Summary:

- Palatir remains favored due to the potential for generative AI to accelerate growth, and we have signs of that acceleration in revenue and RPOs.

- Ongoing customer growth in the commercial business appears to be spearheading a strong acceleration in revenues.

- The stock is pricing a lot in, and I look at various scenarios to determine if the stock is a buy today.

Tasos Katopodis/Getty Images Entertainment

Palantir (NYSE:PLTR) remains a heavily favored stock due to hopes that generative AI will eventually supercharge revenue growth rates. The company has seen some acceleration in growth this year, as well as solid growth in remaining performance obligations. The rapidly rising customer count may indeed lead to a sharp acceleration in growth at some point, but the stock has priced this in given the rich valuation. The net cash balance sheet and GAAP profitability help to de-risk the thesis, but this is one of those moments where we must exercise discipline and sit the fun out. I reiterate my neutral rating on the stock.

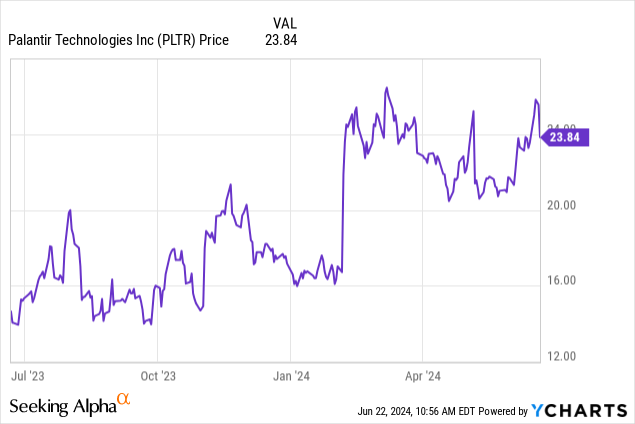

PLTR Stock Price

I last covered PLTR in April, where I explained why I sold my shares. The stock has since kept up with the broader market.

At some point, the pull-forward in stock returns may hold back future return potential.

PLTR Stock Key Metrics

PLTR is a government and enterprise tech company focused on helping customers to use their data for applications such as artificial intelligence. The company has a strong reputation in this field, being a preferred tech partner of the US Army.

The company has responded to the rise of generative AI by hosting AIP boot camps, in which the company helps prospective customers to see how PLTR can help implement AI applications for their personal use cases.

