Summary:

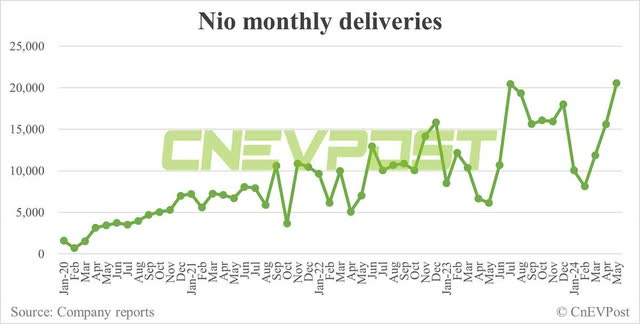

- NIO shipped 20,544 vehicles in May, a significant increase from just three months ago.

- Despite delivery and margin improvements, NIO is still struggling with profitability, affecting its stock performance.

- NIO’s low valuation and potential for sales multiple increase suggest a high margin of safety for investors.

Victor Golmer

NIO Inc. (NYSE:NIO) shipped shipping a total of 20,544 vehicles in May, a healthy number considering that the company’s deliveries dipped below 10,000 monthly deliveries just three months ago.

Robust deliveries for May came out just days before NIO released first quarter earnings that showed some healthy improvement in terms of margins. On the flipside, NIO is still not seeing substantial improvements as far as its total profitability is concerned, which I think is holding the stock back.

With that said, though, NIO’s delivery upswing plus an improvement in margins paint a more positive picture than the market appears willing to accept.

Since the sales multiple for NIO remains extraordinarily low, I think the valuation reflects a very high margin of safety presently.

My Rating History

I have been critical of NIO for a long while, but modified my stock classification for the electric-vehicle company in December of last year from ‘Hold’ to Buy after CYVN Holdings invested in NIO.

My optimism grew after NIO slashed its delivery forecast for the first quarter, leading to exaggerated pressure on the electric-vehicle company’s stock which triggered a ‘Strong Buy’ classification.

NIO’s delivery rebound in May as well as growth in margins are why I continue to think that NIO is undervalued, despite a disappointing stock price performance as of late.

NIO Is Enjoying A Substantial Delivery Rebound

NIO has been a big disappointment in terms of stock price performance, but I think that the stock trend will ultimately follow NIO’s delivery trend. And from this angle, the situation at the Shanghai-based company is not looking nearly as dire as some analysts would want you to believe.

NIO’s deliveries skyrocketed in the last three months, recovering from less than 10,000 units in February to more than 20,000 units in May. Deliveries increased three months in a row as NIO rebounded from a seasonally-weak first quarter.

NIO Monthly Deliveries (NIO Inc)

In addition to the resuscitation of deliveries, NIO is making some progress in terms of margins, a much-watched figure for electric-vehicle companies, most of which don’t turn a profit yet.

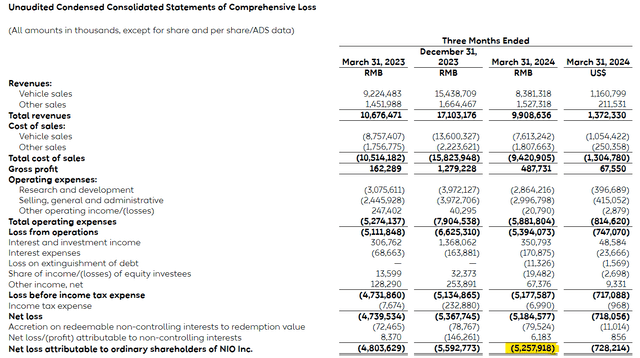

To gauge profitability, we can look at NIO’s vehicle margin which gets reported explicitly each quarters. This margin is calculated by subtracting the cost of goods sold from revenues and dividing this number by revenues. In short, the resulting percentage shows how much money the company is making on each new vehicles sales.

In 1Q24, NIO’s margins amounted to 9.2%, reflecting a 270 basis point change compared to 4Q23, but also a positive 410 basis point swing compared 1Q23 which is when vehicle margins were just 5.1%.

Though the trend in margins is encouraging, as is NIO’s 3-months streak of consecutive delivery growth, NIO is not doing great at all in terms of delivering profits.

NIO Is Still Losing Too Much Money

Electric-vehicle companies around the world are not particularly profitable and this is probably an understatement. U.S. electric-vehicle companies, Tesla Inc. (TSLA) excluded, are not profitable and are losing money for each electric-vehicle they are shipping to customers.

