Summary:

- Microsoft remains a tech investment play with solid growth in software, cloud computing, and gaming sectors.

- Bullish momentum suggests a potential stock price surge to $615 by the end of 2024.

- AI investments have led to a 17% revenue surge, positioning Microsoft for further growth in cloud computing and AI solutions.

- 150 million AI-ready PCs hitting the market will significantly boost Windows 11 adoption, driving Microsoft’s growth.

lcva2

Investment Thesis

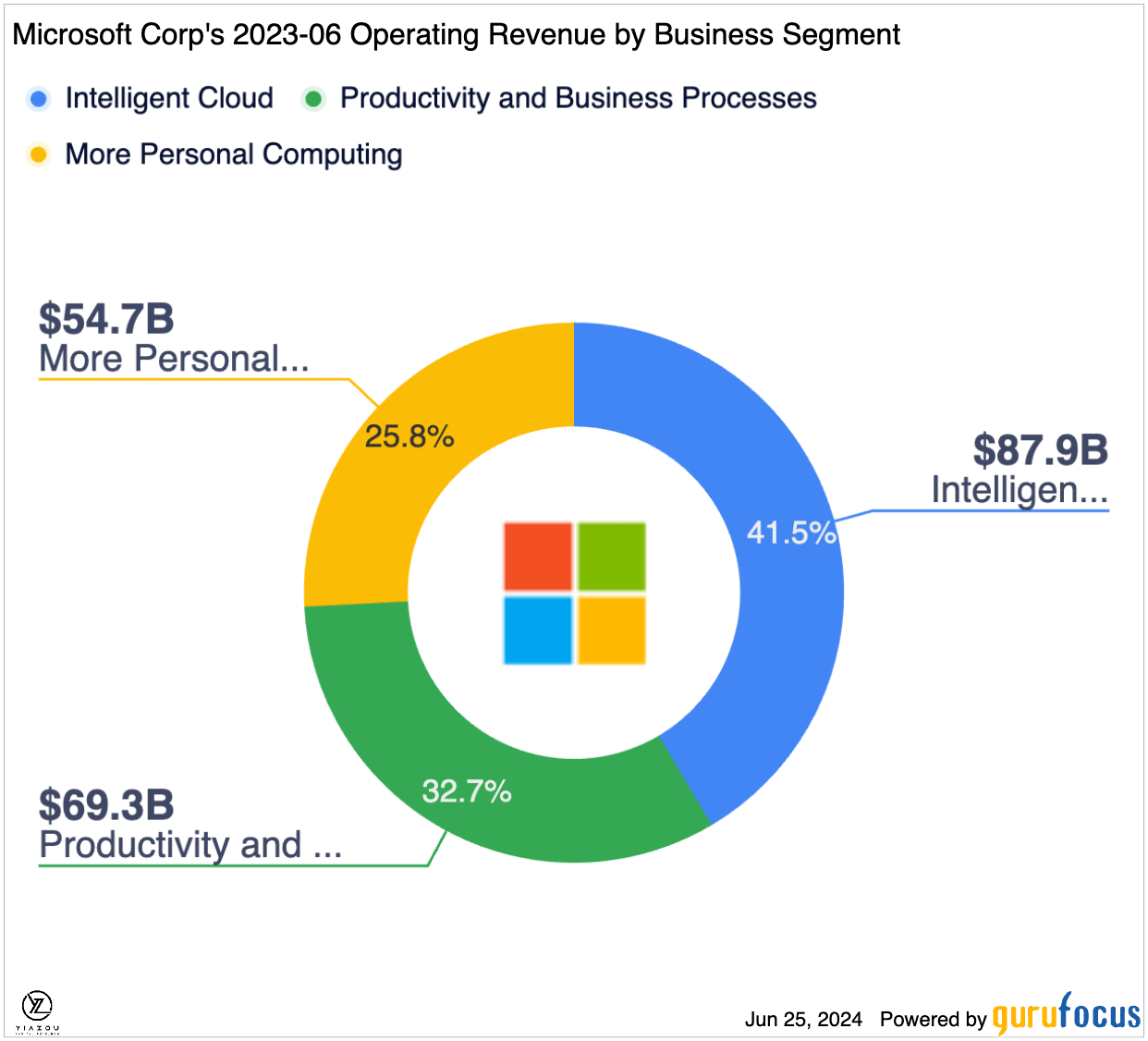

Microsoft Corporation (NASDAQ:MSFT) is still a tech investment play. It has cemented its status as a software king, attracting billions of users with products like Windows Office, productivity, Azure for cloud computing, and Xbox for gaming. Fifty years later, the company is not showing any signs of slowing down as it continues to set the pace in almost all facets of the tech world.

