Summary:

- Snap reported strong Q1 FY24 earnings, with revenue growing 21% YoY and Adjusted EBITDA expanding, beating estimates.

- The strength in revenue was driven by growth in advertising, with particular strength in DR growing 17% YoY, as the company continued to innovate its advertising platform to drive ROAS.

- During the quarter, it saw its DAUs grow 10% YoY with growing engagement on the platform, coupled with SMB advertisers growing 85%.

- While the decline in DAUs in North America is a concern given substantially higher ARPU compared to international markets, I believe the stock has sufficiently priced in the risk.

- Assessing both the “good” and the “bad”, I am optimistic about the product innovation roadmap and growing operational discipline and believe it is attractively priced from a risk-reward perspective.

We Are

Introduction & Investment Thesis

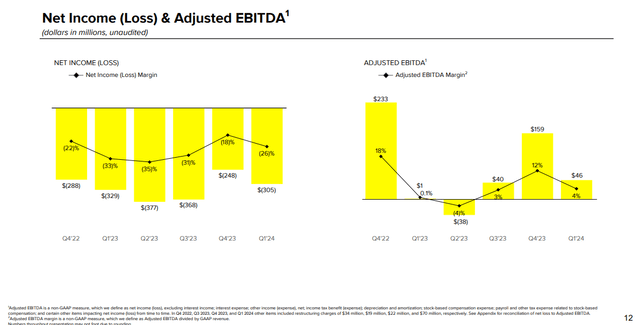

Snap (NYSE:SNAP) is a visual messaging application where Snapchatters (users) can interact using its features that include Camera, Visual Messaging, Stories, Spotlight, and more. The company has underperformed the S&P 500 and Nasdaq 100 YTD, although the stock rose close to 30% after its Q1 FY24 earnings in April, where revenue grew 21% YoY and Adjusted EBITDA expanded from $813,000 in Q1 FY23 to $46M, beating estimates. Its advertising revenue grew 16% YoY with strength in Direct Response (“DR”) advertising solutions, as they continued to build new capabilities in their advertising platform to attract advertisers and drive higher return on ad spend (“ROAS”).

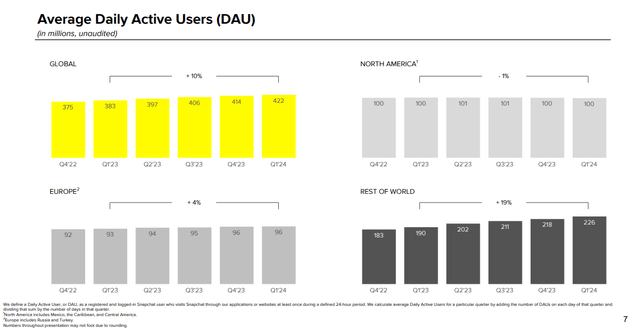

During the quarter, the company grew its Daily Active Users (“DAUs”) by 10% YoY with growing time spent watching content as the company leveraged Machine Learning (“ML”) models to improve content ranking and personalization while investing heavily in Augmented Reality (“AR”) experiences.

Although the company saw a decline of 1% in its North America DAUs, it still managed to grow revenue in the market by 16%. Moving forward, while investors will be paying attention to the acceleration of DAUs in North America, given its product roadmap as well as the fact that the North American market contributes 62% of Total Revenue, I believe that the stock has priced in the risk. In fact, I believe that the stock is trading at an attractive level from a risk-reward standpoint with a potential upside of at least 50%, making it a “buy”.

Advertising Revenue contributed 92.7% to Total Revenue, while Snapchat + grew to 9M subscribers

Snap reported its Q1 FY24 earnings, where revenue grew 21% YoY to $1.195B beating estimates driven by strength in demand for their DR advertising solutions as they continued to add new capabilities to their advertising platform, thus resulting in higher ROAS for their advertisers, while simultaneously diversifying their revenue sources, with Snapchat + growing to 9M subscribers in Q1. When it comes to its advertising revenue, it contributed 92.7% to Total Revenue, growing 16% YoY, with a combination of DR advertising growing 17% YoY and Brand-oriented advertising growing 12% YoY.

Driving deeper community engagement through product innovations and AR

During the quarter, DAUs grew 10% YoY. While North America DAUs declined 1%, Europe and Rest of World made up for it by growing 4% and 19% YoY, respectively, along with time spent watching content growing annually. Specifically, time spent watching Spotlight content grew 125% YoY.

Q1 FY24 Earnings Slides: Growing Daily Active Users globally

In order to deepen user engagement on the platform, Snap is investing in their ML models to improve content ranking and personalization, enabling Snapchatters to find the most relevant and entertaining content while helping creators build an engaged community and audience base. Simultaneously, the company is also growing their creator community by onboarding more than 1500 Snap Stars (creators) in Q1, as Snapchatters are increasingly engaging with creator content, while adding new features that include Creative templates, longer video formats, and AI-powered AR Lens to get more creative with Snaps. Specifically, when it comes to AR, the company continues to invest heavily in building AR experiences, such as improving the AR Carousel ranking model to make it easier to discover new lenses, launching new features such as Friends Lenses and Q&A Lenses for Snapchatters to send fun text and image responses to each other, and more. I believe these will play an important role in driving memorable moments for users, leading to deepening engagement and improved business outcomes.

