Summary:

- Plug Power constantly fails to meet financial expectations, despite potential in green hydrogen.

- The conditional DoE loan amounting to $1.66 billion won’t solve the operational problems with the business.

- Investors should avoid PLUG stock due to dilution risk from the massive cash burn levels.

audioundwerbung

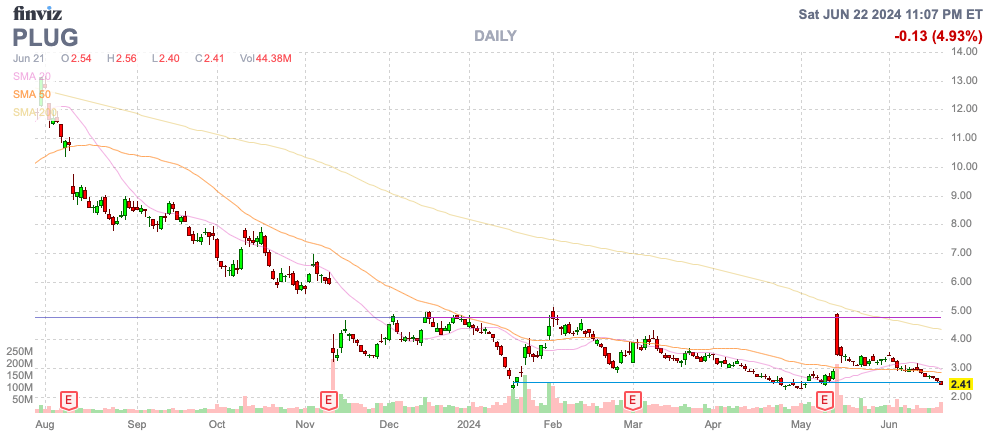

Plug Power Inc. (NASDAQ:PLUG) continues to fail majestically despite the big opportunity ahead in green hydrogen. The financial prospects of the company won’t be helped by a large government loan, and the initial excitement has quickly disappeared. My investment thesis remains Bearish on the stock, despite the potential for strong support at the current price.

Source: Finviz

Ignored Loan

Plug Power soared to $5 on the conditional loan guarantee of as much as $1.66 billion from the U.S. Department of Energy. While the green hydrogen company can sure use cheap debt financing from the government, the financials aren’t altered by borrowing more money.

The loan guarantee is already being questioned by a U.S. Senator, and the loan is conditional. The deal apparently covers the construction of up to six green hydrogen production plants.

The recent Q1’24 results highlight why the U.S. Senator might have some concerns about lending the big money loser $1.7 billion. Plug Power took an extended period to finally launch the commercial-scale hydrogen plant in Georgia, and sales slumped to only $120 million in the quarter.

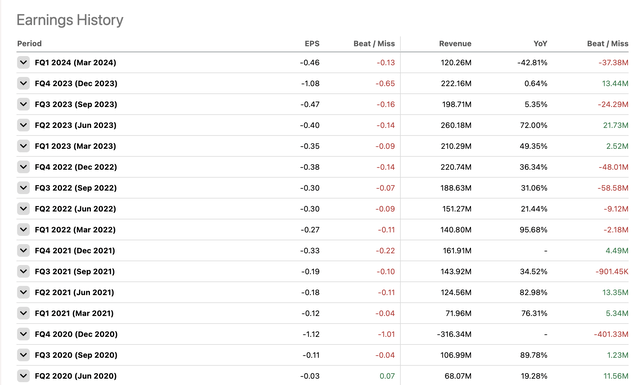

Plug Power reported revenues that collapsed nearly 43% from the prior Q1 and missed analyst estimates by over $37 million. The company had recently promoted the progress of commercial-scale green hydrogen plants in Georgia and Tennessee to 25 tons-per-day (TPD), yet sales collapsed.

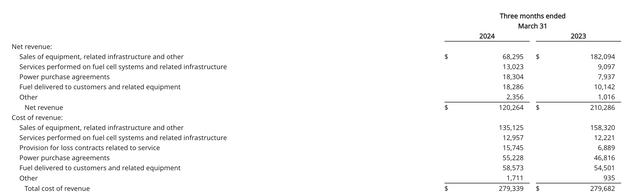

Despite all the excitement on reaching nameplate capacity on those plants, fuel delivery revenue was only $18 million with costs at $59 million. These quarterly results were relatively in line with the quarterly results in 2023.

