Summary:

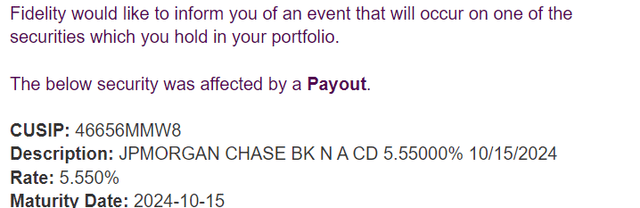

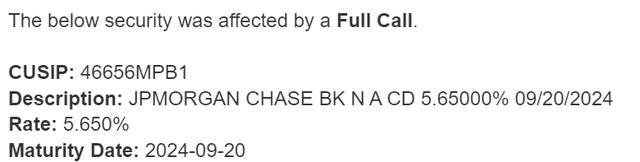

- JPMorgan Chase recently announced premature redemption on 5.5% and higher yielding short-term CDs.

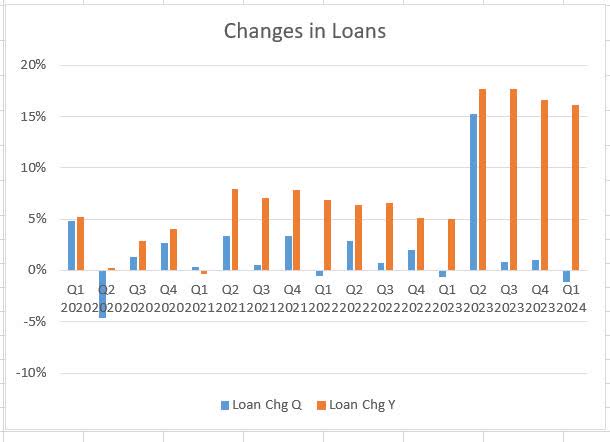

- JPMorgan Chase’s acquisition of First Republic Bank led to loan growth, but the bank surprisingly has struggled with deposits.

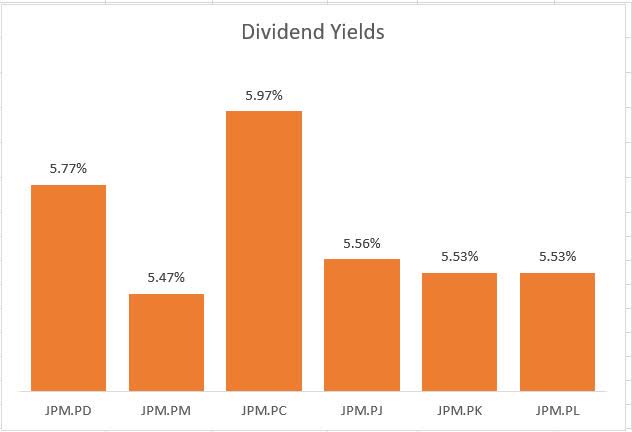

- Series DD and Series EE preferred shares offer attractive income investments at 5.75% and near 6% yield.

danielvfung

Introduction

Last fall, interest rates began a notable climb and equity markets were selling off amid high volatility and fears that interest rates may need to go higher to fight inflation. To hedge against my equity positions, I purchased several 1 year CDs with JPMorgan Chase (NYSE:JPM) that had interest rates ranging from 5.55 to 5.65%. This past week, I received multiple redemption notices on these CDs, meaning JPMorgan Chase had decided to call these securities three to four months before maturity. In order to find a relatively comparable income return, I opted to avoid renewing CDs at a lower rate and instead purchased Series EE (NYSE:JPM.PR.C) and Series DD (NYSE:JPM.PR.D) preferred shares at yields of 5.75% and near 6%.