While the stock is only up by about 14% for the year, it has gained over 80% over the past year, affirming Microsoft’s trillion-dollar empire. The boom has come as AI continues accelerating the company’s growth rates while strengthening its competitive edge in multibillion-dollar industries.

Microsoft has invested billions of dollars, including the $13 billion already invested in ChatGPT parent OpenAI, as it looks to take a front seat amid the AI arms race. From using the technology to strengthen its search engine Bing to improving its cloud computing solutions, the company is increasingly safeguarding its future. Likewise, it is staring at a massive opportunity amid the transition to AI-capable personal computers with its Windows product line. Thus, the positive outlook, strong fundamentals, and technical analysis all support a bullish thesis for the stock.

Bullish Streak: Potential Surge to $615 by End of 2024

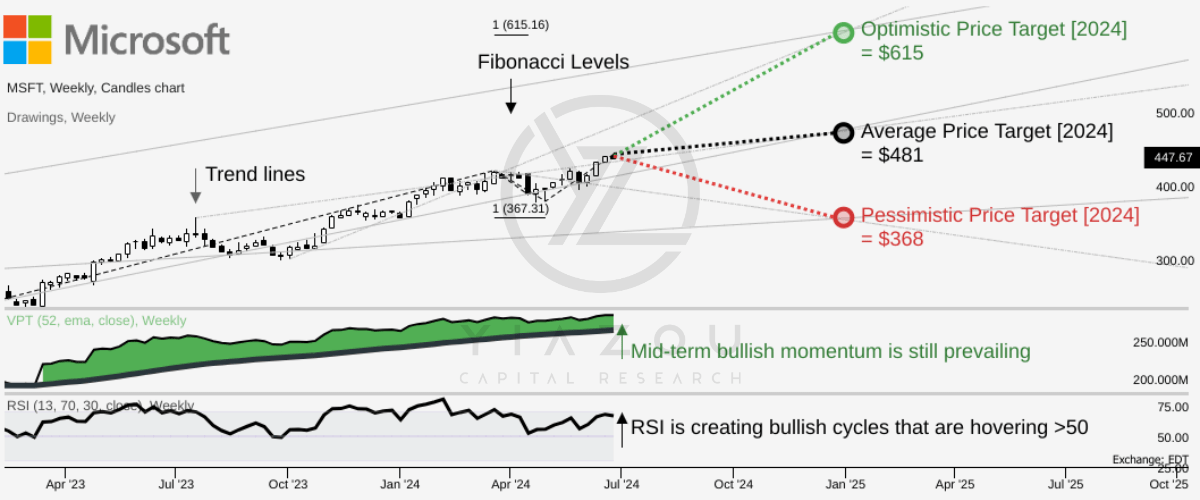

MSFT is currently trading at $448. The stock price showed a strong uptrend. This can be observed in the volume price trend (VPT) line, which is above its annual moving average. Following the VPT line, bullish momentum prevails in the stock price trend over the mid-term.

Similarly, the relative strength index (RSI) is at 67 points, indicating bullish solid strength in the stock price. Observing the indicator over the midterm shows the constant creation of bullish cycles over the 50 level. This pattern suggests constant bullish sentiment running on the street for the stock.

