Summary:

- We had a strong sell rating on Amazon as we expected the market to start focusing on earnings vs the promise of earnings.

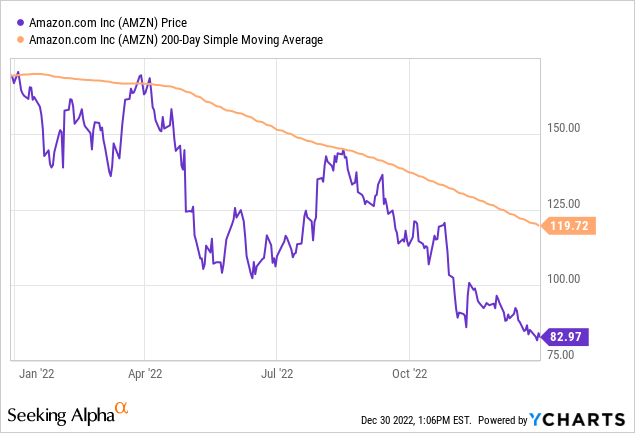

- The stock is arguably oversold and is trading below COVID-19 lows.

- Bubbles play out predictably and Amazon will follow script.

Bezos Estimating Your 10 year Returns In Amazon Stock From Here.

Alex Wong

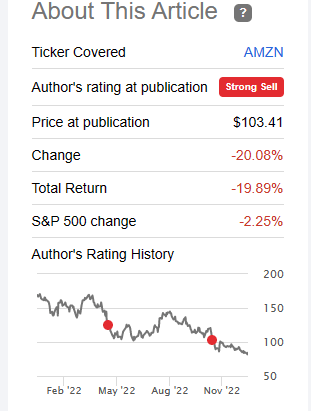

When we last covered Amazon. Com Inc. (NASDAQ:AMZN) we had a bearish take and felt the company would struggle as the froth came off the bubble. Our price target was ambitious, but we had given the stock some time to get there.

Good luck getting interest rate cuts to support these insane valuations. We rate the shares a Strong Sell with a 1-year rice target of $70.00.

Source: Ama-Gone, Why The Fed Is Still Not Bailing Your Poor Investments, Including Amazon

The stock has obliged and trailed the S&P 500 (SPY) by 18% and is also about 18% away from our target.

Seeking Alpha

We examine the developments since then and update our thesis for 2023.

Earnings Estimates

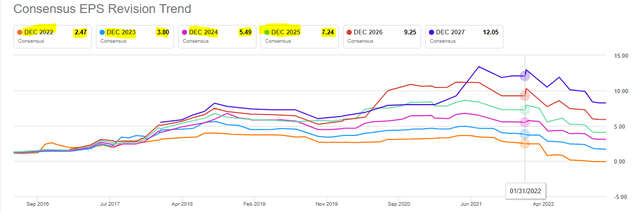

If there is one thing that investors should know by now about AMZN, it is that absolutely no one can predict their earnings. An extension of that is that analysts will always view that things will develop in the most optimistic way possible. To illustrate this point, we show you where the earnings estimates were at the beginning of 2022.

Seeking Alpha-AMZN

On that related note, AMZN which sauntered around $150 per share at the time, was trading at 21X earnings for year ending December 2025. So it was hard to argue that the stock was not priced for perfection. Fast forward to multiple doses of reality bestowed upon the bulls for all of 2022 and we have the earnings estimates as follows.

Seeking Alpha-AMZN

The key piece of information to glean there is despite the drop in 2022, AMZN still trades at the exact same multiple of 2025 earnings estimates. 21X. This is the typical trap where stocks can appear to be cheap all the way down. Of course, here “cheap” definition has to be really stretched, but nonetheless the concept applies. As long as those trend down, expect AMZN to not find a permanent floor.