NIO, in this regard, is not an exception and the loss situation at the company is a potential headwind that could stand in the way of the stock re-rating higher.

In the first quarter, NIO lost a substantial amount of money, again, and this is probably the reason why the stock has disappointed as of late. In 1Q24, NIO lost RMB5.26 billion which equates to $728 million. This is a considerable amount of money, even for a company that has managed to grow its deliveries back to more than 20,000 units per month.

In the prior year, NIO lost RMB4.80 billion which comes out to $700 million. Put simply, the profit situation for NIO has not much improved at all in the last year and the electric-vehicle company is probably going to raise more cash in order to finance the ongoing ramp, which soon will include electric-vehicles that are shipping under the name of a new EV brand.

My Take On Onvo

Onvo is NIO’s new low-price electric-vehicle brand the company seeks to leverage to mount a challenge on Tesla’s leading market position in China. Personally, I don’t like low-price brands, primarily because they tend to be a weight on margins which is the least NIO needs right now.

NIO’s first Onvo product, the L60, which is a family-focused electric mid-size SUV with 455 horsepower, is anticipated to ship in September and went on pre-sale in May. The L60 went on pre-sale at a starting price of 219,900 Yuan (30,500 USD) which is poised to make the SUV one of the most affordable options in China’s mid-size SUV market.

Taking into account that NIO is still losing a lot of money on its existing EVs, I am not sure that the start of a low-price brand is in the long-term strategic interest of NIO, particularly from a margin point of view.

NIO’s Sales Multiple Implies A High Margin Of Safety

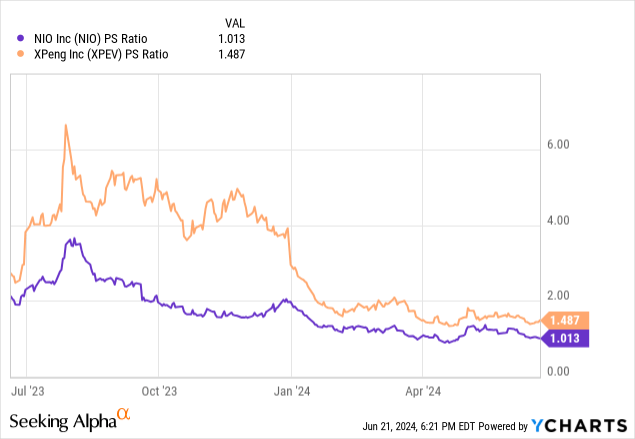

NIO is hardly alone in seeing pressure on its valuation. This year alone, NIO’s valuation has decreased 52%, XPeng (XPEV) is down 49% and Rivian Automotive Inc. (RIVN) lost 56% of its value. These performance metrics indicate growing headwinds for the global EV industry at large which is grappling with moderating demand for electric-vehicles and, yes, lower EV prices.

These trends have taken a toll on NIO’s valuation and the electric-vehicle company is now selling for a sales multiple of 1.01x, based on 2024 anticipated sales.

XPeng, which is also unprofitable, and has a lower vehicle margin of 5.5%, sells for a 1.48x sales multiple. Thus, has higher EV margins and a lower valuation based on sales, so I am more comfortable owning NIO, even though the company is still losing a lot of money.

I think, in the long-run, taking into account the upward trajectory of NIO’s sales and deliveries, that NIO could sell for 2.0x sales (implied stock price $8.00) and would deserve so if NIO made progress in terms of lowering its operating losses.

Why The Investment Thesis Might Disappoint

I explained why I am cautious about the kick-off of the Onvo brand and I am cognizant of profitability challenges that have so far not been resolved.

Consequently, investors taking a risk on NIO, or any other EV company, may be well advised to pay close attention to the profit trajectory and new vehicle margins, as they are probably the two most important metrics for investors. Any weakness here, and the stock multiple may see a new round of compression.

My Conclusion

There are two competing trends in NIO’s business. On one hand, deliveries are seeing upside momentum, with shipments soaring back to more than 20,000 units in May (marking the third straight month of growth) and NIO is enjoying margin growth.

Counteracting these trends is a very soft profit situation as well as the start of the low-price Onvo brand which I am not a big fan of as I think it could create new headwinds for the electric-vehicle company’s margins.

What moves the needle here for me, in terms of reaffirming my ‘Strong Buy’ stock classification, is the valuation: NIO has sold for substantially higher sales multiples in the past which is when investors were more bullish about EV companies generally.

I think that the out-of-favor characteristic of NIO only helps to make the value proposition more compelling and I think that the valuation implies a high margin of safety also.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.