Summary:

- Strong travel is expected around the 4th of July holiday, building on bullish auto sales trends, which should benefit automakers in the second half.

- Ford’s valuation is compelling despite challenges, with optimism expressed in the recent earnings report; the options market prices in a 5% move post-earnings next month.

- F stock’s free cash flow, dividend yield, and historically low P/E make it a compelling value investment opportunity.

- I highlight key fundamental and technical risks.

Vera Tikhonova

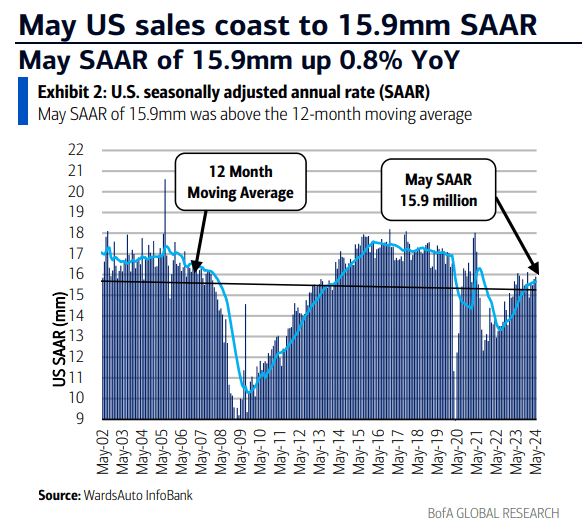

Travelers are set to hit the open road this 4th of July. It’s expected to be a strong travel stretch, building upon bullish auto sales trends so far this year. According to WardsAuto, May US light vehicle sales increased by 0.8% year-over-year (adjusted for selling days). That resulted in a seasonally adjusted annualized rate of 15.9 million vehicles, above estimates, according to BofA. Amid challenges in the EV market, traditional ICE autos and hybrid vehicles are seeing healthy demand despite an uncertain macro backdrop.

I have a buy rating on Ford (NYSE:F). While the firm faces its own challenges, the valuation case is compelling. In the company’s recent earnings report, the management team expressed optimism about its position within the US auto industry.

Improving US Vehicle Sales

BofA Global Research

According to Bank of America Global Research, Ford Motor is one of the world’s largest vehicle manufacturers, with over 6 million units manufactured/sold globally. The company has made significant progress in executing its One Ford plan and delivering best-in-class vehicles. The company also remains committed to positioning itself well within the evolving auto industry through balanced investments across electrification, autonomy, and mobility services.

Back in April, Ford reported a solid set of quarterly results. Q1 non-GAAP EPS of $0.49 topped the Wall Street consensus estimate of $0.44 while revenue of $42.8 billion, up 3% from year-ago levels, was a significant $1.3 billion beat. Strong profitability numbers were driven by its Ford Pro segment, along with lower-than-expected losses in its Model e. The Detroit-based automaker paid higher taxes, which would have otherwise resulted in an even bigger EPS figure.

For the year, the management team tweaked its free cash flow and capex outlooks but maintained earnings guidance. Adjusted EBIT is now expected to be at the high end of the $10 billion to $12 billion range, with high free cash flow between $6.5 billion and $7.5 billion. A bearish risk is a downside in industry vehicle pricing, however. With new product launches in Europe and strength in Ford Pro at home, it should be enough to offset weakness in the EV market.

Ahead of earnings next month, the options market has priced in a 5.0% earnings-related stock price swing when analyzing the at-the-money straddle expiring soonest after the Q2 report, according to data from Option Research & Technology Services (ORATS).

Key risks include a significant downturn in the macroeconomy, which would negatively impact the auto market. Higher input costs, akin to what we saw in 2022, would threaten Ford’s margins, while geopolitical risks could disrupt the supply chain. Likewise, higher gas prices would be a headwind for Ford.

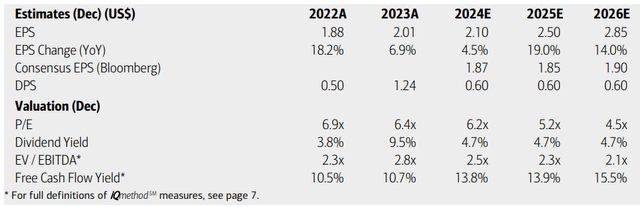

On earnings, analysts at BofA see operating EPS rising just modestly this year, with growth accelerating into the out year. By 2026, Ford is forecast to post per-share profits close to $3. The current Seeking Alpha consensus numbers show less sanguine EPS figures, holding near $2 through 2026. Ford’s top line is seen climbing at a rate near 5% this year, but then slowing to a low-single-digit pace over the following two years.

Dividends, meanwhile, are projected to hold at $0.60 per share, resulting in a high yield of around 5% should the stock price hold at current levels. With a very high free cash flow yield, there’s the opportunity for Ford to reward shareholders, and the stock trades at a very low price-to-earnings multiple.

