Summary:

- Block Stock has dropped into a deep bear market.

- Block has demonstrated its ability to improve its profitability as it scales.

- SQ’s PEG ratio has dropped to highly attractive levels, suggesting the market seems too pessimistic.

- I argue why the market’s misunderstanding has created another attractive opportunity for investors to buy more. Read on.

peshkov

Block Stock Plunged Into A Bear Market

Block, Inc. (NYSE:SQ) investors aren’t new to intense market volatility. As a reminder, SQ is still down almost 80% from its 2021 highs. Therefore, I’m not surprised by the bear market decline since SQ topped in March 2024, declining nearly 30% since then. SQ has also underperformed since my previous article in April. I reiterated my bullish SQ rating and expected buying momentum to remain robust. While I recognized Block’s more intense competitive challenges, I highlighted that the fintech company has also demonstrated its business model.

Despite that, SQ’s bearish sentiments were exposed as selling intensified. SQ’s “D” momentum grade currently corroborates the lack of buying sentiments on SQ, although a possible bottom could be forming. I assess that SQ’s decline has reached a critical support level, which could attract more robust dip-buying fervor to return, bolstering SQ’s ability to bottom.

Block Is Scaling Its Fintech Ecosystem Well

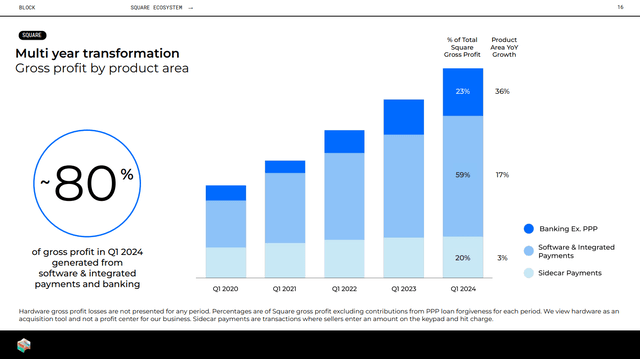

Square gross profit transformation (Block filings)

Block’s Q1 earnings release underscores the increasing scale of Block’s consumer and merchant ecosystem. Block has moved past being solely a peer-to-peer consumer network (Cash App) or a simple transaction platform for merchants (Square). As a result, Square has executed a “multi-year transformation,” leading to a surge in gross profit attributed to higher-valued services.

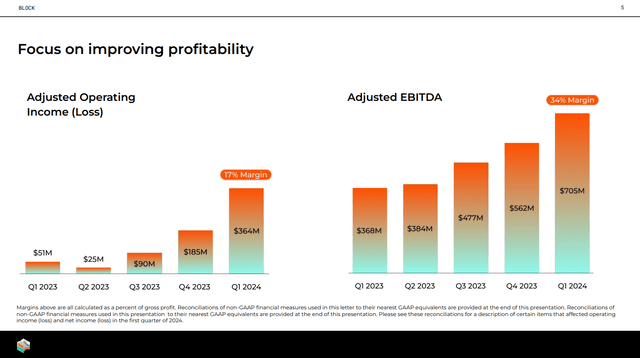

Block financial performance (Block filings)

Consequently, it has also helped Block achieve marked improvements in its profitability growth inflection, leading to a surge in adjusted EBITDA in Q1.

Block CEO Jack Dorsey has also intensified its efforts to become an increasingly important player in Bitcoin. Despite that, Dorsey emphasized that “less than 3% of Block’s resources are dedicated to Bitcoin.” As a result, Dorsey intends to correct the market’s misunderstanding of Block’s business model, even as it is committed to investing more aggressively in its Bitcoin platform.

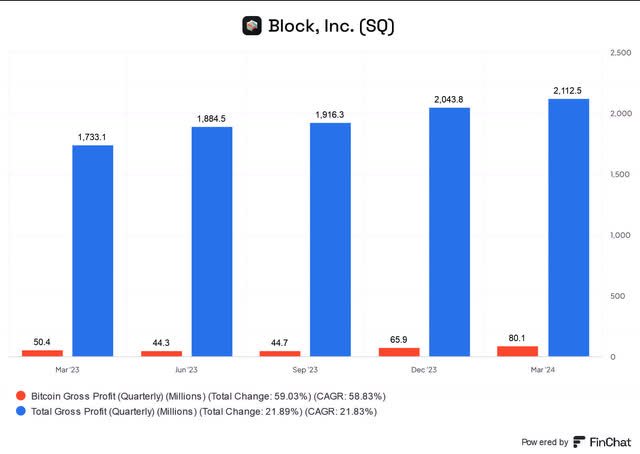

Block gross profit segmentation (FinChat)

Block telegraphed its plans to adopt a dollar-cost average approach to Bitcoin investing. Accordingly, Block would invest “10% of its gross profit from Bitcoin products into Bitcoin each month.” Despite that, investors should note that Bitcoin is considered a strategic investment opportunity for Block. As seen above, Bitcoin accounted for just under 4% of Block’s overall gross profit in Q1. As a result, SQ investors should focus on Block’s progress in its integration with its merchant and consumer ecosystem.

