Summary:

- Tesla’s continued price cuts despite flat interest rates indicate microeconomic demand issues rather than macroeconomic customer affordability needs.

- Competitive threats in the EV OEM market are mounting and Tesla is losing market share in all major geographies.

- Tesla’s energy business is a small silver lining that is expected to grow handsomely and have margin expansion. But it is not enough to offset the weakness in automotive sales.

- Tesla’s 84.5x 1-yr fwd PE is at precarious levels. Investors are banking a lot on immaterialized growth multipliers of FSD and Optimus, which I view as too risky.

- I’m holding off on a ‘Sell’ view as the technicals vs the S&P500 show limited runway for bearish moves as prices trade closer to the support of a monthly range.

happyphoton

Performance Assessment

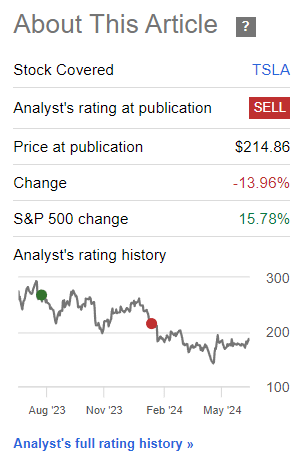

I had a ‘Sell’ rating in my last coverage of Tesla (NASDAQ:TSLA), which played out well:

Performance since Author’s Last Update on Tesla (Author’s Last Article on Tesla, Seeking Alpha)

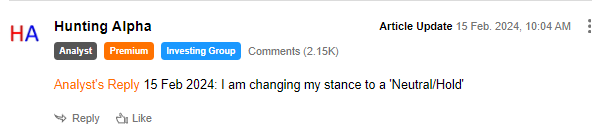

However, I had updated my stance to a ‘Neutral/Hold’ after some initial decline and communicated this in a pinned comment:

Pinned Comment on Author’s Last Article on Tesla (Author’s Last Article on Tesla, Seeking Alpha)

One of the reasons for my change in stance was due to my belief that relief from interest rate hikes may reduce the need to make the cars more affordable. But I was proved wrong here as you’ll see later in this article.

During the time period of the ‘Sell’ view, Tesla had a total shareholder return of -12.2% compared to the S&P500’s +5.06%, leading to an active return on the bearish view of +17.26%.

Thesis

Since my last update, Tesla’s operational performance has deteriorated even further than I had expected as I was surprised by further material price cuts in their vehicles. Due to this, I am more bearish on the stock’s longer term prospects. However, I am keeping a ‘Neutral/Hold’ stance as the stock is near technical support. My thesis is simple:

- Continued price cuts despite flat interest rates indicate microeconomic rather than macroeconomic issues

- Competitive threats in the EV OEM market are mounting

- The energy segment is a small silver lining

- Valuations are at precarious levels

- Technicals make a ‘Sell’ more risky

- Don’t ignore cash flow conversion drivers

Continued price cuts despite flat interest rates indicate microeconomic rather than macroeconomic issues

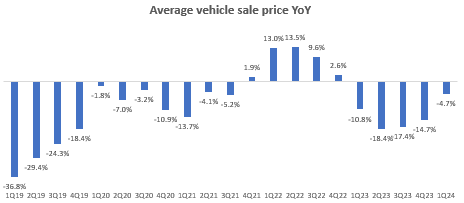

Tesla’s average sale prices of its vehicles sold has been falling for 5 consecutive quarters now:

Average Vehicle Sales Price YoY (Company Filings, Author’s Analysis)

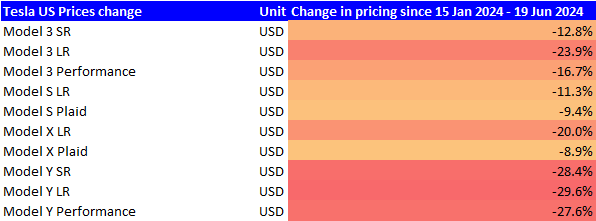

Since my last Tesla update on January 15 2024, the pricing cuts in the US (46% of overall revenue) have been drastic across all its models:

Tesla US Prices Change Summary (Tesla Website, Author’s Analysis)

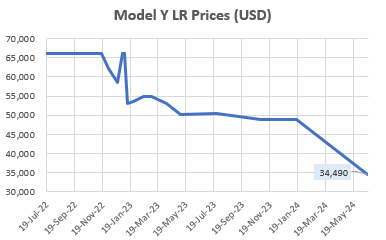

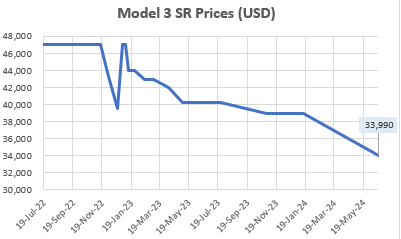

The Model 3 and Model are the most important as they make up more than 95% of total deliveries. Notice the sharpness of these pricing cuts compared to prior cuts:

Model Y LR Prices (USD) (Tesla Website, Author’s Analysis)

Model 3 SR Prices (USD) (Tesla Website, Author’s Analysis)

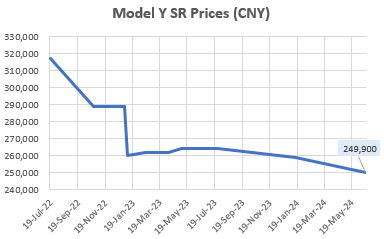

Also, it’s worth mentioning that these price cuts are not limited to the US. For example, the Model Y prices in China (almost 22% of total revenues) too have seen a drop, albeit not to the same extent:

Model Y SR China Prices (CNY) (Tesla Website, Author’s Analysis)

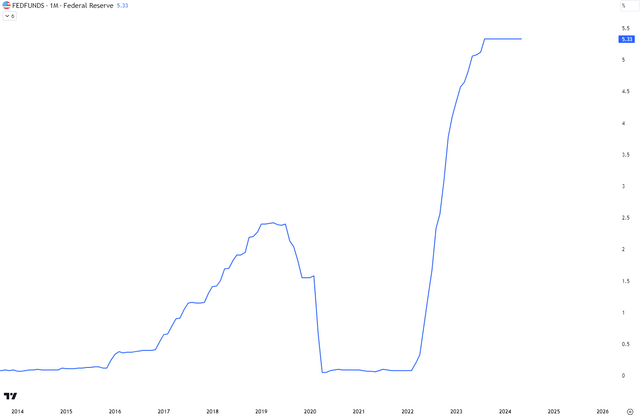

2 quarters ago in Q3 FY23, CEO Elon Musk had previously justified the pricing cuts, suggesting they were necessary to make cars more affordable as interest rates rise, since many people purchase cars with a vehicle financing loan. To some extent, I believed that narrative, which is why I was a bit surprised to see the recent sharp cuts in prices despite interest rates being stable this year:

Federal Funds Rate (TradingView)

Given this context, I think it’s becoming more clear that Tesla’s issues and need to cut prices are due to microeconomic not macroeconomic issues: demand is genuinely weak; it is not about adjusting for affordability.

Competitive threats in the EV OEM market are mounting

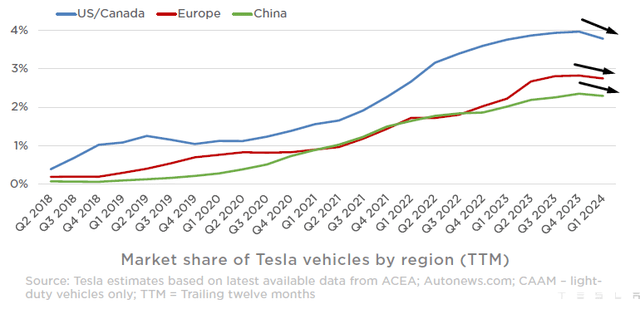

The reason for Tesla vehicles’ demand concerns is increasing competitive intensity from Tesla’s competitors in the EV OEM market. And Tesla is starting to lose the battle here as its market share has started falling again for the first time since early 2019:

