Summary:

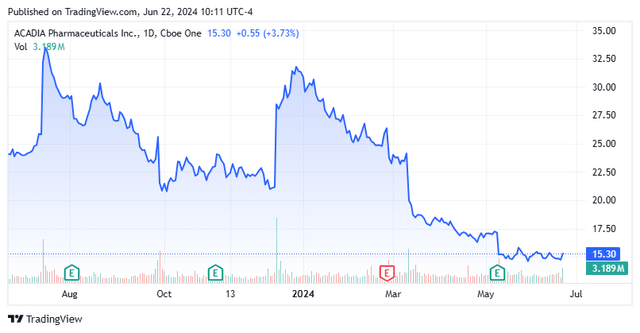

- Acadia Pharmaceuticals, Inc. shares recently hit their lowest level since Daybue approval due to Nuplazid Phase 3 trial failure for schizophrenia.

- Despite setbacks, Acadia has strong financials with $470.5 million in cash and investments, and is trading at two times FY24 revenue net of cash.

- An updated analysis around Acadia Pharmaceuticals follows in the paragraphs below.

ktsimage

Shares of central nervous system therapy concern Acadia Pharmaceuticals, Inc. (NASDAQ:ACAD) have recently fallen to their lowest level since its second commercial asset, Daybue, was approved. The main impetus for the decline was the failure of its other commercial product (Nuplazid) in a Phase 3 label-expansion trial for negative symptoms of schizophrenia. With a potential gene therapy threat to Daybue in early-stage studies but trading at two times FY24E revenue net of cash, Acadia merited another look.

When we last reported on Acadia in January 2023, it had two commercial assets, Nuplazid and Daybue, the latter of which had just launched in Q2’23. Nuplazid was a solid candidate for label expansion after sailing through a Phase 2 trial for the treatment of negative symptoms associated with schizophrenia (p=0.0065). With Phase 3 results a quarter away, a strong ramp for Daybue setting up FY24 combined sales approaching $1 billion, two mid-to-late stage candidates in the clinic, and $345.9 million in the bank, Acadia appeared a solid investment at ~$21 per share, or ~$3.5 billion. However, since then, shares are off ~30%, warranting a reassessment.

As a reminder, Acadia Pharmaceuticals, Inc. is a San Diego based commercial-stage biopharmaceutical concern focused on the development of therapeutics for the treatment of central nervous system disorders and other rare diseases. The company markets two products and is advancing two mid-to-late-stage clinical programs. Acadia was founded as Receptor Technologies in 1993, changed to its current moniker in 1997, and went public in 2004, raising net proceeds of $31.1 million at $7 per share. The stock trades just over $15.00 a share, translating to a market cap of $2.5 billion.

May 2024 Company Presentation

Commercial Assets:

May 2024 Company Presentation

Nuplazid. Until 2023, the company’s sole clinical success was Nuplazid (pimavanserin), a serotonin inverse agonist/antagonist that specifically targets 5-HT2A receptors, which is the one and only approved treatment for hallucinations and delusions associated with PDP. Launched in 2016, it generated FY23 sales of $549.2 million, up 6% from $517.2 million in FY22. Expectations for label expansion were dashed when pimavanserin profoundly flunked (p=0.4825) a Phase 3 study for the aforementioned negative symptoms of schizophrenia indication in March 2024. After failing to add dementia-related psychosis to its indications in 2021, this latest setback impelled Acadia to terminate any label expansion efforts for pimavanserin. The market responded in kind, selling shares of ACAD 17% lower to $19.98 in the subsequent trading session and triggering a downgrade from Mizuho, citing a lack of upcoming catalysts.

Nuplazid was also facing generic challenges in the court, and although cases are still outstanding, the U.S. District Court for the District of Delaware confirmed the validity of its composition of matter patent in December 2023, safeguarding Acadia until 2030.

Daybue. In March 2023, Acadia obtained a second approval when Daybue (trofinetide) became the first-ever treatment approved (in patients two years of age and older) for Rett Syndrome, a dreadful neurological disorder characterized by seizures, inability to speak, loss of hand function, disorganized breathing patterns, sleeping issues, and scoliosis. It typically impacts infant girls between 6 and 18 months of age. Although the symptoms sounds like a vaccine adverse reaction, Rett syndrome is caused by mutations on the X chromosome on the MECP2 gene and occurs in one in every ~10,000 to ~15,000 female births, making it the second most common cause of severe intellectual disability in females. It afflicts ~350,000 worldwide with ~5,000 confirmed cases in the U.S., although the latter figure may be as high as ~11,000. Before the approval of Daybue, the malady was treated with antiepileptics, antipsychotics, antidepressants, and benzodiazepines.

Designed to reduce neuroinflammation and support synaptic function, Acadia’s twice-daily, amino-terminal tripeptide of insulin-like growth factor 1 oral analog accounted for sales of $23.2 million in Q2’23, $66.9 million in Q3’23 (up 188% sequentially), and $87.1 million in Q4’23 (30%). As of March 31, 2024, over 1,300 (~860 active), or approximately one in every four American patients diagnosed with Rett syndrome, were on Daybue. It should be noted that the therapy is menaced by GI issues (namely, diarrhea and vomiting), compressing real-world persistency rates to 58%, with 40% who initiated treatment during its pivotal trial still on therapy.

As for international expansion, trofinetide approval is expected in Canada near YE24 and a registrational filing is anticipated for Europe in Q1’25.

