Summary:

- META has lost 60%+ of its value this year as it wrestles with mounting macroeconomic headwinds and Apple signal-loss impacts to its ad-centric business that will likely last through 2023.

- Waning investor confidence in the company’s loss-incurring metaverse ambitions under the current market climate plagued by surging borrowing costs has also weighed on the stock’s performance.

- The following analysis will dive into key focus areas heading into 2023, and gauge whether the stock has found bottom after rebounding from early-November lows to finding support at the $110 range.

Kelly Sullivan

It has been an ugly year for Meta Platforms’ stock (NASDAQ:META). Having lost more than 60% of its market value on a year-to-date basis, investors continue to question whether the worst of the stock’s wipe-out has passed.

In our recent coverage on the stock, we highlighted how Meta’s operating environment is plagued by both company-specific idiosyncratic risks in addition to broad-based volatility under today’s market climate and macroeconomic backdrop. Aside from rising interest rates that have been detrimental to growth stocks that have their valuations pinned on long-end free cash flows, inflation, and recession headwinds are also driving a cyclical downturn for the cohort, particularly Meta’s ad-focused business which operates in an inherently macro-sensitive industry. And from a company-specific perspective, Meta is also reeling from a restricted business environment given privacy rule changes from Apple (AAPL), among other policy adjustments undertaken by the iPhone seller that have been gating the social media platform from optimizing growth opportunities. Metaverse developments also remain a significant cash-burning endeavour with no clear path to growth and profit realization within sight. Yet, from a valuations perspective, Meta may have found its worst-case scenario already priced in at current levels. The following analysis will dive into key focus areas for the stock heading into 2023.

From a fundamental standpoint, the company continues to benefit from a robust balance sheet with a strong liquidity position funded by its still meaningfully profitable advertising business. While its core advertising business might not be as stellar as it previously was under today’s operating and macroeconomic backdrop, the segment’s profit margins remain attractive, with a growing user base across Meta’s core social media platforms indicating extensive reach still that would make a key ad distribution channel for advertisers. WhatsApp and Messenger is also starting to capitalize on its monetization headroom, which is consistent with the company’s goal of making community messaging its “next investment priority” announced earlier this year.

Looking ahead, tightening financial conditions and still evolving challenges specific to its advertising business could draw further volatility for Meta’s stock. However, it is likely to remain range-bound at current levels while Meta works through the looming macro headwinds and company-specific challenges. This would make the stock a reasonable investment opportunity at current levels, which we view to be already reflective of its worst-case scenario under the current operating environment (i.e. no-growth steady-state) barring any material changes to Meta’s long-term growth strategy and the demand environment for digital ads. In other words, the stock is likely in a state of pending recovery in our opinion, with moderate upside potential once macro headwinds subside, and outsized uptrend over the longer-term if its metaverse aspirations materialize.

The Apple Curse

Meta’s streak of declining ad revenues this year underscores the detrimental impact of signal loss stemming from Apple’s privacy policy changes, among other macroeconomic headwinds (e.g. FX; ad spending slowdown). In addition to diminishing ad spend ahead of the cyclical downturn given the industry’s inherently macro-sensitive nature, Apple signal loss has also made social media platforms a less attractive ad distribution format for advertisers, delivering a double-whammy to Meta’s core profit generator this year:

Social media: Social media ad formats are expected to experience the slowest growth as it struggles with both weakness in ad spending ahead of macro deterioration, as well as industry-specific challenges pertaining to ad signal loss following Apple’s implementation of App Tracking Transparency (“ATT”) last year. The format has already demonstrated relatively muted growth compared to the rest of digital advertising channels in the first half of the year with a mere 3% y/y growth – a far cry from the 38% y/y growth in social media targeted advertising demand observed in 2021. Another headwind facing social media ads is that “usage has reached maturity”, which further strips app-based social media advertising platforms’ appeal to advertisers, especially ahead of a cautious spending environment. Ad spend on social media channels this year is expected to slow to 4%, and improve in 2023 with forecast 6% growth.

[However, Meta] has made positive progress on mitigating downside risks from ad signal loss, which is corroborated by y/y ad revenue growth after rolling off of tough post-ATT lapping comps despite significant FX headwinds. However, the company is far from immune against looming ad spending softness, especially as advertisers shun platforms that lack measurability and engagement / conversion. And increasing competition for user screen time facing Facebook and Instagram is not making the situation any easier.

Source: “Ad-Tech Round-Up: Why We Think Google And Amazon Will Rise On Top“

Yet, we view Meta’s recent introduction and continued ramp-up of “Advantage+“, a new ad distribution format across its social media platforms, as well as other ongoing AI-driven efforts aimed at overcoming signal loss impacts, a positive development that is likely to salvage its ad dollar capture rate heading into the new year.