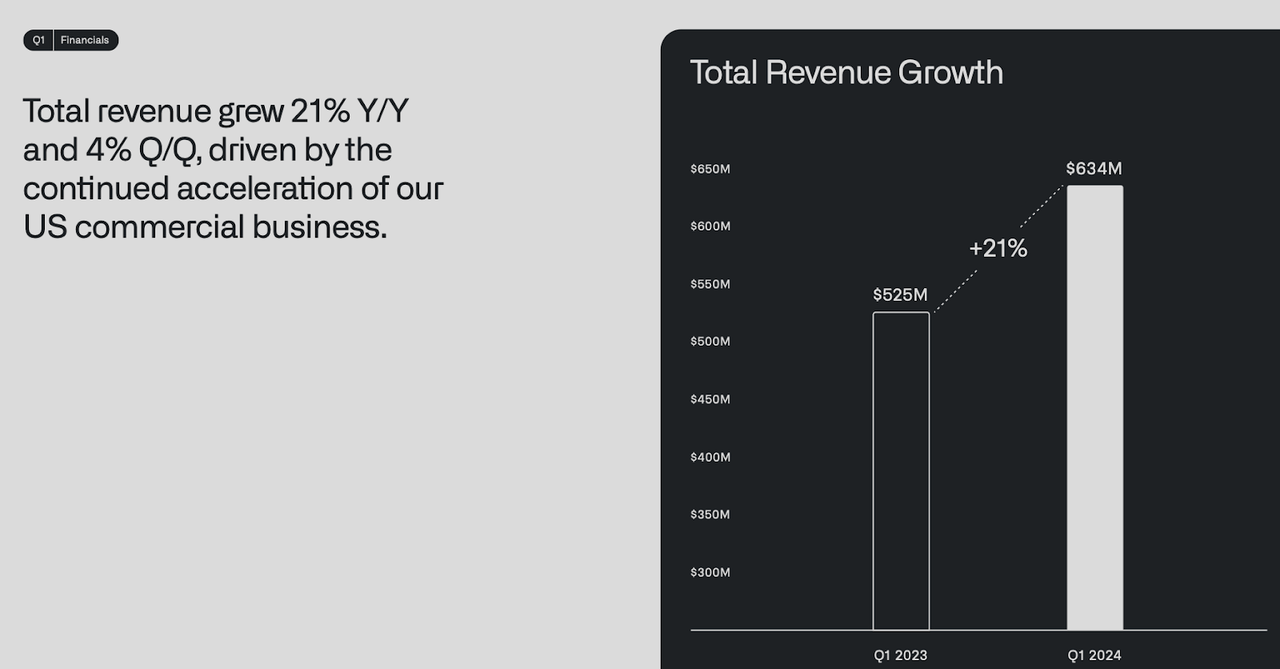

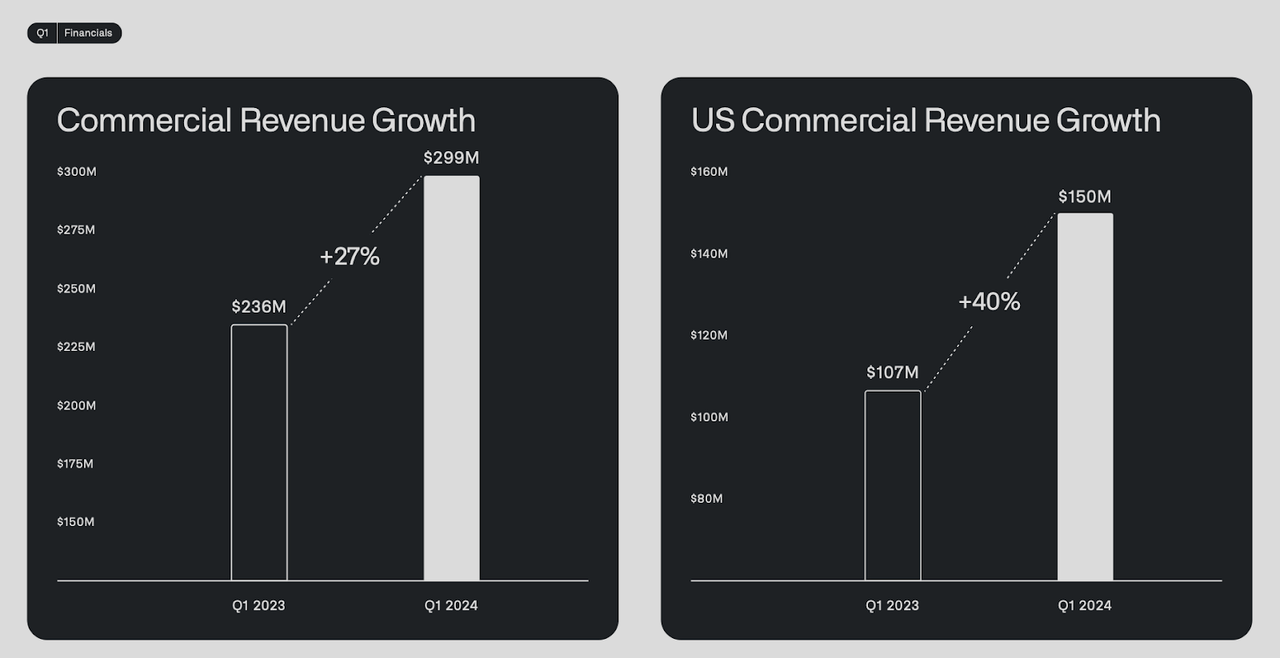

These efforts appear to be working, as acceleration in the US commercial business helped drive 21% YoY revenue growth.

The commercial business grew by 27% YoY, 40% growth in the US.