Fidelity

Fidelity

Microsoft Excel API

JPMorgan Chase Financial Results

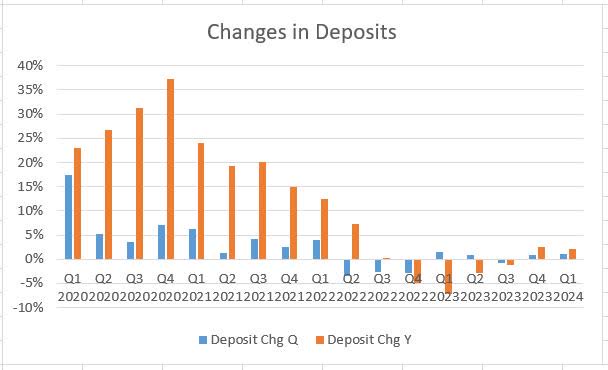

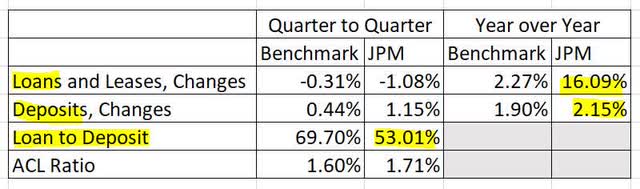

Following the acquisition of First Republic Bank’s loans and deposits last year, JPMorgan Chase became the world’s largest bank by assets. The acquisition increased the bank’s loans by 15%, after a couple of years of 5% loan growth. The acquisition of First Republic did little to change deposits. In fact, the bank has been struggling to grow deposits since the 2nd quarter of 2022, which is somewhat surprising since we were led to believe that deposits were fleeing regional banks for “too big to fail” banks.

Bank Financials

Bank Financials

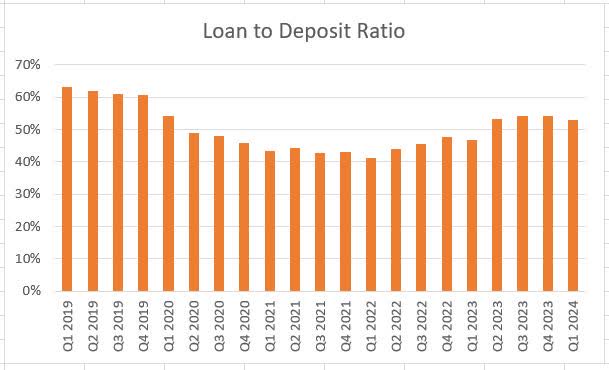

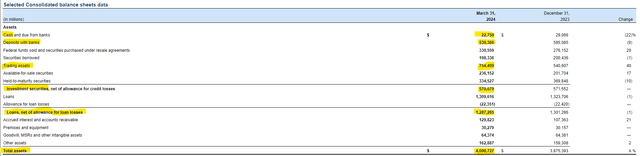

The bank’s surge in loans without much deposit growth did lead to an increase in the loan to deposit ratio, but the ratio is only above 50%, which is one of the lowest ratios in the industry and well below the benchmarks. JPMorgan Chase’s low loan to deposit ratio is somewhat explained by the diversity of assets on the bank’s balance sheet. Only $1.3 trillion of $4 trillion in assets are loans, but the bank also has $755 billion in trading assets (because it has an investment bank arm), $571 billion in investment securities, and $561 billion in cash and deposits with other banks. JPMorgan Chase is the largest bank by assets and quite possibly one of the most diversified.

Bank Financials

Bank Financials & Federal Reserve Weekly Commercial Banking Report

SEC 10-Q

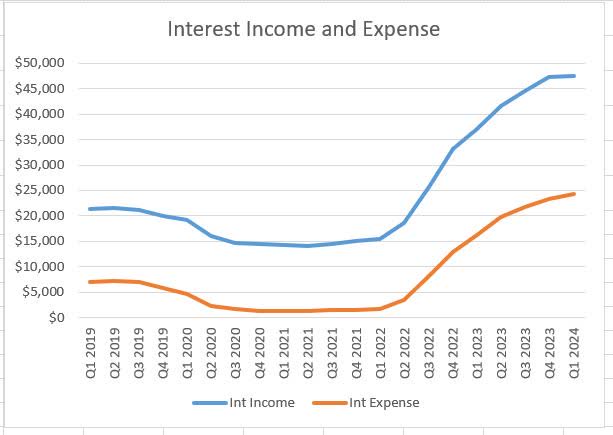

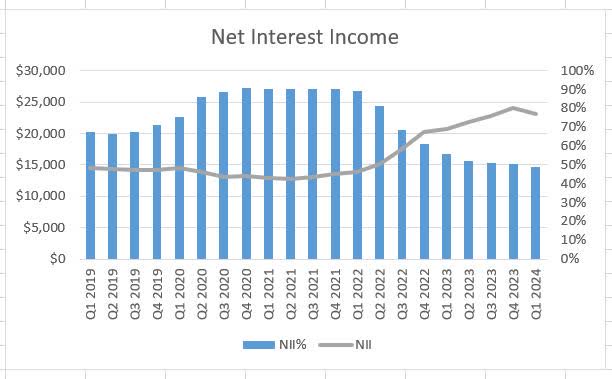

From a profitability standpoint, JPMorgan Chase did not miss a beat with the acquisition of First Republic’s loans. Like most of the banking industry, interest income and interest expenses rose with higher interest rates. What may be most impressive is the bank’s growth in net interest income (interest income less interest expense). While the rest of the industry is facing significant headwinds and multiple quarters of declines, JPMorgan Chase is generating quarterly net interest income that is nearly $10 billion higher than pre-pandemic levels.