Tesla Market Shares (Tesla Q1 FY24 Presentation)

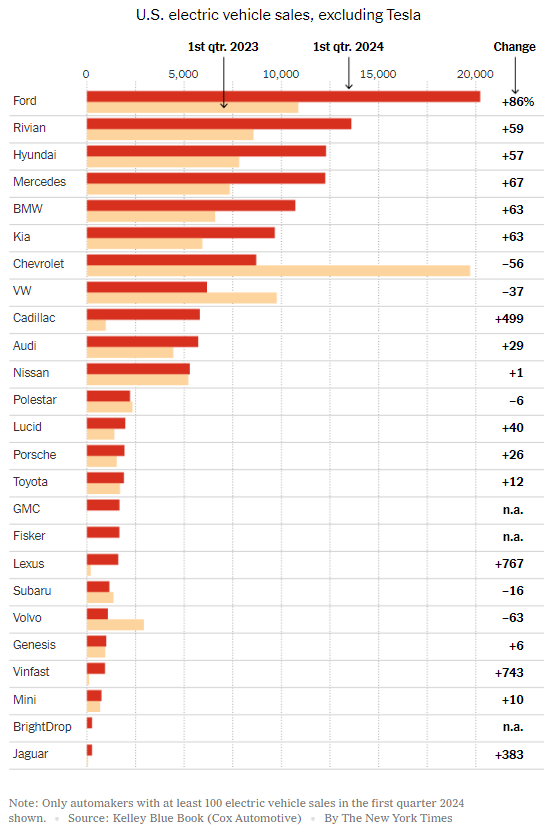

Note how the market share declines are broad-based across geographies. In Q1 FY24, Tesla’s total automotive sales revenue fell 12.8%. This was due to both volume effects of 8.5% and pricing effects as seen earlier. Now, management has cited some production delays as one reason for the volumes decline. But I believe the biggest reason is due to weaker demand. In contrast, many automakers have meaningfully ramped up YoY EV sales in Q1 FY24. Ford (F) is a notable highlight:

US EV Sales (Kelley Blue Book (Cox Automotive), New York Times)

In Europe, Volvo and Volkswagen are challenging Tesla’s leadership. In China, BYD and Nio are engaging in a price war against Tesla and winning. Also, the market is seeing new entrants as well as Xiaomi has recently entered the arena. Hence, I anticipate the competition to intensify in China, with Tesla continuing to lose share.

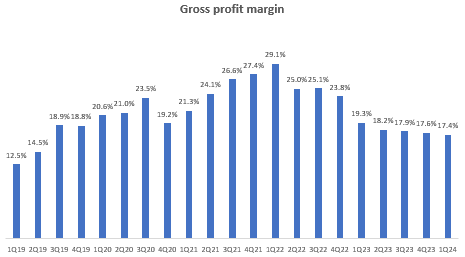

I mentioned the impact this is having on automotive sale and deliveries’ declines. But the most worrying part about higher competition and lower prices is its impact on gross margins:

Gross profit margin (Company Filings, Author’s Analysis)

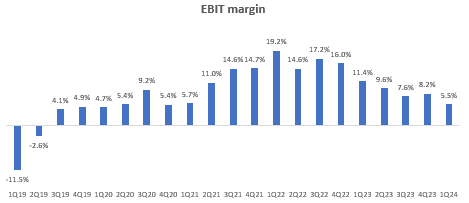

These pricing and volume headwinds are flowing down to the EBIT line as well:

EBIT Margin (Company Filings, Author’s Analysis)

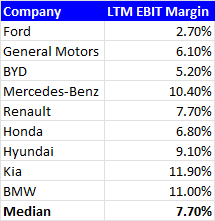

Tesla’s previously mid-high teens EBIT margins have normalized back down to the normal range for automotives; the mid-high single digits:

Automotive OEMs’ EBIT Margins (Company Filings, Author’s Analysis)

The outlook on volumes is also uninspiring as the company has admitted that they expect a volume growth rate “notably lower” than what they saw in 2023 (37.7% YoY for FY23). In the Q1 FY24 earnings call, an analyst asked whether the volume growth would be positive in FY24. I believe CEO Elon Musk exuded lower convinction in his response when he said, “I think we’ll have higher sales this year than last year.” I believe the tone here was quite different than that of his usual confident self.

