Summary:

- Rivian’s strong Q1 production and delivery growth indicate high demand for their electric models, which target a rapidly growing segment of the thriving EV industry.

- The underserved segment of the EV industry includes light electric trucks and pickups. The Company has strong opportunities to capitalize on this market, as established players are only scratching the surface.

- Valuation analysis indicates a 40% upside potential for RIVN stock, outweighing the risks of investing in a young and unprofitable company.

400tmax/iStock Unreleased via Getty Images

Introduction

The EV industry is cooling down after a booming few previous years. But there is an underserved segment of the industry, which includes light EV trucks and EV pickups. All notable players are scratching the surface with their young electric models, and Rivian’s (NASDAQ:RIVN) strong Q1 production and deliveries growth suggest that its models are quite popular and in high demand. Therefore, there is a good chance that the company’s revenue can grow in line with a massive projected CAGR for this segment of the EV industry. There are apparently risks of investing in young and still not profitable companies like Rivian, but I think that a 40% upside potential suggested by my valuation analysis is worth taking these risks. Therefore, I am inclined to give RIVN a ‘Buy’ rating.

Fundamental analysis

Rivian Automotive is a company that develops and builds electric vehicles (‘EV’). The company offers two passenger models (R1T pickup and R1S SUV) and commercial vans. Rivian plans to expand its presence in the SUV niche with a new generation R2 vehicle, scheduled to launch for 2026.

It is widely known that EV is an emerging industry. According to Visual Capitalist, there were 361,157 electric vehicles sold worldwide in 2014. Last year, around 14 million EVs were sold globally. The increase over the last decade is almost by forty times, which means a staggering 44% CAGR. As in the upcoming periods the industry will face the challenge to grow against big numbers, the next decade’s CAGR is expected to be lower at 17%. Additionally, the industry is much more competitive now than it was a decade ago, and even Tesla’s iconic CEO Elon Musk sees a big threat from Chinese EV makers.

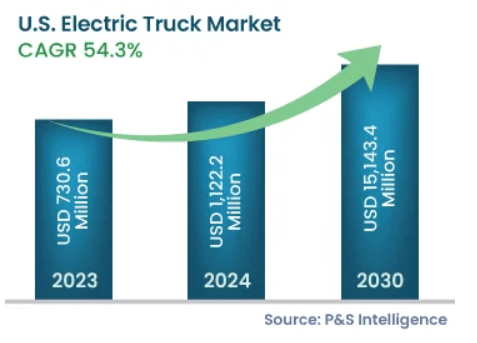

However, Rivian’s management was wise enough to focus on underserved segments of the EV industry. There is much less competition in the electric pickups or large SUVs industry. For example, the industry’s pioneer, Tesla (TSLA), rolled out its pickup called Cybertruck only last year and the production volume is still quite low. Therefore, this segment has much more growth potential compared to the entire EV industry. P&S Intelligence forecasts the U.S. electric truck market to observe a 54.3% CAGR by the year 2030. Moreover, the same source names Rivian as the market leader.