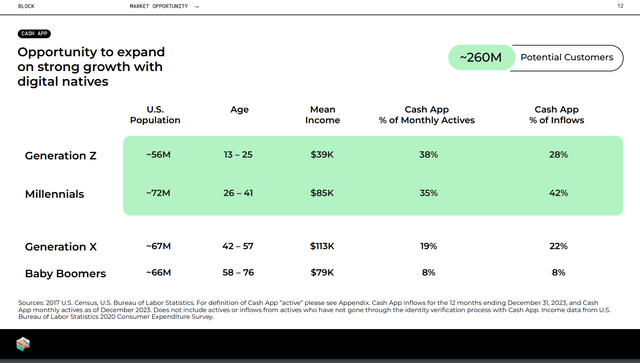

Cash App customers (Block filings)

Dorsey underscored Cash App’s monetization potential. He highlighted that the platform’s “flexibility and experimentation” allow Block to vary its monetization and acquisition strategies. As a result, it helps Block to customize its plan to move faster and more effectively than traditional financial institutions.

In addition, Block believes Cash App has significant potential, given the penetration observed in Gen Z and Millennials customers. With the opportunity to move to higher-income customers, Block’s ability to continue gaining market share will likely be crucial to SQ’s valuation re-rating potential.

SQ Stock: PEG Ratio Is Attractive

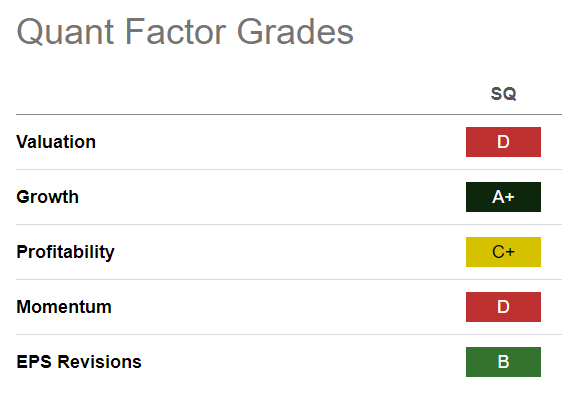

SQ Quant Grades (Seeking Alpha )

SQ is still rated as a top-growth pick (“A+” growth grade) compared to its sector peers. Wall Street is also confident that further integration could translate into a robust growth inflection in Block’s gross profit. Therefore, I urge investors to assess SQ’s valuation appropriately to consider its growth prospects.

SQ’s forward adjusted PEG ratio of 0.45 is well below its sector median of 1.13. Therefore, I assess the market as being too pessimistic about Block’s opportunities, although there are reasons to be concerned.

Accordingly, Apple Pay’s (AAPL) recent integrations highlight Apple’s ambitions in the financial services space. Therefore, more intense challenges with the Cupertino company could weaken Block’s ability to attract iOS users away from Apple’s walled garden.

In addition, there is increased regulatory scrutiny over Block’s compliance and the BNPL’s industry lending practices. Block investors must consider these challenges carefully when assessing SQ’s growth inflection.

Is SQ Stock A Buy, Sell, Or Hold?

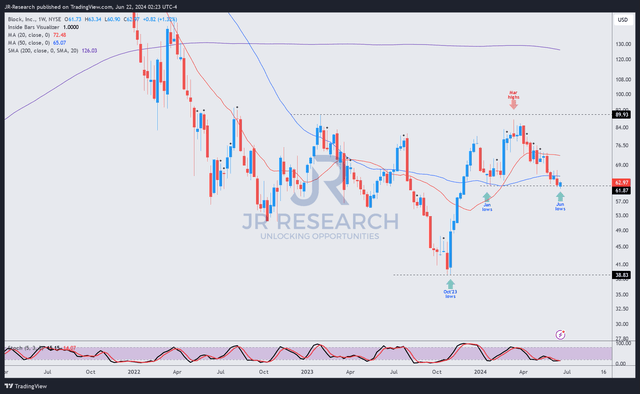

SQ price chart (weekly, medium-term) (TradingView)

SQ’s price action indicates a potential bottom above the $60 level. It’s a pivotal zone support that experienced robust buying sentiments in January 2024.

SQ’s uptrend bias has remained intact, but decisively losing the $60 level could renew intense selling momentum, as dip-buyers from its January lows could exit quickly.

SQ’s $90 resistance zone has not been breached since August 2022. As a result, investors should be wary about chasing possible upside closer to that level until the resistance zone has been decisively broken.

I view SQ’s PEG ratio favorably after the battering over the past few months. A more competitive fintech landscape is assessed to be Block’s most significant risk factor. However, Block’s GAAP profitability achievement while scaling up has demonstrated the potential of its business model.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!