Bank Financials

Bank Financials

Risks to JPMorgan Chase

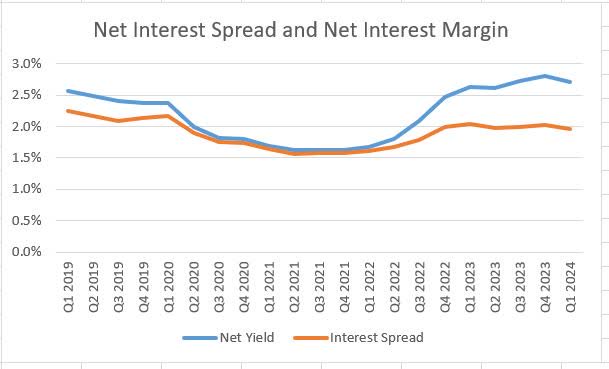

Even the world’s biggest bank with a “too big to fail” backstop has risks that investors should be aware of. First, the bank’s net interest yield and net interest spread are rather small and narrow, with the net interest spread around 2%. Tight interest rate spreads can create problems in a changing rate environment, but investors should note that net yield has recovered above pre-pandemic levels.

Bank Financials

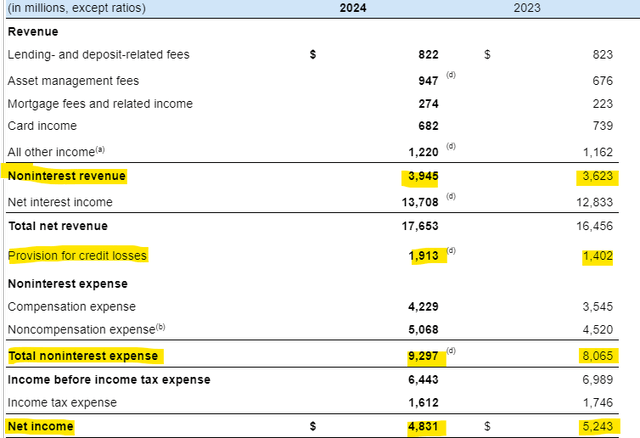

Another risk to the bank’s earnings is credit loss allowances and noninterest expenses. In the first quarter, non-interest expenses grew by $1.2 billion compared to the same quarter a year ago. This increase was led by a $700 million increase in compensation. The provision for credit losses also grew to $1.9 billion, up from $1.4 billion in the first quarter of 2023. While the bank had higher net interest income and noninterest revenue to help offset some of these costs, net income still declined by $400 million to $4.8 billion. Headwinds to net income, especially via the growth in noninterest expenses, are why I am not advocating an investment in the bank’s common shares.

SEC 10-Q

The final risk to mention deals specifically with the Series DD and Series EE preferred shares. Each one of these preferred shares is callable, creating a risk that, like the CD holders, investors may be getting their principal back sooner than they would like. While JPMorgan Chase could call both issuances with cash on hand, that elimination of preferred shares would impact the bank’s capital ratios. An issuance of new preferred shares would not guarantee a better rate, either. Last week, Bank of Hawai’i announced an 8% fixed rate preferred issuance, which is priced more than 100 basis points higher than the dividend yield of their other preferred share. I don’t believe JPMorgan Chase is going to call either preferred issue until we’ve seen a meaningful reduction in interest rates by 75 basis points or more.

Conclusion

Despite a bank’s preferred shares being riskier than their CDs, the implied government backstop of “too big to fail” combined with the fortress balance sheet leads me to believe that the risk spread between CDs and preferred shares at JPMorgan Chase is infinitesimal. This leaves the Series DD and Series EE preferred shares as attractive income investments with yields of 5.75 and 6%, respectively.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM.PR.C, JPM.PR.D either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.