Summary:

- Nvidia Corporation just gained +70% in two months to become the #1 most valuable stock. This blow-off top has happened exactly as how my Cisco Model predicted in April.

- Now this model is anticipating a decline which will happen in three phases. The first phase (today) will be very sharp. The second phase will be the largest.

- Recent stock price behavior, insider sales and economic indicators increase the odds of this bubble collapse occurring.

peshkov

“After a slow-down in March and early April, Nvidia would gain +40% in the next three months to reach a final blow-off top. That would be followed by little weakness first and a huge selloff by late 2024/early 2025.”

This is a piece from my last article on NVIDIA Corporation (NASDAQ:NVDA), “Why Nvidia Could Become The Largest Company, But Not For Long.”

The blow-off top ended exactly as planned, with Nvidia stock peaking at $135.58 on June 18th.

Over the past days, an impressive reversal has occurred, which, I believe, might be the start of one of the biggest bubble collapses from this generation.

With this article, I want to update you how this surprisingly accurate bubble theory is unfolding. Bearish news regarding the economy, insider sales and the stock-split are increasing the odds to the downside.

June 18, 2024, the day we will all remember?

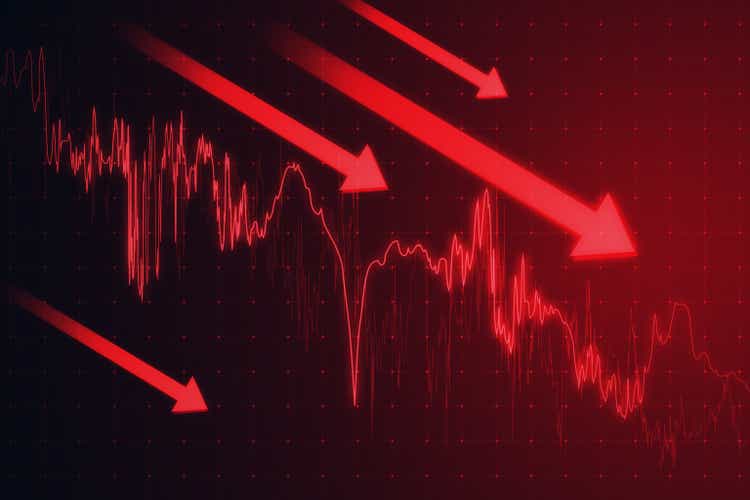

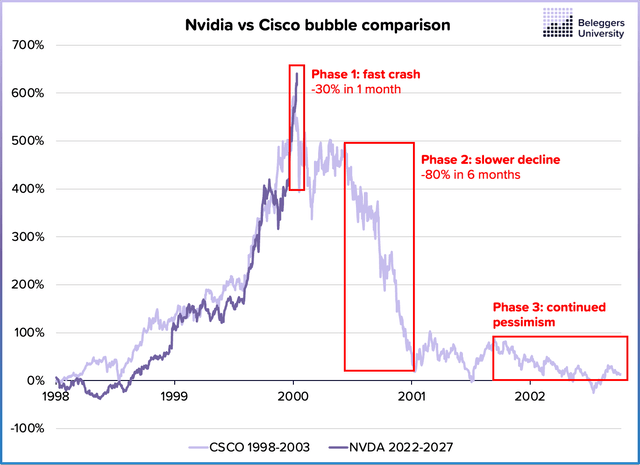

In April, I made the case that the Nvidia of 2024 can strongly be compared with the Cisco Systems (CSCO) of 2000. This is true for its fundamentals, but also based on the share price behavior.

Just like Cisco during the two years leading up to the dot com peak, Nvidia was seeing similar gains and moved in similar waves over the past two years.