Specific to Advantage+, the new ad distribution format has already been well-received by certain verticals that had initial access to the feature, with many observing better return on ad spending (“ROAS”) and lower overall costs (see more here). However, we expect ad sales to remain muted in the fourth quarter for Meta given advertisers remain in a conservative stance amid mounting macroeconomic uncertainties, and are progressively favouring discounts and promotions this holiday season instead to reach price-sensitive consumers under the current inflationary environment. Discounts averaged in the 30% to 40% range during the latest holiday shopping season, with more than three-quarters of Americans “searching the web for the best deals and discounts to maximize their spending power”, underscoring the pinch of inflation and the looming economic downturn that has likely caused advertisers to dial back on discretionary ad spending. For now, advertisers are likely simply “accepting the upside [from] better-than-expected campaign performance driven by Advantage+, but unwilling to allocate more dollars due to macro concerns”.

However, heading into the new year, Meta could potentially re-emerge as a share gainer among its social media advertising peers. From a company-specific perspective, Meta’s introduction of Advantage+, which is showing positive performance and economics for advertisers, alongside other AI-driven improvements in ad delivery and performance measurement are already “far ahead of competitors” when it comes to overcoming Apple’s signal loss. Continued ramp-up in the delivery of Advantage+ availability to more verticals paired with DAU and MAU growth also corroborates the anticipation for a better capture rate on the portion of critical ad spending allocated to social media formats in 2023, especially when macroeconomic conditions are expected to improve later in the year. This is also consistent with the latest industry forecast, which estimates ad spending on social media channels to improve from 4% y/y growth this year to 6% y/y growth in 2023, making a competitive tailwind for Meta’s social media ad leadership.

In addition to Advantage+, Meta’s continued “AI investments to build the most advanced models and infrastructure in the industry [aimed at driving] better [ad] recommendations for people, higher returns for advertisers, and increases [in] revenue growth even in the face of signal loss” is also coming into fruition. Based on a recent round-up of ad-tech industry sentiment performed by RBC Capital Markets, advertisers are starting to realize the benefits of Meta’s AI-driven improvements in providing “probabilistic measurement, and improving CPA [cost per action]” despite barriers from Apple’s recent policy changes, which again highlights the social media giant’s competitive advantage over rivals when it comes to overcoming impacts of signal loss in the longer-term.

But despite the anticipation for continued improvements in what we would like to call Meta’s “ad restart” given the massive setback dealt from Apple’s signal loss, the near-term operating environment remains a tough one. The significant comedown in social media ad sales growth across the industry – from 2021’s whopping 38% to this year’s estimated 4% – is also reflective of advertisers’ concerns over broad-based usage maturity on related platforms, which continues to strip the format’s appeal, especially ahead of a cautious spending environment. This is consistent with the significant deceleration (and even declines) in DAU/MAU growth observed across Meta’s core social media platforms – namely, Facebook and Instagram – especially as it continues to fight for screen time against rivals like Google’s YouTube (GOOG / GOOGL) as well as ByteDance’s TikTok (PRIVATE: BDNCE) in the rapid transition in social preference from text to images to now short-form videos. Although Meta has been aggressively promoting the usage and monetization of Reels across Facebook and Instagram, ramping up take-rates on the feature and replicating the previous success it has demonstrated through Instagram Stories will continue to be a work in progress.

Yet, the company’s turn to aggressive ad cost reductions for merchants to use its new features – such as launching campaigns for “in-feed shopping” across its social media platforms, in addition to Advantage+ – could be strategic for “attracting new advertisers to test out [said] features where they otherwise would not”. Despite concerns that the generous discounts in ad costs could adversely impact its profit margins, the implementation of said strategy is already delivering positive results, which is corroborated by y/y growth in Meta’s latest ad sales (ex-FX headwinds) as well as recognition of improved ROAS across advertisers on its channels, and reinforces Meta’s potential as a share gainer in social media ads heading into the new year.

The company’s continued focus on community messaging opportunities via WhatsApp and Messenger is likely to further its ad share gains heading into the new year and beyond. Following Meta management’s earlier allusion to both messaging platforms as investment priorities going forward, CEO Mark Zuckerberg has recently reaffirmed the company’s plans for WhatsApp and Messenger to “drive the company’s next wave of sales growth”. This includes bolstering monetization efforts on both platforms, which remain in early stages of capturing significant growth headroom still.

The company has already been gaining significant exposure to business demand for its community messaging solutions in Asia – particularly India and Hong Kong – as well as South America. Meta is now considering expanding the business messaging feature to include in-app transaction abilities, which is currently deployed in Brazil. Specifically, merchants in Brazil can now message and facilitate transactions with customers using credit or debit cards within WhatsApp, ushering a new revenue stream for Meta over the longer-term and addressing investor concern over the return potential on Meta’s $19 billion initial investment in the app in 2014. Merchants across Brazil, Indonesia, Mexico, Colombia and the UK that are hooked onto WhatsApp’s business messaging feature will now also have access to a new “business directory” feature, which allows users on the messaging platform to easily find and message said merchants without having to input a phone number – similar to searching a business account handle on Instagram or Facebook.

