Summary:

- TSMC’s CEO predicts strong AI-related demand, but it is only a fraction of their overall revenue.

- TSMC is a key chip manufacturer for smartphones and AI, but AI demand increases have limited benefits with respect to the overall economics.

- AI revenue should eventually be more than 20% of overall revenue but this isn’t expected until 2028.

BING-JHEN HONG

Introduction

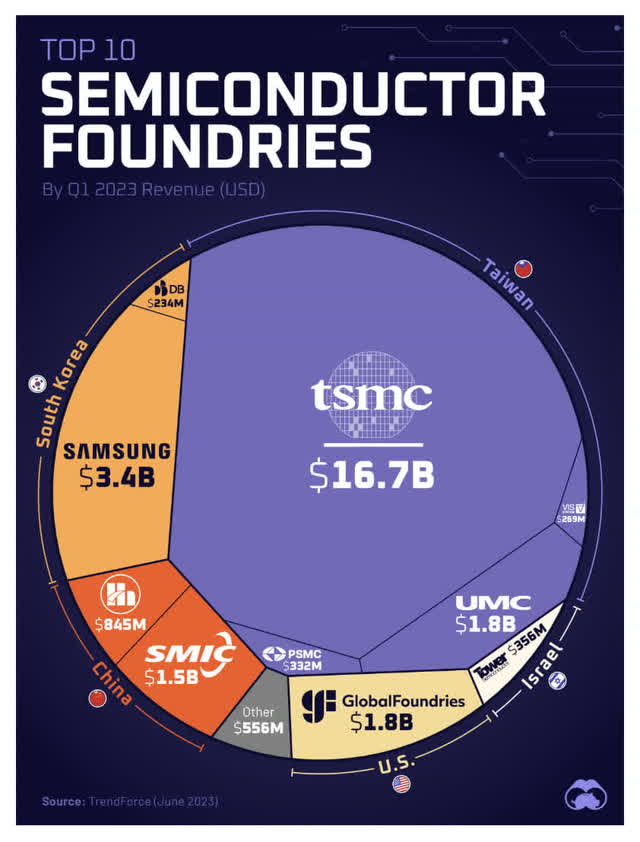

Per my July 2023 article, TSMC (NYSE:TSM) is the most important chip manufacturer for smartphones. Per Visual Capitalist, no fabricator (“fab”) comes close to TSMC in terms of size:

TSMC’s size (Visual Capitalist)

In addition to being the leading fab for smartphone chips, TSMC is also the key manufacturer for chips in the AI space. However, the economics in the AI space have so far benefited designers like Nvidia (NVDA) much more than fabs like TSMC. My thesis is that the explosive growth the world is seeing with AI has limited economic benefits to TSMC because they are a fab as opposed to a designer and AI is just one part of their business along with slower-growth segments like smartphone chips.

TSMC financials use New Taiwan dollars which go by the TWD code, the NT$ symbol and the NTD abbreviation. At the time of this writing, TWD 1,000 is equivalent to about $30.89. In other words, we can multiply the TWD figures by 0.03089.

The Numbers

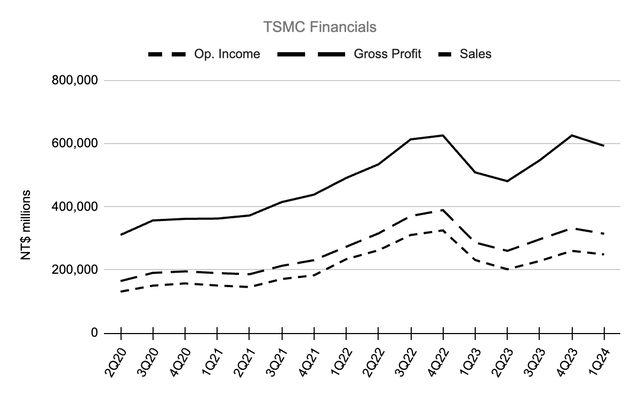

Again, Nvidia designs AI chips and TSMC fabricates them, so one might expect TSMC to have excellent numbers like Nvidia the last 4 quarters, but this hasn’t been the case. Nvidia’s income statement numbers have increased substantially the last 4 quarters because of AI, but we haven’t seen the same degree of increases the last 4 quarters at TSMC:

TSMC financials (Author’s spreadsheet)

Per the 1Q24 call, the 2Q24 period should be a nice one for TSMC, but the growth from AI has limits:

Based on the current business outlook, we expect our second quarter revenue to be between USD 19.6 billion and USD 20.4 billion, which represents a 6% sequential increase or a 27.6% year-over-year increase at the midpoint. Based on the exchange rate assumption of USD 1 to TWD 32.3, gross margin is expected to be between 51% and 53%, operating margin between 40% and 42%.