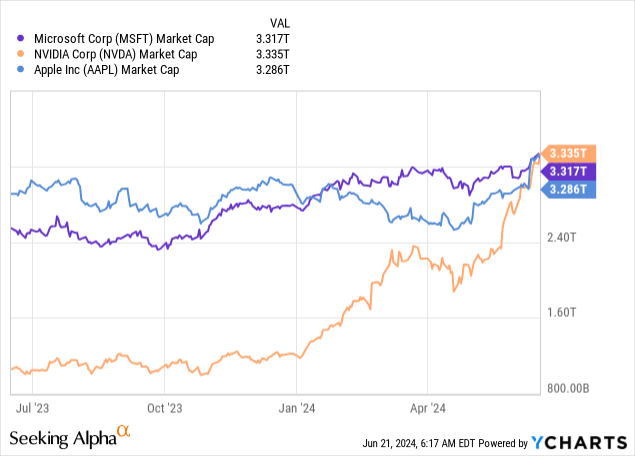

And just like Cisco, Nvidia was ready to overtake Microsoft (MSFT) as the most valuable company on planet Earth.

Based on these assumptions, I made a model to estimate how Nvidia’s stock might behave from the $890 it traded at in early April. I anticipated a +40% gain towards $1,265 per share before July.

So what happened? Nvidia soared to $1356 (not stock-split-adjusted). Not coincidentally, this was just enough to overtake Microsoft’s market cap for one day on June 18, 2024.

This is precisely what Cisco did on March 27, 2000, a day which is engrained in the mind of investors as the ultimate peak of the horrendous dot com bubble.

Share price of Nvidia vs the projection in April based on the Cisco comparison (Robbe Delaet)

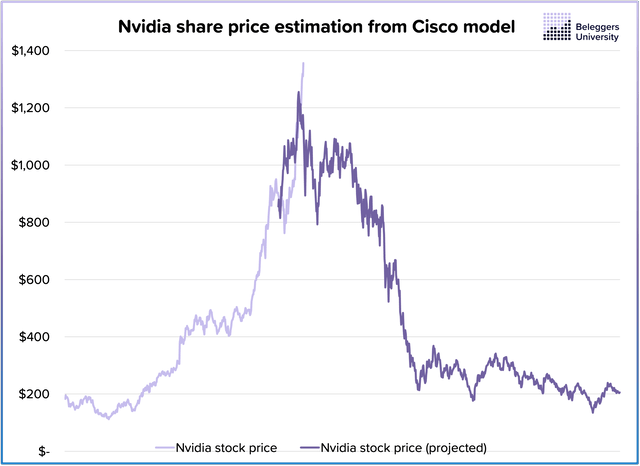

Mr. Market loves to play games. Not only did it let Nvidia peak in the same way as Cisco, but also did the peak occur at a combined market cap for Nvidia, Microsoft, and Apple (AAPL) of $10 trillion.

The canary in the coal mine

Why do I believe that Nvidia can crash by as much as -80% from today’s levels? I explained this in my previous article.

In short, Nvidia’s current profitability levels (49% net margin) and growth (+262%) are highly unsustainable.

After doubling again in 2025, I expect revenues to (at least) stagnate. Also, I believe that profit margins will drop to more normalized levels (25% net margin is the 5-year average). This would happen due to a cool-down in the AI investment cycle, competition catching up and/or an economic slowdown.

Based on my assumptions, the FY2027 forward P/E is currently at 113x, rather than the 33x that is currently in everybody’s software. An -80% drop in the share price would put the P/E ratio at 28x.

| FY 2024 | FY 2027 analyst forecast | FY 2027 realistic projection | |

| Sales | $60.9 bln | $182 bln | $120 bln |

| Net margin | 48.9% | 54.0% | 25% |

| Net profit | $29.8 bln | $98.4 bln | $30 bln |

| EPS | $1.19 | $4.04 | $1.2 |

| P/E | 113x | 33.4x | 113x |

(Source: Robbe Delaet assumptions.)

Inflation stagnated to 0.0% growth last month and interest rates are dropping. Some investors think it is bullish for stocks, others acknowledge that it actually means that the economy is slowing drastically, which will eventually impact AI spending.