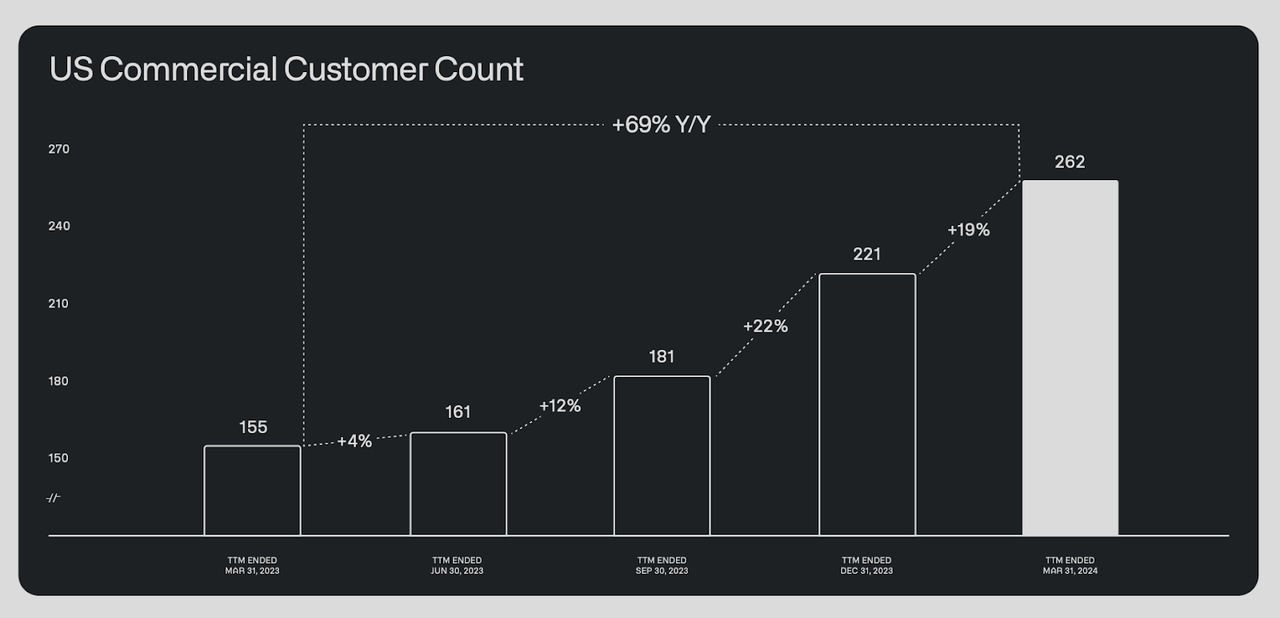

PLTR saw US commercial customers grow 69% YoY, potentially indicating long-term growth potential (but it should be assumed that most of these new customers remain quite small in spending).