Meta’s latest developments pertaining to its investments in community messaging is likely to bolster its share gains in the $5+ billion CPaaS (“Communications Platform as a Service”) market, among other opportunities for WhatsApp and Messenger, which would be a favourable growth driver to compensate for normalizing social media ad demand over the longer-term. Specifically, CPaaS integrates “real-time, cloud-based, customized communication services like video chat or two-factor authentication directly into an existing application”, and WhatsApp and Messenger remains a critical function to benefit from the solution.

Macroeconomic Uncertainties

The ongoing pace of aggressive Fed rate hikes aimed at stamping out persistent inflationary pressures has been a key driver of compressing valuation multiples across growth stocks, including Meta. Recall that valuation multiples are a function of cost of capital, which is benchmarked against a risk-free rate that is typically the long-end Treasury yield. With yield on the 10-year U.S. Treasury notes – which “underpins global capital costs” – having come down significantly from the 4% range observed in October, to now in the 3.5% to 3.8% range in recent months despite the Fed’s commitment to keeping rates “higher for longer” to keep inflation in check, it is likely that long-view market sentiment is improving. This could potentially bring about more forgiving discounting on long-end free cash flows that growth names like Meta are valued on, especially as inflationary pressures are expected to ease further in the coming year and alleviate the Fed’s aggressive monetary policy tightening campaign.

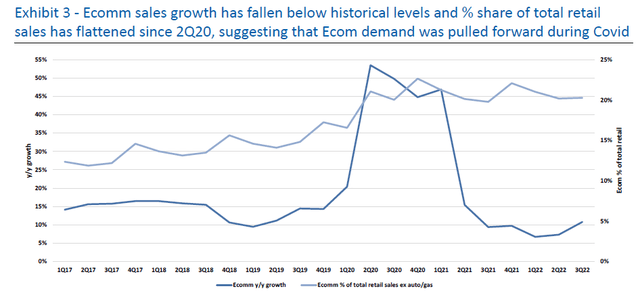

Meanwhile, from a fundamental standpoint, the looming recession continues to be an overhang on Meta’s ad-centric business as discussed in the earlier section. Given the secular demand environment for digital ads is closely tied with e-commerce adoption, which has been pulled forward by at least three years due to the pandemic-driven shift in consumer behaviour and has been on a normalizing trend over the past year, the looming economic downturn adds further complexity to the sector’s recovery. This again highlights the tough operating environment ahead for Meta’s ad-focused business despite continued improvements in addressing its company-specific challenges. Yet, the latter half of 2023 through 2024 and beyond is expected to experience reacceleration in post-pandemic digital ads and e-commerce spend “to teens or 20% growth as secular shift online reverts to the mean”:

E-Commerce Growth vs. E-Commerce Penetration in Total Retail Sales (U.S. Census Bureau, RBC Capital Markets)

And Meta benefits from being one of the few constituents in the ad-tech industry that is already trading at levels reflective of the tough near-term operating environment driven by both looming macro headwinds as well as normalizing e-commerce and digital ad penetration trends. This is likely due to souring investor confidence in the company’s near-term outlook as a result of added idiosyncratic risks facing its ad business, including Apple’s signal loss as discussed in the earlier section. In other words, the near-term challenges to the fundamental leg of Meta’s valuation outlook has likely already been priced in at current levels, implying that even slow improvements to ad sales growth – as long as it is consistent – heading into the new year could be viewed as a positive surprise and catalyst to the stock’s gradual recovery.

The Metaverse Debacle

Meta’s continued investments into building out its metaverse aspirations remains an expensive endeavour. More than 20% of its anticipated capex and opex spend in the coming year will be allocated to Reality Labs, which is not yet profitable.

A 20% investment in futuristic technologies is a level of investment we believe makes sense for a company committed to staying at the leading edge of one of the most competitive and innovative industries on earth.

Source: Andrew Bosworth, Meta CTO, reported by Bloomberg

However, we view recent speculation that Meta may be rethinking its capex spend and allocation this year as a potential positive development in anticipation of the looming economic downturn. For instance, Meta’s recent cancellation of its data center expansion plans in Denmark underscores the extent of a potential pullback in its capex spend as the company regroups ahead of stiffening macroeconomic headwinds. Specifically, there is a “growing view that Meta could cut capex in particular by as much as 30% to 50% relative to the initial guide”, which focuses primarily on “increasing AI capacity” partially attributable to its metaverse ambitions. Under the current market climate where investors are shunning allocation of capital towards speculative projects that are not yet profitable, resorting to a less aggressive stance on building out the metaverse in the near-term with heavier focus on its core profit-generating ad business could be a positive catalyst for Meta’s stock heading into a new year that is still filled with mounting macroeconomic uncertainties:

Faced with a higher cost of borrowing and rising inflation, investors are becoming more exacting in terms of which companies they are willing to back. Big capital projects on unproven technologies, such as Meta’s bet on the metaverse, haven’t gone down well…The market’s telling them we want some near-term profitability and we can’t afford to fund all of your negative free cash flow.

