Summary:

- Snowflake Inc. stock has declined by 70% from its peak valuation of $420 due to the AI selloff and other factors.

- Snowflake has significant untapped AI potential, making it a possible buy opportunity with limited downside.

- Snowflake is cheaper than recently, with strong sales growth and profitability potential, making it a compelling investment at current levels.

oxign

Snowflake Inc. (NYSE:SNOW) “Snow” stock has been demolished after peaking at about $420. Due to the AI selloff and other factors, its share price is now about $125, representing a 70% decline from its peak valuation. Moreover, Snow’s sales and profitability have increased considerably, and the stock is much cheaper than recently.

Snowflake has significant untapped AI potential, and the market could return to favoring Snowflake’s stock soon. Snowflakes’s sales should continue expanding and will likely become increasingly profitable as we move on.

Therefore, in my view, Snowflake is a buy here. The stock’s downside could be limited, providing a favorable risk/reward opportunity in the $125-100 buy-in range.

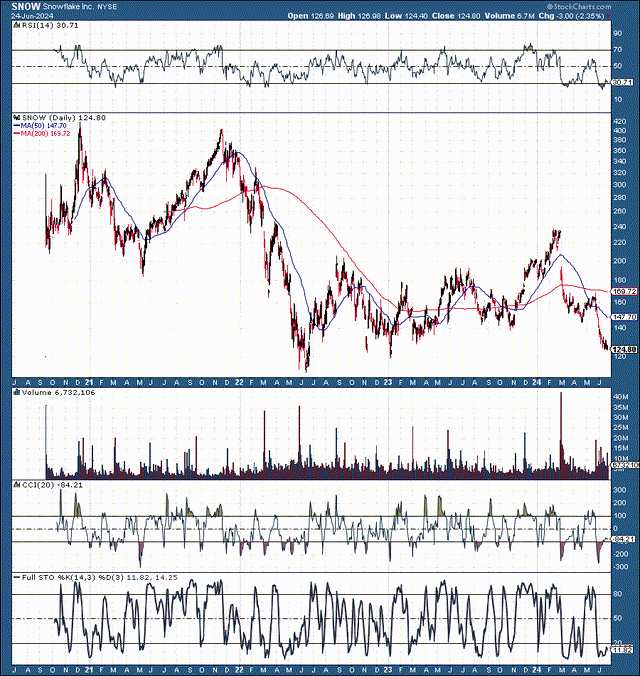

Technically – Snow Is Around A Low Point

As the saying goes, “Buy when there is fear and perhaps even blood in the streets.” We may be at a low point in Snow, and now could be the strategic time to buy, especially if you are building long-term positions.

Snowflake IPOed at a nose-bleeding high valuation, surging to a market cap of about $120B soon after going public. Then came the 2021-2022 tech wreck, and the stock collapsed by about 75%, hitting a low of around $110.

While we’ve seen some attempts at recovery, Snow remains around a low point, at roughly $125. Also, we’ve seen the RSI below 30 and the CCI around -300, demonstrating exceptionally oversold technical conditions. Moreover, the full stochastic and other technical gauges appear to be reversing, and Snow’s technical momentum could improve soon.

Snowflake Is A Bargain Vs. Competitors

Fun fact: When Snowflake debuted, its stock was so “hot” that its valuation soared to about $120B when the company only had about $1.2B in revenues in 2022, placing its valuation at around 100 times forward sales. The average sales estimate is $4.3B for next year (fiscal 2026), pegging Snow’s P/S valuation below ten. Snowflake is ten times cheaper (P/S basis) than it was during its peak valuation in 2021-2022, making it a compelling buying opportunity.

Also, if a ten-times sales valuation still seems expensive, please consider that Snowflake has substantial sales growth and profitability potential and could provide 20-30%+ revenue growth for several years as we advance. While many of Snowflake’s competitors have also had considerable declines, many are still more expensive than Snowflake.

