Summary:

- AMD’s MI300 is the fastest-growing product in company history, surpassing $1 billion in sales in under two quarters.

- AMD plans to release new AI accelerators annually to compete with NVIDIA, but faces supply chain limitations.

- Revenue forecasts have been adjusted, with a HOLD rating on the stock.

JHVEPhoto

Investment thesis

The MI300 has become the fastest growing product in AMD’s history, surpassing $1 billion in total sales in less than two quarters. However, the company is experiencing a supply shortage, which limits the segment’s future financial results.

At the same time, at the recent Computex conference, AMD presented an updated roadmap for the data center GPU subsegment through 2026, according to which the company plans to release new AI accelerators every year. The willingness to release new products at a similar frequency, as well as their actual features, suggests that AMD is serious about competing with NVIDIA. But the production capacity problem remains.

In addition to the revenue constraint in the Data Center segment, we have lowered our revenue forecast for the Gaming segment due to the lack of visible drivers for console sales growth, which we will describe in more detail in the report. The rating is HOLD.

4Q 2023 report overview

Our previous article from February gave a Hold rating and is accessible via this link.

In the last report, we noted that we were waiting for the independent MI300 tests to confirm the words of AMD management. Although rather short, an independent review was published, and it became possible to compare promises with reality. We have become more confident in the MI300 as a product.

Regarding the gaming segment, we previously expected console sales to rise through 2024, which will help reduce inventories and bring AMD’s revenue in the gaming segment back on the path of consistent growth. However, in this report, we have revised the outlook for the console market and no longer expect a serious recovery. We discuss the reasons for this in more detail in the “AMD’s Gaming segment” section.

In AMD’s customer segment, the development and promotion of PCs with embedded artificial intelligence (AI PCs) will continue to be a key driver in the near future.

Data Center segment: demand tops supply

In 1Q 2024, revenue in AMD’s Data Center segment totaled $2.3 bln (+80% y/y and +2% q/q), remaining, as we expected, around the 4Q 2023 level. The sequential revenue growth was driven by increased shipments of AI accelerators of the Instinct series, but was partially offset by a seasonal decline in sales of server processors.

The MI300 became the fastest-ramping product in AMD history, passing $1 billion in total sales in less than two quarters. Management conceded that demand for this lineup of accelerators will continue to exceed supply in 2Q 2024. Of course, the company is working hard to improve the supply chain, but the potential is limited so far, so the forecast for revenue in the sub-segment of data center GPUs for 2024 was raised – again – but more moderately than before, from $3.5 bln to $4 bln.

With respect to independent tests of the MI300X, some testing was done by Phoronix – and the results lived up to the praise from management and customers (speaking of satisfied customers, Microsoft CEO insists that AMD’s MI300X provides the best price/performance ratio for GPT-4). For example, according to the tester, “Llama 2 and other AI workloads were running with great speed,” and the hardware under test was able to push all MI300X to their 750 Watt power capacity rating.

Despite the relatively recent release of the MI300, AMD’s CEO at the Computex conference in the first week of June 2024 unveiled an expanded roadmap for the sub-segment of data center GPUs that runs through 2026:

- in 4Q 2024, the MI325 is expected to be available (with up to 288GB of HBM3E memory and 6 terabytes per second of memory bandwidth);

- in 2025, the MI350, which is based on the new AMD CDNA 4 architecture, is expected to be released. It was also reported that the chip will be built using advanced 3nm process technology. AMD expects it to take on NVIDIA’s Blackwell 200 (the shipments of which are scheduled to start at the end of 2024);

- The MI400, to be powered by CDNA «Next» architecture, is expected to arrive in 2026. The company didn’t disclose details about this chip at this time.

To put this in perspective: the AMD Instinct MI300X is equipped with 192GB of HBM3 memory and 5.2 TB/sec of memory bandwidth; while H100/H200 possess 80GB and 141GB of HBM3 memory, respectively, and the bandwidth of up to 3 TB/sec and 4.8 TB/sec; and the B200 will carry onboard 192GB of HBM3e memory, with the bandwidth capability of up to 8 TB/sec.