Because of Daybue’s low persistency rates, there is still an unmet need in the indication. And until January 2024, the therapy had faced clinical competition from two biotechs. However, after Avanex’s (AVXL) AVANEX 2-73 failed to meet both primary endpoints in a Phase 2/3 study readout in January 2024, the field was effectively narrowed to one gene therapy candidate. Although very early stage, Taysha Gene Therapies’ (TSHA) low dose TSHA-102 demonstrated encouraging efficacy in two Rett patients at 19 and 35 weeks without triggering any treatment-related adverse events in a Phase 1/2 study. Additional low-dosedata came out last week and failed to impress the market.

Daybue was in-licensed from Neuren Pharmaceuticals (OTCPK:NURPF) in 2018 for $10 million upfront, $455 million in potential milestones, and tiered, double-digit royalties. Initially providing Acadia with just North American commercial rights, the deal was amended in July 2023 to include the rest of the world, as well as worldwide rights to Neuren’s early-stage development asset NNZ-2591 – a potential improvement over Daybue – for Rett syndrome and Fragile X syndrome indications, in exchange for: $100 million more upfront; additional potential milestones of $426.3 million on trofinetide; potential milestones of $831.1 million on NNZ-2591; and double-digit royalties.

Clinical Programs

In terms of Acadia’s mid-to-late-stage clinical assets, they continue to enroll patients in their respective trials.

ACP-101. The failure of pimavanserin in March 2024 left ACP-101 (intranasal carbetocin) as the company’s most advanced clinical asset. It is an analog of oxytocin that was onboarded via its acquisition of Levo Therapeutics in June 2022. Acadia initiated a Phase 3 study (COMPASS PWS) in November 2023 to evaluate ACP-101 in the treatment of hyperphagia (lack of satiety) in Prader-Willi syndrome [PWS], a neurobehavioral genetic disorder that afflicts 8,000 to 10,000 Americans with no FDA-approved remedy. It should be noted that the primary endpoint in COMPASS PWS (separation versus placebo on a hyperphagia questionnaire) is the same as a successful Phase 3 study conducted by Levo.

ACP-204. Acadia’s other mid-to-late stage program is ACP-204, an inverse agonist of the 5-HT2A receptor that is being evaluated in a Phase 2/3 study for Alzheimer’s disease psychosis. The Phase 2 portion, which initiated in November 2023, is expected to enroll 318 patients, and assess two doses (30mg and 60mg) of ACP-204. Like ACP-101, owing to its recent trial launch, there is no timeline for data with best guestimates in Q4’25 or 2026.

Q1’24 Financials

With revenue from Nuplazid seemingly limited to its longstanding indication of hallucinations and delusions associated with PDP, Acadia reported Q1’24 financials on May 8, 2024, posting earnings of $0.10 a share (GAAP) on revenue of $205.8 million versus a loss of $0.27 a share (GAAP) on revenue of $118.5 million in Q1’23. Although the bottom line was $0.05 better than expectations, the top line was $2.8 million shy. The culprit was Daybue sales, which, at $75.9 million, represented a 13% sequential decline over Q4’23. Seasonality was blamed, with fewer clinic days and patient visits, as well as issues surrounding beginning of the year insurance reauthorization and re-enrollment. By contrast, Nuplazid net product sales were up 10% year-over-year at $129.9 million.

May 2024 Company Presentation

Even though management reiterated its FY24 top line guidance of $970 million, comprised of $575 million in Nuplazid sales and $395 million from Daybue, as well as operating expenses of $782.5 million – all based on range midpoints – the market was skeptical, selling shares off 11% in the subsequent trading session. Already in decline since the Phase 3 trial flop in March 2024, shares of ACAD closed at $14.85 on May 16, 2024, representing their lowest level since Daybue’s approval.

May 2024 Company Presentation

Balance Sheet & Analyst Commentary:

The company’s balance sheet is pristine, with cash and investments of $470.5 million versus no debt as of March 31, 2024. It neither repurchases shares nor pays a dividend.

The lack of confidence in management’s outlook was exemplified by five Street analysts lowering their price objectives after its reiteration, moving the median target from $30 to $27. That said, they still lean strongly positive on Acadia’s prospects, featuring 13 buy or outperform ratings against five holds and one underperform. On average, they expect the company to earn $0.58 a share (GAAP) on revenue of $954.0 million in FY24, followed by $1.13 a share (GAAP) on revenue of $1.07 billion in FY25.

Verdict:

With nearly $1 billion of projected FY24 net revenue and cash of $470.5 million, shares of ACAD are trading at approximately two times FY24 revenue, suggesting a significant level of pessimism. Part of that negativity surrounds TSHA-102. If updates are positive, Acadia’s future revenue stream from Daybue could eventually be in jeopardy. Factor in Acadia’s lead product coming off patent in 2030 and suddenly the company is considerably less attractive to a potential suitor.

May 2024 Company Presentation

That said, even if Daybue’s net sales were removed from the algebra – something that has little chance of occurring before 2027 – shares of ACAD are trading at 3.5 times Nuplazid FY24E sales net of cash, with a free option on ACP-101 and ACP-204. The suggestion here is that the pessimism surrounding Acadia is overdone, providing an asymmetrical risk/reward profile with greater upside than downside. As such, a covered call strategy appears prudent.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ACAD, TSHA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Live Chat on The Biotech Forum has been dominated by discussion of lucrative buy-write or covered call opportunities on selected biotech stocks over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.