The energy segment is a small silver lining

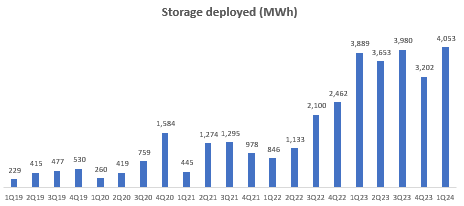

On the brighter side of things, Tesla’s energy segment is seeing good progress, with record battery storage deployments:

Storage Deployed (MWh) (Company Filings, Author’s Analysis)

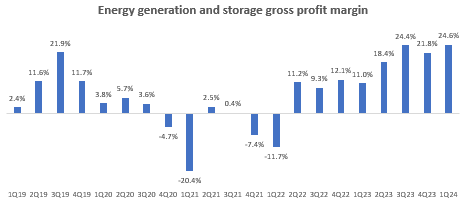

On the profitability front too, it is pleasing to see a steady growth over time:

Energy Generation and Storage Gross Profit Margin (Company Filings, Author’s Analysis)

I am bullish on this segment as the demand picture here is much brighter. Management expects a 75% YoY growth in FY24:

We expect the energy storage deployments for 2024 to grow at least 75% higher from 2023. And accordingly, this business will begin contributing significantly to our overall profitability.

– CFO Vaibhav Taneja in the Q1 FY24 earnings call

I want to highlight Elon Musk’s much more confident tone here regarding the energy business’ profitability:

[Profitability for the energy business]…looks likely to continue to increas[ing] in the quarters and years ahead. It will increase. We actually know that it will, so significantly faster than the car business as we expected.

– CEO Elon Musk in the Q1 FY24 earnings call

At the same time, it’s important to put things into context; the energy business is the much smaller piece, making up only 7.7% of revenues and 10.9% of overall gross profit in Q1 FY24. So overall, it’s not enough to offset the headwinds in the automotive business yet.

Valuations are at precarious levels

Despite the poor, overall operating performance in Tesla’s business today, investors seem to be banking a lot on longer term asymmetric growth opportunities from full-self driving robotaxis and Optimus humanoid robots (which Musk believes can make Tesla worth $25 trillion). Tesla currently trades at a very expensive valuation of 84.50x 1-yr fwd PE.

For my risk tolerance, I would rather invest upon early signs of tangible traction as opposed to immaterialized visions. Paying 84.5x earnings at this stage on something that isn’t yet real at a commercial stage is something I’m not willing to do.

Given these valuations above 50x earnings and the sage learnings from Wharton Professor Dr Jeremy Siegel, I think Tesla rather than NVIDIA (NVDA) has higher chances of being a 2000 Cisco stock.

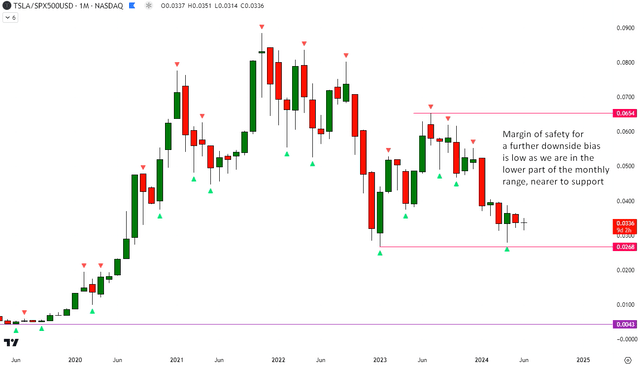

Technicals make a ‘Sell’ more risky

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of TSLA vs SPX500

TSLA vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Despite the weak operational performance and precarious valuation levels, the relative chart of TSLA vs the S&P500 (SPY) (SPX) shows me that the ratio prices are nearer to support in the broader monthly range. Hence, I believe the runway for bearish views is limited at these levels.