Following the trend lines projected over Fibonacci levels, the stock may hit $615 by the end of 2024 (optimistically), based on a higher-highs trend. On an average basis, the price may reach $481 by the end of the year, considering the trend of change in polarity over the mid-term. Pessimistically, the stock price may be around $368 in 2024, based on the higher-lows trend and recent swings.

trendspider.com

Microsoft’s AI Investments Drive 17% Revenue Surge

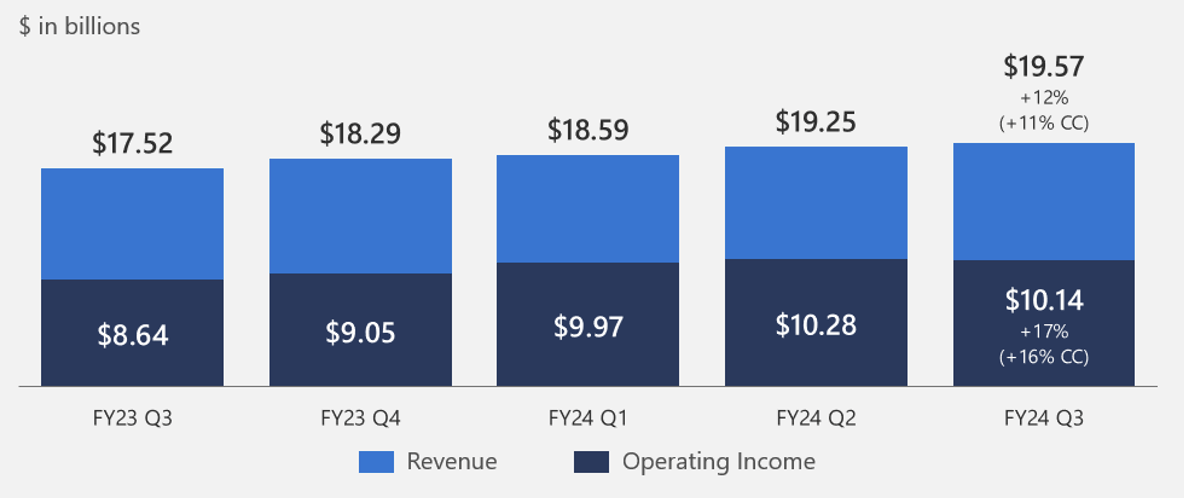

The AI investments are already paying off, going by the better-than-expected fiscal third-quarter results that once again underlined growth across all business segments. Booming business in all of the company’s segments saw revenue increase 17% year over year to $61.9 billion.

Additionally, revenue in the Productivity and Business Processes segment was up 12% to $19.6 billion. The increase was attributed to strong demand for office commercial products such as Word, Excel, PowerPoint, and Outlook, as revenue in the units grew 13%.

Microsoft

Likewise, Microsoft Office’s consumer products and cloud services revenue increased by 4%, Microsoft 365’s consumer subscriber numbers increased to 80.8 million, and LinkedIn revenues were up 10%. The growth in the productivity and business processes segment affirms how Microsoft remains the go-to platform for businesses and individuals looking to leverage the solutions revamped by AI features.

Microsoft’s Intelligent Cloud unit was also on a roll as revenue increased 21% to $26.7 billion. The growth was attributed to the increase in server products and cloud services revenue by 24%. Similarly, Microsoft Azure and other cloud services revenue increased by 31%.

The Personal Computing unit that houses Windows devices and the gaming unit spearheaded by Xbox content continues to fire on all angles. The unit delivered $15.6 billion in revenues, representing a 17% year-over-year increase. The increase was driven by an 11% increase in Windows revenue. Xbox content and services revenue increased by 62% after receiving a boost from the $68 billion acquisition of Activision Blizzard.

Moreover, Microsoft is making impressive strides in the search and news advertising segment and is increasingly benefiting from its AI investments and integrations. The unit delivered a 12% increase in revenues.

As the new era of AI transformation drives better business outcomes across every segment, net income in the quarter increased by 20% to $21.9 billion. Likewise, the software giant delivered earnings per share of $2.94, an increase of 20% year over year.

GuruFocus

Microsoft Cloud Opportunity with AI

The impressive growth rates in all three core business segments will continue as Microsoft ramps up investments in AI tools and solutions. Its $13 billion investment in OpenAI already grants it exclusive access to some of the most advanced AI models.

For instance, Microsoft has succeeded in integrating ChatGPT into its search engine, Bing, as it looks to strengthen the search tool to compete better against Alphabet Inc.’s (GOOG), (GOOGL) Google. The company has also found a way to offer Continuing Education through its cloud computing unit, Azure.