Our Outlook For 2023

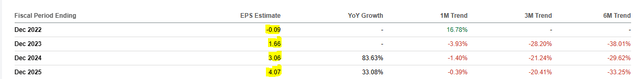

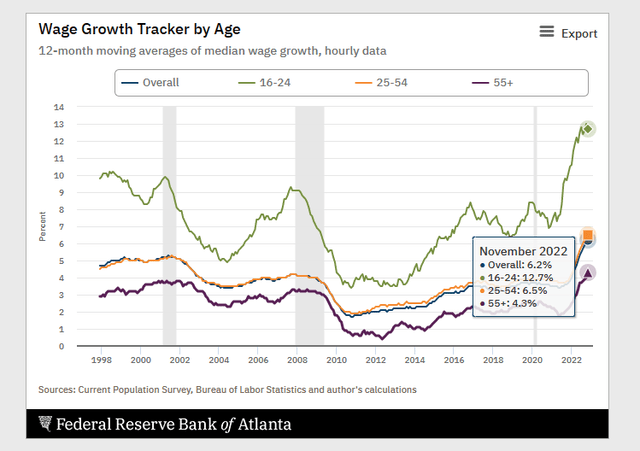

On the retail side, AMZN will likely face increasing wage pressures and alongside that poor profitability. we are in an unusual environment where supply of labor has fallen so far below demand that even a weak recession is unlikely to dent wage pressures. The current run-rate for wages is at a 6.5% annualized increase.

Atlanta Fed

The strength in wages is particularly notable for the 16-24, a demographic that makes a big part of AMZN labor supply.

Atlanta Fed

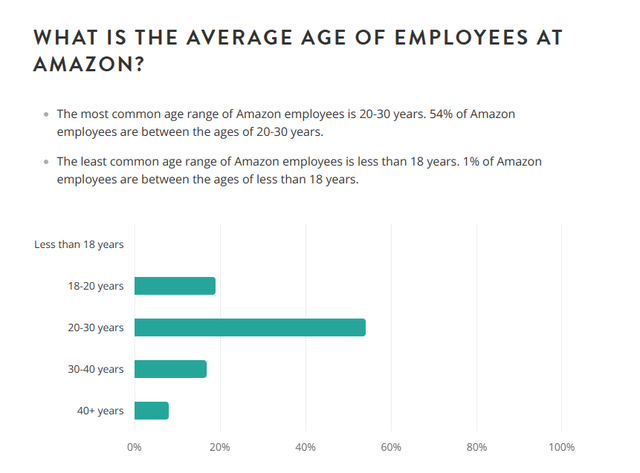

While we don’t have the exact breakdown in this range, we think more than half of AMZN employees are under 24 years.

Zippia

Don’t count on workforce loyalty to get workers to stick it out at AMZN either.

The average Amazon warehouse worker leaves within just eight months – that’s an unmistakable sign that Amazon’s jobs are unpleasant, to put it kindly, and that many Amazon workers quickly realize they hate working there because of the stress, breakneck pace, constant monitoring and minimal rest breaks. Indeed, experts on the future of work often voice concern that Amazon’s vaunted algorithms and technologies treat Amazon’s warehouse workers like mindless, unfeeling robots – having them do the same thing hour after hour after hour. By the way, the eight-month average that Amazon workers stay is a piddling one-sixth the average job tenure for America’s 155 million workers.

Source: The Guardian

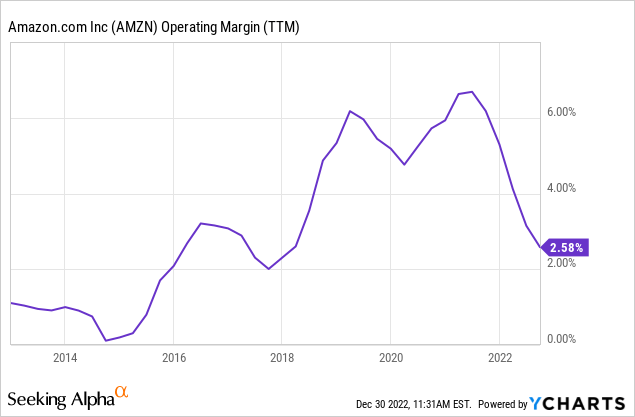

This is going to be the whole driving force for the retailer. 6% wage increases will play havoc with that operating margin.

Of course bulls tend to always bring up AWS as the bailer of last resort. Our response is that the AWS profits are included in that 2.58% (imagine where we would be without that) and those margins have peaked.

AWS, which Amazon launched in 2006, controlled about 39% of the cloud infrastructure market in 2021, down from 41% in 2020, according to estimates from technology industry researcher Gartner. Operating income for the division was $5.4 billion, less than the Street Account consensus of $6.37 billion. Amazon as a whole had $2.53 billion in quarterly operating income. AWS operating margin contracted to 26.3% from 29% in the second quarter. Olsavsky said Amazon has seen wage inflation in 2022, particularly in AWS, and higher energy prices are cutting into operating income as well.