The resolve to roll out new AI accelerators every year – and the specifications of these accelerators – hint at AMD’s serious determination to compete with NVIDIA.

With respect to server processors, as part of the abovementioned Computex 2024 conference there was an announcement about the fifth generation of EPYC processors, codenamed Turin, with sales to begin later this year. These processors will come in two variants: one with 128 standard Zen 5 cores and the other with 192 optimized Zen 5c cores. Turin will be plugged in motherboards with the help of the same SP5 socket that is used for EPYC’s 4th-generation Genoa and Bergamo, allowing users to simply upgrade their existing unit to run on the faster chip.

The goal of increasing computing capacity, both general-purpose and accelerated capabilities, remains on the agenda for enterprise customers, with one of the requirements being that upgrades of existing infrastructure not lead to expansion of physical space or power consumption. According to AMD management, they can deliver the same amount of computing capacity using 45% fewer servers than competition, cutting initial capital expenditures in half and reducing annual operating costs by more than 40%.

Following 1Q 2024, AMD has a 23.6% share of the market of server processors in terms of quantity and 33% in terms of revenue from their sales. Given the announcement of the 5th generation and continued strong demand for server processors, we expect AMD’s share in this market to continue increasing, which will prompt revenue in this part of the Data Center segment to climb.

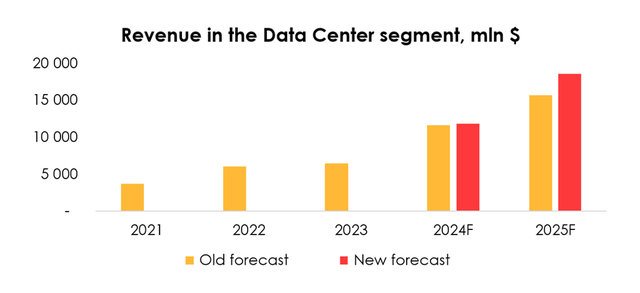

As such, taking into account that the segment is developing in line with our expectations, and considering the released roadmap to 2026, which tentatively looks competitive (given all the specifications that we know as of this time), we are increasing the revenue forecast for this segment slightly for 2024 and more significantly for 2025.

Therefore, we are raising the forecast for revenue in AMD’s Data Center segment from $11.7 bln (+80% y/y) to $11.8 bln (+82% y/y) for 2024, and from $15.7 bln (+34% y/y) to $18.6 bln (+57% y/y) for 2025. We see revenue in the Data Center segment reaching $2.6 bln in 2Q 2024.

AMD’s Gaming segment

The Gaming segment finished 1Q 2024 with a revenue of $922 mln (-48% y/y and -33% q/q), down from our forecast of $1.2 bln. The problem there is still the high inventories held by customers. Combined with lower-than-expected console sales, that led to a decline in revenue of AMD’s Gaming segment. But more importantly for medium-term forecasting, there are concerns that the expected recovery in console sales in 2024 may not materialize after all.

At the heart of the issue is that the younger generation (Gen Z) shows less interest in buying consoles and prefers to play on PCs and smartphones. According to former Xbox CEO Peter Moore, “we’re not in the living room anymore” when it comes to entertainment. Gamers moved to the bedroom, and left the TV screen in favor of smartphones and PCs. The younger generation these days always has the opportunity to play on a smartphone or PC, so they do not see a point in buying other gaming hardware. In addition, while in the past games released for consoles were exclusive, many of them now are also released for PCs, which diminishes the sales potential of consoles even further.

Let’s take a look at this theory based on evidence from major players in the console market. Of the top three – Sony, Microsoft, Nintendo – only Nintendo maintains console exclusivity for their games, which is probably what allows their console sales to rise and beat their own forecasts. Sony and Microsoft, on the other hand, do not maintain platform exclusivity for their games, which reduces the incentive to buy their consoles. Sony, for example, fell short of its PS5 sales goal in 1Q of calendar 2024, even though the forecast had already been lowered from 25 mln units to 21 mln units for fiscal year 2023. Microsoft’s console sales also declined in 1Q 2024.