For Instance:

- Cloudflare Inc. (NET): 13 times forward consensus sales estimate.

- Palantir (PLTR): 16 times forward consensus sales estimate.

Other high-growth AI-related software stocks trade at comparable or even higher P/S multiples, making Snowflake a compelling buy at current levels.

Snowflake’s AI Potential

Snowflake is a market leader in the cloud data warehousing segment, with an estimated 22% market share and thousands of customers globally. It also has the edge in AI, as thousands of companies around the globe, including hundreds of the world’s largest, use Snowflake’s AI Data Cloud to share data, build applications, and power their business with AI.

Snowflake’s AI Data Cloud is a unified service used by nearly 10,000 companies to power their businesses with data, AI, and applications. It comprises platform capabilities supporting diverse data, AI, application workloads, content, models, and apps.

Snowflake is a leader in the lucrative enterprise AI software space and should continue experiencing robust revenue growth and profitability increases. Therefore, its stock could stabilize, recover, and move higher in the coming years.

EPS Growth – Could Be Better Than Expected

While Snowflake’s sales growth has decelerated, it remained over 30% in recent quarters. Moreover, Snowflake’s TTM EPS is 96 cents vs. the consensus estimate of 62 cents, illustrating a 55% outperformance rate over the last year. While Snowflake’s consensus EPS estimate is about $1 next year, it could earn around $1.50 instead (higher-end estimates of $1.74).

Therefore, the market may be overly pessimistic regarding Snowflake’s prospects, and we may see better-than-expected earnings numbers in the coming quarters. Also, Snowflake is still in high-growth mode, and increasing profitability is not a significant priority (maximizing growth is) at this stage of its business cycle.

What Wall St. Thinks

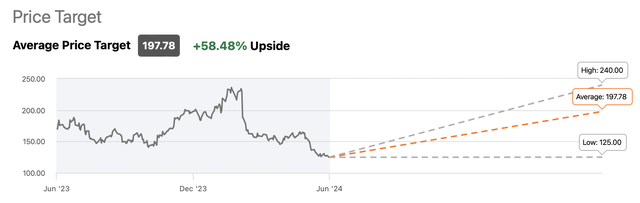

Price targets (seekingalpha.com)

Snowflake trades around the low “rock-bottom” end of its price target estimates. The average price target on Wall St. is around $198, representing a solid possibility of around 60% upside in the next twelve months. Moreover, higher-end price targets go up to roughly $240, implying that the stock could approximately double over the next year.

Where Snowflake’s stock could be in the future:

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $3.56 | $4.67 | $5.84 | $7.4 | $9.3 | $11.7 |

| Revenue growth | 27% | 31% | 25% | 27% | 26% | 25% |

| EPS | $1 | $1.50 | $2.20 | $3.20 | $4.48 | $6.18 |

| EPS growth | N/A | 50% | 47% | 45% | 40% | 38% |

| Forward P/E | 83 | 75 | 70 | 65 | 60 | 55 |

| Stock price | $125 | $165 | $224 | $290 | $370 | $440 |

Source: The Financial Prophet.

While my estimates may seem aggressive, they are below even the consensus figures in many respects. For instance, much higher sales estimates are going out for future years. Still, to be conservative, I’ve kept my projections relatively modest. Yet, even with my “base-case” estimates, Snowflake’s stock price could appreciate considerably as the company continues to provide higher-than-expected EPS and robust sales.

Risks to Snowflake

Despite the probability of improvement, Snowflake has a relatively high valuation, and we may see multiple compressions if market turbulence persists. Snowflake also faces competition risks from Alphabet (GOOG, GOOGL), Amazon (AMZN), Microsoft (MSFT), and other tech titans attempting to capitalize in the AI-enterprise software space.

Snowflake also faces risks of higher costs, lower earnings, and a continued slowdown in sales growth. Additional risks include data breaches, a slower-than-expected economy, higher rates for longer periods, and more. Investors should consider these and other risks before investing in Snowflake.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!