is able to scale its business while keeping its costs under control.

Margin performance (Abercrombie)

The company is guiding for a 14% operating margin for the full year which is impressive. We believe ANF has significant margin upside potential, as its digital capabilities can help achieve greater efficiencies.

Valuation – Upside potential

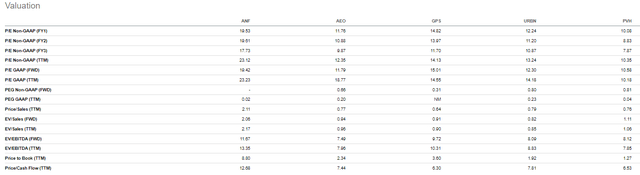

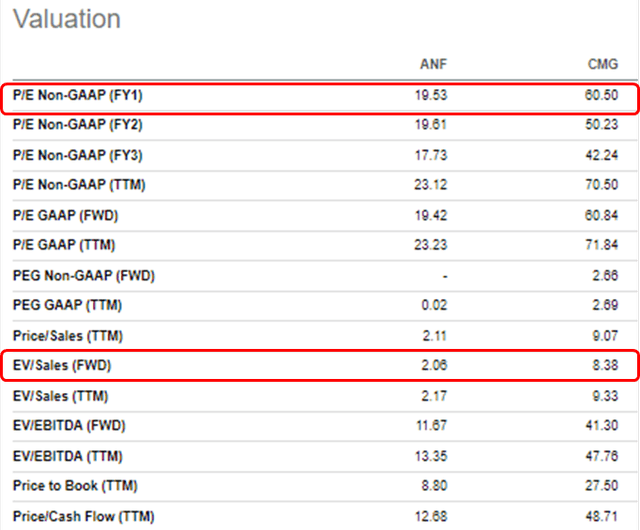

ANF might seem like an expensive stock when valued as a traditional retailer. When compared to its retail peers, it trades at premium valuations (see below)

Peer valuation (Seeking Alpha)

However, we believe Abercrombie should be valued as a retail tech company, given its operating model, accelerating growth and expanding margins. We see ANF showing similarities with Chipotle, which saw a significant re-rating as it transitioned from a traditional fast-food chain to a tech-enabled consumer brand. The company may undergo a similar multiple expansion as investors recognize its digital capabilities.

When comparing ANF multiples to Chipotle, we see significant upside potential. ANF’s fwd EV/S ratio is 2x, while its fwd P/E ratio is 20x, compared to Chipotle’s fwd EV/S ratio of 8x and a P/E ratio of 60x.

If ANF’s valuation multiple were to reach even half of Chipotle’s, its stock price would more than double from current levels, indicating substantial upside potential.

Valuation comparison (Seeking Alpha)

Risks

Our top risks for ANF are as follows:

Fierce Retail Competition: The company has many competitors. The apparel industry is one of the most dynamic and competitive markets, where customer preferences and trends can change rapidly. The company must continuously adapt to shifting trends, and try to stay ahead of the competition.

Weakening Consumer Demand: ANF’s performance is dependent on consumer discretionary spending. Latest reports show there is a weakness in consumer demand, which is negative for retail companies. Retail sales, jobs report, and inflation data need to be monitored closely as retail is very correlated to macro metrics.

Conclusion

We think that ANF is a great example of how a retailer should transform its business in order to survive amidst disruption and heavy competition. Over the past five years, the company has undergone a significant digital transformation and evolved into a data and AI-driven retail tech company. With its digital operating model, data-driven customer strategy, and impressive financial performance, we believe the market has yet to fully appreciate ANF’s digital capabilities.

We believe there is potential for further multiple expansion as the company continues to deliver strong financial results.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ANF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.