As such, while it doesn’t follow from total sales of consoles that the market is getting weaker, we are concerned that the console audience is aging and will not be replaced by the new generation, Gen Z, (let alone Generation Alpha), which will take a toll on revenue in AMD’s gaming segment. However, as AMD sells semiconductors in this segment not just in the console market, but also in the notebook PC market (where we expect sales to recover starting from 2H 2024 and throughout 2025), the negative impact on revenue will be partially mitigated.

Due to expectations that the worldwide market of PC shipments will continue to undergo correction in 2Q 2024, and given the moderate console sales, we are lowering our expectations for revenue in the Gaming segment over the forecast period to 2025. We believe that in 2Q 2024 the market will continue to decline and the segment’s revenue will total $791 mln.

AMD’s other segments

Revenue in the Client segment totaled $1.37 bln (+85% y/y and -6% q/q), down from our forecast of $1.57 bln. Despite AMD’s declining share of the CPU market in 1H 2024, we expect a positive trend in the segment’s revenue going forward, which will be driven by a rebound in global PC shipments starting in 2H 2024, as well as the company’s efforts to develop and promote AI PCs. For example, AMD announced the Ryzen 9000 at Computex 2024 as part of this strategy. Because we lowered our expectations for the segment’s revenue in 1H 2024 and maintained the outlook for subsequent growth, we are cutting the forecast for a period to 2025. We expect revenue in 2Q 2024 to remain at 1Q 2024 levels in absolute terms.

Revenue in the Embedded segment totaled $846 mln (-46% y/y and -20% q/q), which was close to our forecast of $899 mln. The company previously expected sequential revenue in the Embedded segment to stop declining in 1Q 2024 and then start to bounce back, but circumstances changed and the start of the rebound moved back by one quarter. Consequently, we are lowering our expectations for 2Q 2024 revenue in the Embedded segment to $871 mln and expect a subsequent recovery through 2H 2024. Given the lower expectations for 1H 2024 and the unchanged outlook for subsequent growth, the projection for the forecast period have been slightly trimmed.

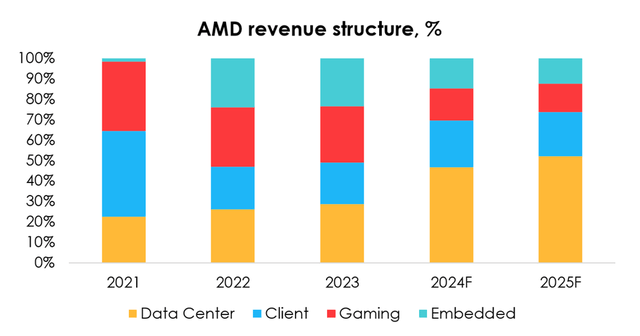

To sum up, we are lowering revenue forecasts for all segments, except the Data Center segment, for 2024 and 2025. We expect that the share of the Data Center segment’s revenue in the company’s total revenue will expand to 47% (+18 pp) in 2024, and the share of the Client segment’s revenue to 23% (+2 pp), provided that AMD’s key drivers in these two particular segments remain in place.

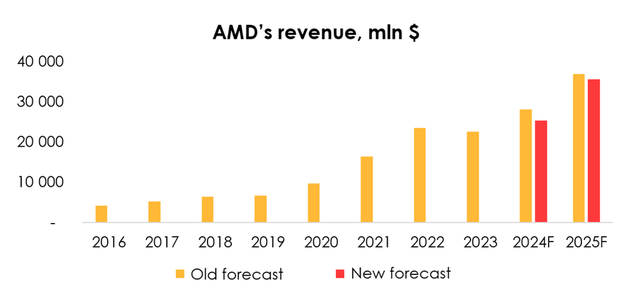

AMD’s financial results

We are lowering the forecast for AMD’s revenue from $28.1 bln (+24% y/y) to $25.3 bln (+12% y/y) for 2024, and from $36.9 bln (+31% y/y) to $35.7 bln (+41% y/y) for 2025 on the back of the cuts to the revenue forecasts for the Gaming, Client and Embedded segments, even though that was partially mitigated by the improved outlook for revenue in the Data Center segment.

