Summary:

- Intel stock has plunged deep into a bear market, even as its semiconductor peers have powered to a new high.

- Intel is facing significant challenges across its ecosystem, undermining investor confidence.

- Nvidia is making a highly determined push to unhinge Intel’s traditional data center leadership.

- Nvidia’s ability to integrate across the stack could stretch the gap with Intel.

- I argue why investor sentiments on INTC have already turned bearish, making a potential turnaround increasingly unlikely.

hapabapa

Intel Stock Plunged Into A Bear Market

Intel Corporation (NASDAQ:INTC) stock has dropped into a deep bear market, down more than 40% from INTC’s December 2023 highs. I upgraded INTC stock in my previous update in early April 2024, anticipating Intel’s well-diversified business segments to provide buying support. However, the thesis has fallen apart as bearish momentum in INTC continued unabated through its recent May 2024 lows.

As a result, INTC has given up all its gains over the past year, notching a 1Y total return of -11.3%. In contrast, the VanEck Semiconductor ETF (SMH) recorded a breathtaking 1Y total return of more than 80%. Therefore, I assess that there’s no question that semiconductor investors have rotated out of INTC rapidly, emphasizing the market’s lack of confidence in Intel’s strategies.

INTC’s underperformance isn’t an understatement. Even Qualcomm (QCOM) stock has powered ahead with a total return of almost 95% over the past year. The cyclical recovery in the smartphone market has supported the valuation re-rating in QCOM. In addition, I believe Microsoft’s (MSFT) decision to partner more closely with Qualcomm to introduce Arm-based AI PCs could further threaten Intel’s weakening moat.

Intel: The Market Has Likely Lost Confidence

Intel is facing significant challenges across all its key product ecosystem. The AI PC upcycle is expected to provide a faster upgrade cadence through 2028. With INTC’s sum-of-the-parts valuation still mainly predicated on its Client Computing Group business, it should provide Intel with a more robust medium-term growth opportunity. However, Apple’s (AAPL) entry into the Generative AI era with Apple Intelligence could drive an upgrade cycle in Apple devices, undermining Intel’s growth opportunities. Therefore, with Qualcomm’s entry to leverage its expertise and edge in mobile computing, the market is likely more concerned with Intel’s execution risks.

Moreover, Intel needs to contend with a much stronger Nvidia (NVDA) that is committed to furthering its dominance in AI data center infrastructure. Intel CEO Pat Gelsinger highlighted Intel’s supposed TCO advantages in GenAI computing against Nvidia’s H100 architecture. However, Nvidia’s next-gen AI architecture is expected to entrench its leadership position.

In addition, Nvidia’s ecosystem has gone further beyond just chips and software (Cuda). Nvidia has expanded its networking opportunities (Ethernet and InfiniBand). Even Broadcom (AVGO) monitors Nvidia’s forays closely, suggesting the King of AI is further integrating its tech stack. Nvidia is also working to build rack servers for the hyperscalers, venturing into market opportunities typically dominated by companies like Supermicro (SMCI). As a result, I assess Intel’s competitive moat against Nvidia could weaken further if data center spending continues rotating away from its CPU-based infrastructure.

Intel Foundry’s Uncertain Spending Outlook

Intel Foundry could become a key valuation driver for INTC. However, TSMC’s (TSM) leadership position has been strengthened by TSMC’s partnership with Apple and Nvidia in the AI era. These market leaders must capitalize on the AI growth momentum quickly, underscoring the criticality of securing sufficient capacity with the foundry market leader. As a result, Intel might find it increasingly challenging to dislodge TSMC even as it aims to regain foundry leadership.

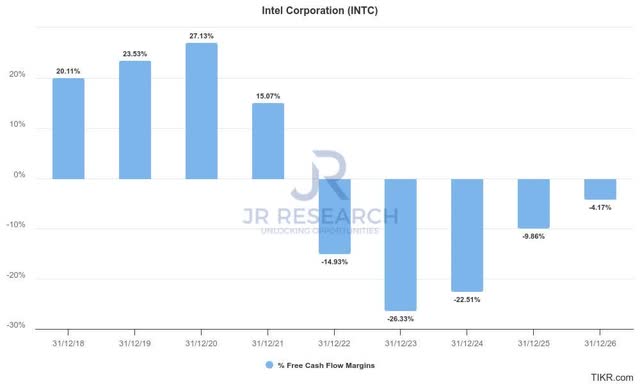

Intel free cash flow margins estimates % (TIKR)

Moreover, the uncertain spending and funding outlook could impact Intel’s free cash flow growth potential in the medium term, lowering investor sentiments. As seen above, Intel’s free cash flow margins are expected to remain in negative territory through FY2026.