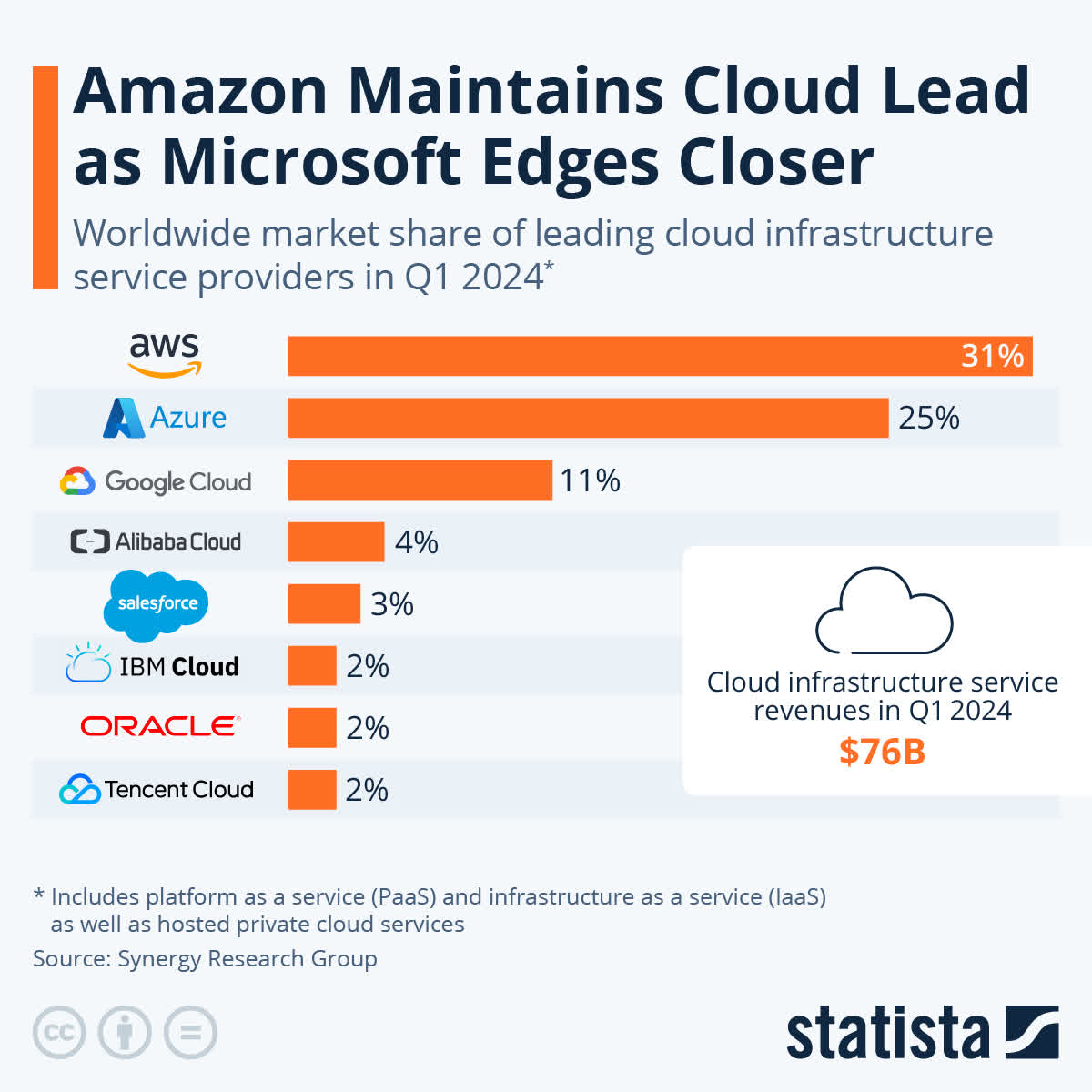

Microsoft recorded a 21% increase in Intelligence Cloud segment revenue in Fiscal Q3, much higher than Amazon Web Services’ 17% growth. Microsoft’s higher growth rates stem from integrating generative AI features into platforms like Word and PowerPoint and launching an AI assistant dubbed Copilot.

While Amazon.com, Inc. (AMZN) has dominated the cloud computing segment for over a decade, the landscape is beginning to shift. Microsoft’s aggressive investments into AI features to bolster its cloud unit Azure are already paying off. As of the end of last year, Microsoft had about 53,000 customers using its Azure AI, increasing its market share to 25% from 22% a year ago. The increased market share comes from the Azure OpenAI service, which attracts many takers who allow customers to build AI applications without investing in expensive hardware.