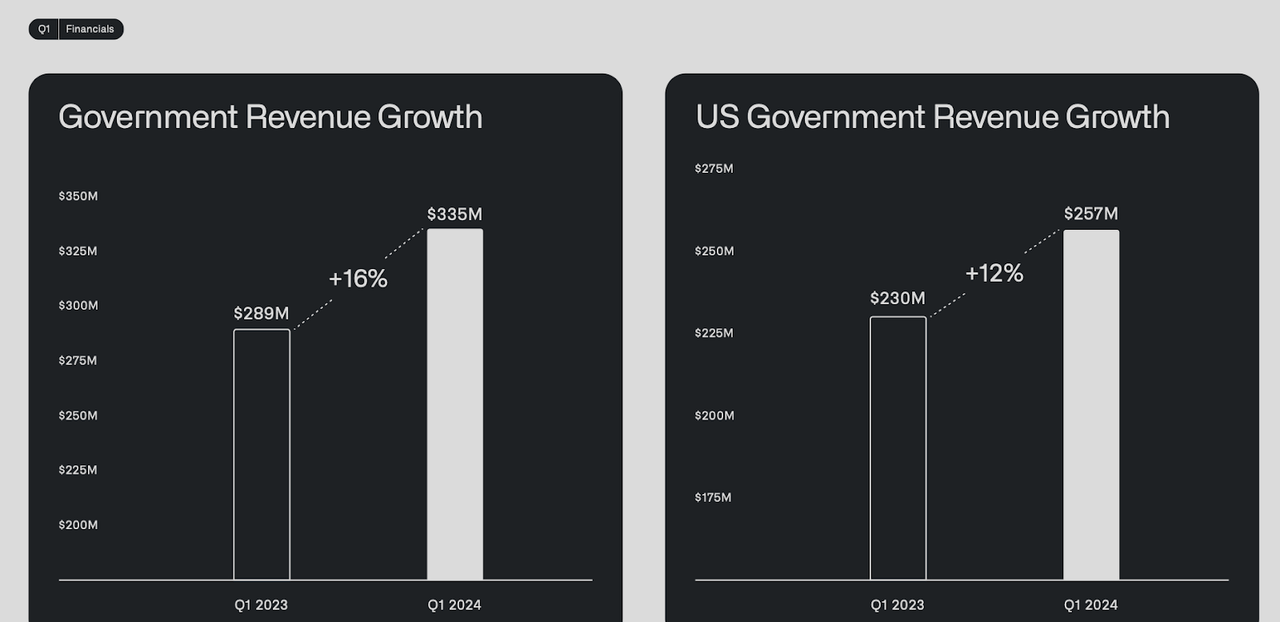

Government revenues grew by only 16% YoY. I view this segment to be of the utmost quality, but it cannot be denied that it might drag on overall growth rates for many years, as it still makes up over 50% of overall revenues.

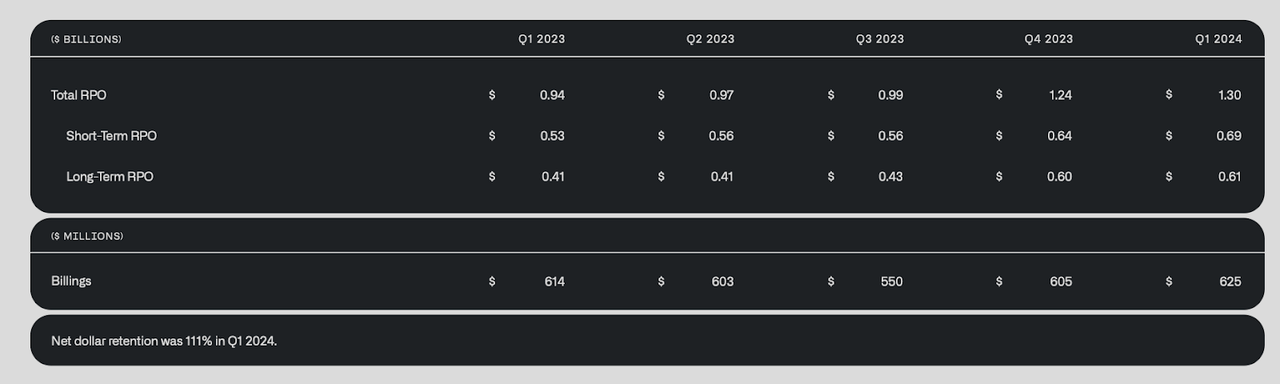

PLTR reported 38% growth in remaining performance obligations (‘RPOs’) and 30% growth in RPOs. Some investors for RPO growth as a potential leading indicator of future revenue growth.