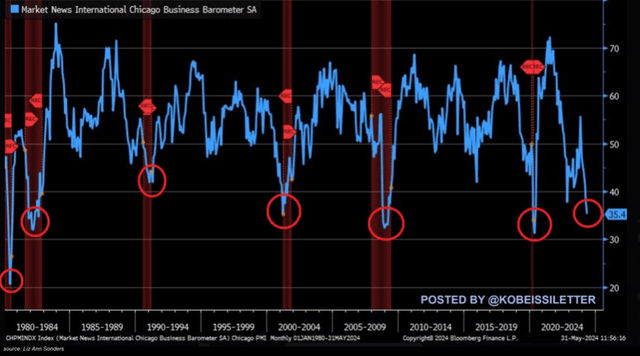

Many indicators are signaling that the economy is in for a rough time in the coming period. I will just share one very intimidating chart below: the Chicago PMI index. After a recovery from the economic turbulence in 2022, the index dropped to 35.4 in May, significantly below expectations of 41.1. This level is approaching the levels we saw during the Great Financial Crisis and Covid-19 crisis.

In May 2024, the Chicago PMI dropped to 35.4, its lowest level since 2020. (Kobeissiletter on X/Twitter)

I believe that the economic deterioration is the canary in the coal mine for the crash of the AI bubble.

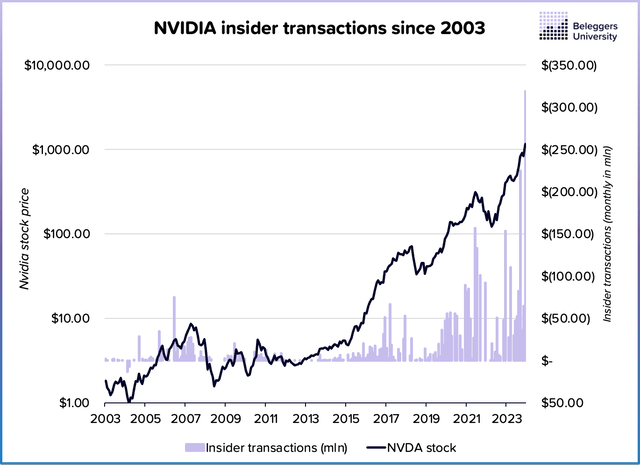

As an outsider, we are not aware how demand is actually evolving in the sector. Luckily, we can rely on insider trading, which shows us how management is reacting to underlying trends with their money.

If management truly believes that AI infrastructure spending is still in its early innings and that demand will continue to skyrocket going forward, we should see a lot of insider buying, right?

Well, here is the chart of Nvidia on the left y-axis, overlaid with the insider transactions (insiders buys minus sales) on the right y-axis (inverse).

Nvidia’s insider sales reached a monthly record at $319 mln in June. The month is not over yet. (Robbe Delaet)

As you can see, the monthly insider sales reached a record of $319 mln in June. The previous record ($225 mln net sales) occurred in March this year and before that in December 2021, right before the -60% drop.

I pay the closest attention to director Coxe Tench’s purchases and sales, as they have been very successful repeatedly over the past two decades. He sold $289 mln worth of shares already this year.

Not only the smart money in Nvidia, but also in other AI semiconductor companies, are running away as fast as they can from this bubble. For example, Dell Technologies (DELL) CEO Michael Dell sold a staggering $2.1 bln worth of shares in 2024 alone and Applied Materials (AMAT) CEO Gary E Dickerson just sold $98.6 mln worth of shares.

And unfortunately, the ones buying from the smart money at the peak are, as always, the retail investors who get caught by their greed.

Is the Nvidia stock split going to prolong the rally?