Nvidia is the dominant designer of AI chips. One of the reasons TSMC’s numbers for the last 4 quarters have been tepid is because Nvidia only accounted for 11% of TSMC’s revenue in 2023. Much of Nvidia’s cost of revenue translates into sales for TSMC, but Nvidia’s cost of revenue hasn’t been growing as quickly as their revenue the last 4 quarters ($ in billions):

|

Period |

Cost of rev. |

Q/Q growth |

Y/Y growth |

Revenue |

Q/Q growth |

Y/Y growth |

|

Jul ’23 |

$4.0 |

59% |

7% |

$13.5 |

88% |

101% |

|

Oct ’23 |

$4.7 |

17% |

71% |

$18.1 |

34% |

206% |

|

Jan ’24 |

$5.3 |

13% |

139% |

$22.1 |

22% |

265% |

|

Apr ’24 |

$5.6 |

6% |

122% |

$26.0 |

18% |

262% |

Broadcom (AVGO) is another example of a designer where the overall economic impact from AI is higher than what we see from a fab like TSMC. Per Broadcom’s 1Q24 call, AI revenue quadrupled year-on-year to $2.3 billion, which was 19% of their quarterly revenue total of $12 billion. Broadcom’s 2Q24 revenue was $12.5 billion, and the 2Q24 call talks about the upside of AI:

And this 12% organic growth in revenue was largely driven by AI revenue, which stepped up 280% year-on-year to $3.1 billion, more than offsetting continued cyclical weakness in semiconductor revenue from enterprises and telcos.

TSMC doesn’t identify top customers explicitly, but they report companies with more than 10% of revenue as “Customer A” or “Customer B.” For many years, we’ve known Apple (AAPL) is “Company A.” Nvidia has been widely reported as the “Customer B” 11% company for 2023. Here is the yearly history of key TSMC customers as a percentage of revenue, including assumptions with AMD (AMD) and Qualcomm (QCOM):

|

Year |

Apple |

Nvidia |

AMD |

Qualcomm |

|

2013 |

1% |

22% |

||

|

2014 |

9% |

21% |

||

|

2015 |

16% |

16% |

||

|

2016 |

17% |

11% |

||

|

2017 |

23% |

7% |

||

|

2018 |

22% |

6% |

||

|

2019 |

23% |

|||

|

2020 |

25% |

|||

|

2021 |

26% |

10% |

||

|

2022 |

23% |

|||

|

2023 |

25% |

11% |

In the TSMC 1Q24 call, CEO C. C. Wei said there is strong AI-related demand. Nvidia will be more than 11% of revenue in 2024, but the growth may not be as high as some expect. AI-related revenue from all customers should eventually be over 20%, but it may take 5 years for this to happen, per comments from CEO Wei (emphasis added):

Almost all the AI innovators are working with TSMC to address the insatiable AI-related demand for energy-efficient computing power. We forecast the revenue contribution from several AI processors to more than double this year and account for low-teens percent of our total revenue in 2024. For the next 5 years, we forecast it to grow at 50% CAGR and increase to higher than 20% of our revenue by 2028.

Valuation

Operating income, gross profit and revenue fell from NT$ 1,121,279 million, NT$ 1,348,355 million and NT$ 2,263,891 million, respectively, in 2022 to NT$ 921,466 million, NT$ 1,175,111 million and NT$ 2,161,736 million, respectively, in 2023.

Looking at the trailing twelve months (“TTM”) from the 1Q24 results and the 2023 annual report, operating income was NT$ 939,246 million or NT$ 249,018 million + NT$ 921,466 million – NT$ 231,238 million. Gross profit came in at NT$ 1,203,116 million or NT$ 314,505 million + NT$ 1,175,111 million – NT$ 286,500 million and revenue was NT$ 2,245,747 million or NT$ 592,644 million + NT$ 2,161,736 million – NT$ 508,633 million.

Converting into USD, we have $29.1 billion, $37.3 billion and $69.7 billion for TTM operating income, gross profit and revenue, respectively. FCF is typically well below operating income, so I like to use a relatively low operating income multiple when thinking about valuation. In my last article, I used a valuation range of 15 to 16x operating income, which was probably too low. I could see investors using a valuation range much higher, given considerations such as the solid 2Q24 guidance.

We have 25,930 million weighted average outstanding shares and 1 ADR is equivalent to 5 shares. As such, the market cap is $870 billion based on the June 25 ADR price of $167.81. At 30x TTM operating income, the stock is near the top of an optimistic valuation range, so I don’t see it as a buy right now – more of a hold.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSMC, AAPL, ASML, NVDA, VOO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.