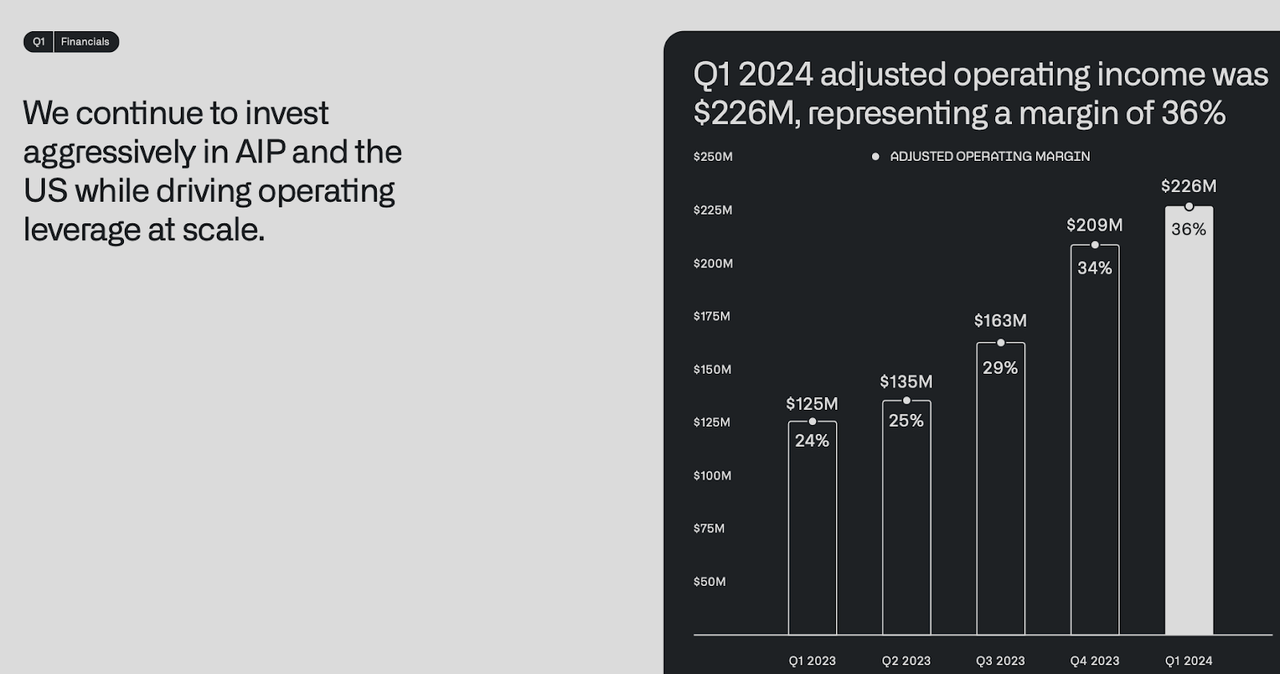

PLTR also continues to make progress on profitability, with its adjusted operating margin jumping 1200 bps YoY.

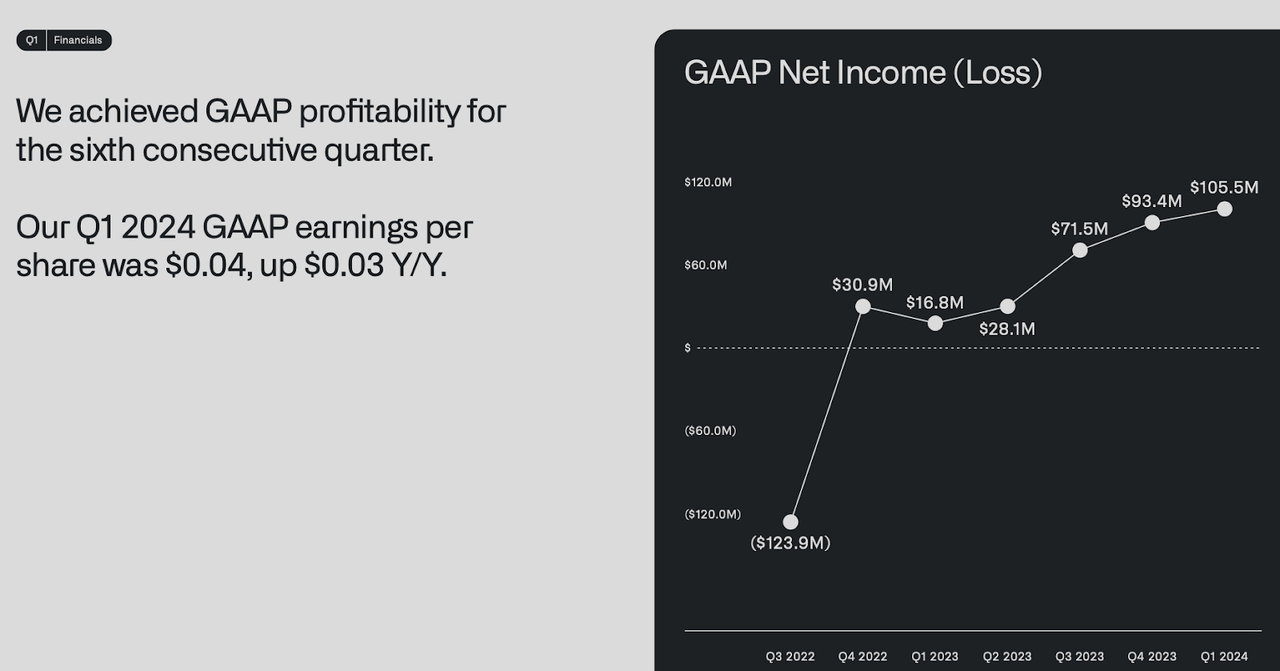

The company has been profitable on a GAAP for 6 straight quarters.