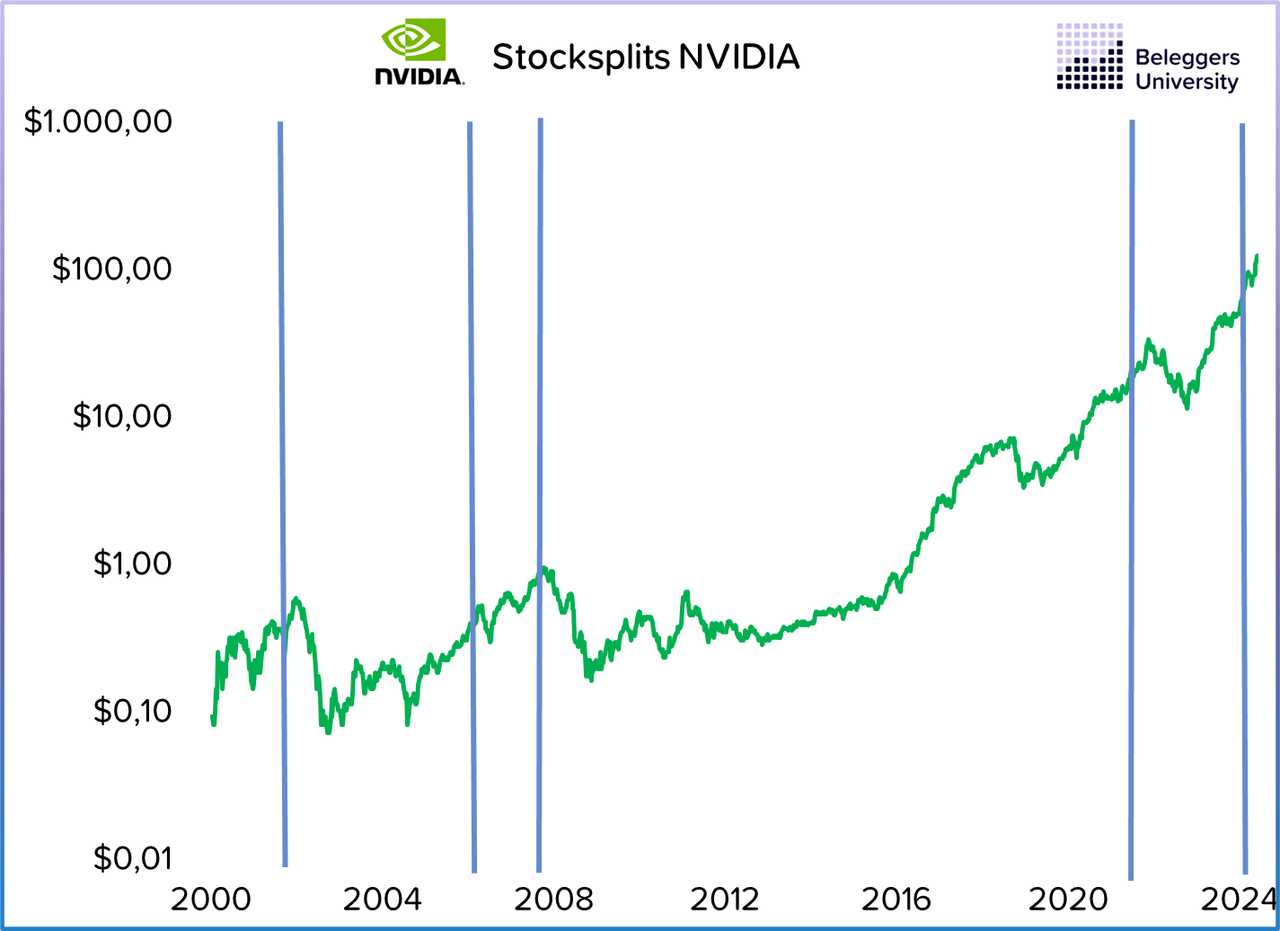

A big part of the hype around Nvidia has been its 10-for-1 stock split. Splits are seen as a positive driver for the stock price, as it makes the stock more affordable for smaller investors. This is also backed by empirical research, which has proven that stocks, on average, perform well one year after the split.