Don’t ignore cash flow conversion drivers

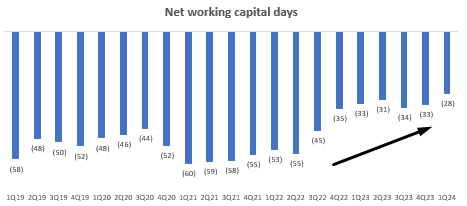

A key monitorable that I believe can provide additional color on the demand and pricing trends are the cash flow conversion metrics such as net working capital days. I notice that this has generally increased since late 2022, which implies worse cash flow conversion:

Net Working Capital Days (Company Filings, Author’s Analysis)

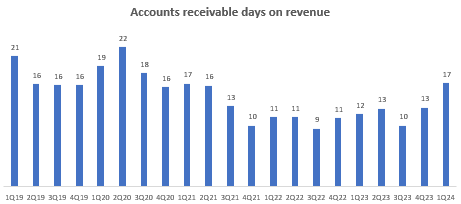

In Q1 FY24, there was a notable spike in receivable days from 13 to 17:

Accounts Receivable Days on Revenue (Company Filings, Author’s Analysis)

Sometimes, companies extend credit terms to customers to increase demand. I believe it is too early to tell, but I would be watching for continued increases in this figure to see if the company is sacrificing receivable days to support revenue growth.

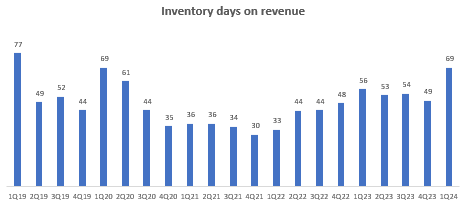

Inventory Days on Revenue (Company Filings, Author’s Analysis)

Tesla’s inventory days also saw a spike in the latest quarter from 49 to 69 days. In the Q1 FY24, management attributed this to a mismatch between production builds and deliveries. I believe this is a sign of volume expectation shocks. CFO Vaibhav Taneja assured us that the inventory buildup is expected to reverse in Q2 FY24:

We expect the inventory build to reverse in the second quarter and free cash flow to return to positive again.

– CFO Vaibhav Taneja in the Q1 FY24 earnings call

I will be checking to see if this occurs next quarter since if inventory remains high, that would likely be another sign of persisting volume issues, worse than what management expected.

Takeaway

Tesla has surprised me with even sharper pricing cuts in a stable rates environment, indicating that management’s prior justifications about ensuring affordability of vehicle-financed purchases amid interest rate hikes did not give the full story. It is becoming clear that the true reason for pricing cuts is that Tesla is facing fierce competition from competitors in all geographies, and losing, as evidenced by drops in market share. This has not only led to sales degrowth in the automotives business, but dragged down the company’s previously outsized EBIT margins back to automotive OEM industry norms.

Tesla’s energy generation business is a small silver lining and is expected to lead growth going ahead, with continued gross margin expansion from its current levels of mid-20s%. However, the contribution of that business is still small at sub-10%. Hence, it does not offset the weaker operational execution in the automotives business.

At a 1-yr fwd PE of 84.50x, investors seem to be banking highly on Tesla’s growth bets in full-self driving robo-taxis and Optimus humanoid robots, even when those projects have not become a commercial reality yet. I think this is a precarious price to pay.

However, I am not inclined to issue a ‘Sell’ view yet as from a relative technical analysis vs S&P500 standpoint, the stock is closer to support amid the broader monthly range, reducing the likely runway for bearish moves.

Overall, I think an investment today in Tesla would be betting heavily on an immaterialized future with a deteriorating present reality. And that is too risky for my liking.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.