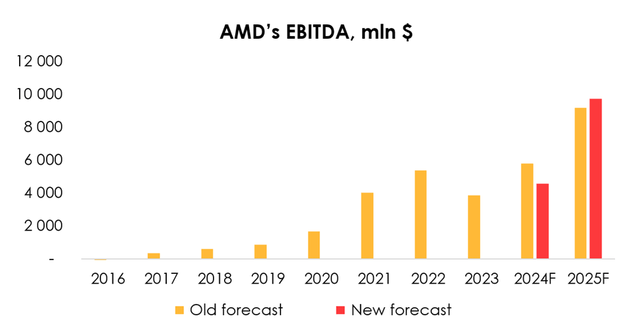

We are lowering the EBITDA forecast from $5802 mln (+51% y/y) to $4580 mln (+19% y/y) for 2024, but raising it from $9168 mln (+58% y/y) to $9744 mln (+113% y/y) for 2025 due to:

- the reduction of the 2024 revenue forecast and the forecast for the company’s operating margin from 9.4% to 5.5% of revenue;

- the reduced forecast for 2025 revenue, which was more than offset by the increase in forecast for the company’s operating margin from 16.8% to 18.7% of revenue.

The cut to the forecast for the company’s 2024 operating margin was driven by the lower actual margin in 1Q 2024, along with expectations for elevated costs that will be related to ramping up the production of the MI300 and preparations for the start of MI325 sales. The increase for 2025 assumes that production costs will go down on the back of an improved supply chain.

The outlook for the company’s free cash flow is that it will total $1620 mln (+44% y/y) in 2024, given the expectations for increased inventories due to the headwinds for the Gaming segment in the console market, and $7376 mln (+355% y/y) in 2025.

Valuation

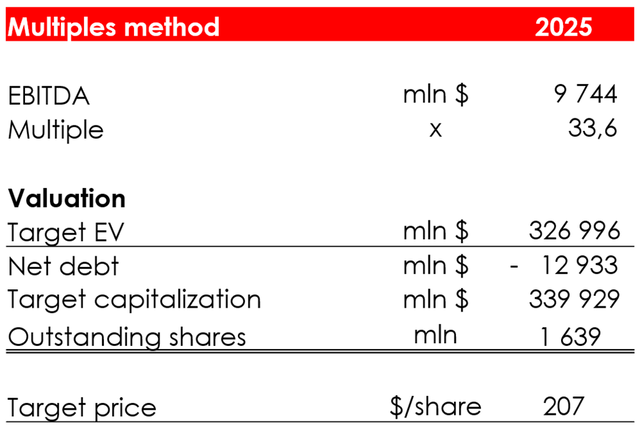

We are raising the target price of the shares from $170 to $189 due to:

- the increased EBITDA forecast for 2025 (positive impact);

- the increase of the projected net debt from ($19) bln to ($12.9) bln (negative impact);

- the shift of the FTM valuation period, which makes future financial results closer by one quarter and reduces the discount factor (positive impact).

Based on the new assumptions, we are assigning a HOLD rating to the stock.

The share price of $189 was achieved by computing the target price based on estimated financial results for 2025, and discounting it to the FTM price at the rate of 13% per annum.

The discount rate of 13% is the average growth of the S&P 500 Index over the past 20 years. In other words, when we value a company based on its long-term results, it is important to us that the company’s growth exceeds the average growth of the index.

Conclusion

AMD’s latest roadmap, which implies an annual release of a new AI accelerators, and the specifications of these accelerators hint at AMD’s serious determination to compete with NVIDIA. To ramp up production of the Instinct series, AMD still has a lot of work to streamline the supply chain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.