Source: Bloomberg

Specifically, the company appears to be resorting to a realistically conservative stance in its approach to building out the metaverse. The recent round of unprecedented layoffs as well as the implementation of a hiring freeze that is likely to last through next year will contribute to lower operating expenses at Meta, helping it “preserve margins” as markets prepare for recession – a plus for investors leaning in favour of profitable growth. Meanwhile, Quest 2 headset sales has likely repeated last year’s holiday season success again this time around despite a broad-based slowdown in consumer demand for big-ticket items like PCs and gaming devices. The Meta Quest app trended first on App Store “over the Christmas period” for the second consecutive year, assuaging investors’ angst over the expensive build-out of Reality Labs for now:

As in previous years, the Meta Quest app once again climbed to the top of the US app charts over the Christmas period. The Meta Quest app is required to set up the VR headset. The fact that it was downloaded more than any other iOS and Android app on Christmas suggests numerous new Quest users.

Source: “Is Meta Quest 2 a Christmas Hit Again?“

Looking ahead, metaverse spend will undoubtedly remain a drag on Meta’s fundamentals as well as investor confidence in the stock, as mass market adoption for the technology remains further out in the future:

Economic challenges across the world, combined with pressures on Meta’s core business, created a perfect storm of skepticism about the investments we’re making…still, pulling back on future bets to focus on short-term goals alone can have disastrous consequences.

Source: Andrew Bosworth, Meta CTO, reported by Bloomberg

Although the company remains fixed on boarding a massive spending cycle that coincides unfavourably with currently tightening financial conditions, Meta’s expensive bet on the metaverse could help the company partake in renewed growth opportunities over the longer-term as VR experiences build out for application across a greater range of verticals. Specifically, the company is already making inroads in enterprise productivity use cases via its partnership with Microsoft (MSFT) to introduce mission critical software implemented across all industries in the metaverse, as well as the introduction of Quest Pro to capitalize on commercial opportunities. And on the leisure front, Quest 2 continues to be a market leader in VR gaming devices currently available in the market, which is further corroborated by positive take-rates observed in the latest holiday season as highlighted in the earlier section, pointing to gradual positive progress in Meta’s continued build-out of its metaverse ambitions.

Despite uncertainties over whether Apple or Meta will win the race on the future of immersive experiences, we remain optimistic that Meta’s foot in immersive gaming with Oculus Quest 2 and new inroads made in the corporate setting with Quest Pro – as observed through core partnerships recently forged with Accenture (ACN), Autodesk (ADSK) and Adobe (ADBE) – are positive developments that underscore the social media giant’s crucial role in building out the future of social experiences, and a step in the right direction towards capitalizing on a $100+ billion market opportunity over the longer-term.

Source: “Meta Q3 2022 Quick Take: Apple Has It In A Deadlock“

Final Thoughts

As we have discussed in a recent coverage on the stock, Meta continues to find support at the $110-level in recent months after bottoming in the sub-$90 level in early November, which is consistent with our estimated steady-state firm value for the shares at $113 apiece. Recall that the steady-state firm value estimate aims to approximate Meta’s valuation prospects in the conservative event that any “incremental investments will not add, nor subtract, value”, or in other words, a point of no growth and indefinitely sustained profits. The stock is also trading at levels consistent with valuations specialist and NYU Professor Aswath Damodaran’s estimated value of $259 billion (or approximately $115 apiece) for Meta under a “no-growth” scenario where the company still maintains market leadership in social media digital ads and an ability to preserve indefinite profitability/positive free cash flow generation. The consistency supports the likelihood that Meta’s shares have found bottom at current levels considering its near-term challenges and opportunities under its current operating environment and business strategy, barring any additional material adverse changes.

While Meta’s growth outlook is likely to remain turbulent within the foreseeable future as it wrestles with looming macroeconomic headwinds while also forging out a new road for its nascent metaverse ambitions, the stock remains a potential gainer at current levels building on its existing advertising business alone – even if growth decelerates towards normalized levels. And of course, the stock’s upside potential would be all the more attractive if the metaverse growth prospects materialize over the longer-term, especially as digital transformation trends persist, which creates a compelling risk-reward opportunity at current levels that imitate a no-growth scenario.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!