Source: CNBC

We have not seen the worst of this and sustainable margins in the AWS segment are likely going to be in the teens within 1-2 years.

Verdict

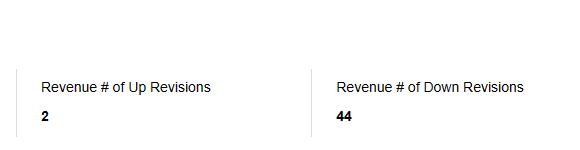

AMZN can grow into the current price. 56% drop from the all the time highs has certainly increased the chances of positive (barely positive) 10-year returns. The problem is that it has gotten huge and the law of large numbers still applies. Revenues are expected to grow just 8% for 2022, a year powered by high inflation. We just don’t see consensus estimates for 11% revenue growth panning out in 2023. So there will be a lot of disappointments and we will continue to see downgrades as the realization hits home.

Seeking Alpha- AMZN

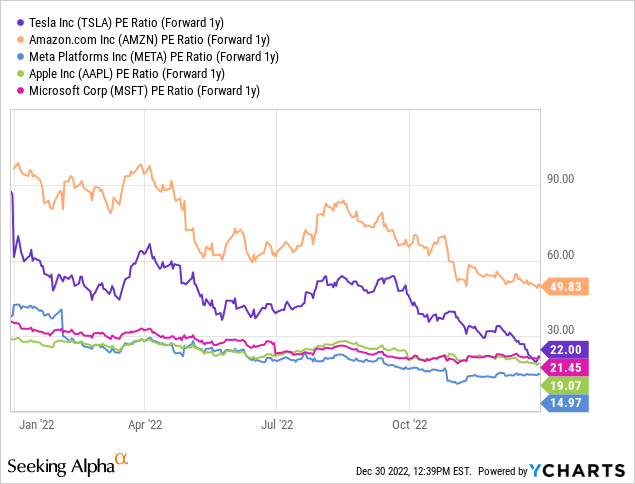

The other problem is that there are zero legs to support the current price if investors start saying “show me the money”. The company is still trading at over 50X bloated 2023 profit estimates and downside punishment can still be severe. If you don’t believe us check out where Tesla Inc. (TSLA), Meta Platforms (META), Apple Inc. (AAPL) and Microsoft Corp (MSFT) are trading.

The stock is quite oversold though and that makes it risky to press the short case.

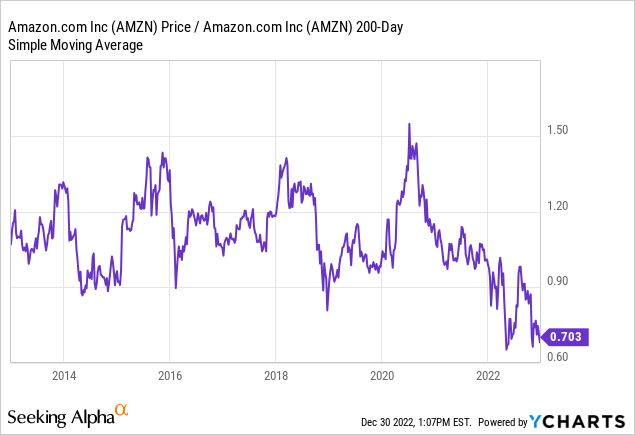

A better way to visualize this is to see the ratio of the price to its 200-day moving average. At the current 0.703X, we are the most oversold in the last decade, in line with the COVID-19 selloff.

A bounce to the 200-day moving average would be rather painful for the short side. Hence we are upgrading this to a “hold”, from a “Strong Sell”. While we would not want to purchase AMZN even 50% lower than this, we think the case for shorting the stock is no longer compelling and we are hence moving to the sidelines.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have a beneficial short position in the shares of QQQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Covered Call Portfolio is designed to reduce volatility while generating 7-9% yields. We focus on being the house and take the opposite side of the gambler.

Learn more about our method & why it might be right for your portfolio.

Stanley Druckenmiller on mental flexibility and the ability to be both bearish and bullish.

Stanley Druckenmiller on mental flexibility and the ability to be both bearish and bullish.