Improvements in the Advertising Platform to drive higher ROAS for advertisers

Turning your focus to the advertising platform, the company is continuing to drive encouraging results for advertisers with the ongoing momentum of their 7-0 Pixel Purchase Optimization Model, where advertisers have seen a 75% increase in purchase-related conversions YoY. At the same time, the company also launched a privacy-centric first-party signal solution called Conversion API (“CAPI”), where advertisers that represent half of all DR ad revenue had already completed CAPI integrations. What is also interesting to note is that advertisers are increasingly partnering with creators through Snap Star Collab Studio, as 49% of Snapchatters are likely to purchase products featured by creators that they are aligned with, leading to advertisers expanding their user base and driving a higher click-through rate and lower cost per click, with SMB advertisers growing 85% YoY on the platform as they achieve higher ROAS.

Improvement in Adjusted EBITDA margins from revenue acceleration and operating discipline

Shifting gears to profitability, the company saw a decline in Adjusted Gross Margins from 56% in Q1 FY23 to 52% in Q1 FY24, which was primarily driven by rising infrastructure costs from the ramp in ML and AI investments in their advertisement platform. However, when it comes to its Adjusted EBITDA, the company was able to generate $46M with a margin of 3.8%, a huge improvement from the previous year where it generated $813K in Adjusted EBITDA with a margin of 0.08%. I believe that the improvement in profitability was driven by a combination of revenue acceleration with Average Revenue Per User (“ARPU”) growing 9.6% YoY given growing DAUs and advertising spend on the platform, as well as operating expense discipline as it reduced its full-time headcount by 7% YoY from its restructuring initiative.

Q1 FY24 Earnings Slides: Improving EBITDA margin year-over-year

Declining DAUs and time spent watching content in North America can spell trouble for future growth, given thin margins

However, one of the areas of concern would be the decline in DAUs for North America, which accounts for 23.7% of all DAUs. Simultaneously, the management also mentioned that time spent on watching content is flat YoY in North America. The reason why the North American market is important for Snap’s success is because it contributes 62% of Total Revenue. While Europe and Rest of World are increasingly accounting for a growing share of Total Revenue, as they are growing faster than the North American market, their ARPU of $2.04 and $1.13 is miniscule compared to $7.44 ARPU for North America. Therefore, I believe it is important the company sees a revival of growth in DAUs and time spent on the platform in North America given its product innovation roadmap to deepen user engagement and attract advertisers on its platform; otherwise, margins will continue to remain under pressure, especially when it is required to keep up its R&D spend to competitively position itself against competitors such as Meta (META) and Google (GOOG), who have sufficient resources at their disposal.

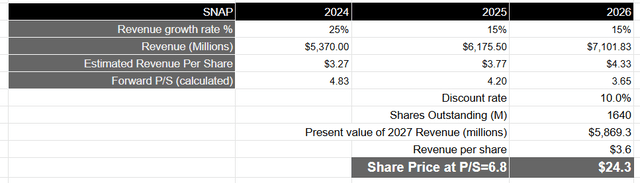

Tying it together: Snap has significant upside

Looking forward, I will take the consensus expectations for revenue growth over the next 3 years until FY26, where revenue is expected to grow in the mid-twenties region in FY24, followed by a slowdown in the mid-teens range until FY26 to a total of $7.1B. I believe this should be achievable for Snap as it continues to deepen its user engagement on the platform through personalization efforts and AR innovation, thus increasing time spent on the platform watching videos, while simultaneously growing its advertiser spend as it builds capabilities in its advertiser platform to deliver higher ROAS.

Since the company hasn’t provided a long-term operating model, it will be difficult to assess its profitability landscape over the coming years. During the earnings call, the management outlined that they see limited opportunity to productively reduce operating expenses below their estimated FY24 range of $2.42-$2.52B, which would yield approximately 7% of Adjusted EBITDA margin, assuming adjusted gross margin of 52%. However, for the purpose of the valuation, I will base it on revenue growth projections over the next few years.

Therefore, assuming that Snap generates $7.1B in revenue, that would translate to a present value of $5.8B when discounted at 10%. Taking the S&P 500 as a proxy, where its companies grow their revenues at an average rate of 4.8% with a price-to-sales ratio of 2.19, I believe that Snap should trade at 3 times the multiple given the growth rate of its revenues during this period of time. This will translate to a P/S ratio of 6.8, or a price target of $24, which represents an upside of 54% from its current levels.

My final verdict and conclusions

It is optimistic to see that the company is translating its product innovations into deeper user engagement, where its global DAUs continue to grow along with time spent on the platform, with greater opportunities in AR that lie ahead. Simultaneously, its innovations on its advertising platform are driving higher ROAS, thus attracting more advertisers on the platform. While this has resulted in overall ARPU growing 10% YoY, I believe investors will be looking to see acceleration in the North America market, where DAUs have declined 1% YoY.

While there are some uncertainties in North America to a certain extent, I believe that the stock has priced it in and is currently trading at an attractive level from a risk-reward perspective. In fact, should the company see a revival in the growth rate of DAUs and time spent on platform in the North America market in the coming quarters given its product innovation, especially with AR, the stock can have substantial upside from its current levels. Plus, the management is showing operational discipline as it improves its overall profitability. Assessing the “good” and the “bad”, I believe that the stock is attractively priced, making it a “buy”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in SNAP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.