P&S Intelligence

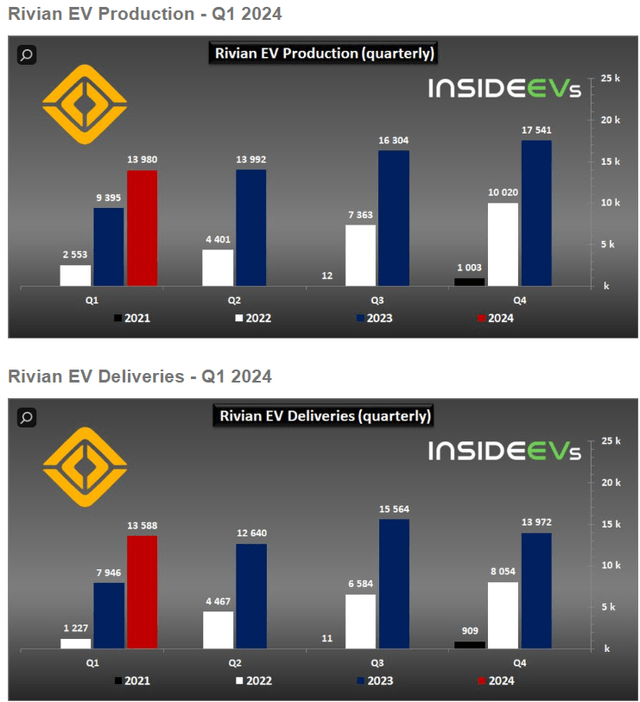

While Tesla faces various challenges to ramp up Cybertruck production, Rivian demonstrated robust production and deliveries growth in Q1 2024. The management plans to produce 57,000 units of R1T and R1S during the entire year. It means approximately flat dynamic compared to 2023, but I think that this is temporary due to the unfavorable macro environment with high interest rates. For example, Tesla’s deliveries targets in 2024 are also projected to be approximately flat YoY.

The passenger trucks industry is expected to grow rapidly over the long term, and that is more important to me as a long-term investor. Moreover, the industry is apparently underserved as all automotive players are scratching the surface, especially in the pickups segment. For example, there is an electric version of Ford’s (F) iconic F-150 model called “F-150 Lightning”. Despite having a popular brand and big fan base, Ford delivered only 7,743 units in Q1 2024. Other popular American pickup brands are also launching their electric versions, but they are also at a nascent stage of development. For example, General Motors’ (GM) Chevrolet Silverado EV model deliveries totaled 1,061 units in Q1 2024. Therefore, the competition is not that fierce in the segment, and this is quite good for Rivian.

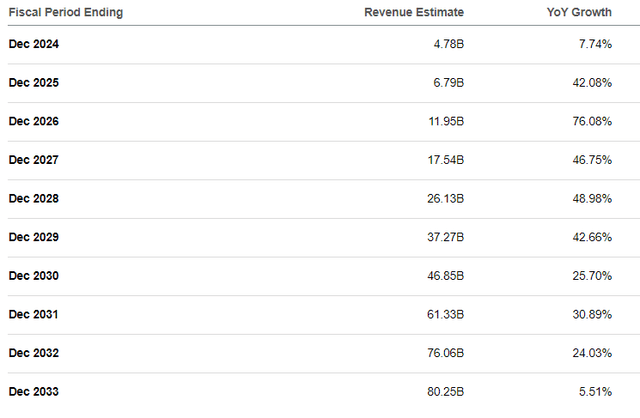

The fact that the industry is expected to grow rapidly with a massive 54.3% CAGR and relatively low competition, I agree with the optimism from Wall Street consensus expecting Rivian’s revenue to reach $80 billion in FY 2033.

In opposition, from the financial perspective, the picture does not look so bright yet. Rivian’s gross profit is negative with a -40.6% TTM margin, meaning that there is still a long road to profitability. Rivian’s cumulative free cash flow (‘FCF’) for the years 2020-2023 was around -$13 billion. In the below table, Rivian’s balance sheet is outlined. The cash balance deteriorated notably over the last five quarters, but there is still almost $8 billion in cash. The financial position is robust, even considering Rivian’s cash burn.

Apart from a solid balance sheet, Rivian is also backed by a prominent investor. Amazon (AMZN) holds a big 17% stake in the company. There is a commitment from Amazon to bring 100,000 Rivian’s electric vans on the road by 2030. Therefore, Rivian’s financial position can also be backed by its hyper scale shareholder if needed.

