Summary:

- AT&T stock outperformed the S&P 500 recently. Are you surprised?

- Bearish investors who rated T as dead money realized their pessimism didn’t pay off.

- Income investors have likely returned to the appeal of AT&T stock.

- AT&T should benefit as the Fed potentially reaches peak rates.

- I explain why my bullish thesis played out. I also make the case why it’s time to be more cautious.

Anne Czichos

AT&T Stock: Outperformed The S&P 500 Recently

I reminded AT&T Inc. (NYSE:T) investors in my previous update in March that T was still “dirt cheap” while offering a high dividend yield. Therefore, I’m not surprised with T stock’s relative outperformance against the S&P 500 (SPX) (SPY), as buyers reallocated to AT&T’s well-battered thesis.

Why has the market awakened to T even though subscriber growth dynamics are still expected to normalize? Given T’s resurgence, I believe it’s clear that the market has already moved past the lead-sheathed cables troubles last year. Hence, a significant level of pessimism has likely been deflated.

Furthermore, the Fed is close to peak rates. As a result, income investors who were previously unsettled with AT&T’s relatively high CapEx investments are likely more assured with AT&T’s free cash flow projections. As a reminder, AT&T’s 2024 guidance indicates a CapEx range of between $21B and $22B. Despite that, AT&T’s FY2024 free cash flow guidance of between $17B and $18B should provide income investors with confidence about the resilience of its dividends.

T Stock: Income Investors Have Likely Returned

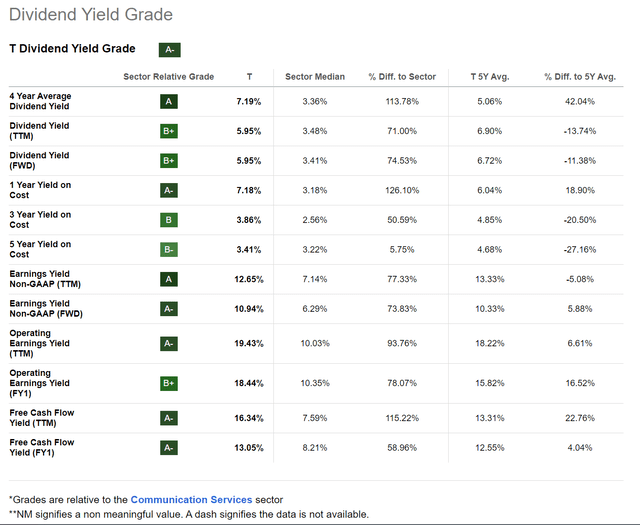

T dividend yield grade analysis (Seeking Alpha)

T’s forward dividend yield is close to 6%. It’s still well above its sector median, providing significant valuation support. Therefore, I assess T’s recent outperformance as likely attributed to its previous unjustified discount.

The Telco operator’s Q1 earnings release also underscores the rationalization of the industry dynamics. AT&T continues to expand its wireless and fiber networks. Despite that, AT&T is experiencing challenges in its business wireline segment as it looks to transition its legacy products. AT&T can potentially make further gains in fixed wireless for consumer and business customers, although I would have preferred management to provide more clarity.

In a recent conference, AT&T highlighted that “specific quarterly targets for its fixed wireless access program, Internet Air,” have not been disclosed. Management emphasized that the FWA is still considered a “strategic tool” for AT&T. However, it’s in contrast to its arch-rivals Verizon (VZ) and T-Mobile (TMUS), as they telegraphed specific targets. Therefore, the market could assess AT&T’s reticence as less optimistic than that of its leading rivals.

AT&T: Resilient Free Cash Flow Margins

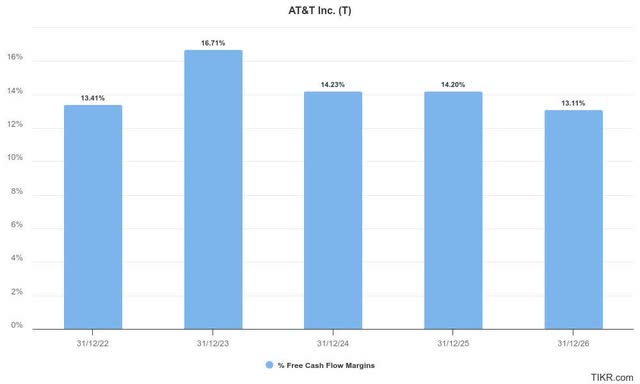

AT&T free cash flow margins estimates % (TIKR)

Given the telco industry’s consolidation phase, investors will likely anticipate AT&T and its leading peers to pay more attention to sustaining their profitability.

Wall Street expects AT&T’s FCF margins to remain resilient through 2026. Therefore, income investors are likely to remain vested, capitalizing on the appeal of T’s forward yield.

However, the threat of cable operators looking to gain market share shouldn’t be underestimated. Despite that, the assessed growth normalization phase should also temper unrealistic competition between the key players. Furthermore, AT&T believes owning its fiber and wireless networks should enable T to “optimize costs and improve service quality” more effectively.

Is T Stock A Buy, Sell, Or Hold?

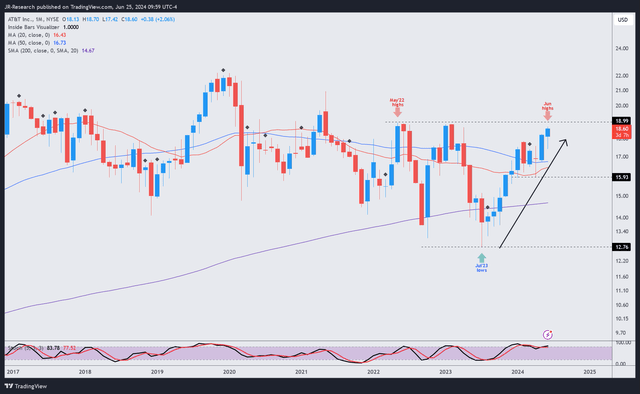

T price chart (weekly, medium-term, adjusted for dividends) (TradingView)

T’s price action (adjusted for dividends) indicates a lack of a sustained bullish trend bias. Therefore, it calls into question whether buying momentum can be maintained, as T has already moved past peak pessimism.

With T buyers attempting to retake its $19 level, I assess more robust resistance to deny further potential upside as investors need to reflect higher execution risks.

The market seems to have priced in a less hawkish Fed. However, a higher-for-longer posture must be considered a potential headwind against a further re-rating in T’s valuation. Investors will likely demand a reasonable spread between T’s forward yield and the 2Y (US2Y), which last printed at 4.75%.

Hence, I view T’s thesis as more balanced at the current levels, behooving a more cautious outlook.

Rating: Downgrade to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!