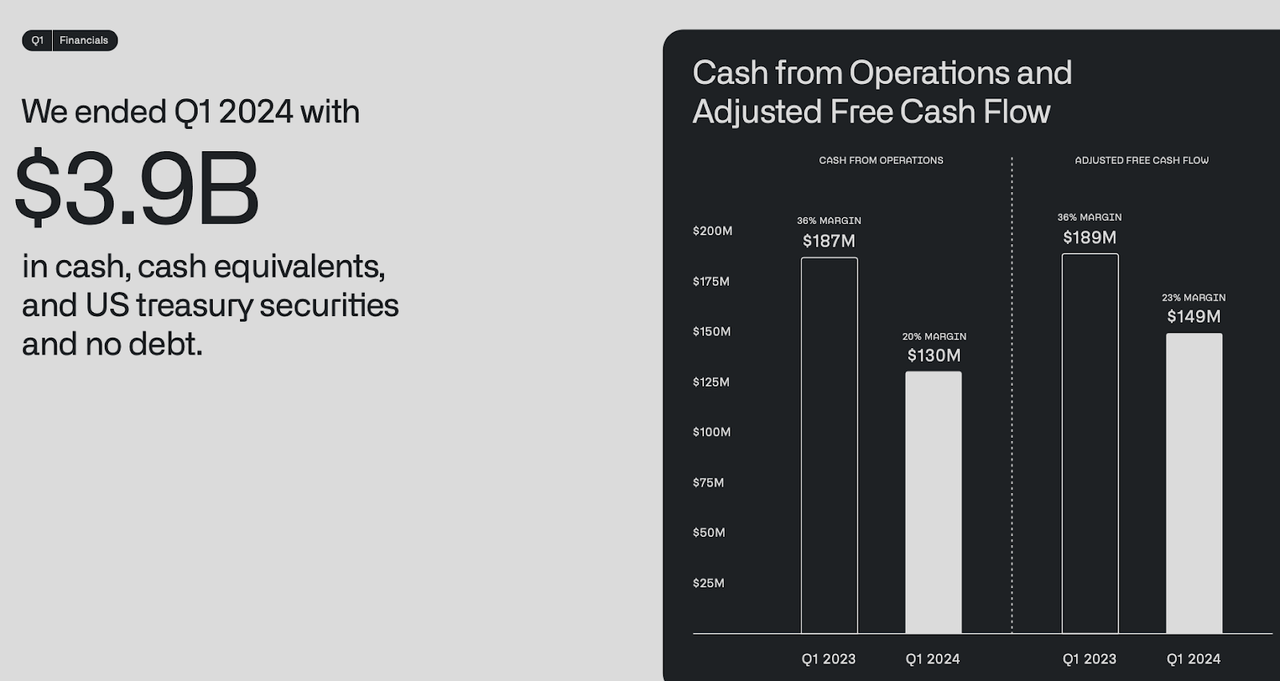

PLTR ended the quarter with $3.9 billion in cash versus no debt.