Valuation analysis

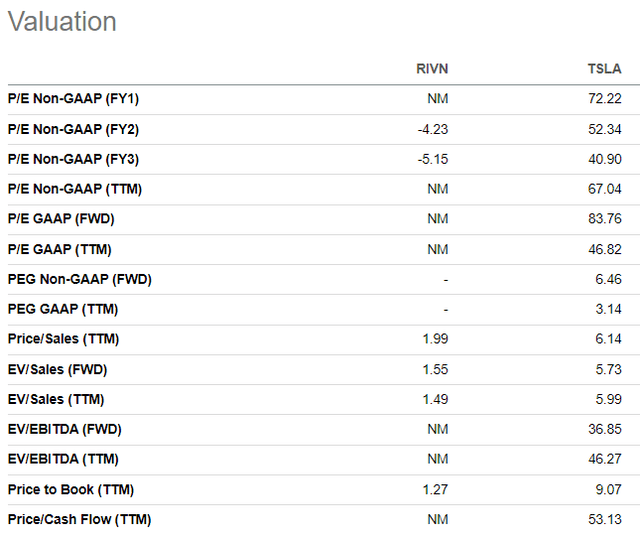

Rivian’s current market capitalization is $10.3 billion, which is only $2.5 billion higher than the company’s outstanding cash position. Rivian’s 1.5 price-to-sales ratio is relatively low for a company that is expected to demonstrate a 50% CAGR for the next decade. Tesla’s P/S ratio is around 6.

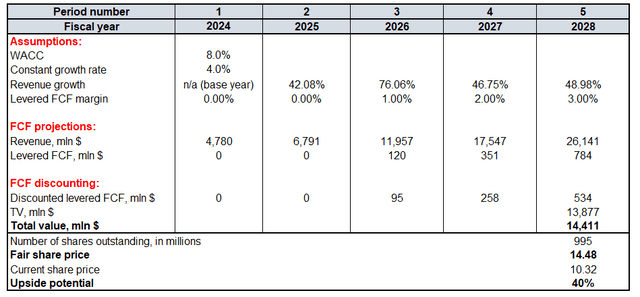

Figuring out fair value via the discounted cash flow (‘DCF’) approach will also help to make valuation analysis more well-rounded. Future cash flows will be discounted using an 8% WACC. Constant growth rate for the terminal value (‘TV’) calculation is twice as high as historical inflation rates, i.e. 4%.

I have to explain the projected revenue growth from consensus because there is an unexpected spike in FY2026 revenue growth to 76%. This optimism likely factors in the expected launch of R2 vehicles sales, which is reasonable. Apart from this, FY 2026 revenue growth spike, consensus expects around 45%-50% revenue growth. This aligns with the expected industry CAGR mentioned in fundamental analysis. Thus, I think that using revenue forecast from consensus is fair.

The free cash flow is still negative, but I think that expecting it to become positive when the company surpasses $10 billion in annual sales in FY 2026 is reasonable. Further expansion by 100 basis points per year is a very modest assumption, and I expect this conservativeness to offset massive uncertainty which is inherent to DCF models of long-duration stocks. According to Seeking Alpha, there are 995 million RIVN shares outstanding.

The stock’s fair price is $14.5, 40% higher than the current share price. The upside potential is extremely attractive, and I have high conviction that RIVN is a compelling opportunity at the current share price.

Mitigating factors

While all competitors are also at the early stages of ramping up their pickup models and all players seem to be in about the same position in a thriving industry, there is one thing that Rivian lacks compared to Tesla, Ford, or Chevrolet. It is the brand name. Ford and Chevrolet are extremely popular brands in the U.S., and their ICE F-150 and Silverado pickups were among the best-selling cars in the country for ages. Tesla has not been in the market for decades, but it definitely has the reputation of an EV pioneer and the most innovative automotive company. Rivian’s relative brand weakness might be an obstacle to capitalizing on the expected rapid industry growth.

Despite RIVN having almost $8 billion in cash, the company burned more than $4 billion in FCF in FY 2030. That said, Rivian has cash reserves to finance its operations for the next two years at best, and it will inevitably face the need to raise more cash. There is no guarantee that Rivian will be able to raise finance on favorable terms, and there is a significant risk of diluting shareholders’ value as a result of additional shares issuances.

A 19% short interest for RIVN means that a significant portion of investors bet on the stock tanking in the future. High short interest does not guarantee future stock price declines, but it might mean that my analysis is missing something, and I might be wrong.

Conclusions

I think that a 40% upside potential is worth all the risks and uncertainties. Moreover, RIVN has the potential to capitalize on a massive 53% industry CAGR with is expected to last for the next decade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.