Ford: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

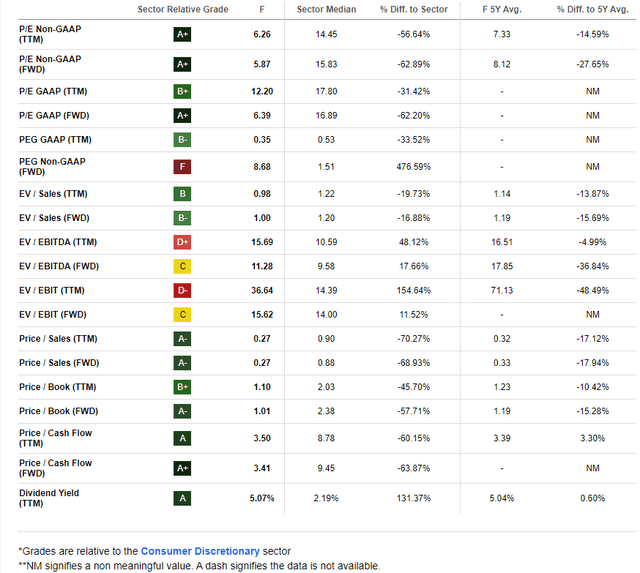

Ford and other automakers typically trade with muted P/Es. But today’s 5.9 forward non-GAAP earnings multiple is historically low – its 5-year average P/E is 8.1 while the sector median is closer to 16x. If we assume $2 of normalized operating EPS and apply the 5-year mean P/E, then shares should be close to $16.50, making F a compelling value today. Supporting the valuation thesis is the company’s high free cash flow and discounted price-to-sales ratio.

Ford: A 10% Free Cash Flow Yield, Historically Low P/E

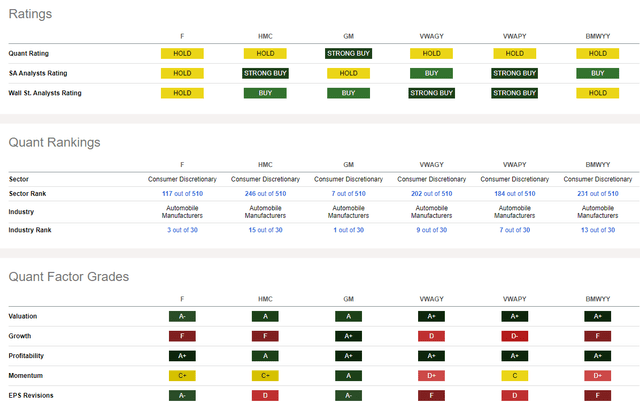

Compared to its peers, Ford features a strong valuation rating while its growth trajectory is weak. But the firm’s profitability metrics are robust and there has been a slew of sellside EPS upgrades in the past 90 days compared with few downgrades. There’s work to be done when it comes to the stock’s share-price momentum, however. I will detail key price levels to monitor later in the article.

Competitor Analysis

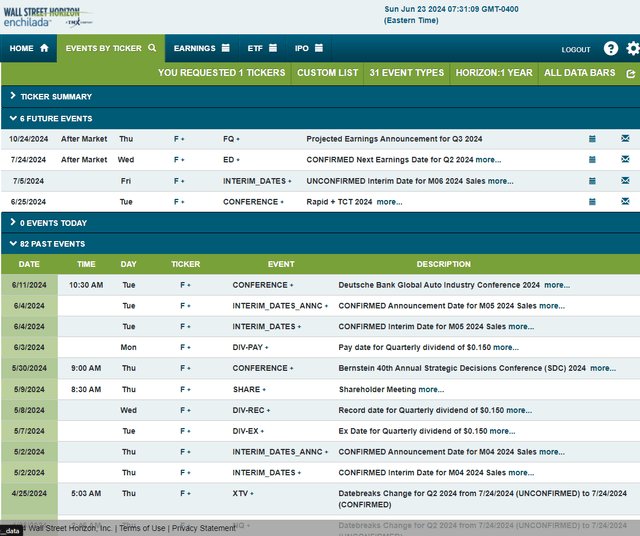

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q2 2024 earnings date of Wednesday, July 24 AMC. Before that, the management team is slated to speak at the Rapid+ TCT 2024 Conference in Los Angeles, CA from June 25 to 27.

Corporate Event Risk Calendar

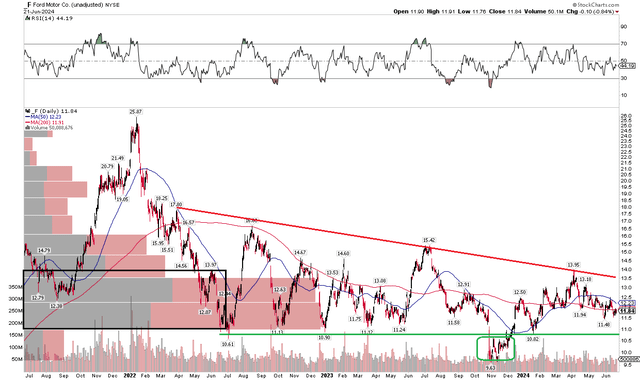

The Technical Take

With a growth story potentially on tap and a low valuation, Ford’s technical situation is less than ideal. To say that the stock is not firing on all six cylinders is an understatement. Notice in the chart below that it has been a rocky road since shares notched a peak north of $25 back in early 2022. A protracted downtrend has been ongoing for more than two years, and resistance is evident at a downtrend line off the $18 high from Q2 2022. That comes into play near $13.50 today. Support is apparent from $10.50 to $11.

What’s encouraging, however, is that there was a bullish false breakdown last November which may have shaken out the weak hands. But with a negatively sloped long-term 200-day moving average and weak RSI momentum trends, the bears appear to be in the driver’s seat when it comes to control of the primary trend.

Overall, with a high amount of volume by price and a downtrend still ongoing, the chart is not encouraging. I would like to see a breakout above $14 to help confirm a reversal.

Ford: Downtrend In Place, Eyeing A $14 Breakout

The Bottom Line

I have a buy rating on Ford. While earnings growth has been hard to come by, I see the stock as undervalued with a high yield and solid free cash flow. Its chart has issues, so buying on a technical breakout would help from a risk/reward point of view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.