Source: Plug Power Q1’24 earnings release

In total, revenues of $120 million were swamped by costs of $279 million. Despite the collapse in revenues YoY, total costs of revenues were the same.

Plug Power did successfully cut operating expenses to just $100 million in the quarter, down from $140 million in the prior year. Adjusted operating expenses of $103 million were down from $131 million in a slightly positive sign as the company implemented plans to cut expenses by $75 million.

Again, the issue is that Plug Power is nowhere close to even producing positive gross margins to cover the reduced operating expenses. The company is working on the Louisiana green hydrogen plant to boost capacity to 40 TPD, but Plug Power still hasn’t shown any improving financials, despite the Georgia plant starting liquid green hydrogen production in late January.

The general frustration with the financials is this constant willingness to subsidize the business when customers should be willing to overpay to move to clean energy. The company forecasts ending the year with a green hydrogen fueling business at 65 TPD, up from 50 TPD now. The problem is that Plug Power is only now producing 25 TPD, and the Louisiana project brings the total to just 40 TPD. The company will only supply up to 60% to 65% of demand, leaving Plug Power in a position of still losing money on 35% or more of production. The business shouldn’t have negative margins

The big Texas project adds a massive 45 TPD in green hydrogen production. The latest forecast is for a start date in late 2025, suggesting Plug Power will have a substantial amount of fuel supplied via the vastly higher repurchases from third parties where the costs are $12 to $14 per kg versus sales at only $6 to $7 per kg.

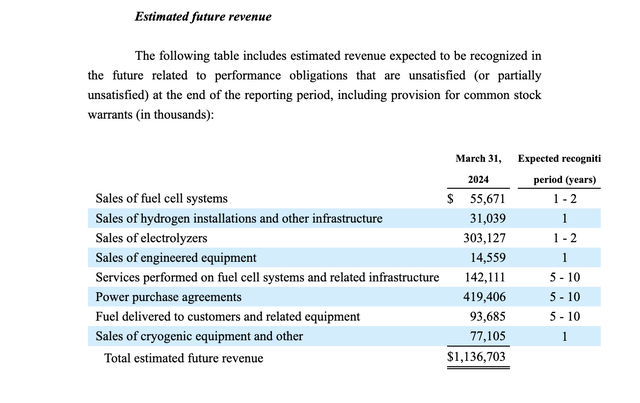

Even the future revenue amounts questions the ability of Plug Power to ever hit financial targets. The backlog is only $1.1 billion, with substantial amounts assigned to electrolyzers and power purchase agreements. The green hydrogen fuel business is a minor part of the story.

Cash Problems

Plug Power ended the quarter with a cash balance of nearly $400 million, with $220 million restricted. The company has $210 million in convertible debt, plus several other finance and lease obligations.

The issue is cash flow, with Plug Power burning $168 million during the quarter from operations. CapEx was another $93 million, leading to a total quarterly burn of $261 million.

The company always sees low sales in the March quarter and a ton of equipment/electrolyzer projects are at the site inspection process leading to additional sales in near term. Plug Power promotes only 10% of sales in Q1, but the amount was much closer to 25% last year, with relatively flat quarterly revenues over the year.

Plug Power has no history of predicting quarterly and annual sales while expenses are always at elevated levels, even for a company reaching $1+ billion in annual sales as projected. The financials become horrible after the company misses targets dramatically and those fuel and power purchase losses add up.

Analysts forecast smaller loses going forward, but the forecasts are still for losses the rest of the year to nearly double the Q1 loss. The balance sheet doesn’t support this level of losses and cash burn.

Even worse, analysts haven’t been accurate on Plug Power losses since Q2’20.

The DoE loan just helps the company cover the capex to build new facilities totaling $1.7 billion. The loan will lead to additional interest expenses and the management team hasn’t shown any discipline to turn the green hydrogen plants into a profitable business with the need to cut off new supply contracts that aren’t economical.

Takeaway

The key investor takeaway is that Plug Power investors continue to face more dilution ahead, while the stock trades at the lows below $2.50. The green hydrogen company continues to have highly volatile sales, while expenses are always elevated.

Plug Power should report higher sales due to equipment sales ramping throughout the year, but the key green hydrogen fuel business isn’t amounting to much. Investors should avoid the stock due to the high cash burn rates and likely need to raise additional capital.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market as Q2 comes to an end, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.