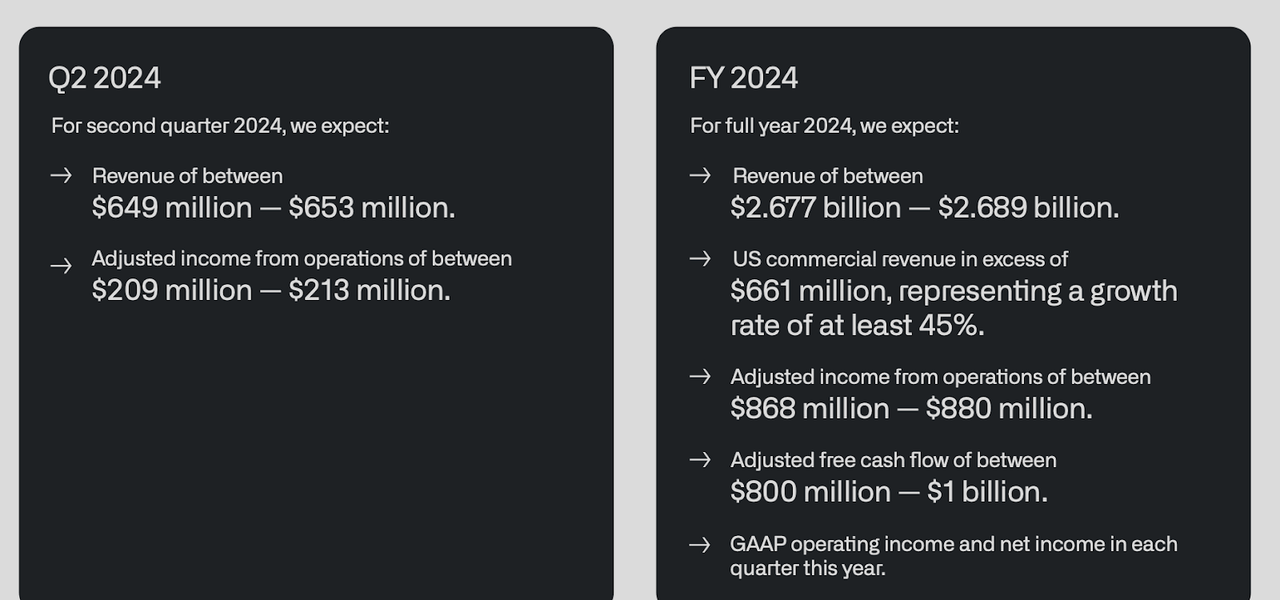

Looking ahead, management expects to generate up to $653 million in revenue in the second quarter and $2.689 billion for the full year, representing 21% YoY growth.

On the conference call, management noted that customer Lowe’s was able to go from a “starting point of no AI to utilizing production-level AI for over 1,000 customer service agents, resulting in a 75% reduction in overdue tasks.” The business impact of generative AI is undeniable, but perhaps the company still needs time to help customers discover those use cases. Management boldly stated that they do not believe they have competition in either the US commercial or US government markets. Perhaps a reasonable follow-up question would be why growth remains held back in the absence of competition, but perhaps an acceleration in growth is just around the corner.

Is PLTR Stock A Buy, Sell, or Hold?

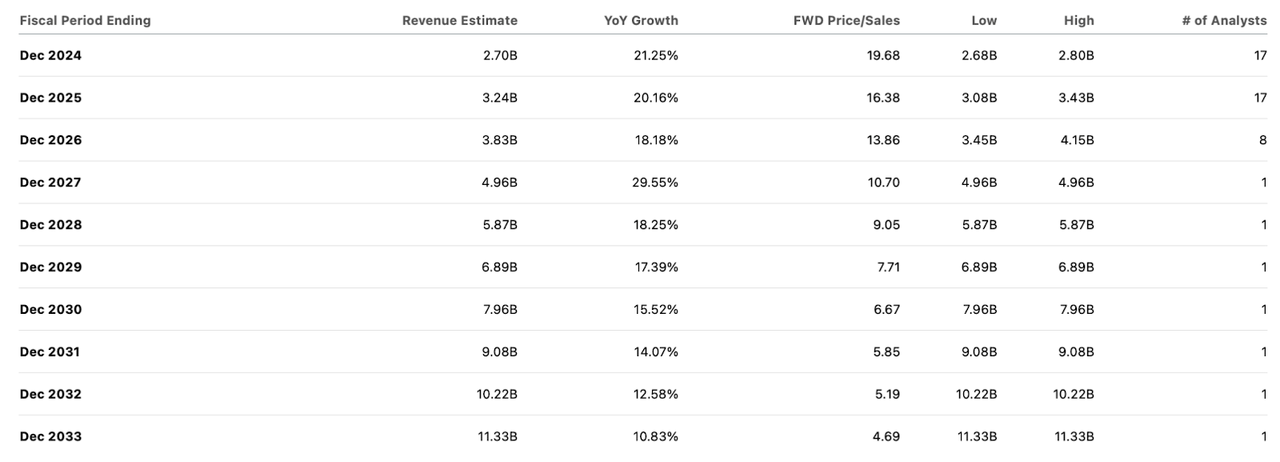

As of recent prices, PLTR was trading at just around 20x sales. Consensus estimates call for an eventual acceleration in top-line growth.