Asking Intel investors for patience is likely getting increasingly challenging as the NVDA surge left them behind. Given Intel’s transition challenges, I don’t expect semiconductor growth investors to return aggressively to INTC. In addition, INTC’s forward dividend yield of 1.6% offers little comfort for income investors, who can obtain a much higher ROI with the 2Y (US2Y) printing at 4.73%.

INTC: Still Not Undervalued

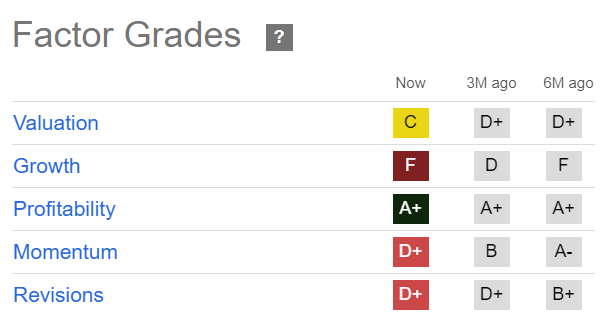

INTC Quant Grades (Seeking Alpha)

As a result, INTC’s “C” valuation grade is apt, suggesting the previous surge toward the $50 level overstated INTC’s recovery. The company has failed to convince semi-investors that it has the necessary execution capabilities to overcome Nvidia’s aggressive forays to proliferate the buildout of AI data centers.

The lack of confidence in Gelsinger’s transformation is telling, as INTC’s “D+” momentum underscores INTC’s reversal from bullish (“A-” grade) to bearish momentum. It offers little consolation for INTC holders, witnessing its plunge to a 1Y low while SMH has continued to power to new highs.

Wall Street has also downgraded Intel’s estimates, underscoring the immense challenges Gelsinger and his team face.

Is INTC Stock A Buy, Sell, Or Hold?

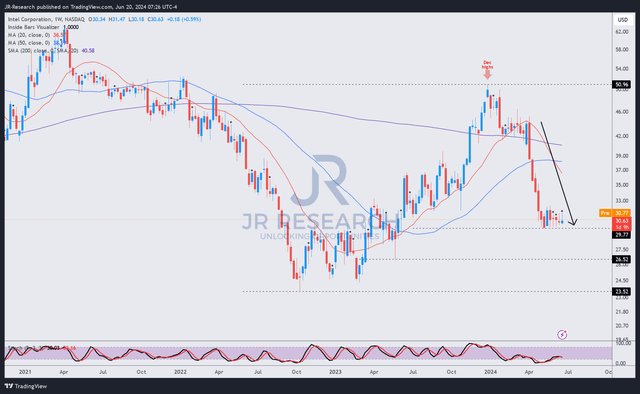

INTC price chart (weekly, medium-term, adjusted for dividends) (TradingView)

INTC’s drop into a 1Y low was rapid, as sellers quickly rotated out of INTC over the past two months. I assess that INTC’s selling intensity has subsided, suggesting it could be too late to turn bearish.

INTC has found buying support above the $30 zone, although momentum has remained tepid over the past eight weeks. While a near-term mean reversion could still occur, INTC’s trend bias is assessed to have reversed to a bearish downtrend.

As a result, I assess that the bullish thesis in INTC has weakened significantly over the past few months. Nvidia’s incredible growth inflection is unprecedented, which could further impact Intel’s data center market share. Intel’s ability to convince customers about its GenAI capabilities while winning orders for Intel Foundry could also stretch its focus too thin.

Therefore, maintaining a bullish rating on INTC is increasingly challenging, even though a near-term bottom is assessed.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, TSM, SMH, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!