Let’s see if that is also the case with Nvidia, shall we? Below, you see the long-term price (on a logarithmic scale, of course), with the blue lines showing all the historical splits.

Astonishingly, in two out of four cases (2001 and 2007), the stock crashed with more than -60% one year after the split occurred. In the two other cases, the returns were marginally positive (+11% and +24%).

Are you still sure that the stock split is something we should celebrate? Maybe shorts should, as all the hype has inflated the bubble even more, widening the potential downside risk from here.

The stock price of NVIDIA (green) with the timing of the five stock splits (blue). (Robbe Delaet)

How I shorted the NVDA peak and looking for an even better opportunity

So now comes the juicy part – how am I trying to profit from this once-in-a-generation bubble?

Firstly, I need to admit that although I am a big believer of the company and its CEO, I unfortunately haven’t profited from the upside.

- In October 2022, I did a deep dive in the sector and named Nvidia my favorite semi to buy, together with ASML (ASML). But I didn’t have the available capital to buy shares myself.

- In April 2024, a little after my SA article, I wanted to bet on the blow-off top with OTM call options, but didn’t do so. I don’t know what happened, but I do remember that I was in the French Riviera at that point, so I was probably distracted. I missed a potential 20x gain on those call options. The French Riviera was expensive.

The three phases of the bubble collapse, Cisco in 1998-2003 and potentially Nvidia in 2022-2027. (Robbe Delaet)

Profiting from the downside – part one (June 2024)

As I also explained in my previous article, it is extremely difficult to profit from the first phase of the bubble collapse. Premiums on options are high due to the abnormal implied volatility. As such, you need to time the peak perfectly to be able to make good returns.

I made an attempt with a small amount of my portfolio on Tuesday, June 18, 2 minutes before market close. I bought $105 July 19 puts for $0.40. Currently, as of writing, they are worth $0.95, good for more than a +100% return in two trading days.

Based on my Cisco Model, I expect Nvidia to drop to $95 in July. If this happens, these options will be worth $10 at least, good for a 25x return.

For that to happen, everything needs to work out perfectly. And if it doesn’t, I am okay with it given the low capital allocation.

Profiting from the downside – part two (October 2024?)

There will probably be a more interesting risk/reward trade in the second phase of this downturn.

Almost all bubbles first crash rapidly, while the numbers are still very rosy. They recover swiftly from this crash and stabilize for a while, before starting their second phase of the downturn.

During this phase, the decline is caused by actual numbers disappointing investors. It happens more slowly, but the downturn is much larger. For Nvidia, a drop from about $110 to less than $30 might occur in less than a year.

The option prices will probably be much lower at that moment, given the lower volatility preceding the downturn. As such, the risk/reward will likely be much more attractive for option positions.

Profiting from the downside – part three (mid-2025?)

The last phase of the down cycle occurs when the horrible numbers are being reported. You can still profit from this decline, but to a much lesser degree than the previous phases.

Also, if you believe in the long-term fundamentals of the underlying company, it is more interesting to look for an entry point currently to profit from the next up cycle. That is probably what I will do with Nvidia, as I am a big fan of the stock at the right price at the right moment of the cycle. Below $40 will be the price I would be interested to start building out a long position again.

Conclusion

I have been watching Nvidia with awe over the past weeks. It has been very entertaining to see how the stock moved almost exactly as Cisco during the Dot-Com bubble. This is not a coincidence, but a result of Nvidia’s fundamental story being very similar to Cisco and investor behavior remaining the same throughout history.

The recent macroeconomic deterioration, insider sales and stock price behavior make me increasingly confident that we have seen a historic peak of Nvidia this week, which will be followed by a big drop going forward.

Watch out on the long side and for the more experienced investors – take a look at what is possible on the downside, especially in phase 2 of the decline.

Best of luck to all of you. Be careful out there.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.