Recent developments suggest Azure Cloud could surpass AWS and become the leading cloud service provider by 2026. As 2023 ended, AWS remained the leader despite losing two percentage points of market share to 31%. On the other hand, Microsoft Azure gained two percentage points, up to 24%.

If CEO Satya Nadella’s remarks are any indication, Microsoft’s market share in cloud computing is set to keep growing. The executive reiterated that 65% of the Fortune 500 companies already use Azure OpenAI service. Hence, the enormous following underscores the effectiveness and reliability of the company’s AI solutions and features in most of its products.

statista

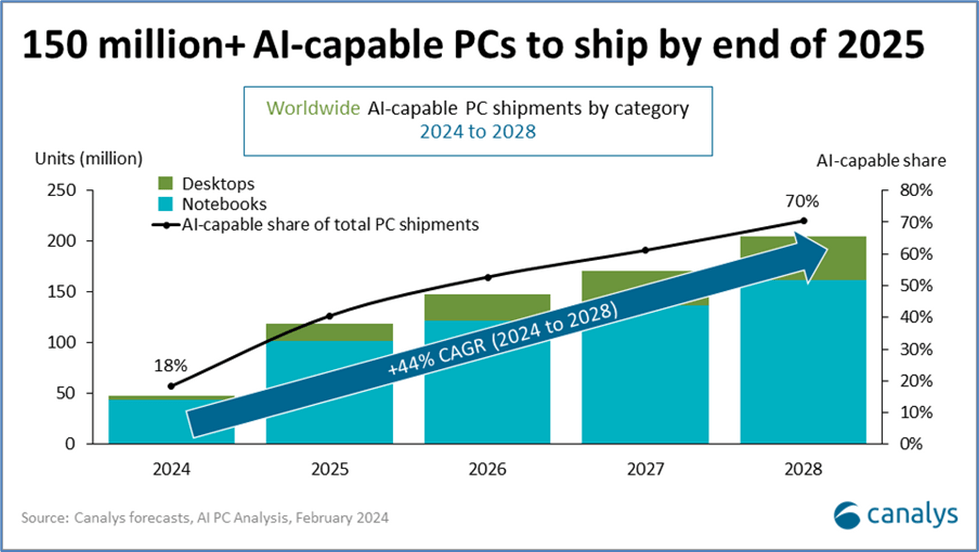

Microsoft Poised for Major Gains as 150 Million AI-Ready PCs Hit Market, Boosting Windows 11 Adoption

Microsoft’s AI opportunity is broader than just the cloud computing business. Given that 150 million AI-capable Personal computers are on course to hit the market between 2024 and 2025, a new opportunity is slowly cropping up for the tech giant. Microsoft’s Windows business is well poised to receive a significant boost, especially with the latest Windows 11 software that is well poised to run AI features.

71% of Windows users were using Windows 10 until September of last year, and only 13.6% were on Windows 11, which presents a significant opportunity, given the upgrades expected over the next year. Microsoft has indicated that the capabilities of AI tools like Copilot are restricted to Windows 10 systems. Consequently, the move to Windows 11 is expected to accelerate.

Finally, a key observation is that the uptake of Windows 11 appears to be picking up pace. Microsoft’s earnings from Windows products rose by 11% quarter over quarter, marking a significant reversal from the previous year, when Windows OEM revenue declined by 28% year over year.

It Channel Oxygen

Concluding Thoughts

After gaining over 20% year to date, Microsoft stock is trading at 38 times forward earnings, slightly lower than a P/E of 42 for Amazon, its fiercest rival. While still a premium valuation, it is expected of a company of Microsoft’s stature that’s growing on all fronts.

Microsoft is poised for significant growth amid the AI boom. Integrating technology into the company’s structure, Microsoft Office, Windows, and other workplace solutions has strengthened its competitive edge and demand.

Likewise, the company’s revenues and earnings are expected to continue increasing, which explains the stock’s premium valuation. The share price gains experienced over the past year, fueled by the company’s return to value through buybacks and dividends, affirm why it is a solid tech stock pick. That said, Microsoft will always be a solid buy on market pullbacks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.