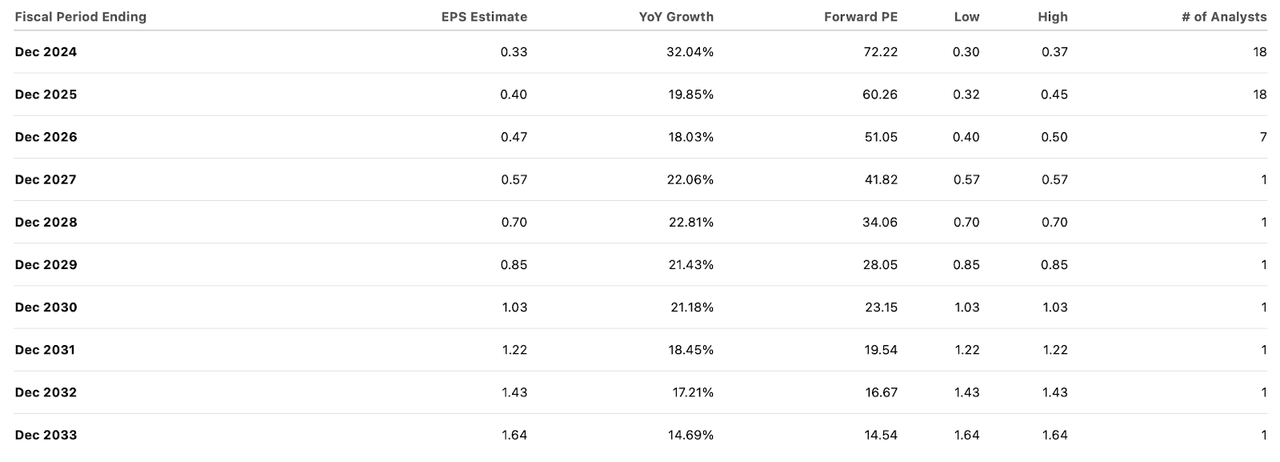

That is expected to help drive operating leverage, with earnings growing sharply faster.

Yet looking at consensus estimates above, it is hard to consider PLTR cheap here, with the stock trading at 15x 2033 earnings estimates (at an implied 32% net margin).

But bulls might contend that consensus estimates are too conservative. Let’s instead assume 40% revenue growth over the next 2 years, which I consider to be an “ultra-bull” case. Investors should remember that with government revenues growing at slow rates and still making up half of the revenue base, a 40% consolidated growth rate essentially implies an incredible acceleration to over 70% growth in commercial revenues. That would place 2033 revenues at $15.6 billion. The stock is trading at 3.6x those estimates, or 11.3x earnings (again assuming 32% net margins). I could see 30x earnings being a reasonably full valuation assumption at that point. That might place the stock at $69 per share, representing around 10.5% annual return potential over the next 9.5 years, or perhaps around 13% inclusive of the earnings yield. That would likely be enough to beat the typical 8% return from the market index, but I find it insufficient given that, as stated earlier, the assumptions look a lot like “ultra-bullish” expectations. For reference, I can see the stock as offering 92% potential upside through 2033 based on consensus estimates, implying just around 7% annual returns over the next 9.5 years (or 9% inclusive of the earnings yield). The net cash balance sheet and positive GAAP profitability help to lower required hurdle rates, but not by enough to justify the current stock price.

PLTR Stock Conclusion

There’s a lot to like at PLTR, with revenue growth continuing to accelerate and the net cash balance sheet being coupled with GAAP profitability. But I think that investors are paying too much for the stock before tangible evidence of the sharp acceleration in topline growth needed to justify current multiples. With software stocks facing elevated volatility in recent weeks due to generative AI fears, readers are advised to look elsewhere in the sector for alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!